Macro Overview

Powell just isn’t able to pause

Traders are searching for an indication of a slowdown from Fed chair Powell, which they initially thought they had been getting regardless of a fourth consecutive 75bps hike that takes the goal price to three.75% – 4%. US equities and bonds rallied forward of Powell’s convention, with Powell emphasizing;

“very untimely to be fascinated with pausing price will increase.”

U.S. GDP for the third quarter confirmed indicators of development. Nonetheless, it got here at a value, with core inflation accelerating and the labor market remaining strong, with housing beginning to tumble however unemployment at historic lows of three.5%. For the reason that hikes started in March, little to counsel the influence of hikes has been felt.

Chair Powell was evident in his assertion;

“end-point [for rates] is probably going larger than it was, given how inflation information proceed to come back in scorching.”

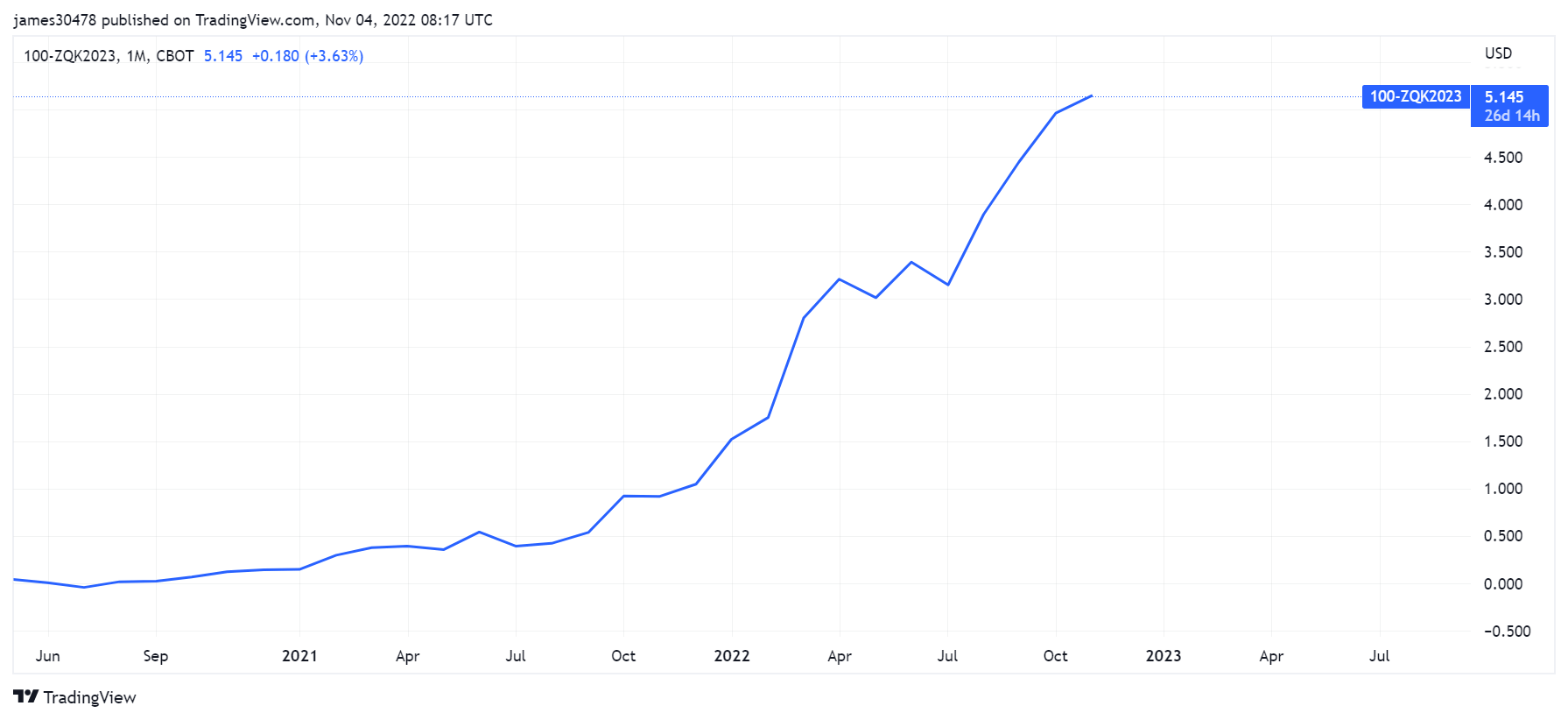

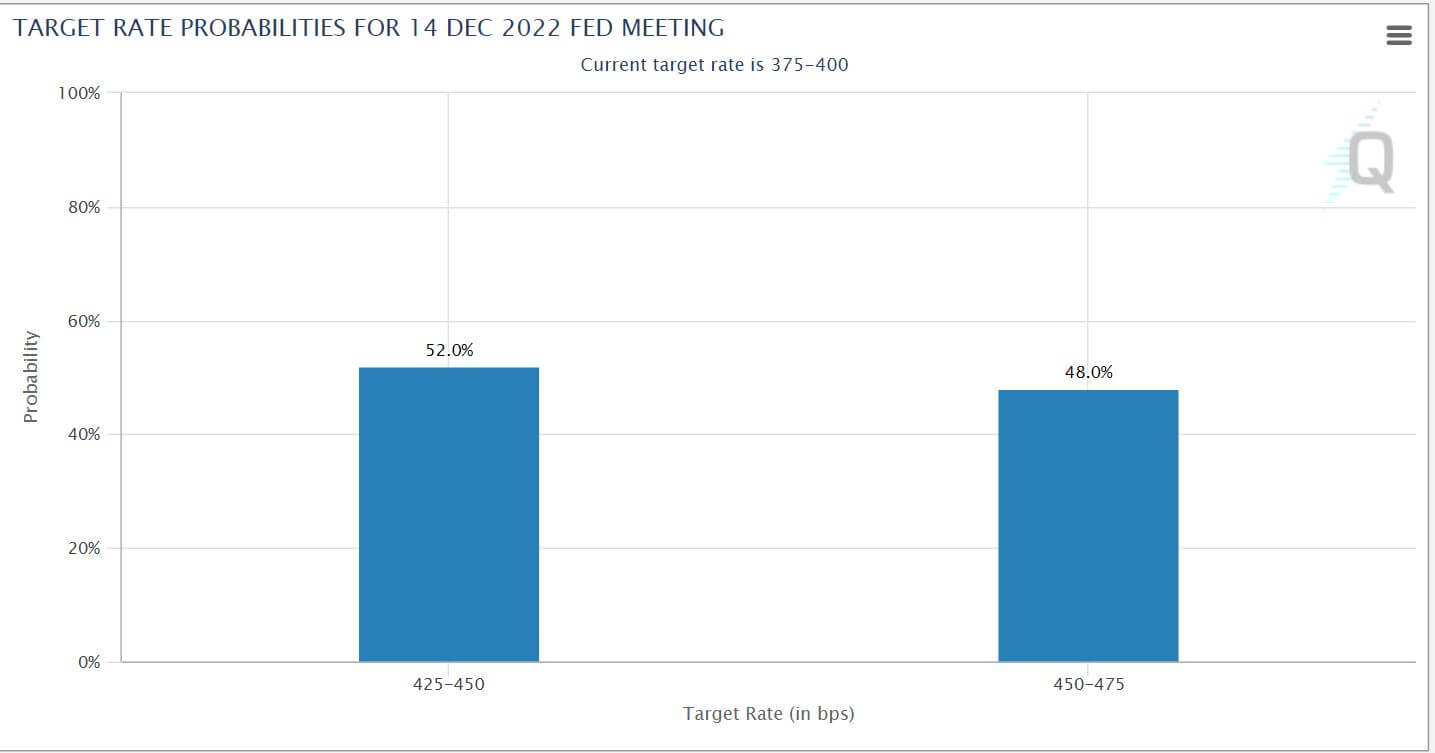

The following price hike is scheduled for Dec. 14; the U.S. has two additional CPI prints and two labor market studies with Powell indicating no motion has been taken but on the dimensions of the long run hike.

At present, markets are predicting fed funds charges will get to five.1% by the primary half of 2023, whereas there’s a 50% likelihood of a 75bps hike for Dec. 14.

