That is an opinion editorial by Luke Mikic, a author, podcast host and macro analyst.

That is the second half in a two-part collection in regards to the Greenback Milkshake Concept and the pure development of this to the “Bitcoin Milkshake.” On this piece, we’ll discover the place bitcoin matches into a world sovereign debt disaster.

The Bitcoin Milkshake Concept

Most individuals consider the monetization of bitcoin will most harm the USA because it’s the nation with the present world reserve foreign money. I disagree.

The monetization of bitcoin advantages one nation disproportionally greater than another nation. Prefer it, welcome it or ban it, the U.S. is the nation that can profit most from the monetization of bitcoin. Bitcoin will assist to increase the lifetime of the USD longer than many can conceptualize and this text explains why.

If we transfer ahead on the belief that the Greenback Milkshake Thesis continues to decimate weaker currencies world wide, these international locations can have a call to make when their foreign money goes by hyperinflation. A few of these international locations might be compelled to dollarize, just like the greater than 65 international locations which can be both dollarized or have their native foreign money pegged to the U.S. greenback.

Some might select to undertake a quasi-gold normal like Russia just lately has. Some might even select to undertake the Chinese language yuan or the euro as their native medium of alternate and unit of account. Some areas may copy what the shadow authorities of Myanmar have finished and undertake the Tether stablecoin as authorized tender. However most significantly, a few of these international locations will undertake bitcoin.

For the international locations that will undertake bitcoin, it will likely be too unstable to make financial calculations and use as a unit of account when it’s nonetheless so early in its adoption curve.

Regardless of what the consensus narrative is surrounding those that say, “Bitcoin’s volatility is reducing as a result of the establishments have arrived,” I strongly consider this isn’t a take rooted in actuality. In a earlier article written in late 2021 analyzing bitcoin’s adoption curve, I outlined why I consider the volatility of bitcoin will proceed to extend from right here because it travels by $500,000, $1 million and even $5 million per coin. I believe bitcoin will nonetheless be too unstable to make use of as a real unit of account till it breaches eight figures in immediately’s {dollars} — or as soon as it absorbs 30% of the world’s wealth.

For that reason, I consider the international locations who will undertake bitcoin, can even be compelled to undertake the U.S. greenback particularly as a unit of account. International locations adopting a bitcoin normal might be a Computer virus for continued world greenback dominance.

Put apart your opinions on whether or not stablecoins are shitcoins for only a second. With current developments, reminiscent of Taro bringing stablecoins to the Lightning Community, think about the potential for transferring stablecoins world wide, immediately and for almost zero charges.

The Federal Reserve of Cleveland appears to be paying shut consideration to those developments, as they just lately revealed a paper titled, “The Lightning Community: Turning Bitcoin Into Cash.”

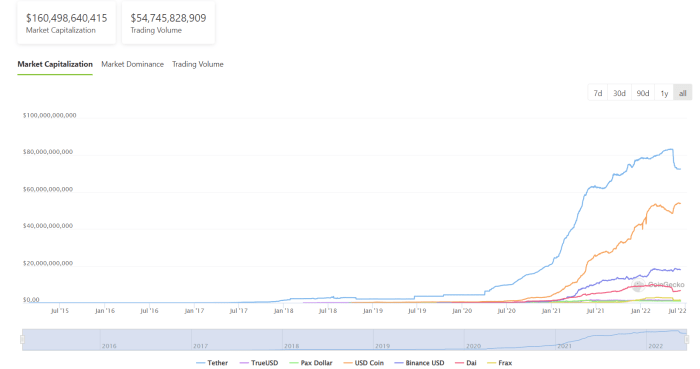

Zooming out, we are able to see that since March 2020, the stablecoin provide has grown from beneath $5 billion to over $150 billion.

