Since bottoming at $17,700 on June 18, Bitcoin has been buying and selling inside a comparatively tight band, with $25,100 marking the higher restrict of this channel.

Though the previous week or so noticed BTC print six consecutive each day inexperienced closes, higher-than-expected CPI inflation information, launched on September 13, ended the upward momentum. On that day, BTC swung 13% to the draw back to backside at $19,800.

Value uncertainty is the dominant narrative as macro pressures proceed to weigh heavy in the marketplace chief. In line with the Choices 25 Delta Skew and Choices Quantity Put/Name Ratio, this has performed out as a willingness to go lengthy, even on minor indicators of worth restoration. Nevertheless, the general sentiment is bearish.

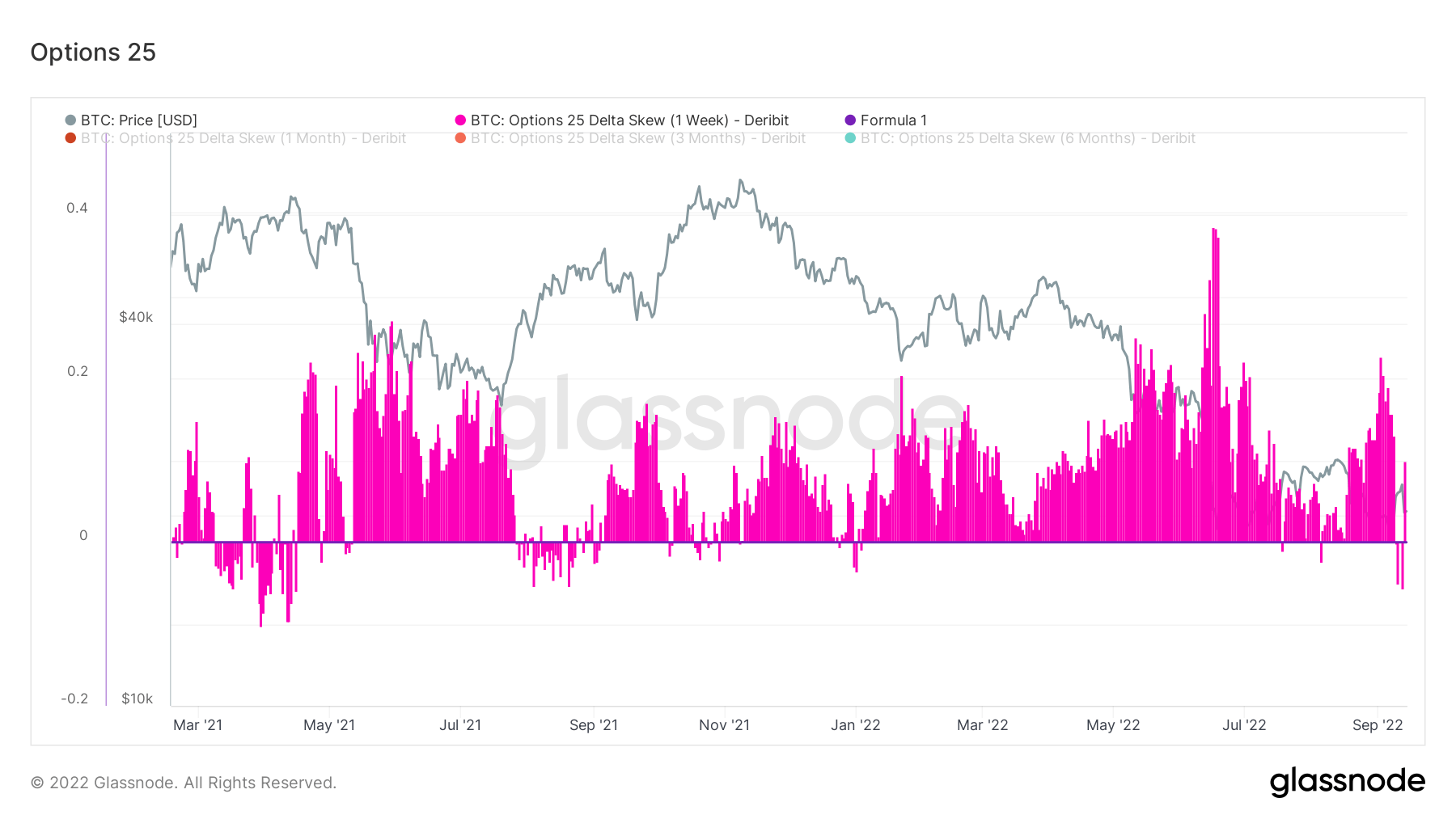

Choices 25 Delta Skew

The Choices 25 Delta Skew metric appears on the ratio of put vs. name choices expressed when it comes to Implied Volatility (IV). Places being the correct to promote a contract at a particular worth and calls being the correct to purchase.

For choices with a particular expiration date, 25 Delta Skew refers to places with a delta of -25% and calls with a delta of +25%, netted off to reach at a knowledge level. In different phrases, it is a measure of the choice’s worth sensitivity given a change within the spot Bitcoin worth.