Correlations

ETH/BTC outperformance

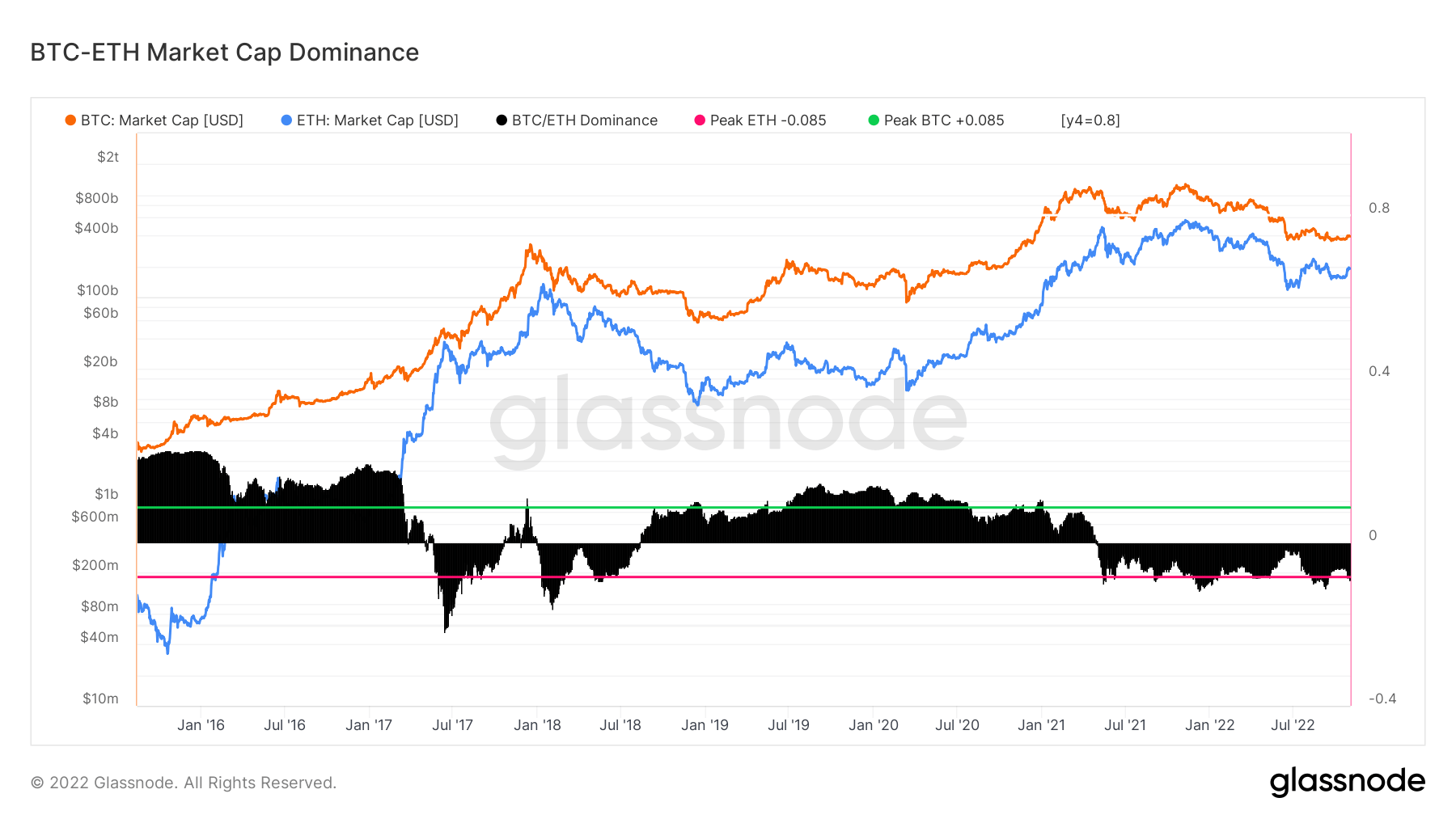

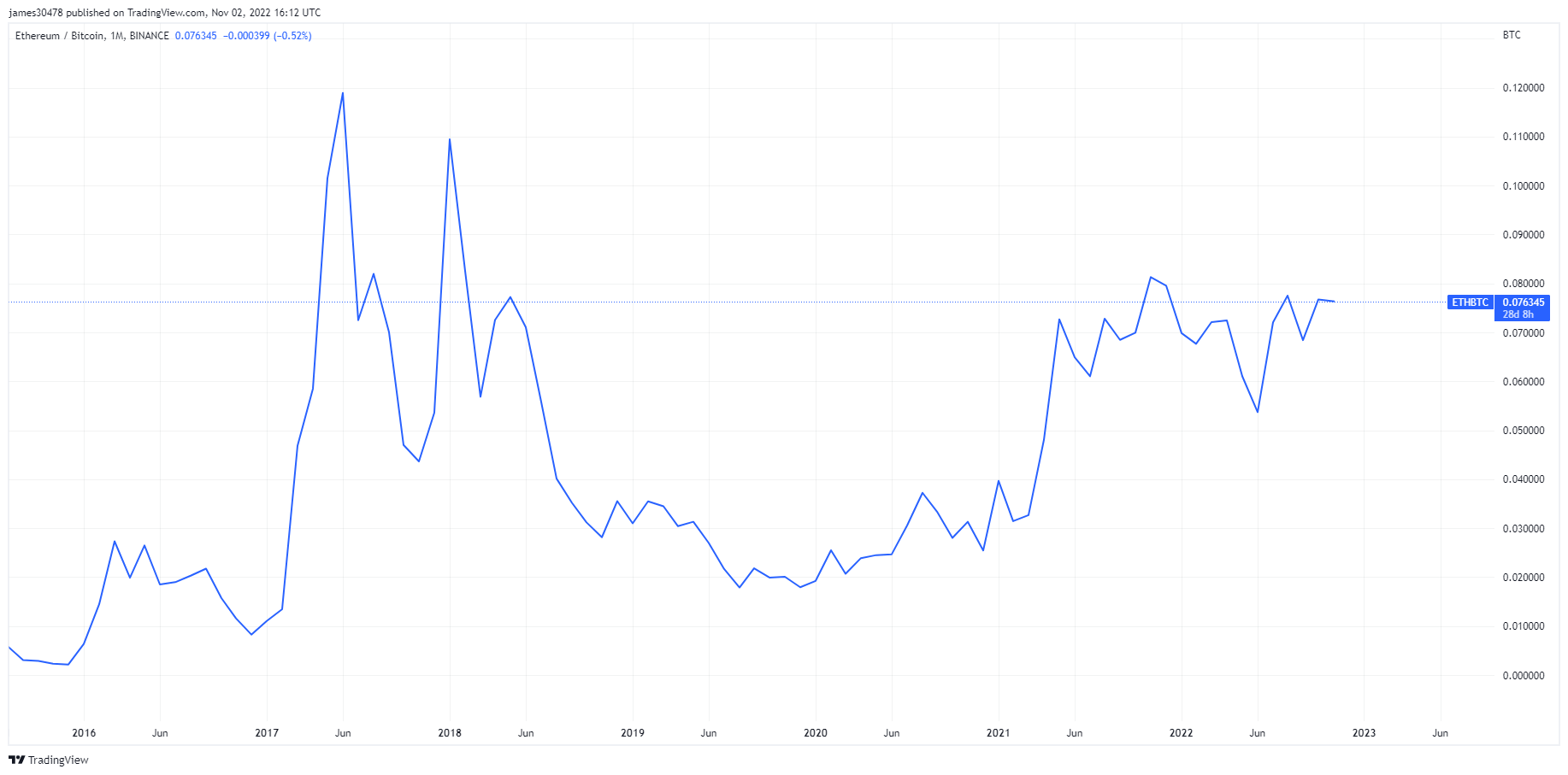

Ethereum has regained its peak dominance in opposition to Bitcoin. The BTC-ETH Dominance metric is an oscillator that tracks the macro outperformance tendencies between the highest two crypto-assets. It considers solely the market cap of Bitcoin relative to the mixed market cap of the digital currencies.

So when the metric is over the pink line, ETH outperforms on a relative foundation and vice versa with the inexperienced line for BTC.

A have a look at the charts confirmed that Ethereum’s dominance over Bitcoin has risen since July 2021 and peaked in July 2022, just some months earlier than the Merge.

Whereas ETH/BTC is at the moment round 0.076, it’s approaching the merged excessive of 0.081.

Equities & Volatility Gauge

The Normal and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 giant firms listed on exchanges in america. S&P 500 3,771 -2.91% (5D)

The Nasdaq Inventory Market is an American inventory trade based mostly in New York Metropolis. It’s ranked second on the listing of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Alternate. NASDAQ 10,857 -4.93% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of threat, worry, or stress out there when making funding selections. VIX 25 -8.94% (5D)

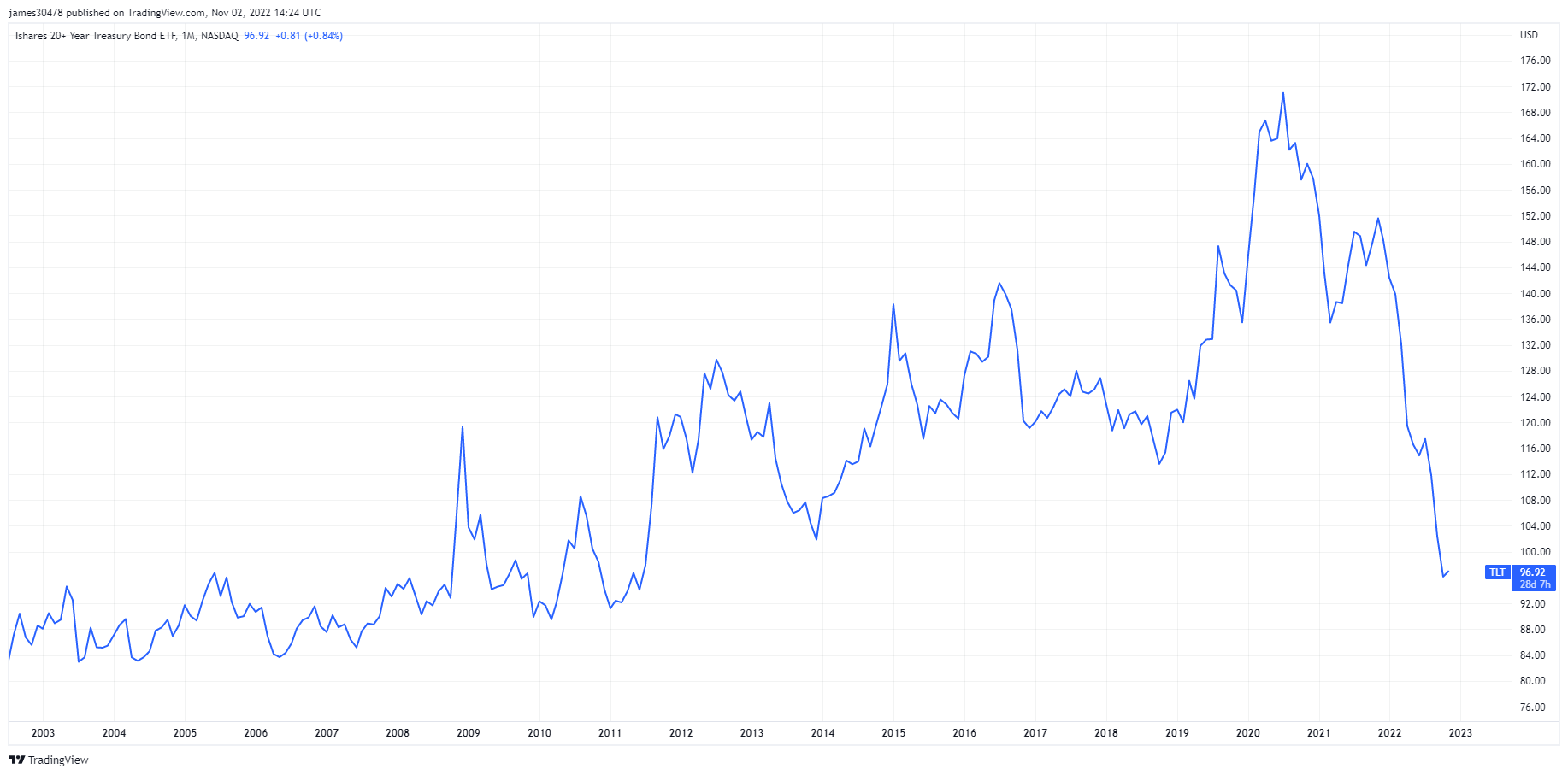

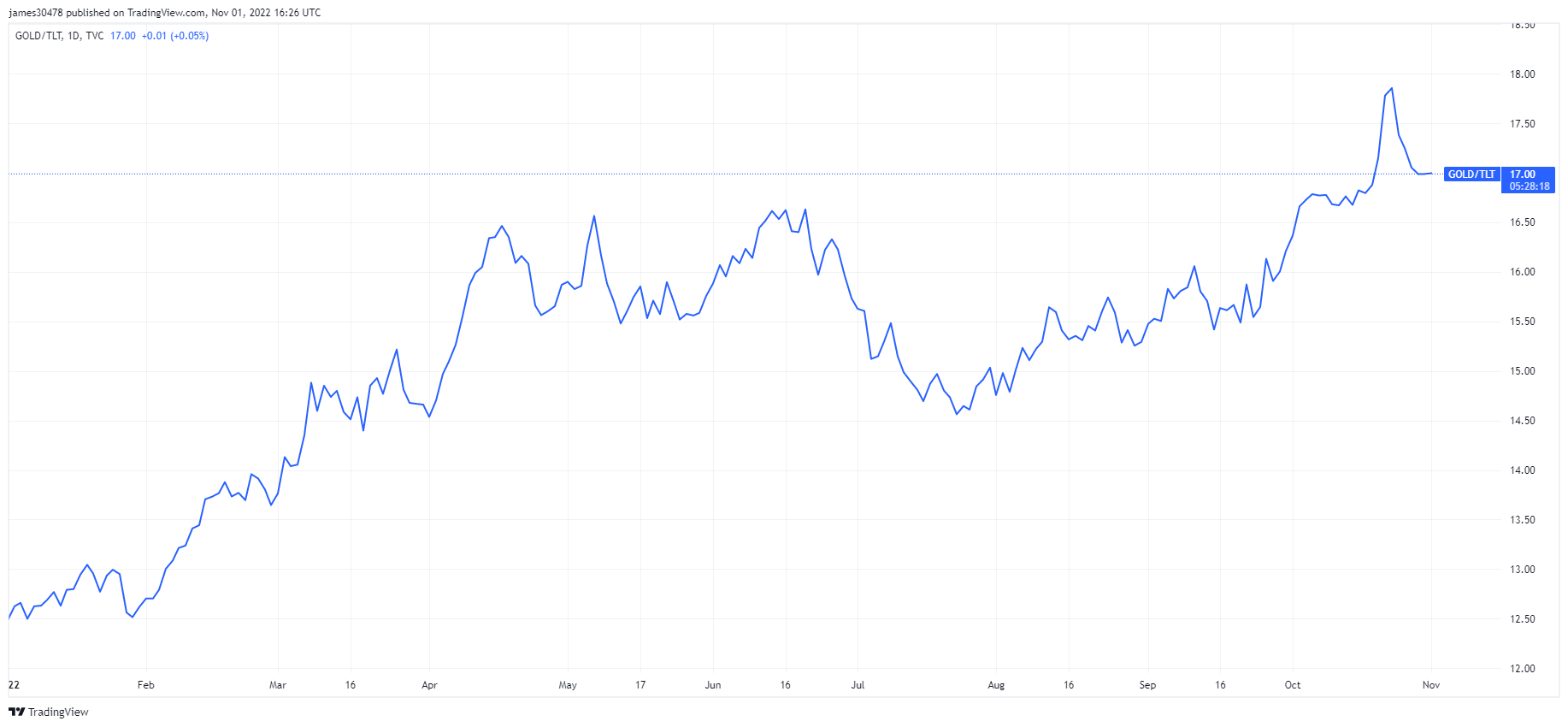

The 12 months of the sovereign debt bubble unwinds

The financial system has been constructed on low cost debt with the promise of risk-free returns, particularly USTs. Since 2008, rates of interest have been held to the decrease sure of 0 whereas the quantitative easing program has been in full drive contributing to ‘increase and bust cycles.

