On-chain and off-chain metrics point out that one of many largest occasions to happen in crypto isn’t producing curiosity outdoors of the crypto neighborhood.

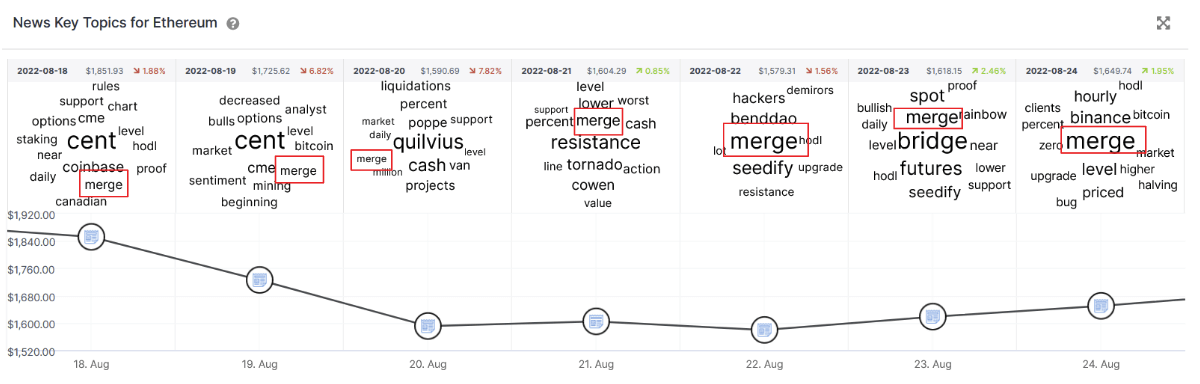

As almost all crypto customers are conscious of by now, the Ethereum Merge is about to happen in the course of September, shifting the chain from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mannequin. This much-talked-about occasion has been years within the making and is now lower than a month away. Outdoors of the hacks and token collapses of this yr, the merge has been one of the mentioned occasions and has been omnipresent within the final week as seen in IntoTheBlock’s phrase cloud for Ethereum information.

Off-chain social metrics

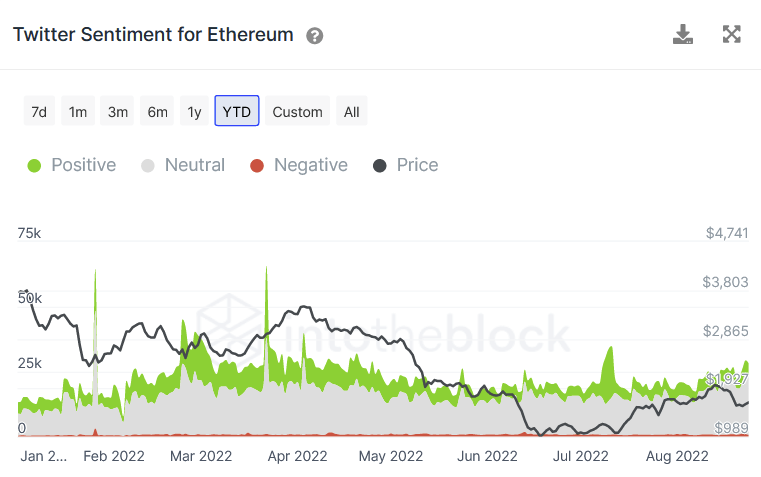

Moreover, Twitter sentiment fashions present that the amount of current tweets concerning ethereum are nearing this yr’s highs (excluding outliers) that had been final seen in late February and early March.