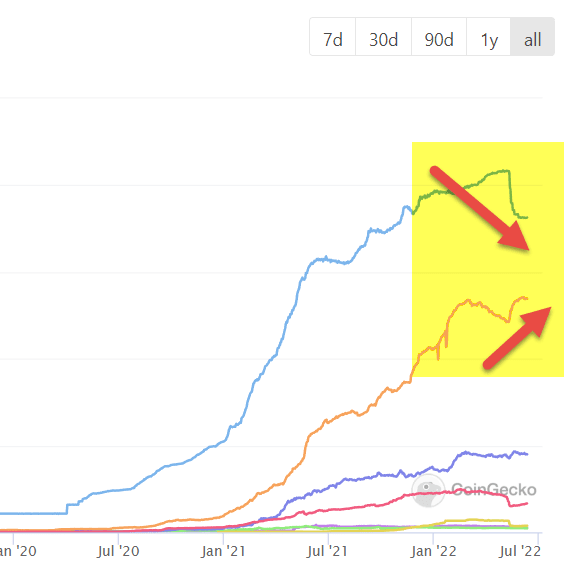

What I discover most fascinating is just not the speed of progress of stablecoins, however which stablecoins are rising the quickest. After the current Terra/LUNA debacle, capital fled from what’s perceived to be extra “dangerous” stablecoins like tether, to extra “protected” ones like USDC.

It is because USDC is 100% backed by money and short-term debt.

BlackRock is the world’s largest asset supervisor and just lately headlined a $440 million fundraising spherical by investing in Circle. But it surely wasn’t only a funding spherical; BlackRock goes to be appearing as the first asset supervisor for USDC and their treasury reserves, which is now almost $50 billion.

The aforementioned Tether seems to be following within the footsteps of USDC. Tether has lengthy been criticized for its opaqueness and the actual fact it’s backed by dangerous industrial paper. Tether has been considered because the unregulated offshore U.S. greenback stablecoin. That being mentioned, Tether bought their riskier industrial paper for extra pristine U.S. authorities debt. Additionally they agreed to endure a full audit to enhance transparency.

If Tether is true to their phrase and continues to again USDT with U.S. authorities debt, we may see a situation within the close to future the place 80% of the overall stablecoin market is backed by U.S. authorities debt. One other stablecoin issuer, MakerDao, additionally capitulated this week, shopping for $500 million authorities bonds for its treasury.

It was essential that the U.S. greenback was the primary denomination for bitcoin throughout the first 13 years of its life throughout which 85% of the bitcoin provide had been launched. Community results are exhausting to vary, and the U.S. greenback stands to learn most from the proliferation of the general “crypto” market.

This Bretton Woods III framework appropriately describes the difficulty dealing with the USA: The nation wants to search out somebody to purchase their debt. Many greenback doomsayers assume the Fed must monetize a variety of the debt. Others say that elevated rules are on the way in which for the U.S. industrial banking system, which was regulated to carry extra Treasurys within the 2013-2014 period, as international locations like Russia and China started divesting and slowing their purchases. Nonetheless, what if a proliferating stablecoin market, backed by authorities debt, may help take in that misplaced demand for U.S. Treasurys? Is that this how the U.S. finds an answer to the unwinding petrodollar system?

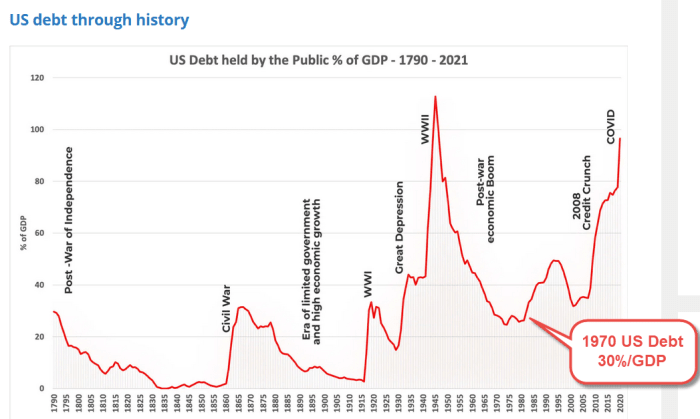

Curiously, the U.S. must discover a resolution to its debt issues, and quick. Nations world wide are racing to flee the dollar-centric petrodollar system that the U.S. for many years has been capable of weaponize to entrench its hegemony. The BRICS nations have introduced their intentions to create a brand new reserve foreign money and there are a number of different international locations, reminiscent of Saudi Arabia, Iran, Turkey and Argentina which can be making use of to grow to be part of this BRICS partnership. To make issues worse, the USA has $9 trillion of debt that matures within the subsequent 24 months.

Who’s now going to purchase all that debt?