The U.S. 20+ Yr Treasury Bond ETF – TLT. At its peak in 2020, it hit a excessive of 170; it’s now at 97, a 55% drawdown, and again to the identical ranges of 2011 earlier than adjusting for inflation. It was a comparatively good funding throughout an period of low-interest charges; nonetheless, these bonds will proceed to be slaughtered in a excessive inflationary and high-interest price interval. Not solely is the 60/40 portfolio in flames, however the state of passive investing has ended.

“TLT is a high-quality ETF, due to a low expense ratio and liquidity” – Investopedia.

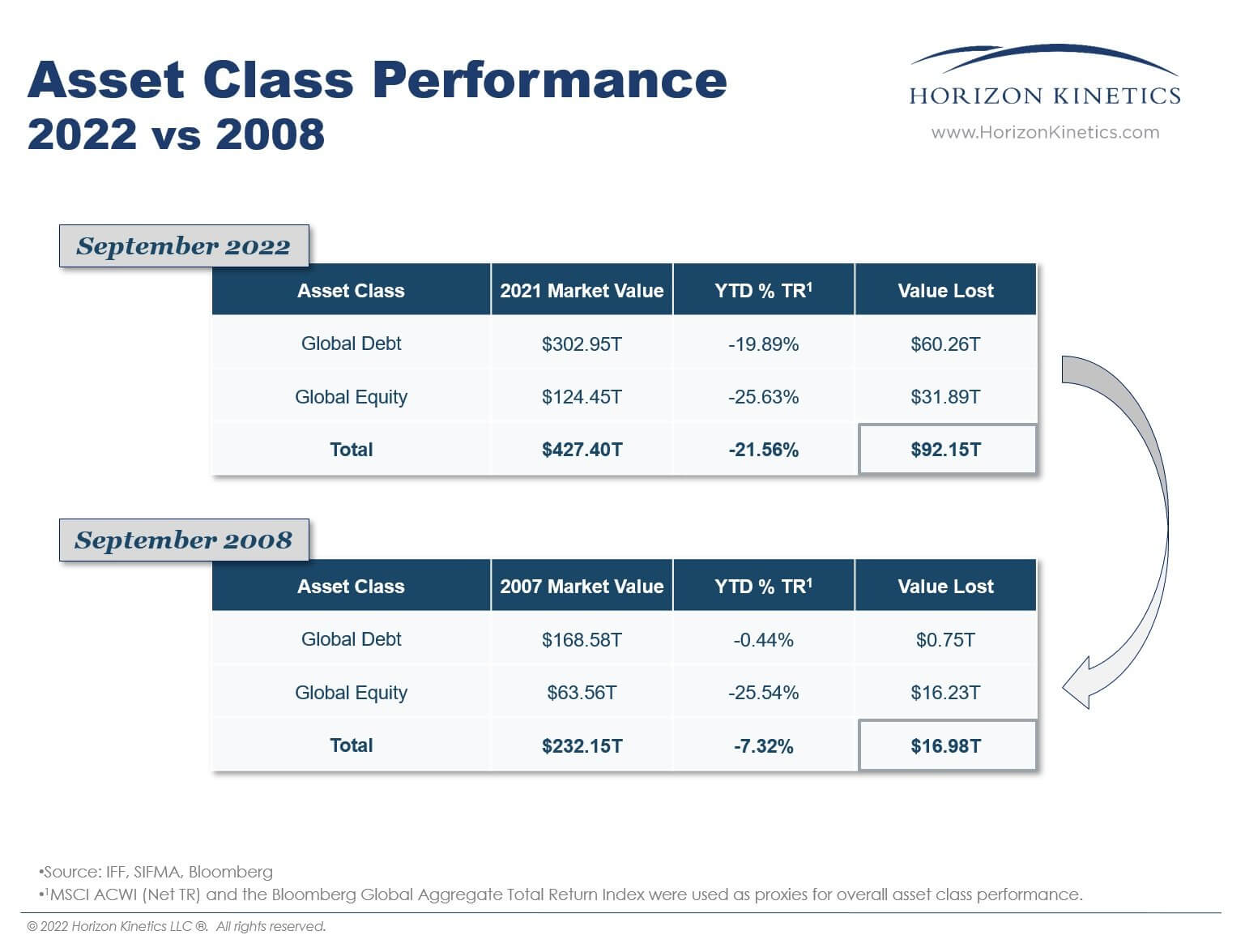

The 12 months 2022 shall be known as wealth destruction; $ 92.15tn has been worn out throughout international shares and bonds, which dwarfs 2008 by an element of 6.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the need to carry gold as a hedge in opposition to inflation and forex devaluation, all assist drive the value of the dear metallic. Gold Worth $1,680 2.29% (5D)

Just like most commodities, the silver worth is set by hypothesis and provide and demand. It is usually affected by market circumstances (giant merchants or buyers and quick promoting), industrial, business, and shopper demand, hedge in opposition to monetary stress, and gold costs. Silver Worth $21 8.53% (5D)

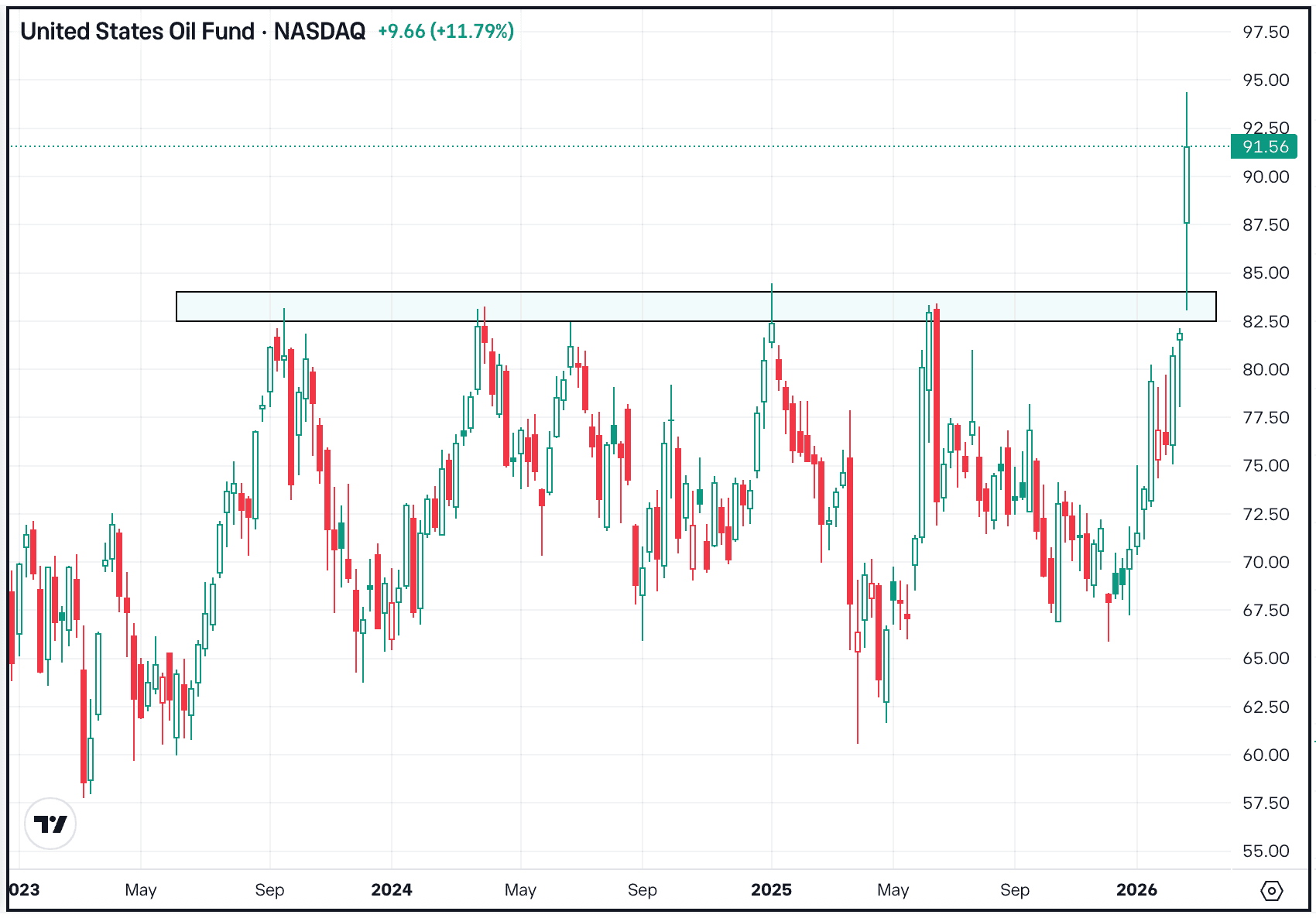

The value of oil, or the oil worth, typically refers back to the spot worth of a barrel (159 litres) of benchmark crude oil. Crude Oil Worth $92 4.61% (5D)