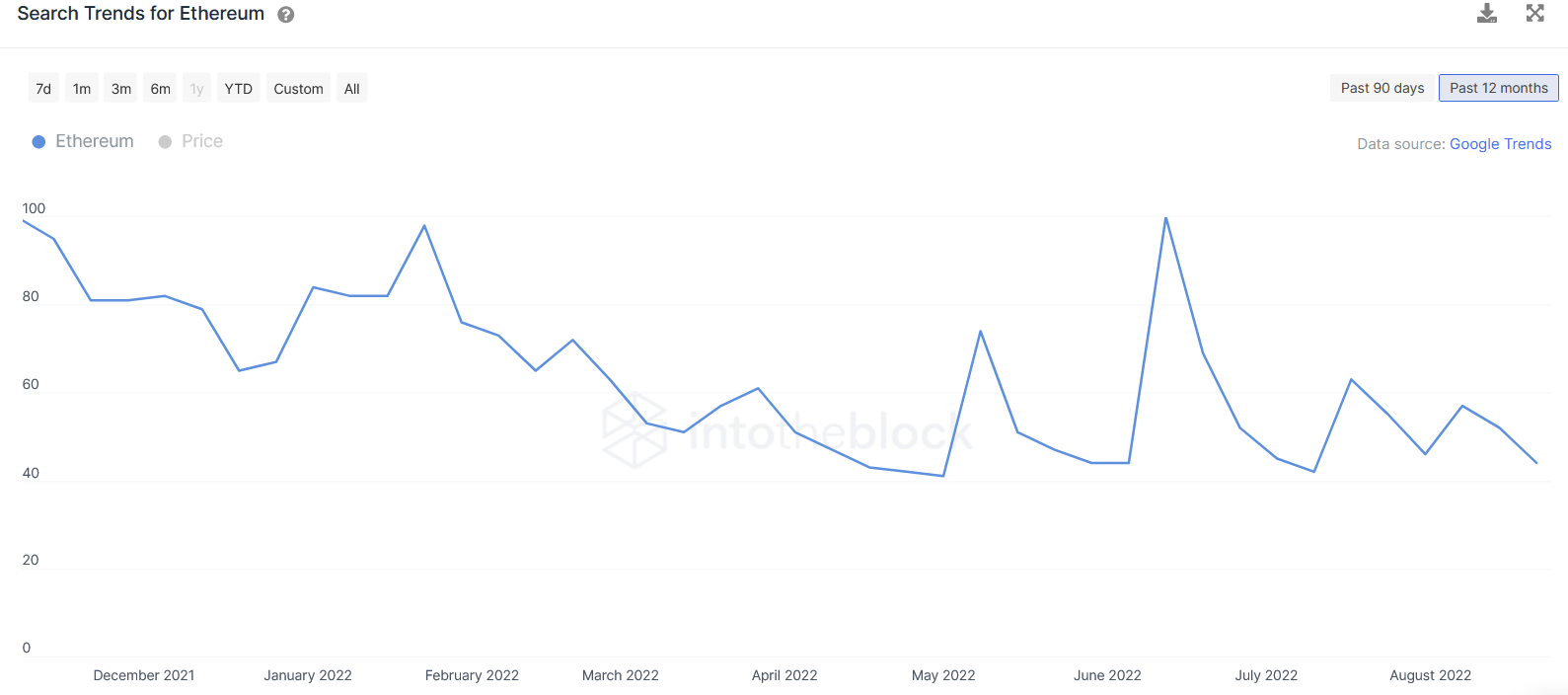

Nevertheless, the Twitter information reveals that although there are elevated tweets about Ethereum, optimistic sentiment is considerably decrease in comparison with earlier this yr with the tweet progress coming solely from sentiment-neutral tweets. This lackluster pleasure is corroborated by search traits for Ethereum for the reason that all time highs in November. We see that other than a number of peaks, there was a gradual downtrend in search metrics for Ethereum.

On-chain Metrics

The social information highlighted above signifies that there’s a macro downtrend in curiosity for Ethereum and that the merge doesn’t seem to have the ability to change the path of that pattern.

