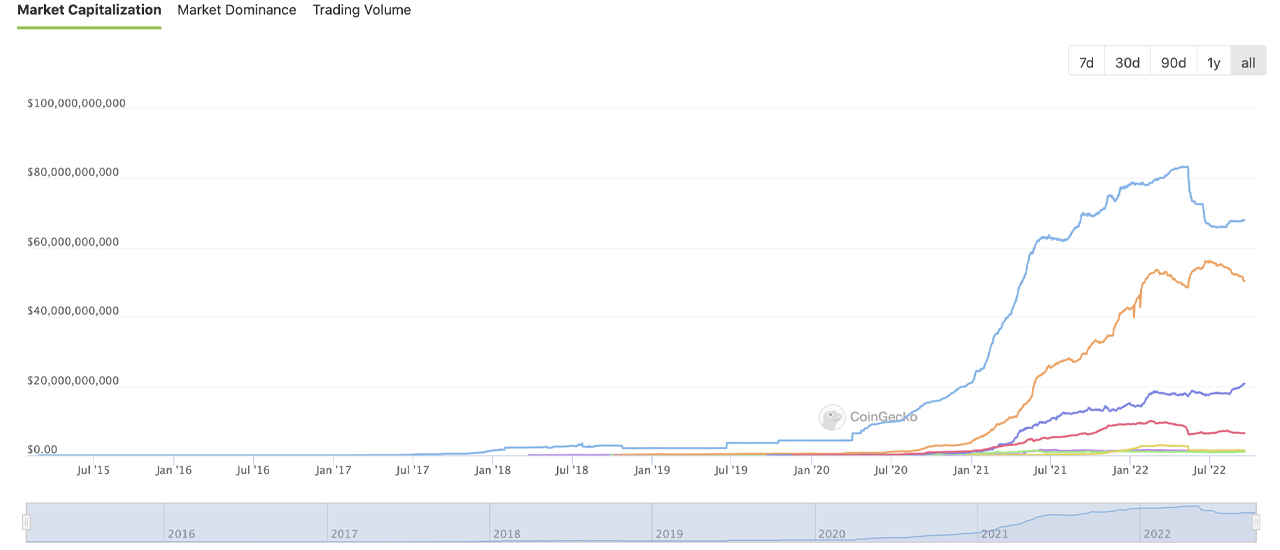

Because the Terra stablecoin fiasco in Might, the highest stablecoins by market capitalization dropped 10.66% from $171.37 billion to immediately’s $153.09 billion. Over the last two months, the highest stablecoins by market capitalization have seen little progress remaining at $153 billion since mid-July.

For Extra Than 2 Months Stablecoin Market Caps Stagnate Seeing Little Development

Following the numerous climb since mid-2020, the stablecoin financial system has seen progress sluggish throughout the previous few months. In mid-April 2022, the stablecoin financial system neared the $200 billion vary for the primary time in historical past, however following Terra’s stablecoin fiasco, greater than $35 billion disappeared from the stablecoin financial system by Might 13, 2022. On Might 12, 2022, the stablecoin financial system was 10.66% bigger than it’s immediately at $171.37 billion.

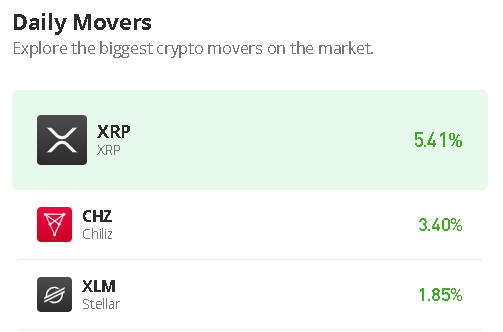

By July 7, the stablecoin financial system was right down to $154 billion, based on stats saved by archive.org through coingecko.com. The stablecoin financial system has remained stagnant when it comes to progress in the course of the previous 73 days. Tether (USDT), the biggest stablecoin market cap, has grown barely rising 0.7% in the course of the previous month, whereas usd coin (USDC) noticed a 4.9% decline. Binance’s stablecoin BUSD noticed an 11.1% improve, whereas DAI, FRAX, and TUSD declined over the last 30 days.

Pax greenback (USDP) jumped 19.7% greater this previous month, however neutrino usd (USDN) dipped by 9.5% decrease. Moreover BUSD and USDP, celo greenback (CUSD) was one of many solely stablecoin market valuations that grew, as CUSD noticed a 7.1% improve. A lion’s share of stablecoins throughout the stablecoin financial system noticed their market valuations slide in the course of the previous month. Moreover, out of all of the stablecoins in existence immediately, each USDT and USDC equate to 77.26% of the $153 billion stablecoin financial system.

Out of all the crypto financial system’s web worth at $1 trillion, tether (USDT) represents 6.761%, whereas usd coin (USDC) equates to 4.995%. Whereas the stablecoin financial system has seen stagnant progress over the last 73 days, stablecoins nonetheless characterize a substantial amount of the worldwide crypto commerce volumes worldwide. Immediately, $37.68 billion of the $50.55 billion in general international crypto commerce quantity is settled in stablecoin belongings. The stablecoin commerce quantity equates to 74% of the worldwide crypto commerce quantity on Sunday, September 18, 2022.

What do you consider the stablecoin financial system’s stagnant progress over the last 73 days? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.