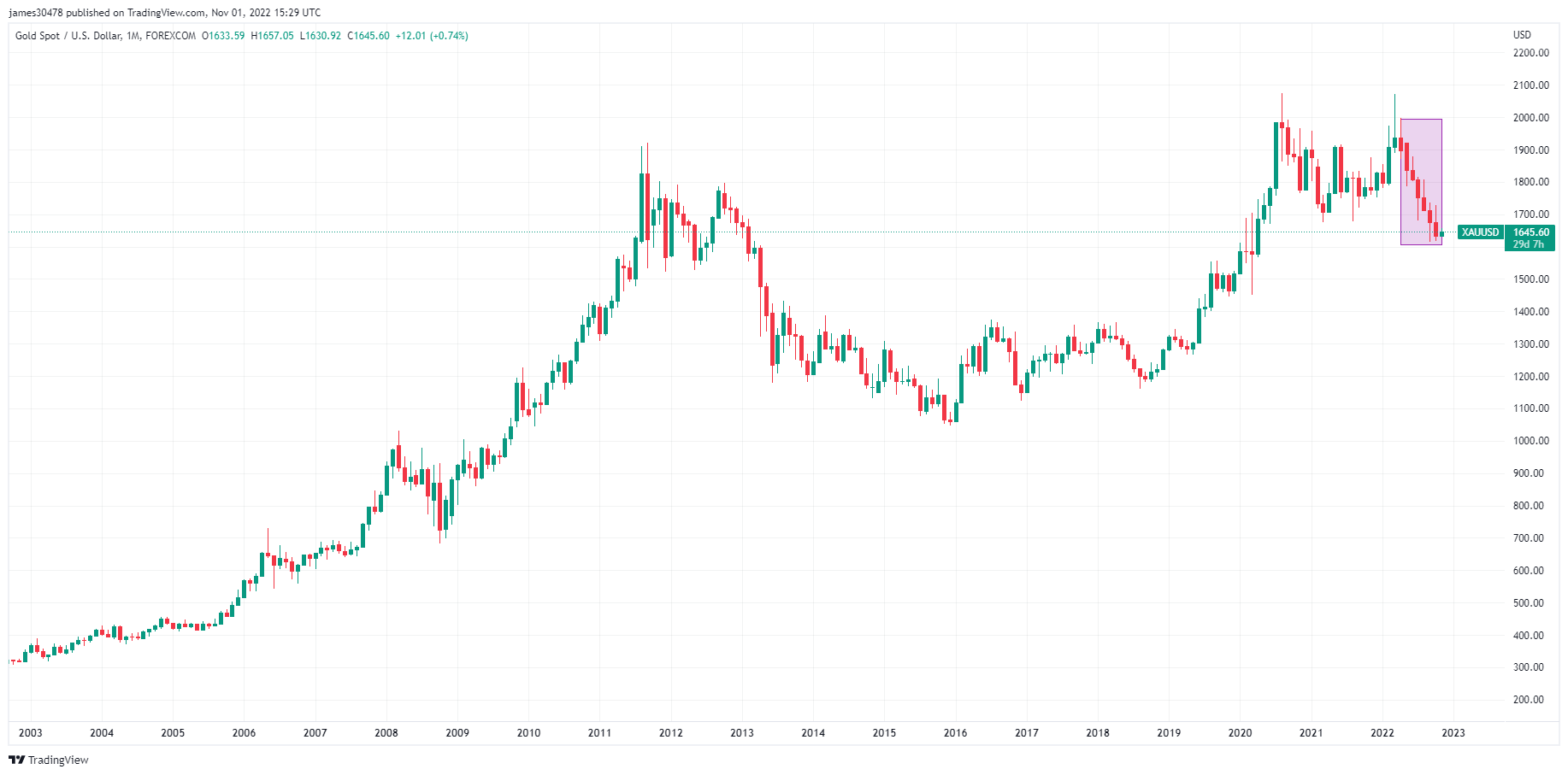

The sensible central banks are accumulating gold

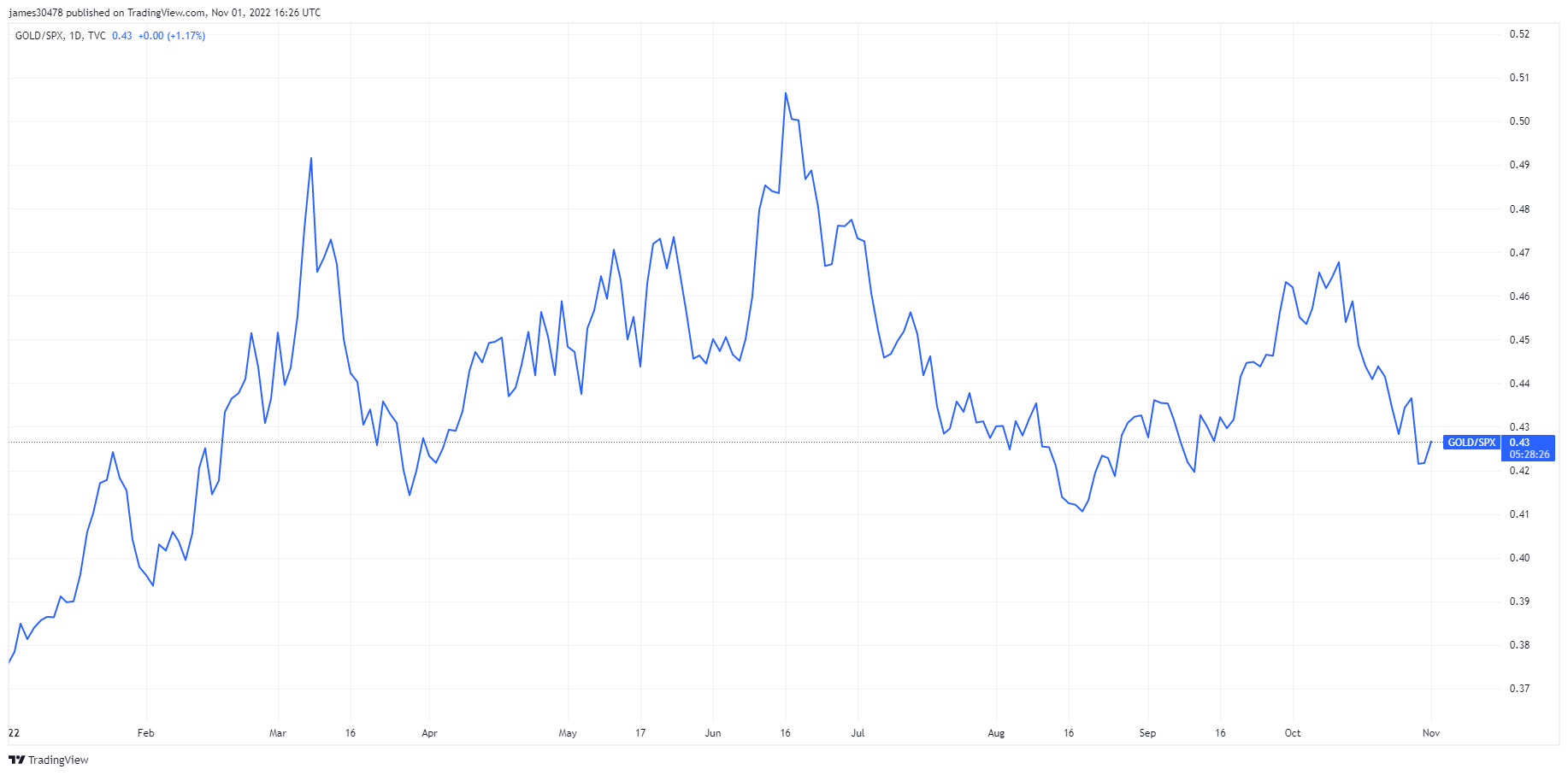

Gold is buying and selling roughly for $1,645, which is in the same worth vary to the highs in 2011 and 2012. Gold has been marveled as an asset to carry throughout unsure occasions; nonetheless, it has not carried out in 2022 however is that about to alter?

Gold is at the moment 9% down year-to-date in opposition to the greenback, and for the primary time in its historical past, it has marked seven pink month-to-month candles in a row. This has by no means occurred in gold’s historical past.

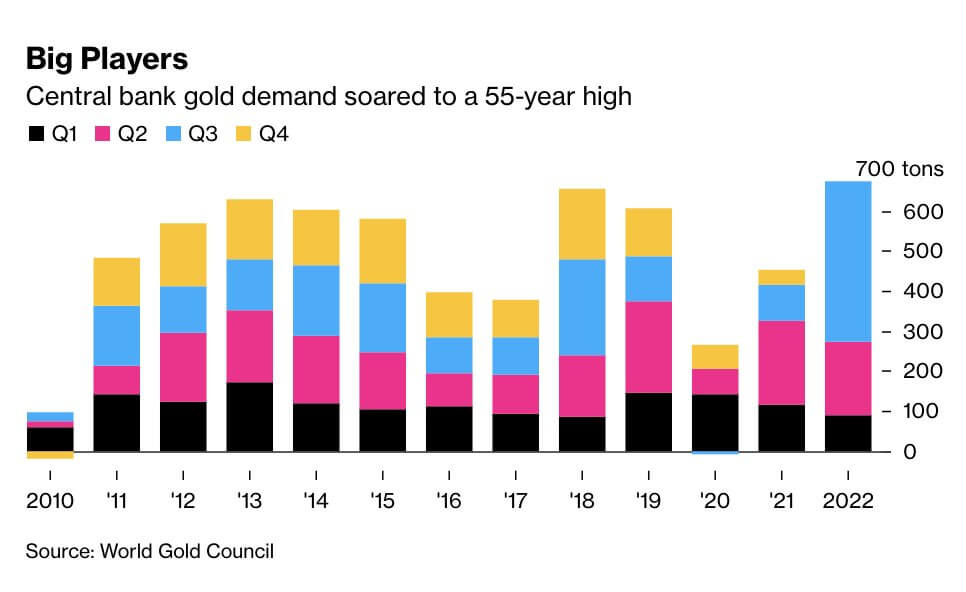

Nonetheless, with the credit score system tightening and inflation working riot. Central banks have amassed a whopping quantity of Gold in Q3 of 2022, 399 tonnes, round $20bn. Which noticed gold demand soar to a 55-year excessive. Purchases are up 338% in comparison with Q3 of 2021. In the meantime, sovereign debt has had its worst 12 months in a long time, placing additional strains on the fiat financial system.

“It didn’t give any particulars on which nations these may very well be, however banks that don’t often publish details about their gold stockpiles embrace these of China and Russia…” – Reuters.

Nonetheless, many similarities happen between gold and Bitcoin via manipulation of the paper and derivatives markets”, which is why Gold Bugs and Bitcoiners buy bodily gold and safe custody of their Bitcoin. Nonetheless, regardless of a robust greenback crushing all property this 12 months, gold has nonetheless carried out higher than equities and lengthy bonds.

Charges & Foreign money

The ten-year Treasury be aware is a debt obligation issued by america authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury be aware pays curiosity at a set price as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 4.163% 3.66% (5D)

The Federal Funds Fee is the rate of interest that U.S. banks cost one another to lend funds in a single day. Federal Funds Fee 3.75% 0.75% (30D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign exchange. DXY 110.788 0.01% (5D)

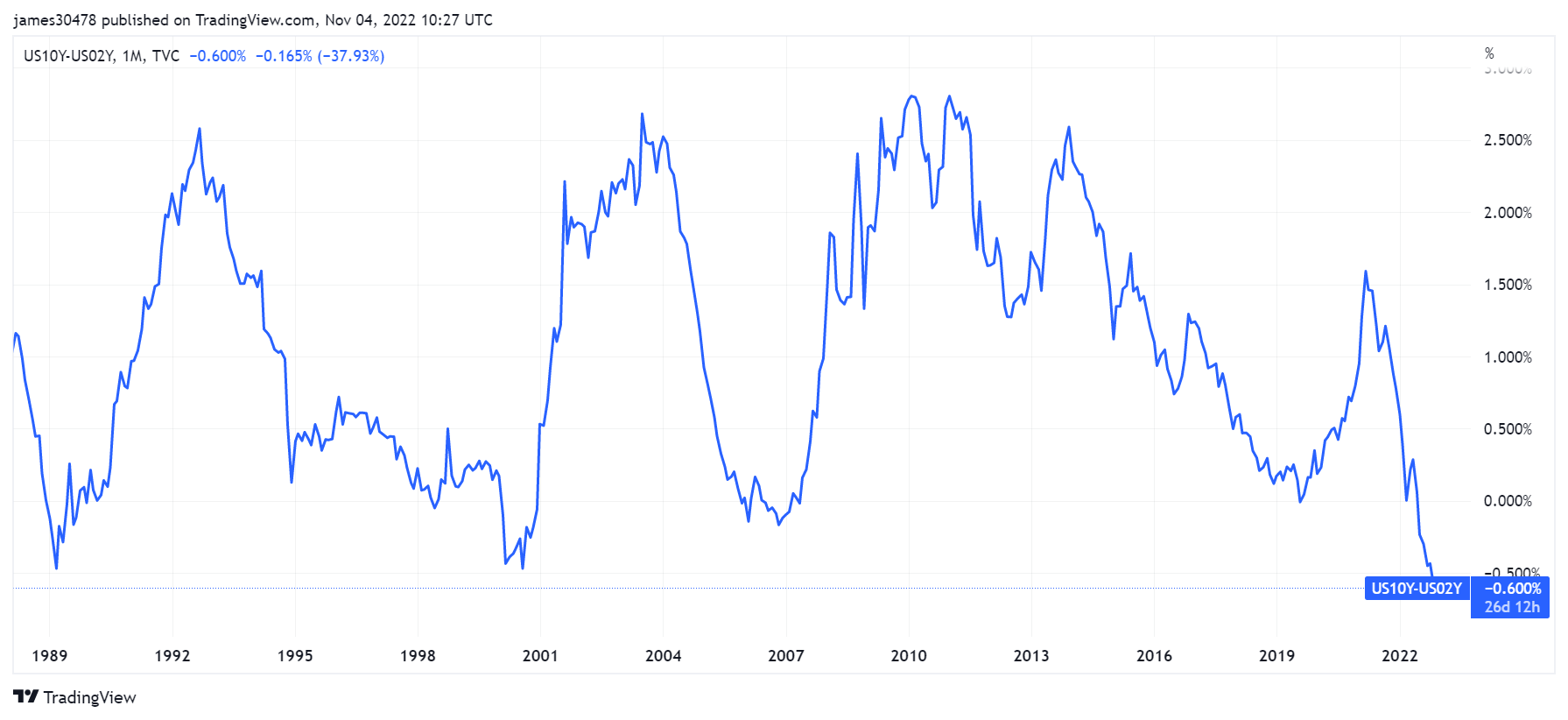

The three-month T-Invoice yield inverts with the 30-year-long bond

US recession forecasts have been ten a penny this 12 months, with the slope of the treasury curve being cited as a forward-looking indicator of slower development. Nonetheless, the unfold between two and ten-year yields tracks the unemployment price. Recessions usually begin from the purpose when unemployment reaches its lows, however the treasury curve is extra of a coincident indicator than a predictor.

