That is an opinion editorial by Aleks Svetski, creator of “The UnCommunist Manifesto,” founding father of The Bitcoin Instances and Host of the “Wake Up Podcast with Svetski.”

It’s October 2022. Bitcoin is as soon as once more under $20,000.

R.I.P. bitcoin. You might have lastly died. You’ve misplaced your luster. The Ponzi has ended. The present is over. It’s time to go dwelling.

Subsequent cease, $10,000, then $1,000 after which $0.

On this essay, I will probably be channeling my inside Nassim Taleb, Frances Coppola, Jim Cramer, Peter Schiff and Paul Krugman to show that this time, bitcoin has properly and really failed!

Bitcoin Has No Laborious Cap, You Can Divide It!

Let’s start by exploring the big-brained thought of “inflation through divisibility,” proposed by the unbelievable Coppola. Her concept could also be how we remedy world starvation and really feed all people with a single pizza as a result of “subdivision eliminates shortage.”

It’s really extraordinary stuff.

Fan golf equipment of hers have begun to spring up in chartered monetary analyst (CFA) circles all around the globe. See Dick under:

Based on the consultants, for those who can divide issues down, you possibly can truly create extra of them!

Lord Keynes himself may by no means have imagined such wonders.

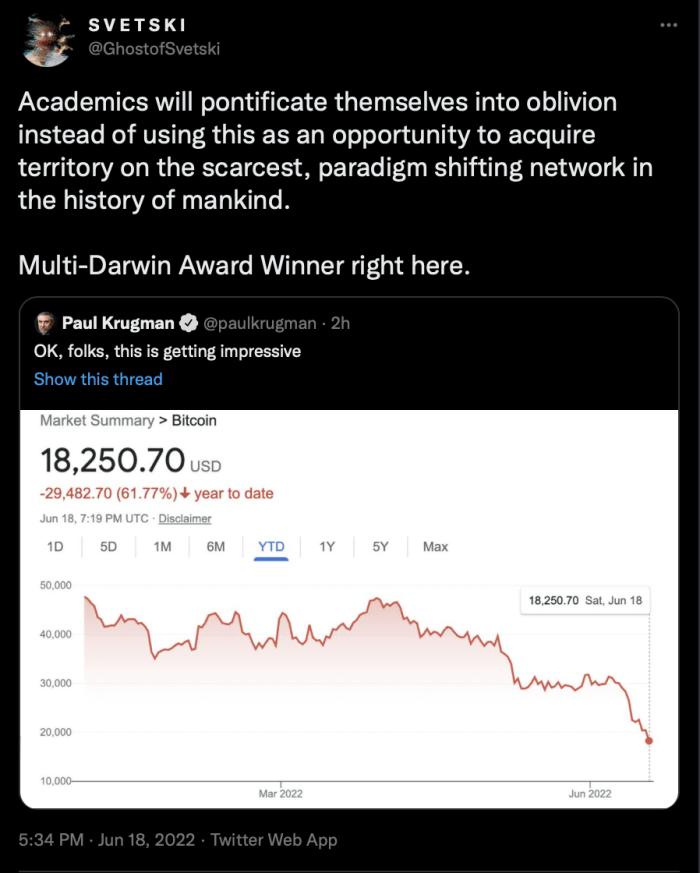

Then there’s Paul Krugman. One of many biggest of the greats, faxed the world his opinion, after having been on the improper aspect of historical past (once more). I believe this time he’s proper. Bitcoin has failed.

Fiat geniuses and Nobel Prize winners equivalent to Krugman are identified for his or her unbelievable predictions, whether or not it involves the influence of the web, or extra lately, Bitcoin.

Krugman has been warning us all for years now of the peril of being concerned in Bitcoin. Have you ever been listening?

