Whereas the value of bitcoin has remained vary certain and coasting alongside simply above the $19K zone, over 60% of the bitcoin in circulation has not moved in a 12 months or extra. Furthermore, there’s been only a few transfers from bitcoins stemming from 2010, and it’s been greater than two months for the reason that final 2010 block subsidy switch. In the meantime, 2011 block subsidy transactions have appeared every so often, and on October 25, 2022, roughly 92.76 bitcoin price roughly $1.79 million from 2011 had been transferred to unknown wallets.

2010, 2011 ‘Sleeping Bitcoin’ Spending Slows — 92 Bitcoin From 2011 Transferred on Tuesday

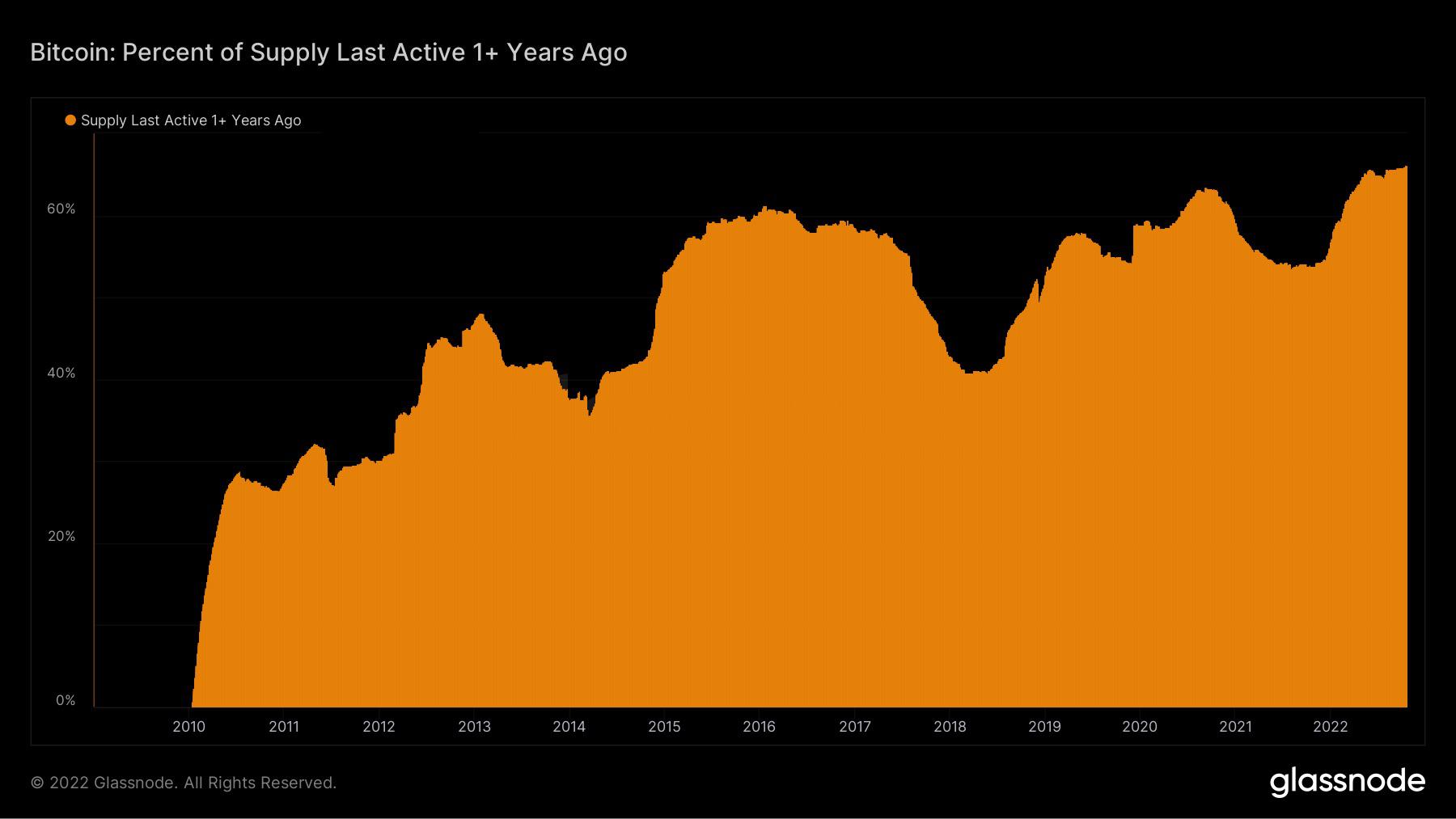

On October 24, bitcoin supporters celebrated the variety of bitcoin (BTC) that haven’t moved in a 12 months or extra. The bitcoiners shared a chart from Glassnode that signifies greater than 60% of the BTC in circulation has not moved in a 12 months or extra.

Bitcoin.com Information has additionally seen that the variety of so-called ‘sleeping bitcoins’ transferred in 2022 has slowed down a terrific deal for the reason that all-time BTC value highs on the finish of 2021. For example, information from January 2021 to September 28, 2021, had proven 152 transactions derived from ‘sleeping bitcoins’ from 2010.

The identical analysis had proven from January 2021 to September 2021, 85 transfers from 2011 ‘sleeping bitcoins’ occurred. Furthermore, whereas bitcoin (BTC) moved towards its $69K all-time excessive, a whole bunch of hundreds of thousands of {dollars}’ price of ‘sleeping bitcoins’ had been transferred in mid-November 2021.

This 12 months, nevertheless, the variety of ‘sleeping bitcoins’ from 2010 was solely 12, and the variety of 2011 transactions added as much as solely 30 transfers. Moreover, it’s been roughly 64 days for the reason that final 2010 BTC spend that occurred on August 22, 2022.

Nonetheless, there’s been a complete of ten 2011 transactions since then, with two transfers spent on Tuesday, October 25, 2022. On Tuesday, 42.76 BTC had been transferred to an unknown handle and spent at block peak 760,212.

It’s price noting that the phrases “spent” or “spend” on this article, don’t essentially imply that the bitcoins had been “offered” to a 3rd get together for fiat or one other crypto asset. After the 42.76 BTC spend, seven block subsidies later at block peak 760,219, roughly 50 BTC had been transferred to an unknown handle.

Between the 42.76 BTC and the 50 BTC moved on Tuesday, the stash was price 1.79 million nominal U.S. {dollars} utilizing in the present day’s BTC change charges. Whereas October isn’t over but, September and October haven’t seen any 2010 spends in any respect, however a complete of 9 2011 transfers have occurred in the course of the two-month span.

Whereas 2022 has had a complete lot much less spending from 2010 and 2011, the 12 months did present some transfers sorts that had not occurred since Might 2020. This 12 months, a complete of 5 block subsidies or roughly 250 BTC mined in November 2009, had been transferred.

The latest information from Glassnode exhibits that greater than 60% of the BTC in circulation has not moved in a 12 months or extra, and the less 2010 and 2011 transfers suggests BTC house owners are ready for the bear market to finish earlier than transferring outdated cash. An awesome majority of the outdated ‘sleeping bitcoins’ that moved in October have derived from cash and block subsidies from 2012, 2013, 2014, 2015, 2016, and 2017.

What do you consider the slowing pattern of 2010 and 2011 ‘sleeping bitcoin’ spends? Tell us your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Btcparser.com,

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.