The unfold between the ten and two-year yields has been adverse for many of 2022, at the moment at whooping -0.6%, however the unfold between the 10yr and 3m charges (the popular measure by the fed) turned adverse for the primary time this cycle, Oct. 26.

As of Nov. 1, the 3-month T-Invoice Yield inverts with the 30-year-long bond; as an investor, you’ll get the next return on a three-month treasury than the 30-year-long bond. This has solely occurred 4 occasions in historical past; 2000, 2007, 2020, and 2022. A recession is imminent, however the severity or magnitude of this recession is unknown.

Bitcoin Overview

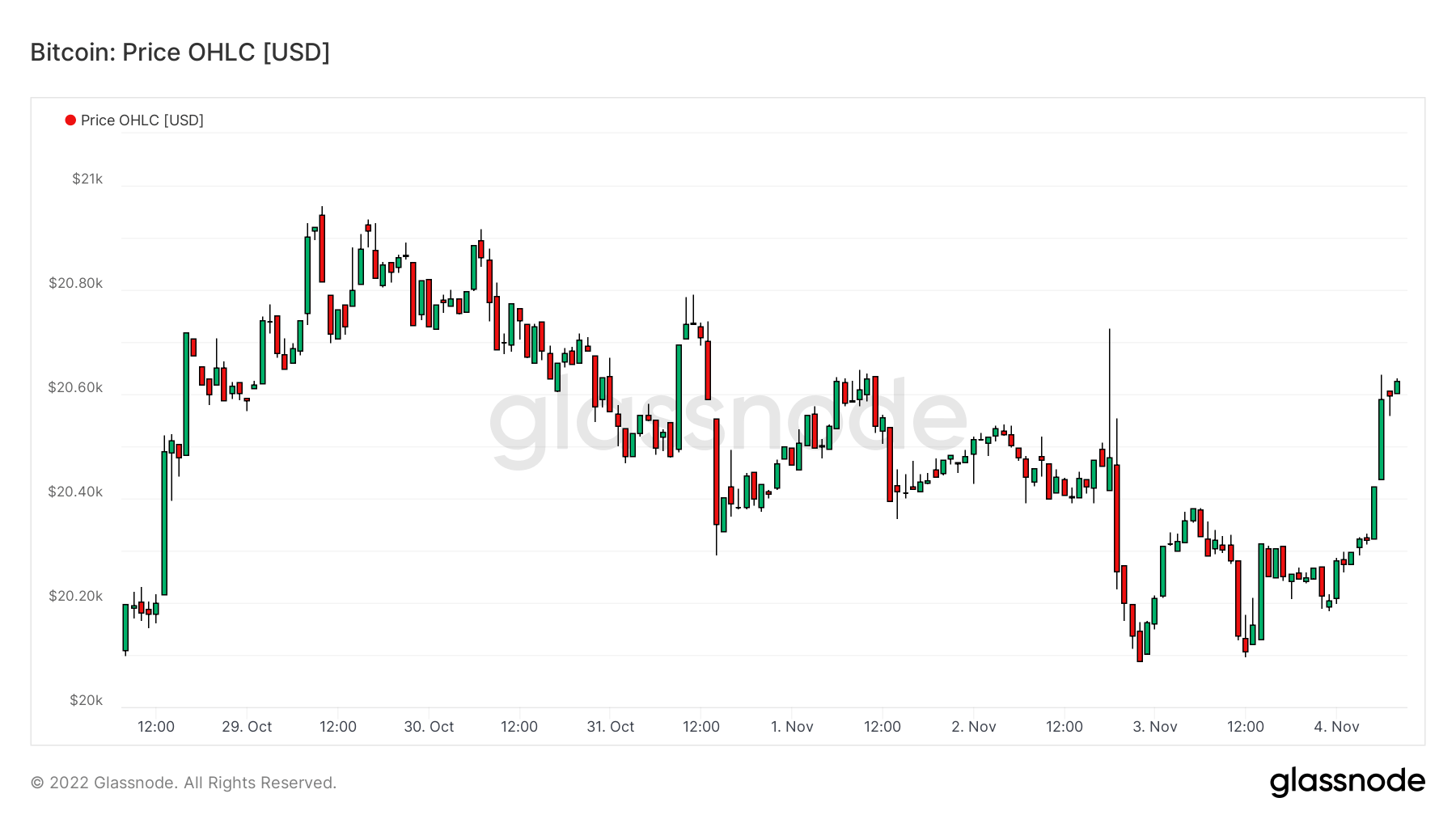

The value of Bitcoin (BTC) in USD. Bitcoin Worth $21,118 2.84% (5D)

The measure of Bitcoin’s whole market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 40.25% -1.17% (5D)

- Bitcoin stays flat for the week buying and selling round $20k

- Bitcoin hash price continues to blow up larger approaching 300 EH/s

- Mining issue projected to extend for the third consecutive constructive adjustment

- Miners proceed to really feel the stress as Argo joins the listing of troubled miners

Addresses

Assortment of core handle metrics for the community.

The variety of distinctive addresses that had been lively within the community both as a sender or receiver. Solely addresses that had been lively in profitable transactions are counted. Energetic Addresses 1,010,000 14% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 467,384 9% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 42,963,000 0.03% (5D)

The variety of distinctive addresses holding a minimum of 1k BTC. Addresses with Stability ≤ 1k BTC 2,118 -0.4% (5D)

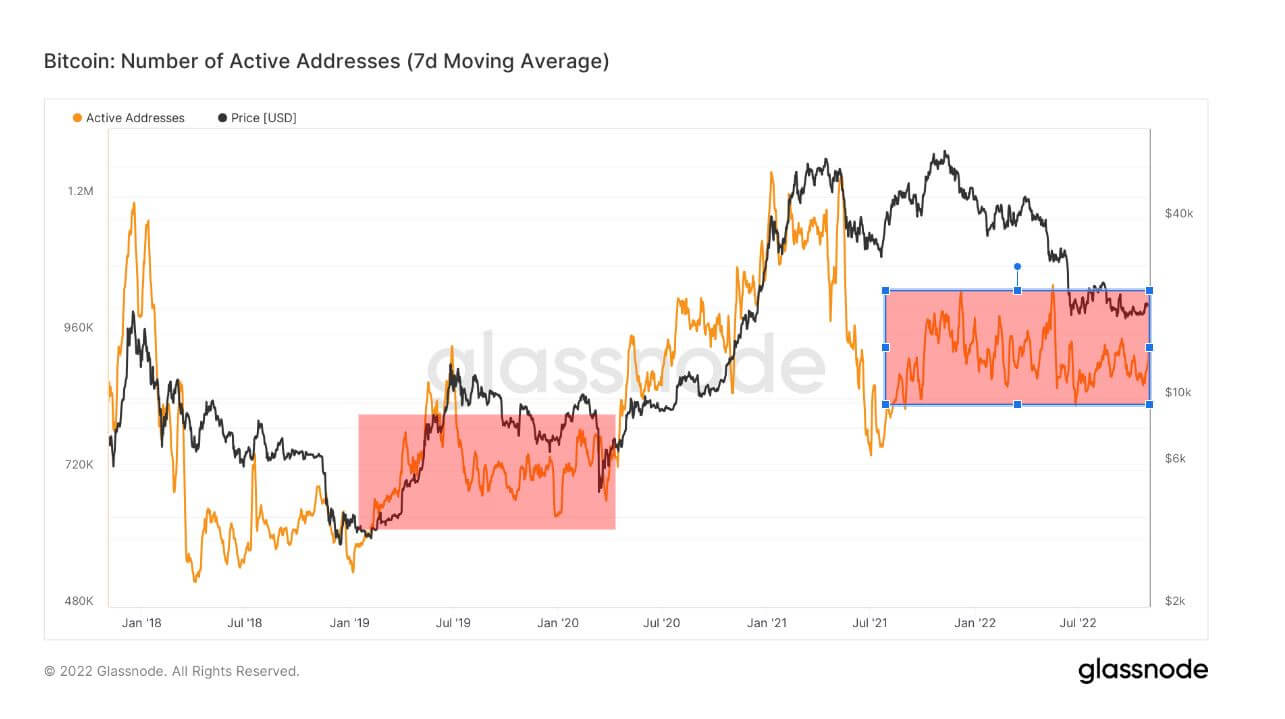

Energetic addresses stay flat amid the bear market

The variety of distinctive addresses lively within the community both as a sender or receiver. Solely addresses that had been lively in profitable transactions are counted.

Energetic addresses have remained comparatively stagnant since Might 2021, suggesting the bear market began round then. At present, the Bitcoin community has slightly below 1,000,000 lively addresses, which is significantly larger than the earlier bear market in 2018, which had roughly 500k-600k lively addresses. It’s encouraging to see the next excessive in every bear market cycle as new contributors enter the ecosystem.

Nonetheless, this previous week we have now seen a notable improve in lively and new addresses, which suggests new contributors are getting into the ecosystem.