The U.S. is as soon as once more backed right into a nook prefer it was within the Nineteen Seventies. How does the nation shield its almost 100-year hegemony as the worldwide reserve foreign money issuer, and 250-year hegemony because the globe’s dominant empire?

Forex Wars And Financial Wild Playing cards

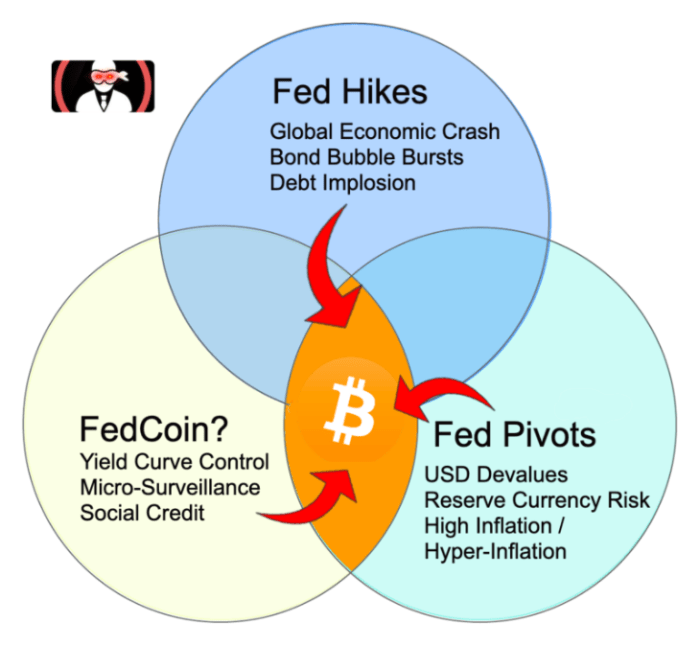

That is the place the thesis turns into much more speculative. Why is the Fed persevering with to aggressively increase rates of interest, bankrupting its supposed allies like Europe and Japan, whereas seemingly sending the world into a world despair? “To struggle inflation,” is what we’re instructed.

Let’s discover another, potential motive why the Fed may very well be elevating charges so aggressively. What choices does the U.S. should defend its hegemony?

In a world presently beneath a scorching warfare, would it not appear so far-fetched to invest that we may very well be coming into an financial chilly warfare? A warfare of central banks, if you’ll? Have we forgotten in regards to the “weapons of mass destruction?” Have we forgotten what we did to Libya and Iraq for making an attempt to route across the petrodollar system and cease utilizing the U.S. greenback within the early 2000s?

Till six months in the past, my base case was that the Fed and central banks across the globe would act in unison, pinning rates of interest low and use the “financial repression sandwich” to inflate away the globe’s monumental and unsustainable 400% debt-to-GDP ratio. I anticipated them to observe the financial blueprints laid out by two financial white papers. The primary one revealed by the IMF in 2011 titled, “The Liquidation Of Authorities Debt” after which the second paper revealed by BlackRock in 2019 titled, “Dealing With The Subsequent Downturn.”

I additionally anticipated all of the central banks to work in tandem to maneuver towards implementing central financial institution digital currencies (CBDCs) and dealing collectively to implement the “Nice Reset.” Nonetheless, when the information modifications, I alter my opinions. For the reason that creepingly coordinated insurance policies from governments and central banks world wide in early 2020, I believe some international locations usually are not so aligned as they as soon as have been.

Till late 2021, I held a robust view that it was mathematically unattainable for the U.S. to lift charges — like Paul Volcker did within the Nineteen Seventies — at this stage of the long-term debt cycle with out crashing the worldwide debt market.

However, what if the Fed desires to crash the worldwide debt markets? What if the U.S. acknowledges {that a} strengthening greenback causes extra ache for its world opponents than for themselves? What if the U.S. acknowledges that they might be the final domino left standing in a cascade of sovereign defaults? Would collapsing the worldwide debt markets result in hyperdollarization? Is that this the one financial wild card the U.S. has up its sleeve to delay its reign because the dominant world hegemon?

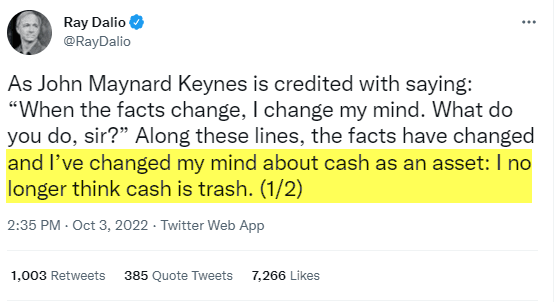

Whereas everyone seems to be ready for the Fed pivot, I believe a very powerful pivot has already occurred: the Dalio pivot.