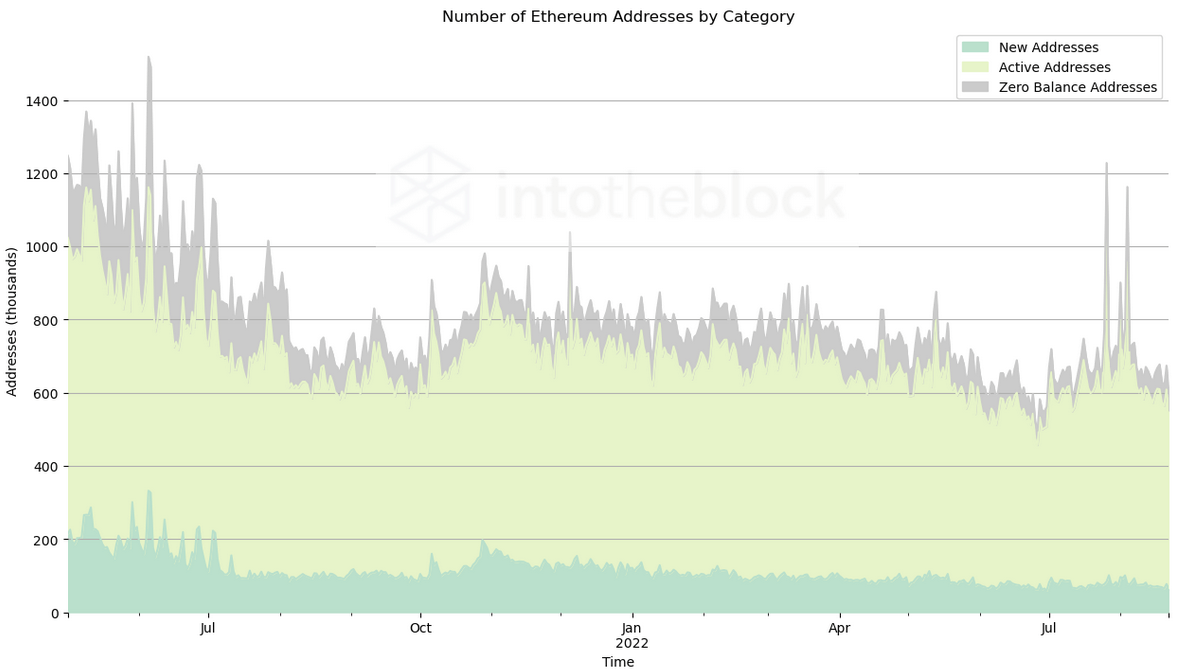

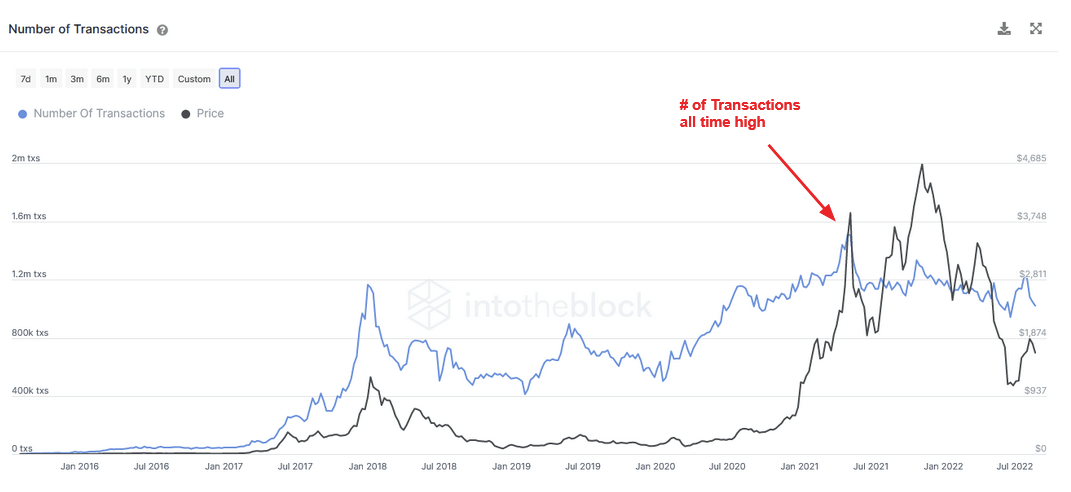

This lack of curiosity can be confirmed via on-chain metrics. Newly created addresses per day have been in a downtrend for the reason that first market peak in Might. This means that fewer newcomers are coming into the market. Along with lowering new addresses, the overall variety of transactions per week additionally peaked in Might. These two metrics collectively, point out weak progress and low curiosity in Ethereum.

The metrics present that the present pattern was set in movement lengthy earlier than the all time highs in November. Observing the low numbers of recent addresses and stagnating transaction volumes after the Might peak, counsel that newer retail traders misplaced curiosity and left the market (or by no means entered in any respect), leaving solely institutional cash and crypto veterans within the house. With international inflation charges at 40 yr highs in lots of international locations, retail traders will probably have much less discretionary earnings to place in the direction of investments comparable to crypto.

Remaining Ideas

The merge is being talked about in all places within the crypto neighborhood. As of proper now, it doesn’t seem that will probably be the catalyst to spark enthusiasm for traders outdoors of the house. The merge could also be too summary for individuals who usually are not already within the house, which makes it troublesome to draw new entrants.

Nevertheless, as soon as it turns into extra obvious how switching to a PoS consensus mannequin considerably reduces Ethereum’s power use, we’d begin to see renewed curiosity. Along with a greener blockchain, the flourishing roll-up and L2 ecosystems with considerably decrease fuel charges, is likely to be the mixed catalyst to deliver Ethereum again into the limelight.