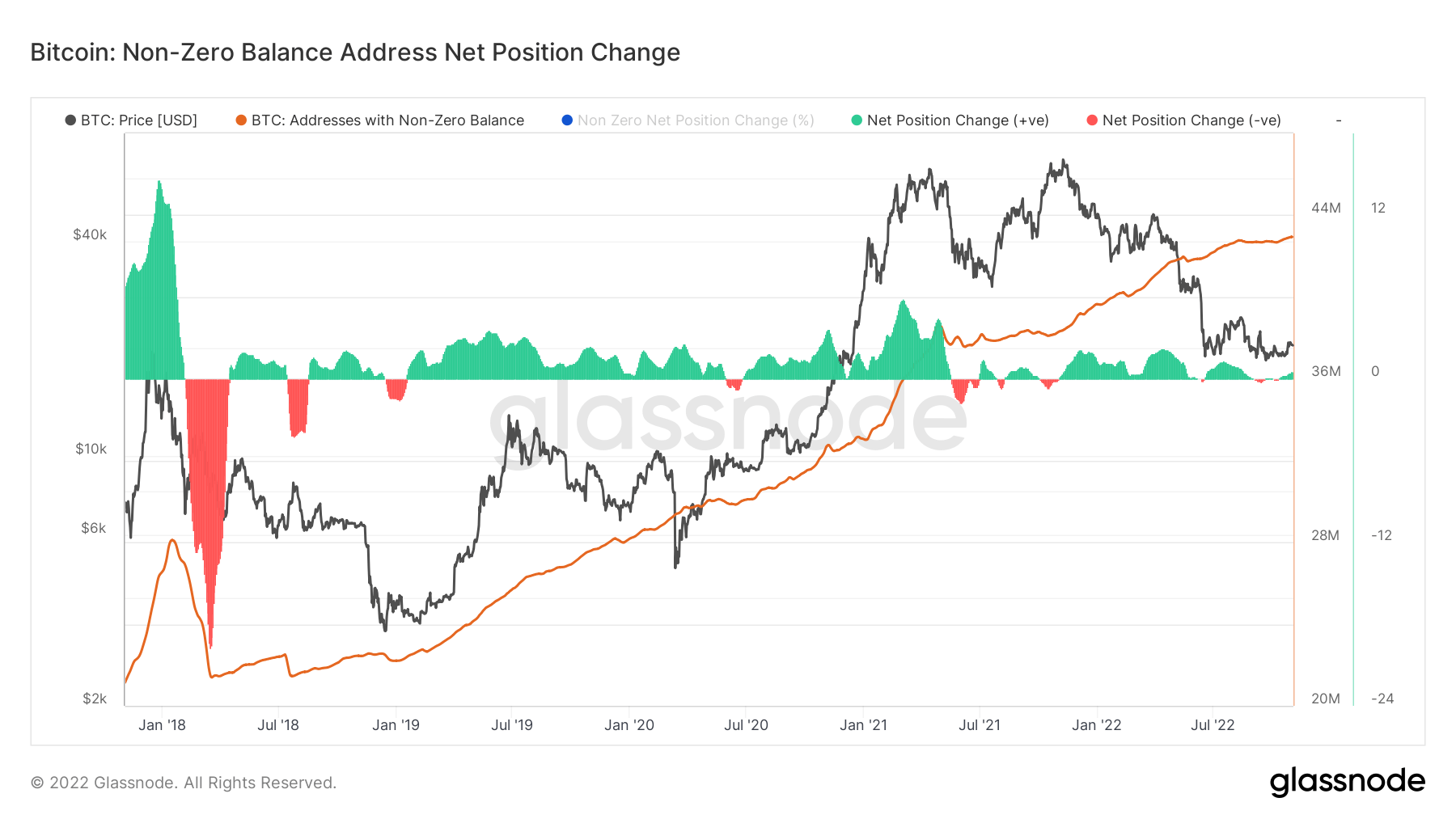

Retail accumulation has gone quiet

A stability of non-zero addresses implies a minimal quantity of BTC of their wallets and suggests retail are the holders who’ve simply began their journey within the Bitcoin journey.

The expansion price for non-zero stability has stalled since August, which has similarities to the earlier bear market cycle in 2018. This assumes the urge for food for this cohort is to not accumulate. Nonetheless, it’s encouraging to see them not promoting both and maybe watch for the macro uncertainty to turn into clearer.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to offer a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that had been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which might be managed by the identical community entity and are estimated via superior heuristics and Glassnode’s proprietary clustering algorithms. Energetic Entities 300,000 22% (5D)

The variety of distinctive entities holding a minimum of 1k BTC. Variety of Whales 1,693 -0.5% (5D)

The overall quantity of BTC held on OTC desk addresses. OTC Desk Holdings 3,438 BTC -18% (5D)

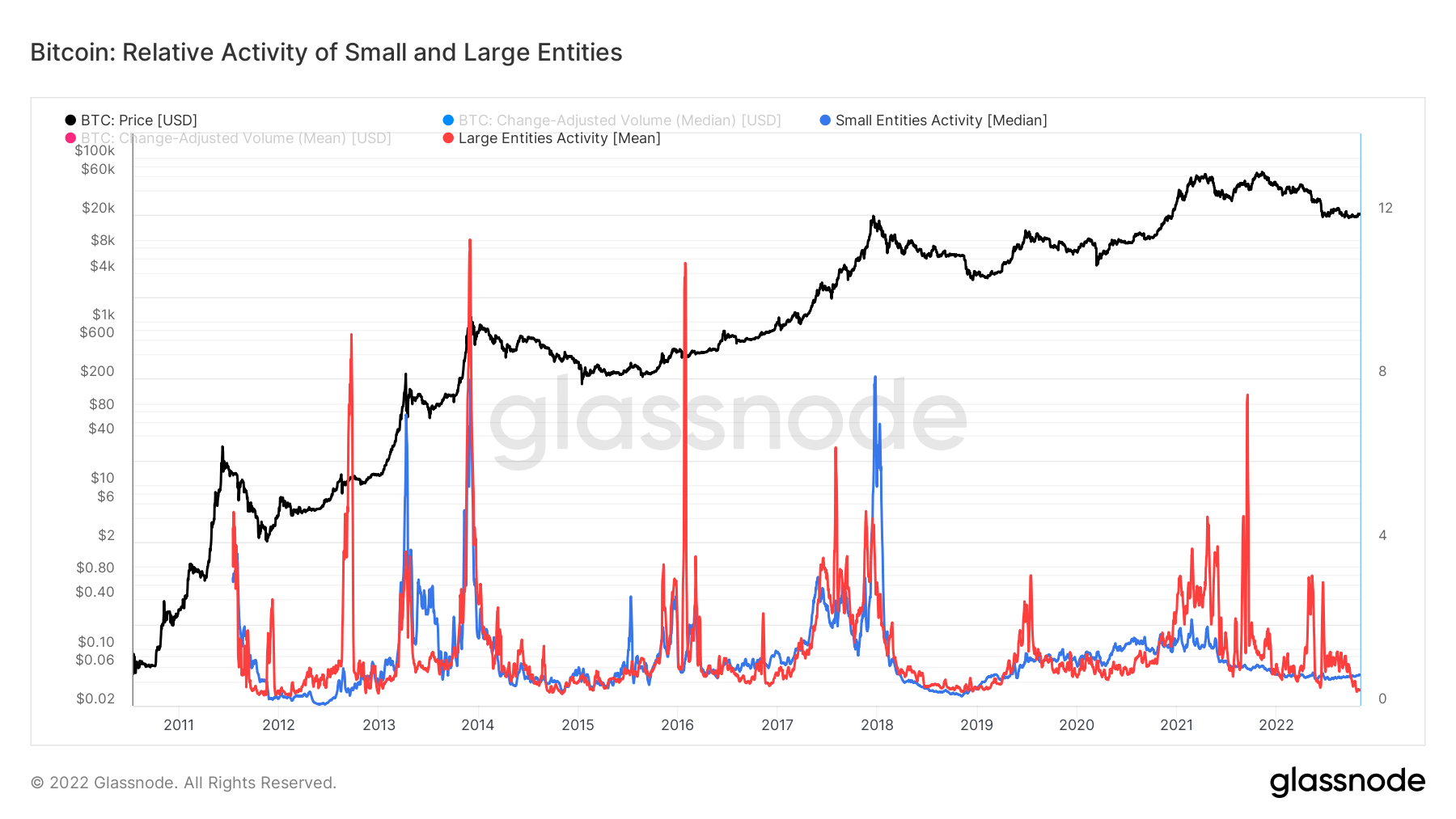

Muted bear market

- When small entities ? exceed giant entities ?, it usually suggests an inflow of small dimension transactions and is commonly related to the joy of bull markets and better hypothesis.

- When the symptoms are rising, it may be thought-about to be a sign of upper demand from the related entities.

- When the symptoms are lowering, it may be thought-about to be a sign of decrease demand from the related entities.

Wanting on the pattern of each small and huge entities, they’re on the decrease degree with a lowering pattern, which has similarities to earlier bear market cycles. Giant entities have dropped significantly, which assumes curiosity just isn’t prevalent. In distinction, smaller entities have stayed stagnant, which is according to lively addresses, non-zero stability, and worth staying flat.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The typical estimated variety of hashes per second produced by the miners within the community. Hash Fee 299 TH/s 12% (5D)

The overall provide held in miner addresses. Miner Stability 1,831,761 BTC 0% (5D)

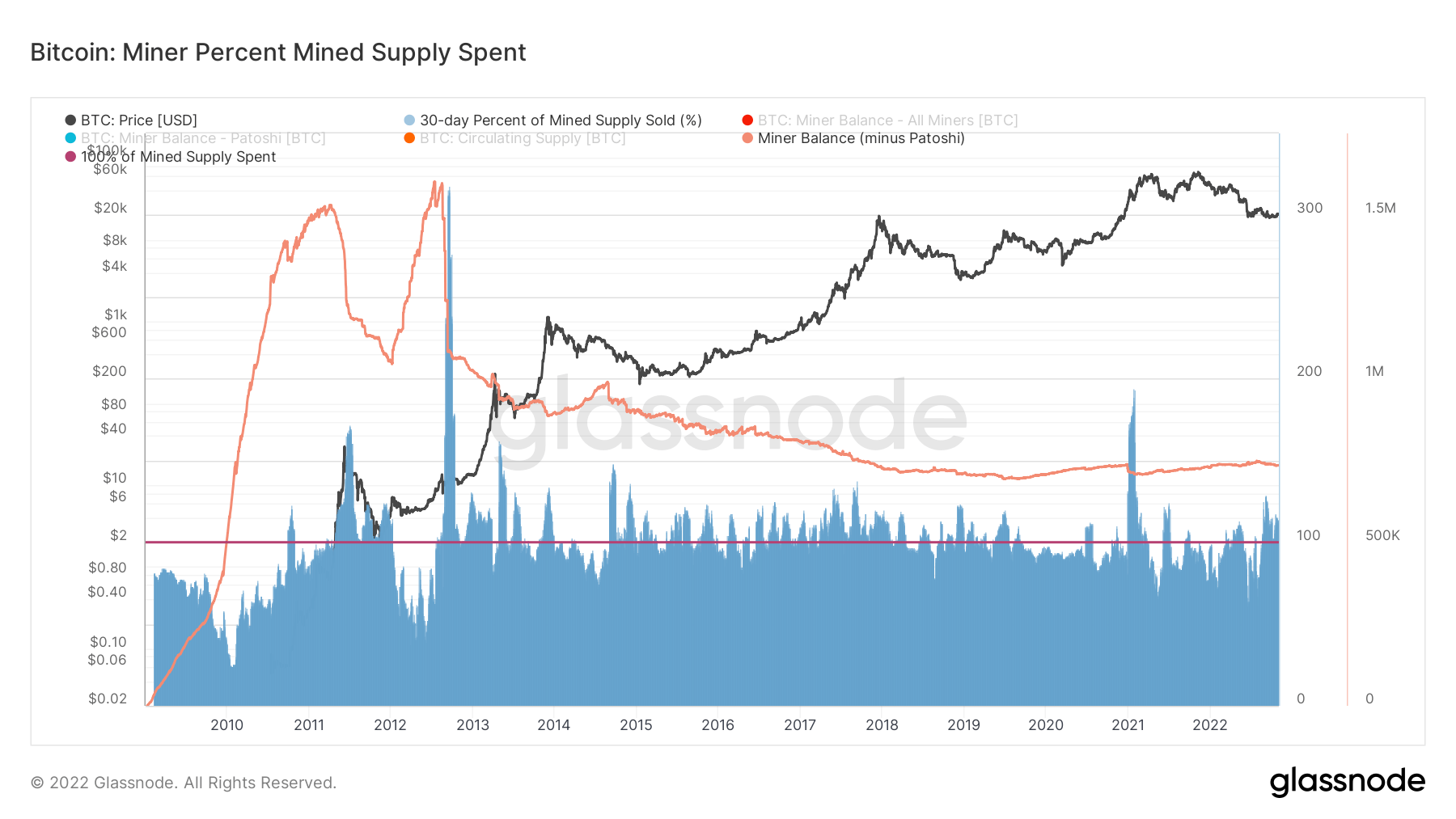

Miners proceed to promote

This metric offers an estimate of the p.c of mined provide which is spent by the mining cohort over a 30-day window. As a result of aggressive, and capital intensive nature of the mining business, miners have traditionally wanted to distribute a majority of the cash mined to cowl enter prices.