(Source)

As a Ray Dalio disciple, I’ve constructed my complete macroeconomic framework on the concept “money is trash.” I consider that mantra nonetheless holds true for anybody utilizing another fiat foreign money, however has Dalio stumbled upon some new details about the USD that has modified his thoughts?

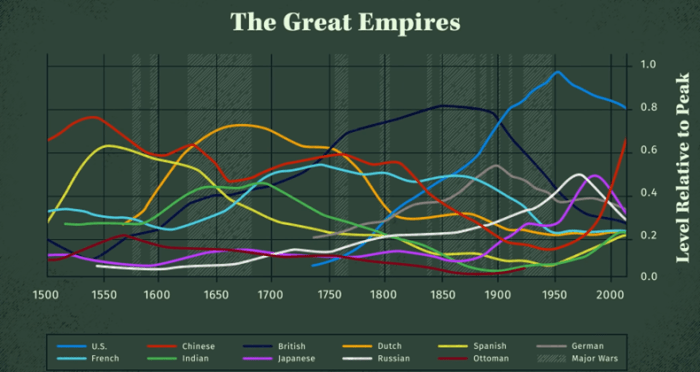

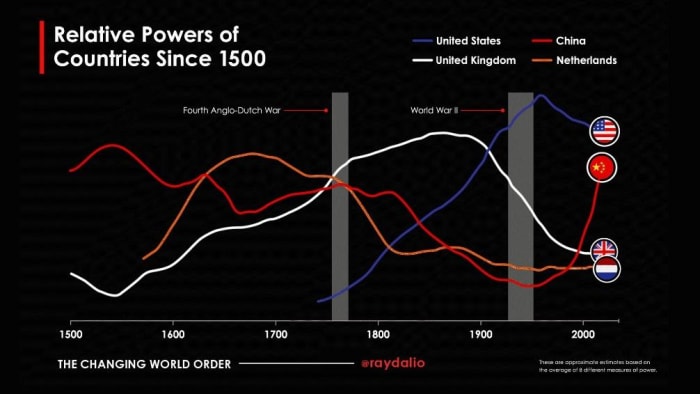

Dalio wrote an outstanding ebook “The Altering World Order: Why Nations Succeed or Fail” that particulars how wars happen when world empires conflict.

(Source)

Has he concluded that the USA may very well be about to weaponize the greenback, making it not so trashy? Has he concluded that the U.S. isn’t going to willingly permit China to be the world’s subsequent rising empire like he as soon as proclaimed? Would the U.S. aggressively elevating charges result in a capital flight to the U.S., a rustic that has a relatively more healthy banking system than its opponents in China, Japan and Europe? Do we’ve got any proof for this outlandish left-field, hypothetical situation?

Let’s additionally not overlook, this isn’t only a race with the USA versus China. The second-most used overseas foreign money on the earth — the euro — in all probability wouldn’t thoughts gaining energy from a declining U.S. empire. We’ve got to ask the query, why is Jerome Powell refusing to align financial insurance policies with one in every of our closest allies in Europe?

On this illuminating 2021 webinar, on the Inexperienced Swan central banking convention, Powell blatantly refused to go together with the “inexperienced central banking” insurance policies that have been mentioned. This visibly infuriated Christine Lagarde, head of the European Central Financial institution, who was additionally a part of the occasion.

Among the quotes from Powell in that interview are illuminating.

Is that this an indication the U.S. is not a fan of the Nice Reset ideologies popping out of Europe? Why is the Fed additionally ignoring the United Nations begging them to decrease charges?

(Source)

We are able to speculate about what Powell’s intentions could also be all day, however I favor to have a look at knowledge. Since Powell’s preliminary heated debate with Lagarde and the Fed’s subsequent price enhance on the reverse repo days after, the greenback has decimated the euro.

In April 2022, Powell was dragged into one other “debate” with Lagarde, led by the pinnacle of the IMF. Powell reaffirmed his stance on local weather change and central banking.