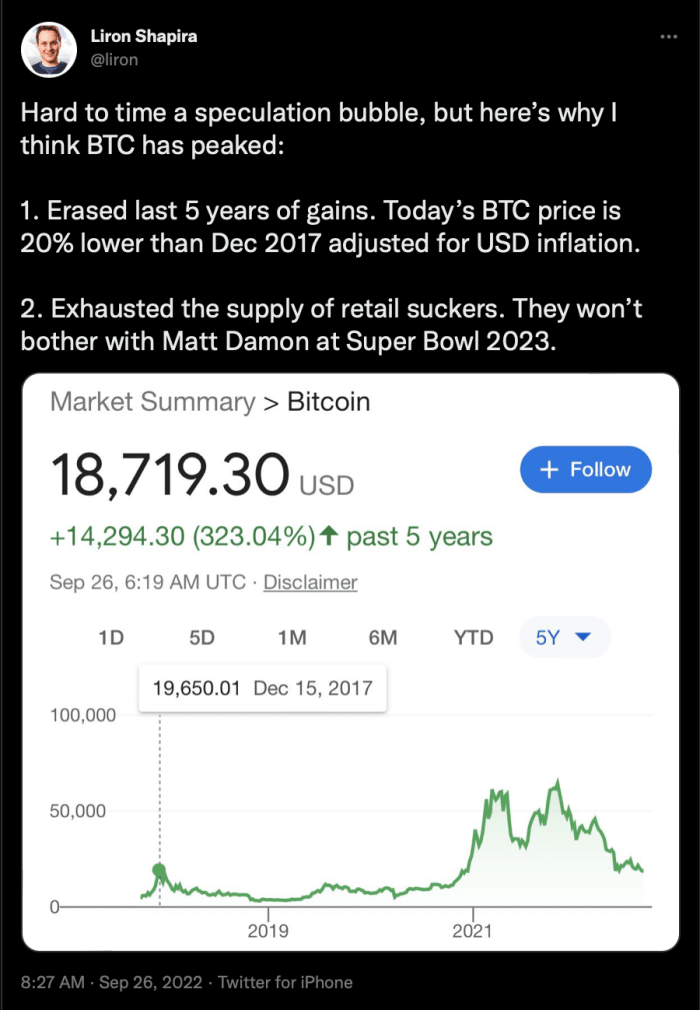

Younger Liron Shapira under certain has been:

Oh, Shapira. How may we’ve not seen that bitcoin fell 80% (once more) and that regardless of the identical factor having occurred many occasions within the final decade, that this time will probably be totally different, within the face of orders of magnitude extra hash charge, wallets, customers and technical improvement?

Jeez. Bitcoiners are such ignorant morons. They don’t know!

It’s over for retail. There aren’t any extra individuals on the planet who want sound cash and financial savings that received’t soften like ice…