The mannequin compares the 30-day change in miner stability, to the 30-day whole issuance in an effort to assess the proportion of mined cash which might be spent in combination.

- Values = 100% point out that in combination, a quantity of cash equal to the entire mined provide was spent.

- Values < 100% point out that miners are retaining a portion of mined provide in treasury reserves.

- Values > 100% point out that miners are distributing cash in extra of the mined provide, and are thus depleting treasury reserves.

In earlier macroslate studies, miners have been a scorching matter of debate attributable to hash price and mining issue squeezing miner earnings. October public updates have proven that miners similar to Core Scientific and Argo have proven they’re in a interval of misery and miners to maintain their heads afloat are promoting and distributing cash in extra of mined provide and going into their treasury reserves.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized trade exercise.

The overall quantity of cash held on trade addresses. Alternate Stability 2,357,400 BTC 0 BTC (5D)

The 30 day change of the availability held in trade wallets. Alternate Web Place Change 254,000 BTC -130,245 BTC (30D)

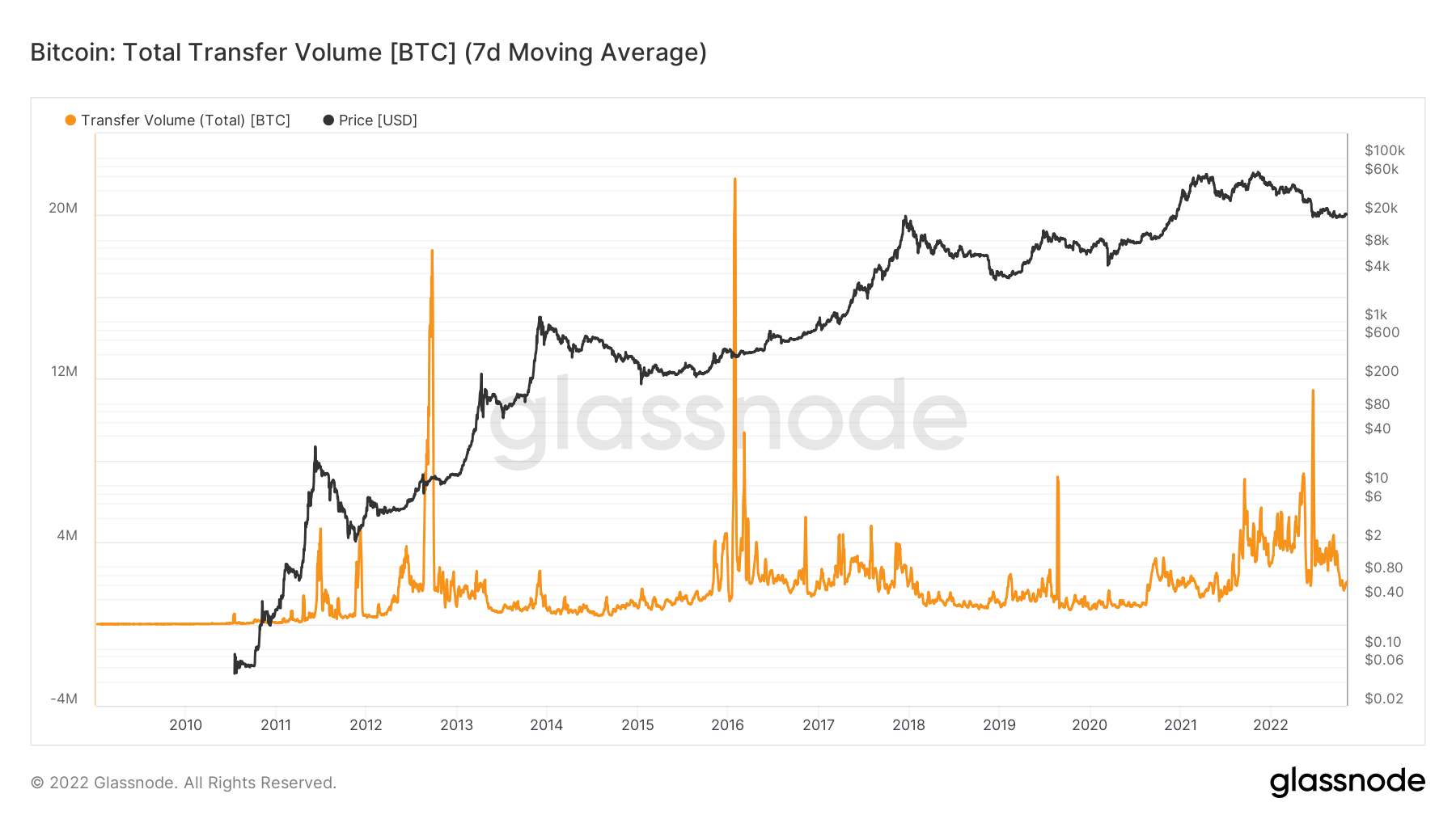

Switch quantity at 12 months lows

Switch quantity is the entire quantity of cash transferred on-chain. Solely profitable transfers are counted.

This metric had put in a brand new cycle low which sees slightly below 2 million cash for transfers, exhibiting little interplay with the community and again to related ranges in Might-June 2021 when the China ban occurred. Whole switch quantity has seen nearly a 50% drop; it was over 4 million BTC in early September.

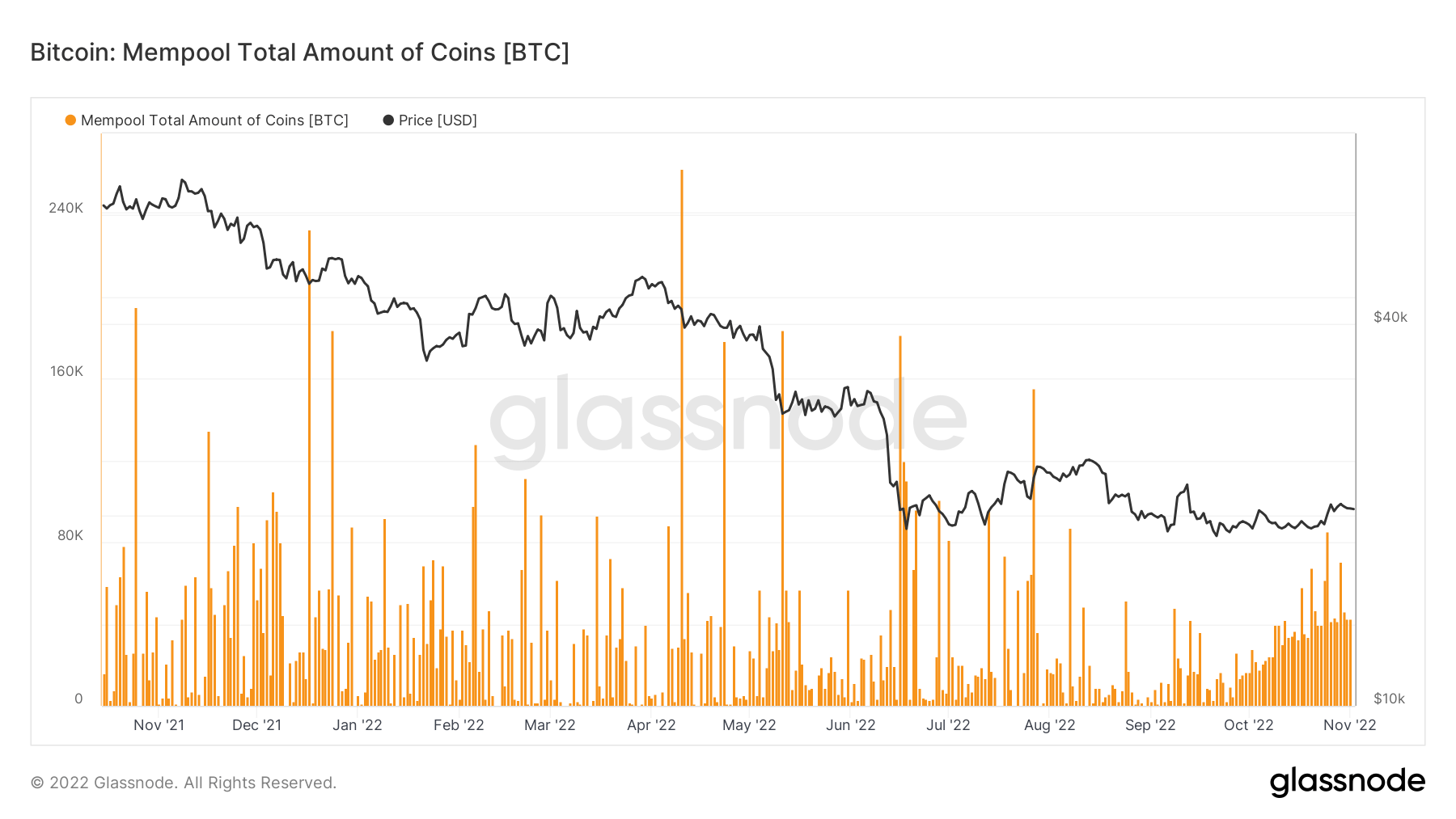

Mempool resurgence

Nonetheless, a slight resurgence within the mempool. The overall quantity of cash in transactions ready within the mempool. Over 40k BTC is ready within the mempool, which has stayed constant for everything of October, which is encouraging to see.

Provide

The overall quantity of circulating provide held by completely different cohorts.

The overall quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.91M BTC 0.2% (5D)

The overall quantity of circulating provide held by quick time period holders. Brief Time period Holder Provide 2.89M BTC -0.2% (5D)

The p.c of circulating provide that has not moved in a minimum of 1 12 months. Provide Final Energetic 1+ Yr In the past 67% 0.3% (5D)

The overall provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.86M BTC 0.12% (5D)