The plot thickens after we contemplate the implications of the LIBOR and SOFR rate of interest transition that occurred in the beginning of 2022. Will this rate of interest change allow the Fed to hike rates of interest and insulate the banking system from the contagion that’ll ensue from a wave of world debt defaults within the wider eurodollar market?

(Source)

I do assume it’s fascinating that by some metrics the U.S. banking system is displaying comparatively fewer indicators of stress than in Europe or the remainder of the world, validating the thesis that SOFR is insulating the U.S. to a level.

A New Reserve Asset

Whether or not the U.S. is at warfare with different central banks or not doesn’t change the truth that the nation wants a brand new impartial reserve asset to again the greenback. Creating a world deflationary bust, and weaponizing the greenback is only a short-term play. Scooping up property on a budget and weaponizing the greenback will solely power dollarization within the brief time period. The BRICS nations and others which can be disillusioned with the SWIFT-centered monetary system will proceed to de-dollarize and attempt to create an alternative choice to the greenback.

The worldwide reserve foreign money has been informally backed by the U.S. Treasury observe for the previous 50 years, since Nixon closed the gold window in 1971. In instances of threat, individuals run to the reserve asset as a approach to come up with {dollars}. For the previous 50 years, when equities unload, buyers fled to the “security” of bonds which might respect in “threat off” environments. This dynamic constructed the muse of the notorious 60/40 portfolio — till this commerce in the end broke in March 2020 when the Treasury market grew to become illiquid.

As we transition into the Bretton Woods III period, the Triffin dilemma is lastly turning into untenable. The U.S. wants to search out one thing to again the greenback with. I discover it unlikely that they are going to again the greenback with gold. This is able to be taking part in into the fingers of Russia and China who’ve far bigger gold reserves.

This leaves the U.S. with their backs in opposition to a wall. Religion is being misplaced within the greenback and they’d certainly wish to retain their world reserve foreign money standing. The final time the U.S. was in a equally weak place was within the Nineteen Seventies with excessive inflation. It appeared just like the greenback would fail till the U.S. successfully pegged the greenback to grease by the petrodollar settlement with the Saudis in 1973.

The nation is confronted with an identical conundrum immediately however with a unique set of variables. They not have the choice of backing the greenback with oil or gold.

Enter Bitcoin!

Bitcoin can stabilize the greenback and even delay its world reserve foreign money standing for for much longer than many individuals count on! Most significantly, bitcoin offers the U.S. the one factor it wants for the Twenty first-century financial wars: belief.

International locations might belief a gold-backed (petro-)ruble/yuan greater than a greenback backed by nugatory paper. Nonetheless, a bitcoin-backed greenback is way extra reliable than a gold-backed (petro-)ruble/yuan.

As talked about earlier, the monetization of bitcoin not solely helps the U.S. economically, however it additionally instantly hurts our financial opponents, China and to a lesser diploma, Europe — our supposed ally.

Will the U.S. notice that backing the greenback with vitality instantly hurts China and Europe? China and Europe are each dealing with vital energy-related headwinds and have each infamously banned Bitcoin’s proof-of-work mining. I made the case that the vitality disaster in China was the actual motive China banned bitcoin mining in 2021.

At present, as we transition into the digital age, I consider a basic shift is coming:

For 1000’s of years, cash has been backed by belief and gold, and guarded by ships. Nonetheless, on this millennium, cash will now be backed by encryption and math, and guarded by chips.