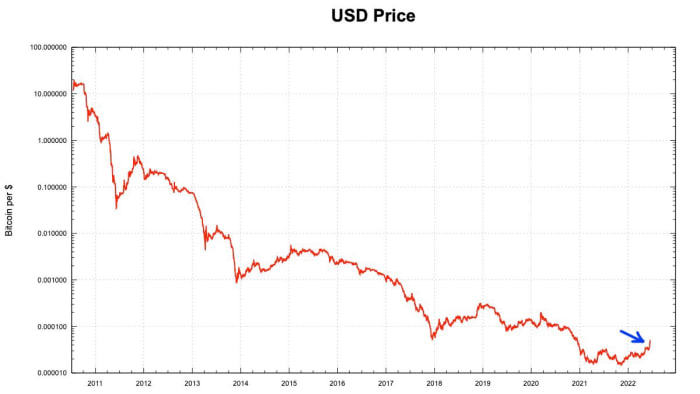

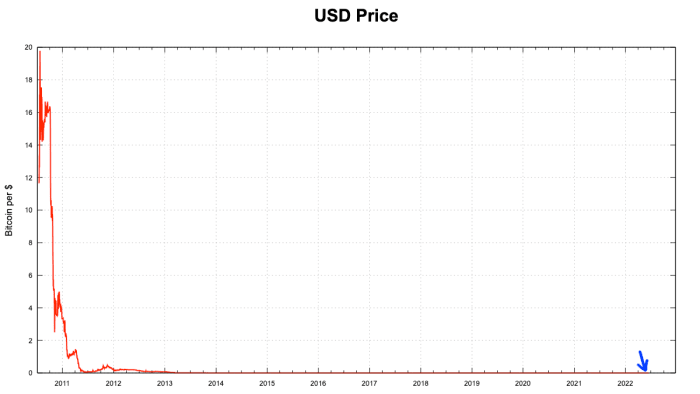

Again to the U.S. greenback we go:

Oops … that’s the logarithmic chart. The true distinction is healthier represented in absolute phrases. This latest “bitcoin is useless” section may be seen within the backside proper hand nook, the place the arrow is pointing. This proves the purpose unequivocally. Bitcoin is useless.

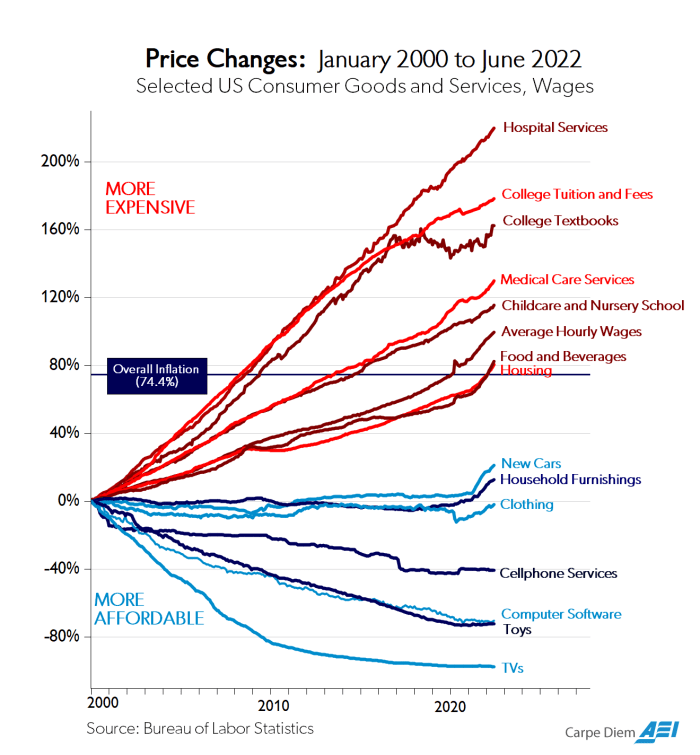

Look! The USD could also be struggling slightly bit, however at the very least with it we get low cost TVs!

Reader: please ignore the highest half of the next chart. Issues like meals, healthcare and housing are not essential. What issues is that we’ve a regulated medium of trade issued by fossils over on the central financial institution. Solely on this method can we’ve a clearly useful society the place irrelevant conveniences like medical service go up in value whereas TVs go down!

The Fb To Your Myspace!

