The most important information within the cryptoverse for Sept. 1 contains Michael Saylor disagreeing with allegations of tax avoidance, U.S. probing Binance over AML compliance since 2020, Celsius asking to return $210 million to collectors, and OpenSea supporting solely NFTs on PoS post-merge.

CryptoSlate Prime Tales

Saylor respectfully disagrees with DC AG allegations of tax avoidance

Following the tax fraud case filed in opposition to Bitcoin Maximalist Michael Saylor on Aug. 31, he has issued a press release claiming that he has no tax legal responsibility to the District of Colombia since his residence is in Miami.

The lawsuit had earlier said that Saylor intentionally claimed to be a resident of decrease tax jurisdictions like Miami in order to keep away from paying taxes to the District the place he reportedly has “a number of yachts” and a luxurious penthouse.

Saylor mentioned in a press release:

“I respectfully disagree with the place of the District of Columbia, + look ahead to a good decision within the courts.“

Ethereum POW token might commerce for $18, Paradigm predicts

Analysts at Paradigm weighed the distinction between ether’s spot and future costs and arrived at a prediction that the Ethereum POW token might commerce at $18 post-merge.

It added that ETHPOW could be priced at 1.5% of ETH’s present market cap on condition that ETH holders at present have a impartial bias towards the futures market.

Babylon Finance to close down Nov. 15 after failing to get well from Rari/FEI hack

Months after Babylon Finance suffered an $80 million hack, the protocol has introduced it would shut down operation efficient on Nov. 15.

The impact of the exploit was compounded by the declining market circumstances. Consequently, customers have exited 75% of the belongings locked within the protocol.

The announcement induced the BABL token to crash 92% after dropping from about $5 to as little as $0.218, as per Congecko knowledge.

Collectors file contemporary go well with in opposition to Celsius in search of $22.5M reimbursement

A brand new group of collectors has filed a lawsuit in opposition to Celsius in search of compensation of $22.5 million.

The collectors said that their funds had been held within the custodial account and are redeemable primarily based on the agreed time period of service.

The collectors have urged the court docket to permit Celsius to reimburse their withheld belongings.

Celsius needs to return $210 million value of custody belongings

As a result of rising filings by aggrieved collectors, Celsius has filed a movement in search of the court docket to permit eligible prospects to withdraw as much as $210 million from the platform.

The crypto lender confirmed that the affected belongings are properties of the shoppers and never a part of its chapter property.

OpenSea to solely help Ethereum PoS NFTs following Merge

OpenSea introduced it would solely help NFTs on the proof-of-stake model of Ethereum instantly after the merge. Consequently, it would stop buying and selling ETHPoW NFTs on its platform.

Analysis Spotlight

The Fed will huff and puff and blow your home down because it begins quantitative tightening

CryptoSlate’s latest macro evaluation reveals that the Fed’s plan to launch $35 billion as mortgage-backed securities (MBS) in its effort to curb inflation might result in one other housing market collapse.

Personal traders can add up MBS to the portfolio which helps take out cash from the financial system and expectedly cut back inflation. With mortgage funds 75% larger year-over-year, many individuals might default on their funds resulting in an oversupply of homes and financial loss for MBS traders.

When housing provides develop into extreme, a brand new housing disaster might happen which might drag monetary markets down together with cryptocurrencies.

Nonetheless, with anticipated forex devaluation within the occasion of a housing disaster, many individuals might flip to “laborious belongings” like crypto to protect their wealth.

