It’s been greater than a decade because the monetary disaster in 2007-2008 when Lehman Brothers, the fourth largest funding financial institution within the U.S., collapsed and filed chapter. Near 14 years later, Credit score Suisse and Deutsche Financial institution, two of the world’s largest banks, are affected by distressed valuations and the banks’ credit score default insurance coverage ranges are approaching levels not seen since 2008.

Credit score Suisse and Deutsche Financial institution Valuations Have Dive-Bombed — Traders Talk about the Systemic Threat to the International Economic system

Through the first week of October, the world financial system continues to look bleak as vitality and fuel costs have reached document highs, inflation in lots of nations is the very best in 40 years, provide chains are fractured, fairness markets have shed vital worth, and the tensions between the West and Russia has elevated.

Amid this nasty financial system, two of the most important funding banks are floundering from distressed valuations. Market information exhibits that Credit score Suisse Group AG (NYSE: CS) and Deutsche Financial institution AG (NYSE: DB) are buying and selling at extraordinarily low values not seen because the 2008 monetary disaster.

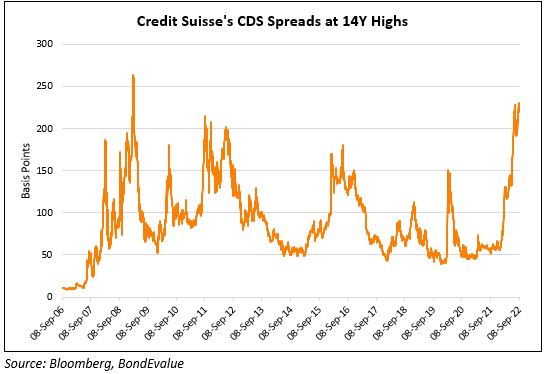

On the finish of August, Deutsche Financial institution analyzed the problems tethered to Credit score Suisse, and the financial institution’s analysts famous that there was a $4.1 billion hole that must be stuffed in an effort to fight the monetary establishment’s monetary well-being. Moreover, Credit score Suisse’s credit score default insurance coverage (CDS) ranges resemble the identical CDS ranges Lehman Brothers had simply earlier than the financial institution’s chapter.

Credit score Suisse CEO Ulrich Koerner just lately defined that his firm is going through a “vital second” and he pressured that the Swiss-based monetary establishment has a “robust capital base and liquidity place.”

Massive Investor Says Credit score Suisse CDS Is Buying and selling Like a ‘Lehman Second,’ Wallstformainst CEO Says ‘Anybody Who Totally Trusts Credit score Suisse’s accounting Additionally Believes in Unicorns and the Tooth Fairy’

Not everybody agrees with Koerner as a report from investing.com particulars {that a} “giant investor that offers with Credit score Suisse says the funding financial institution is a catastrophe, [and] CDS is buying and selling like a ‘Lehman second’ [is] about to hit.” The managing companion at Compcircle Gurmeet Chadha, nonetheless, doesnt assume a serious market anomaly will reveal itself.

“Since 2008, yearly Credit score Suisse [and] as soon as in [two] years Deutsche financial institution is about to default,” Chadha tweeted. “In Each correction – this hypothesis begins coming. In my little experience- A black swan occasion by no means declares itself.”

Credit score Suisse analysts downgrading their very own inventory to a promote ranking pic.twitter.com/SghqtoFnhS

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 2, 2022

Chadha’s commentary has not put a cork on the hypothesis surrounding the 2 banks and plenty of imagine a catastrophe is imminent. “Credit score Suisse might be going bankrupt,” the Twitter account ‘Wall Avenue Silver’ told its 320,000 followers.

“The collapse in Credit score Suisse’s share value is of nice concern,” Wall Avenue Silver mentioned. “From $14.90 in Feb 2021, to $3.90 at present. And with P/B=0.22, markets are saying it’s bancrupt and doubtless bust.”

Credit score Suisse, the 4 key numbers:

160b Money

400b at name Liabilities

900b Leveraged publicity

40b Fairness— Charlie Munger Followers (@CharlieMunger00) October 1, 2022

An evaluation of the scenario printed on Searching for Alpha additionally notes that each Credit score Suisse and Deutsche Financial institution are buying and selling at distressed valuations and additional says that Credit score Suisse “must undergo a painful restructure.” The Searching for Alpha creator writes that “[Credit Suisse] is buying and selling at 0.23x tangible guide [and] Deutsche Financial institution is buying and selling at 0.3x tangible guide worth.” Nevertheless, the Searching for Alpha creator says that Deutsche Financial institution is working by the storm by way of advantages from rates of interest. The creator provides

Traders ought to keep away from [Credit Suisse] and purchase [Deutsche Bank].

Traders imagine that the 2 monetary giants are going through a big disaster and so they don’t imagine the statements made by the Credit score Suisse CEO. Some have criticized the banks’ auditing course of as they imagine Credit score Suisse and Deutsche Financial institution are up to their necks in debt and unhealthy loans.

“Inform me the actual quantity quantity of unhealthy loans excellent that Credit score Suisse has to those hedge funds and household places of work like Archegos,” the CEO of Wallstformainst Jason Burack tweeted in August. “As a result of anybody who absolutely trusts their accounting additionally believes in unicorns and the tooth fairy.” On the time of writing, the time period “Credit score Suisse” is a really popular vertical trend on Twitter on Sunday morning (ET) with 46,000 tweets.

What do you concentrate on the monetary points surrounding Deutsche Financial institution and Credit score Suisse? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: Nataly Reinch and Rostislav Ageev

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.