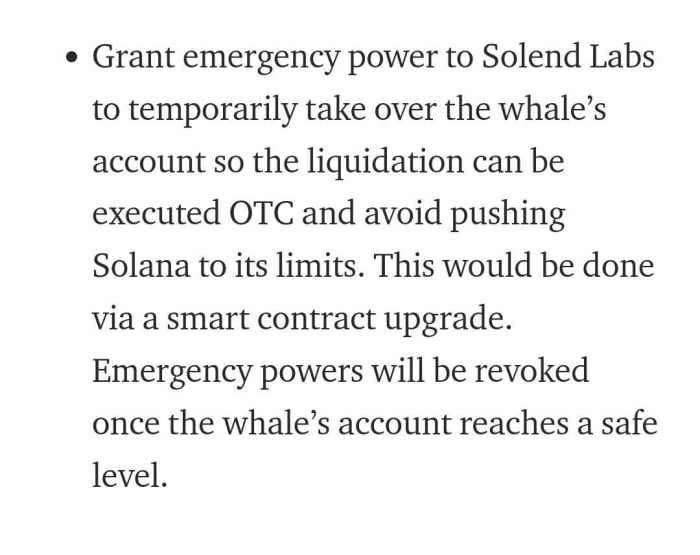

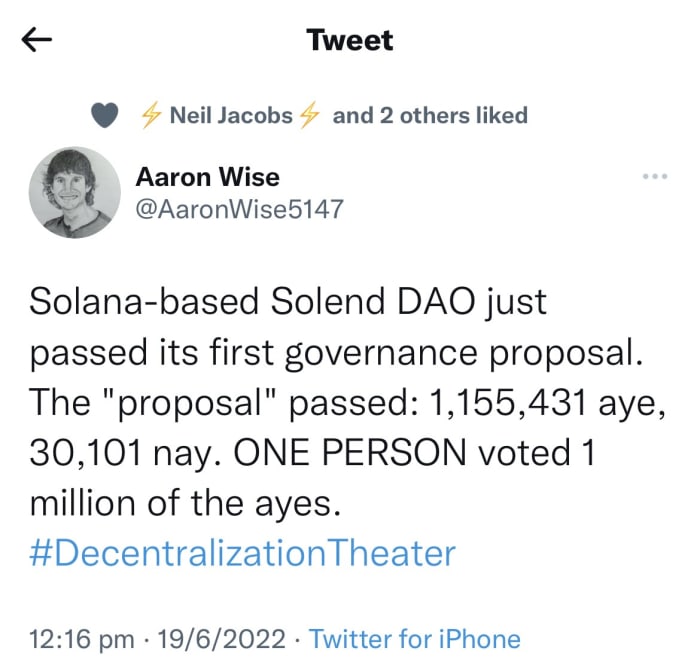

Bitcoin has did not innovate. In 2022, we’ve created quicker, newer, extra “dEcEnTrALiZeD” blockchains, like Solana. Nevermind that Solana backwards is definitely “Anal OS.” That’s only a coincidence made up by that toxic nym Gigi.

We’ve moved on from old skool applied sciences like proof of labor. We’re now utilizing power environment friendly consensus mechanisms like proof of stake:

Additionally — simply incase you haven’t seen, the Federal Reserve isn’t printing any extra money, so now enterprise capital companies have determined to take it upon themselves to print in its stead. The methodology is good and fairly easy:

Take slightly little bit of seed cash, combine it with some technical buzzwords, wrap it in a really wholesome dose of contemporary advertising and marketing with buddies over at Fb and Google, then have it served by everybody’s favourite Instagram movie star.

It’s an attractive factor.

Why would anybody want one thing so boring as sound cash in a world the place cash doesn’t even have to develop on bushes, however may be conjured up with a number of strains of code?

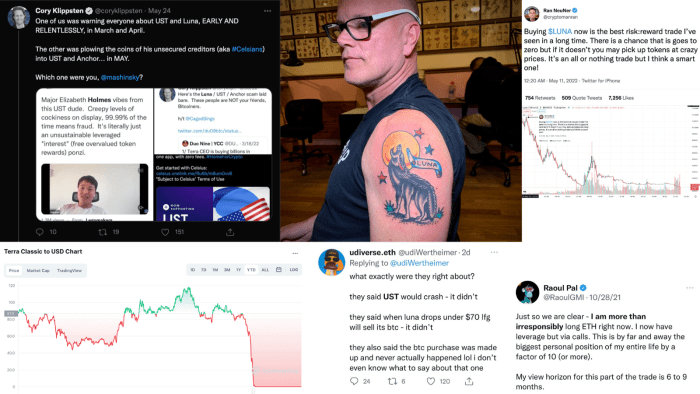

Why would anybody want power cash, inconveniently rooted within the legal guidelines of thermodynamics which thus can’t be printed, modified or manipulated, when you possibly can simply get tatted-up hedge fund managers and washed up bears from funding banks to pump digital Ponzi schemes?