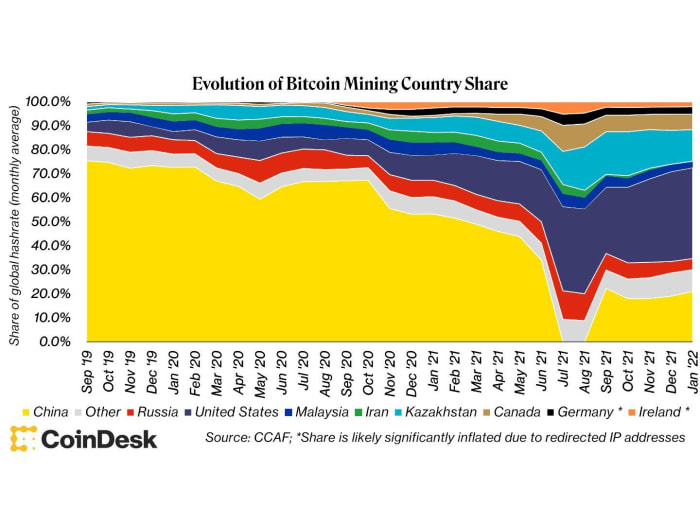

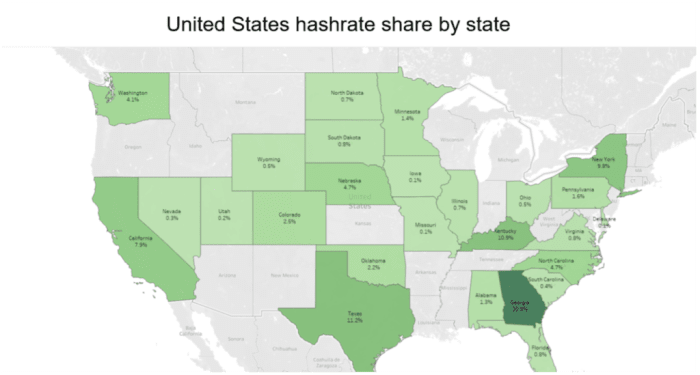

If you’ll permit me to as soon as once more have interaction in some hypothesis, I consider the U.S. understands this actuality, and is getting ready for a deglobalized world in many alternative methods. The U.S. seems to be the Western nation taking the friendliest method to Bitcoin. We’ve got senators all throughout the U.S. tripping over themselves to make their states Bitcoin hubs by enacting pleasant regulation for mining. The good hash migration of 2021 has seen the lion’s share of the Chinese language hash being transferred to the U.S., which now homes over 35% of the world’s hash price.

Latest sanctions on Russian miners may solely additional speed up this hash migration. Aside from some noise in New York, and the delayed spot ETF choice, the U.S. seems to be as if it’s embracing bitcoin.

On this video, Treasury Secretary Janet Yellen talks about Satoshi Nakamoto’s innovation. The SEC Chair Gary Gensler frequently differentiates Bitcoin from “crypto” and has additionally praised Satoshi Nakamoto’s invention.

ExxonMobil is the most important oil firm within the U.S. and introduced it was utilizing bitcoin mining to offset its carbon emissions.

Then there’s the query, why has Michael Saylor been allowed to wage a speculative assault on the greenback to purchase bitcoin? Why is the Fed releasing instruments highlighting worth eggs (and different items) in bitcoin phrases? If the U.S. was so against banning bitcoin, why has all of this been allowed within the nation?

We’re transitioning from an oil-backed greenback to a bitcoin-backed greenback reserve asset. Crypto-eurodollars, aka stablecoins backed by U.S. debt, will present the bridge between the prevailing energy-backed greenback system and this new energy-backed bitcoin/greenback system. I discover it awfully poetic that the nation based on the ideology of freedom and self-sovereignty seems to be positioning itself to be the one that the majority takes benefit of this technological innovation. The bitcoin-backed greenback is the one various to a rising Chinese language menace positioning for the worldwide reserve foreign money.

Sure, the USA has dedicated many atrocities, I’d argue that at instances they’ve been responsible of abusing their energy as the worldwide hegemon. Nonetheless, in a world that’s being quickly consumed by ramped totalitarianism, what occurs if the mighty U.S. experiment fails? What occurs to our civilization if we permit a social-credit-scoring Chinese language empire to rise and export its CBDC-backed digital panopticon to the world? I used to be as soon as one in every of these individuals cheering for the demise of the U.S. empire, however I now worry the survival of our very civilization depends upon the survival of the nation that was initially based on the rules of life, liberty and property.