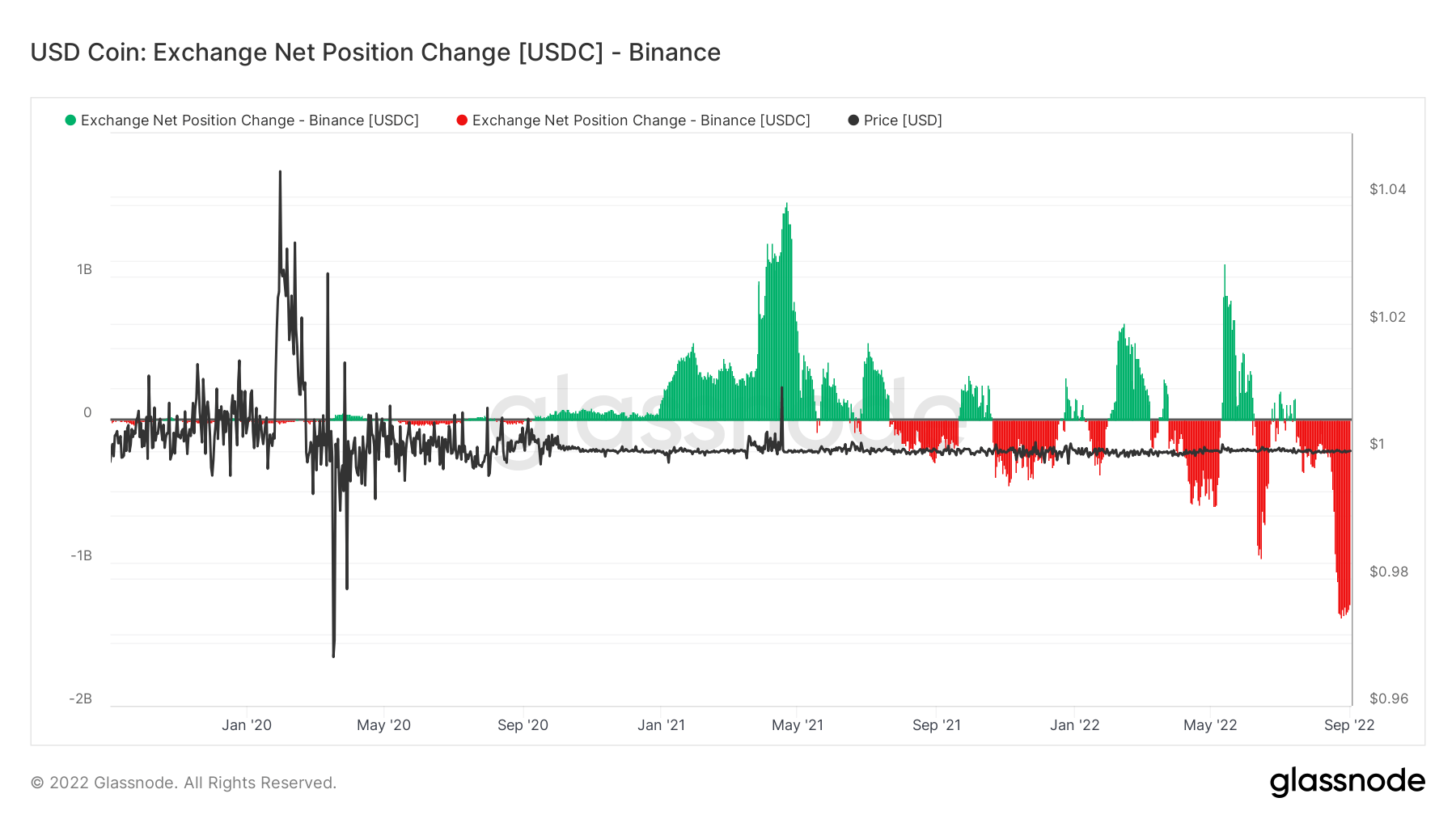

Binance USDC withdrawals prime $1 billion per day this week

On-chain knowledge analyzed by CryptoSlate reveals that a mean of $1 billion value of USDC left Binance’s scorching pockets this week, which is per the market development.

Additional evaluation of stablecoin withdrawals throughout different exchanges, reveals that there was a major decline in stablecoin balances usually.

Stablecoin wars warmth up as USDC and USDT battle for market share

Premier stablecoins USDT and USDC, which make up 12% of the entire crypto market cap, have been battling for dominance in latest weeks.

In a interval the place USDT misplaced over $16 billion in market cap, USDC reportedly grew by $4 billion. The warmth of the market downturn in August pressured the tokens to succeed in their native low.

Nonetheless, the 2 stablecoins are recovering from the elemental tales that contributed to their decline. They’re witnessing a resurgence of their crypto market dominance which has boosted by 40% up to now few weeks.

Information from across the Cryptoverse

US prosecutors probing Binance on AML compliance

U.S. prosecutors have been investigating Binance since 2020 on measures it has adopted to make sure anti-money laundering and sanctions compliance, Reuters reported.

Binance CEO Changpeng Zhao in a tweet said that the trade met all the regulator’s 2020 calls for.

One other story at present a few crypto firm receiving an inquiry from a regulator. A request to VOLUNTARILY share sure data again in 2020, which we did. Necessary for the trade to construct belief with regulators.

My chat messages are semi-public anyway. pic.twitter.com/h35Xd4tZhf

— CZ ? Binance (@cz_binance) September 1, 2022

Binance Chief Communications Officer Patrick Hillmann mentioned the corporate’s compliance staff is comprised of ex-regulators and regulation enforcement brokers to make sure it totally complies with all regulatory necessities.

FASB crypto accounting guidelines skip NFTs, some stablecoins

The Monetary Accounting Requirements Board (FASB) won’t embody NFTs and a few stablecoins in its crypto accounting overview, The Wall Avenue Journal reported,

The scope of the challenge would come with belongings that aren’t distinctive and interchangeable, and in addition intangible and don’t include contractual rights to money flows, items or providers.

Binance introduces free ETH buying and selling

Customers buying and selling the ETH/BUSD pair won’t be required to pay buying and selling charges over the following one month.

Binance introduced that the transfer is to draw each newcomers and veterans within the Ethereum ecosystem in anticipation of the upcoming Merge,

Cardano is now dwell on Robinhood

As anticipation for the Vasil laborious fork mounts, Robinhood has introduced customers can begin buying and selling Cardano’s ADA token on its platform.

Regardless of the itemizing information, ADA’s worth has remained steady. On the day by day chart, ADA rose to $0.462 simply 9% from its 24 hours low of $0.424.

LG to launch crypto pockets on Hedera

LG Electronics is reportedly launching its crypto pockets “Wallypto” in Q3 of 2022. Wallypto was inbuilt partnership with Hedera blockchain.

Crypto Market

Bitcoin was up 0.2% on the day, buying and selling at $20,085, whereas Ethereum was buying and selling at $1,586, reflecting a rise of two%