I imply, simply have a look at the caliber of individuals backing “crypto”:

Critically man.

You Bitcoiners have philosophers, engineers, writers, artists and memers.

What are they good for?

We’ve got “influencers” and JPMorgan executives, as a result of “cRyPtO is dA fEwTcHa.”

Bitcoin Is For Losers

It has clearly failed as a result of, in 2022, you may be an artist and receives a commission straight. You possibly can monetize your unbelievable, Fiverr-created or AI-generated JPEG on OpenSea and the lemmings … I imply “followers” … will purchase it as a result of they love your artwork!

Didn’t you realize this?

Why on the earth would you continue to want Bitcoin when you are able to do this?

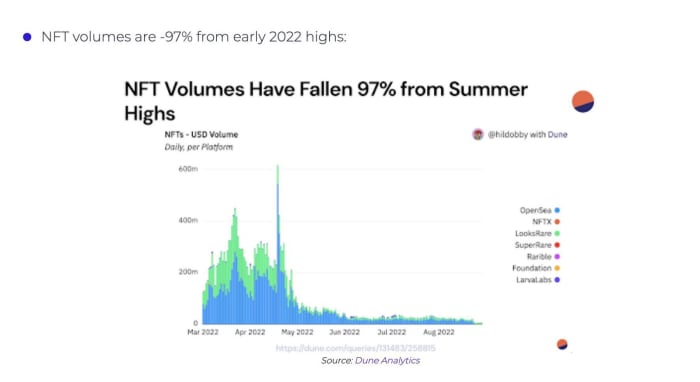

NFTs have and can proceed to take the world by storm.

And as soon as once more, Bitcoiners have did not evolve and alter with the occasions. Similar to they missed out on ICOs, they’re lacking out on NFTs. And so they’ll miss out on extra.

Why? As a result of there may be far more…

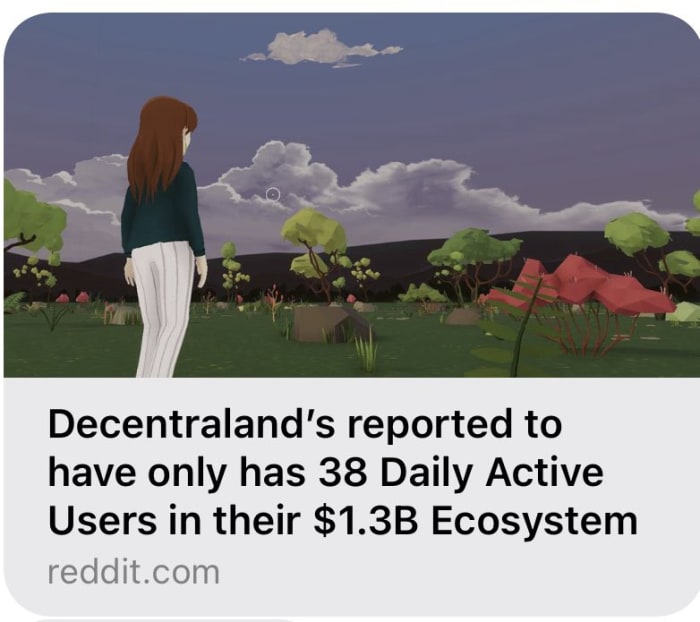

Have you ever heard in regards to the Metaverse, or the decentralized land on the blockchain? Why would you personal actual land in the actual world, or one thing as ineffective as a “sToRe oF vALuE” when you possibly can ackchyually personal land on a $1.3 billion community like Decentraland?