Conclusions

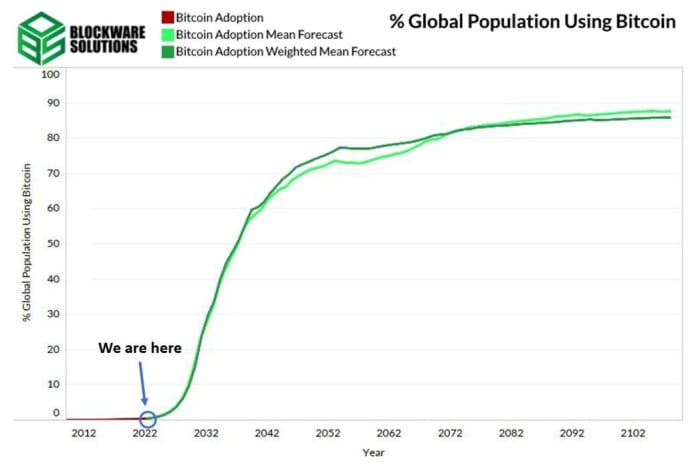

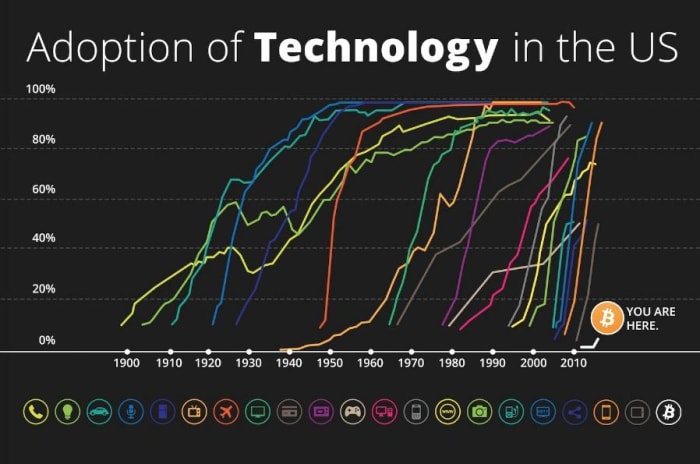

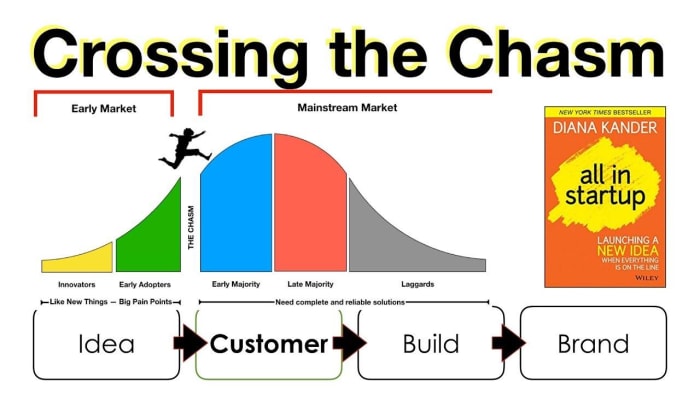

Zooming out, I stand by my unique thesis that we’re in a brand new financial order by the tip of the last decade. Nonetheless, the occasions of the earlier months have definitely accelerated that already-rapid 2030 timeline. I additionally stand by my unique thesis from the 2021 article surrounding how bitcoin’s adoption curve unfolds due to how damaged the present financial regime is.

I consider 2020 was the financial inflection level that would be the catalyst that takes bitcoin from 3.9% world adoption to 90% adoption this decade. That is what crossing the chasm entails for all transformative applied sciences that attain mainstream penetration.