The person intervals confer with choice contracts expiring 1 week, 1 month, 3 months, and 6 months from now, respectively.

Beneath 0 signifies calls are pricer than places. This case has occurred solely six occasions this 12 months. Throughout Bitcoin’s current bottoming, merchants scrambled for places after which reverted to calls on the native high.

This changeable habits will be defined by an extended, drawn-out bear market prompting merchants to react shortly, even on minor indications of worth restoration.

In current weeks, as Bitcoin flitted above and beneath $20,000, merchants have struck for calls, to go lengthy, on 4 events, just for the market to maneuver in opposition to them. Consecutive back-to-back calls haven’t occurred because the finish of final 12 months.

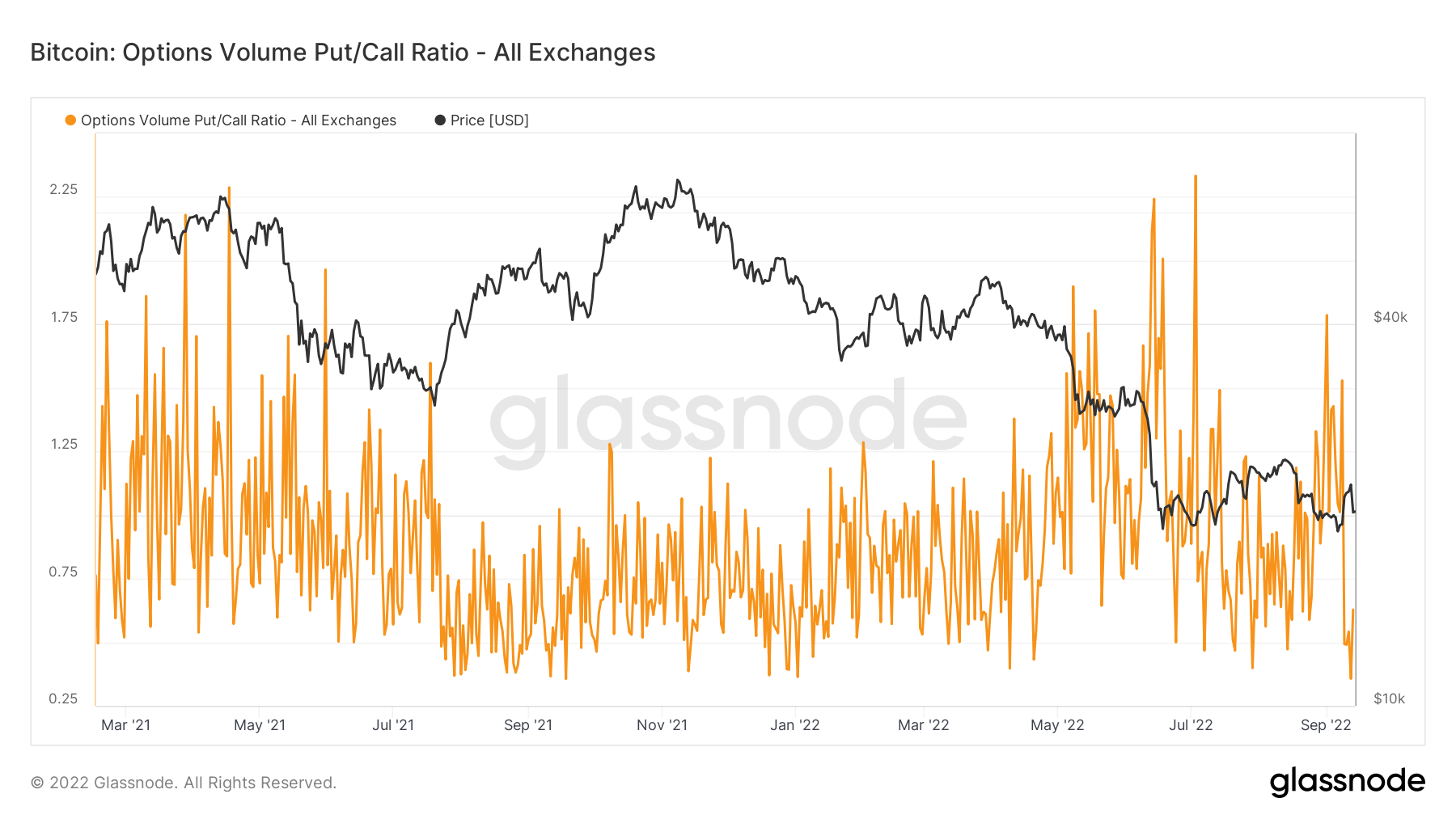

Choices Quantity Put/Name ratio

The Choices Quantity Put/Name Ratio exhibits the put quantity divided by the decision quantity traded in choices contracts within the final 24 hours. It’s used to gauge the final temper of the market.

The chart beneath exhibits a heavy skew in the direction of places, as evidenced by sharp will increase within the ratio throughout situations of worth bottoming.

This implies bearish sentiment is firmly embedded. However just like the Choices 25 Delta Skew information, merchants will go lengthy on indicators of worth restoration.