Metaverse initiatives are backed by the neatest individuals on the earth, like Andreessen Horowitz, and it’s really the longer term. Come be a part of us and the opposite 38 individuals on the community.

It’s a brand new world, and Bitcoiners are previous information.

That is what occurs once you don’t adapt and conform to the world round you. You miss out on every part. Even on free cash.

Yield!

You Bitcoiners are so silly that you just don’t even get any yield. You sit there together with your foolish store-of-value tokens, locked up in wallets doing completely nothing! Critically?

It’s 2022. Didn’t you realize you must make your cash give you the results you want? That’s what cryptocurrencies and DeFi are all about! One more reason why bitcoin is so dumb.

Utilizing the facility of root greens, we’ve found out how one can conjure yield from digital cash that in flip is conjured up from code, which in flip is conjured up from the creativeness of the neatest 20 12 months olds on the earth!

It’s magic all the way in which down, and we’re making all types of cash.

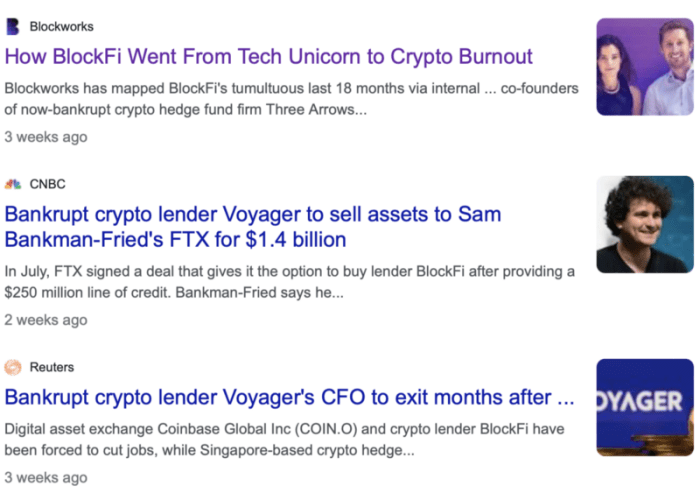

DeFi, CeFi, yield, yams. We’ve received all of it.

What do you will have? Retailer of worth. Hah!