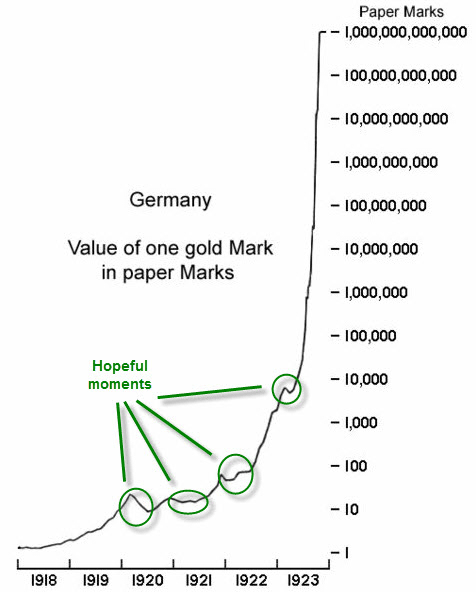

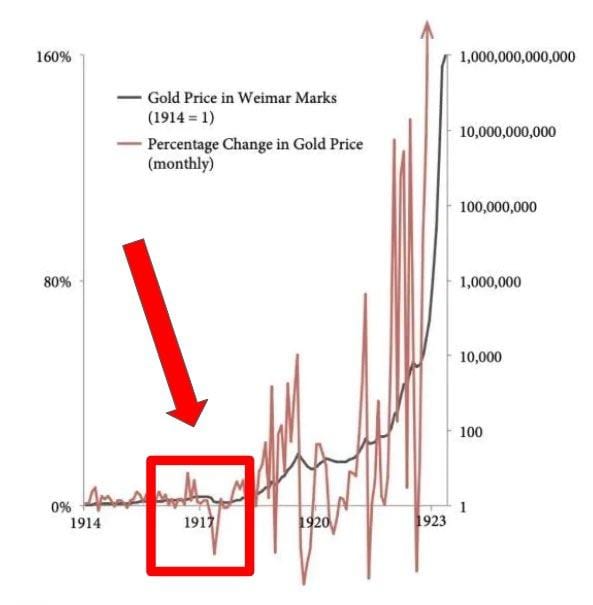

There’ll nevertheless be many “hopeful moments” alongside the way in which, like there was within the German Weimar hyperinflationary occasion of the Twenties.

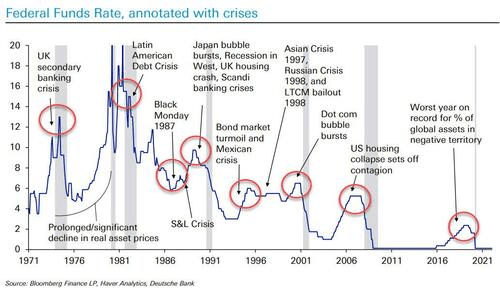

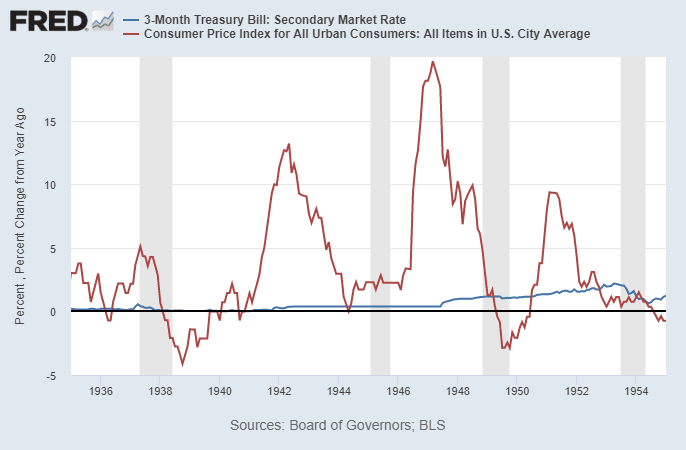

There might be dips and spikes in inflation, like there was within the Forties throughout U.S. authorities deleveraging.

(Source)

Deglobalization would be the excellent scapegoat for what was all the time going to be a decade of presidency debt deleveraging. The financial contractions and spasms have gotten extra frequent and extra violent with every drawdown we encounter. I consider the vast majority of fiat currencies are within the 1917 phases of the Weimar hyperinflation.

(Source)

This text was very centered on nation-state adoption of bitcoin, however don’t lose sight of what’s really unfolding right here. Bitcoin is a Computer virus for freedom and self-sovereignty within the digital age. Curiously, I additionally really feel that hyperdollarization will speed up this peaceable revolution.

Hyperinflation is the occasion that causes individuals to do the work and find out about cash. As soon as many of those power-hungry dictators are compelled to dollarize and not have the management of their native cash printer, they might be extra incentivized to take a guess on one thing like bitcoin. Some might even do it out of spite, not desirous to have their financial coverage dictated to them by the U.S.

(Source)

Cash is the first instrument utilized by states to train their autocratic, authoritarian powers. Bitcoin is the technological innovation that’ll dissolve the nation-state, and fracture the ability the state has, by eradicating its monopoly on the cash provide. In the identical manner the printing press fractured the ability of the dynamic duo that was the church and state, bitcoin will separate cash from state for the primary time in 5,000+ years of financial historical past.

(Source)

So, to reply the greenback doomsdayers, “Is the greenback going to die?” Sure! However what’s going to we see within the interim? De-dollarization? Perhaps on the margins, however I consider we’ll see hyperdollarization adopted by hyperbitcoinization.

It is a visitor publish by Luke Mikic. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.