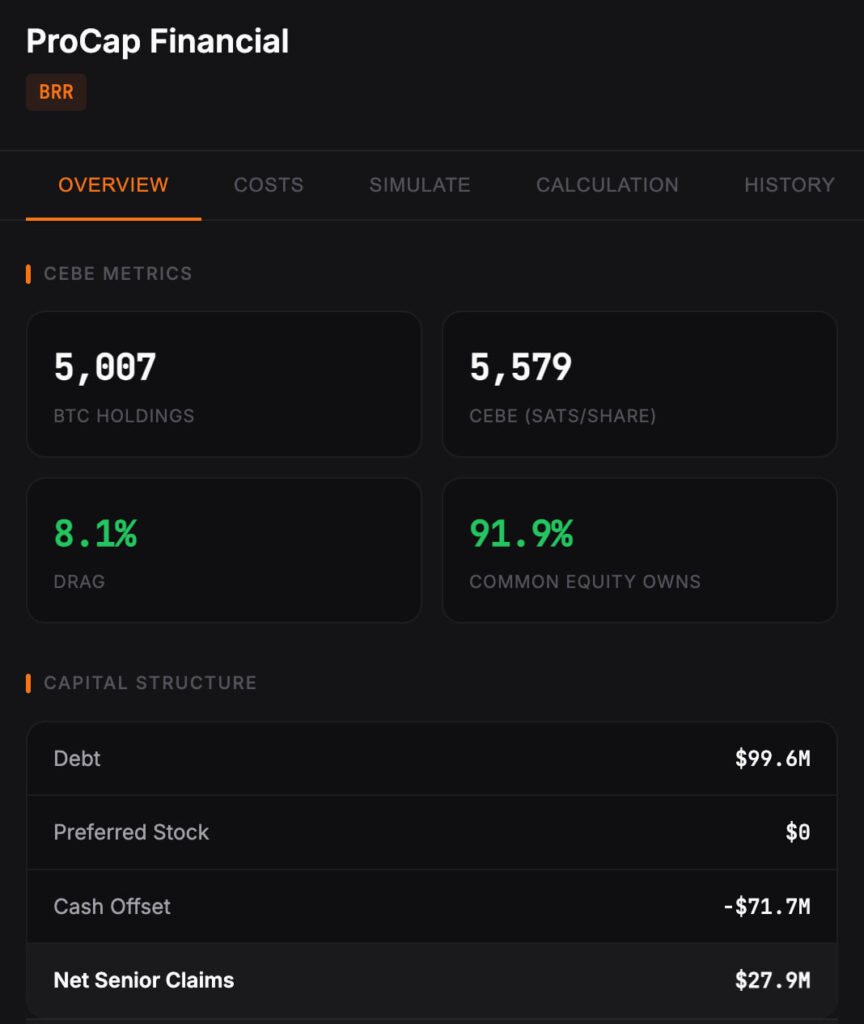

No less than a few of you’re sensible sufficient to wrap your BTC in ETH and stake it, or on the very least, put your bitcoin to work for 3%.

Certain there could also be some dangers, however you possibly can’t make an omelet with out breaking a number of eggs. And that’s what Bitcoiners don’t perceive. To make progress, you must transfer quick and break issues.

The Details

Bitcoiners simply don’t get it. They’re a brainwashed cult stuffed with fascist conspiracy theorists and extremists who’re too busy being poisonous assholes as a substitute of coming to phrases with actuality.

Because of this they’re all improper. The remainder of us, dwelling in the actual world, know the info. And so they’re fairly easy:

- Bitcoin is previous expertise. It’s just like the Myspace of cryptocurrency.

- Central banks are elevating charges, which implies they’ll by no means once more print cash. Jerome Powell is the brand new Paul Volcker and he’s going to set issues straight, whereas Christine Lagarde, along with buddies within the European Central Financial institution, are going to save lots of Europe.

- The nice leaders on the World Financial Discussion board have all our greatest pursuits at coronary heart. They wish to make the world inexperienced, and can assist the central banks create a worldwide central financial institution digital foreign money (CBDC) that’s so a lot better than bitcoin.

- In contrast to CBDCs which will probably be given to everybody, bitcoin is so erratically distributed that 10 individuals personal, like, all of it. They’ll change the principles in the event that they actually wish to. Richard Coronary heart stated so, and he’s all the time proper.

- In fact, then there’s the danger of Satoshi Nakamoto shifting his bitcoin. That may show it’s not unchangeable. Individuals are beginning to understand this.

- Bitcoin doesn’t have a safety funds, or a improvement funds. When the block reward runs out, all of the miners will go broke as a result of, 120 years from now, the worth of bitcoin will probably be $1,000 so there’s not sufficient to be produced from charges!

- And with out a improvement funds, who’s going to improve Bitcoin to proof of stake? Did you ever take into consideration that? I wager you didn’t!

And look. Most significantly of all, bitcoin is just not even actual. I imply — have you ever even touched one? Didn’t suppose so. How can one thing like that be value something? There isn’t any intrinsic worth.

On the very least, these are all explanation why it’s best to have a various portfolio, since you by no means know what would be the subsequent bitcoin.

It’s been round for 13 years and it’s about time for it to cease going up. And with all that’s taking place around the globe, I believe it’s fairly apparent at this level. In case you can’t see it, even with the entire proof from the consultants, I don’t know what else to inform you.

Besides in fact:

Have enjoyable staying poor!

This can be a visitor publish by Aleks Svetski, creator of “The UnCommunist Manifesto,”, founding father of The Bitcoin Instances and Host of The Wake Up Podcast. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.