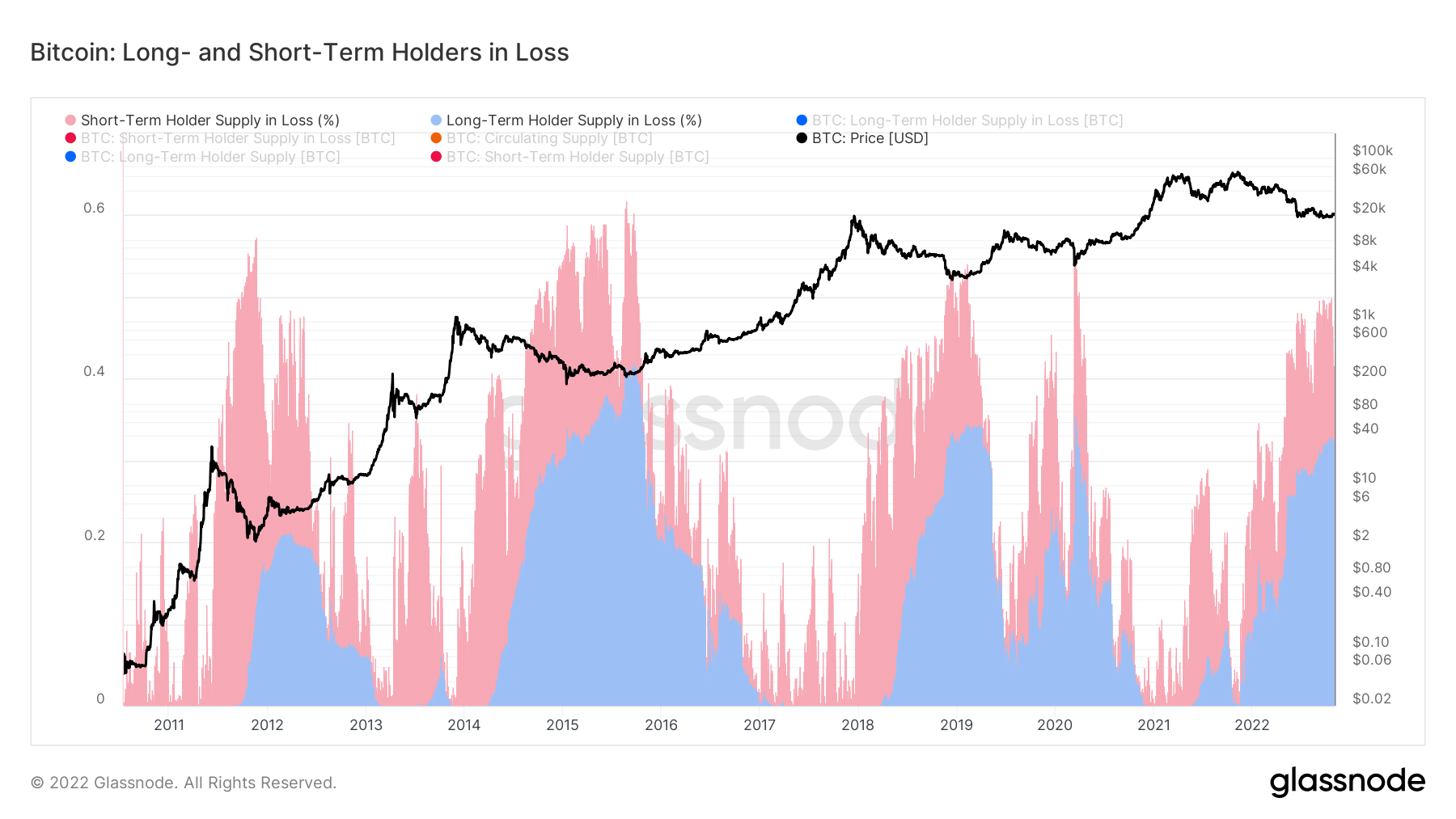

Provide in loss

This metric offers a breakdown of the p.c of provide that’s in loss and held by Lengthy-Time period Holders (blue) and Brief-Time period Holders (pink). Provide is outlined as Lengthy-Time period Holder Provide plus Brief-Time period Holder Provide (each of which exclude Provide held on Exchanges).

Every prior bear market cycle has seen STHs at a lack of 50% or extra; as of Oct. 20, this occurred, which is according to 2012, 2015, 2018, and 2020. LTH loss is at the moment at 34%, just like the 2018 cycle however not the identical magnitude as 2015.

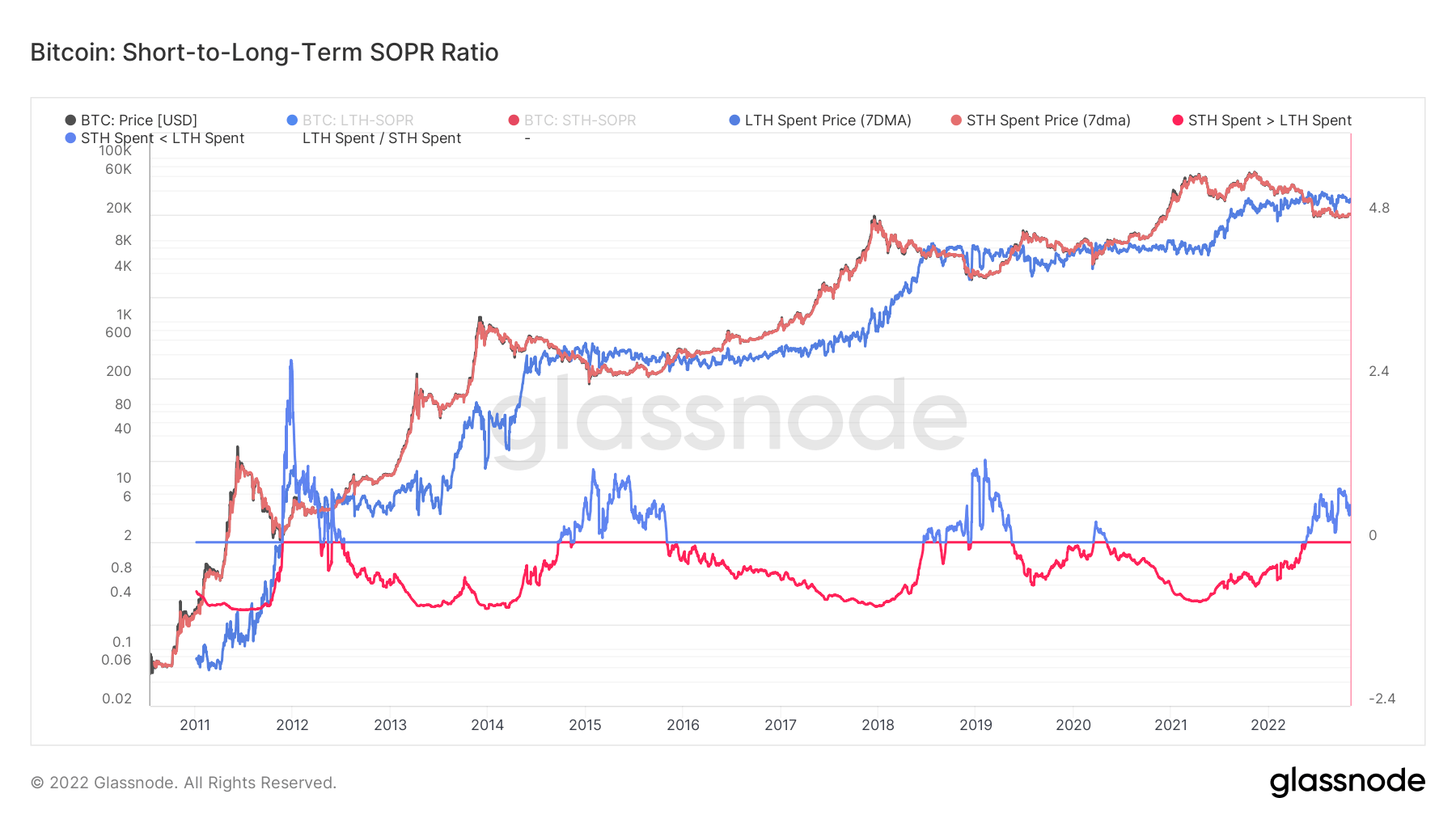

Late-stage bear market

The Brief-to-Lengthy Time period Holder SOPR Ratio is a mannequin that compares the common revenue a number of and, thus, the fee foundation of cash spent every day.

- Damaging Values in pink point out that the common realized revenue a number of for the STH cohort is decrease than that of the LTH cohort. That is typical in bull markets the place longer-term buyers get pleasure from high-profit multiples.

- Optimistic Values in blue point out that the common realized revenue a number of for the STH cohort is larger than that of the LTH cohort. That is typical in late-stage bear markets, the place LTHs comprise cycle high consumers underwater on their holdings.

The ratio turned from pink to blue throughout the luna collapse again in Might 2022, in earlier bear market cycles the place the cycle has been blue have seen a minimum of a 12 months with STHs underwater and witnessing a transition of extra cash to LTHs.

Cohorts

Breaks down relative habits by numerous entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: worth offered / worth paid. Lengthy-term Holder SOPR 0.73 5.3% (5D)

Brief Time period Holder SOPR (STH-SOPR) is SOPR that takes into consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of quick time period buyers. Brief-term Holder SOPR 0.99 -1% (5D)

The Accumulation Pattern Rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain by way of their BTC holdings. The dimensions of the Accumulation Pattern Rating represents each the dimensions of the entities stability (their participation rating), and the quantity of latest cash they’ve acquired/offered over the past month (their stability change rating). An Accumulation Pattern Rating of nearer to 1 signifies that on combination, bigger entities (or an enormous a part of the community) are accumulating, and a worth nearer to 0 signifies they’re distributing or not accumulating. This offers perception into the stability dimension of market contributors, and their accumulation habits over the past month. Accumulation Pattern Rating 0.47 41% (5D)

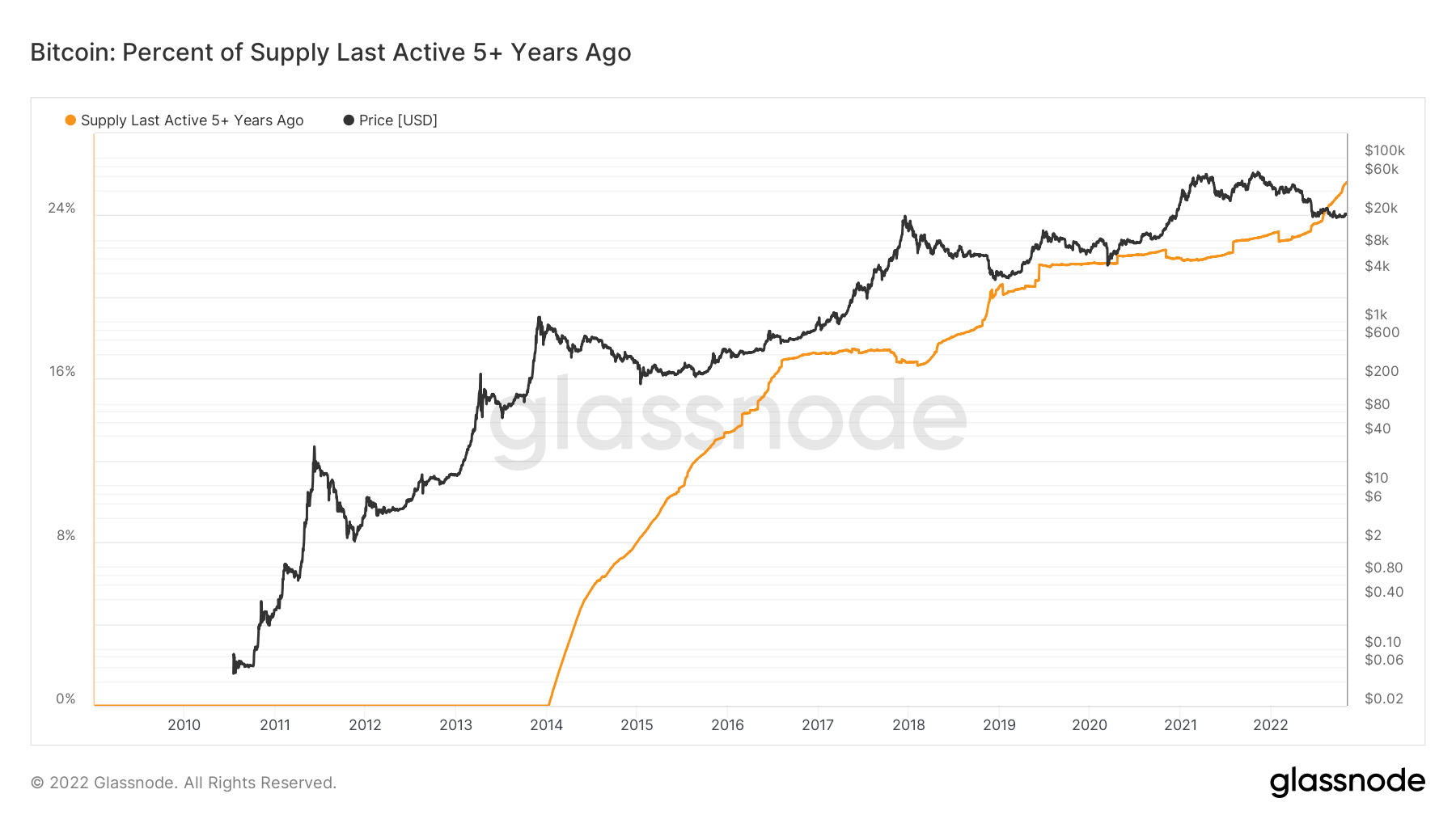

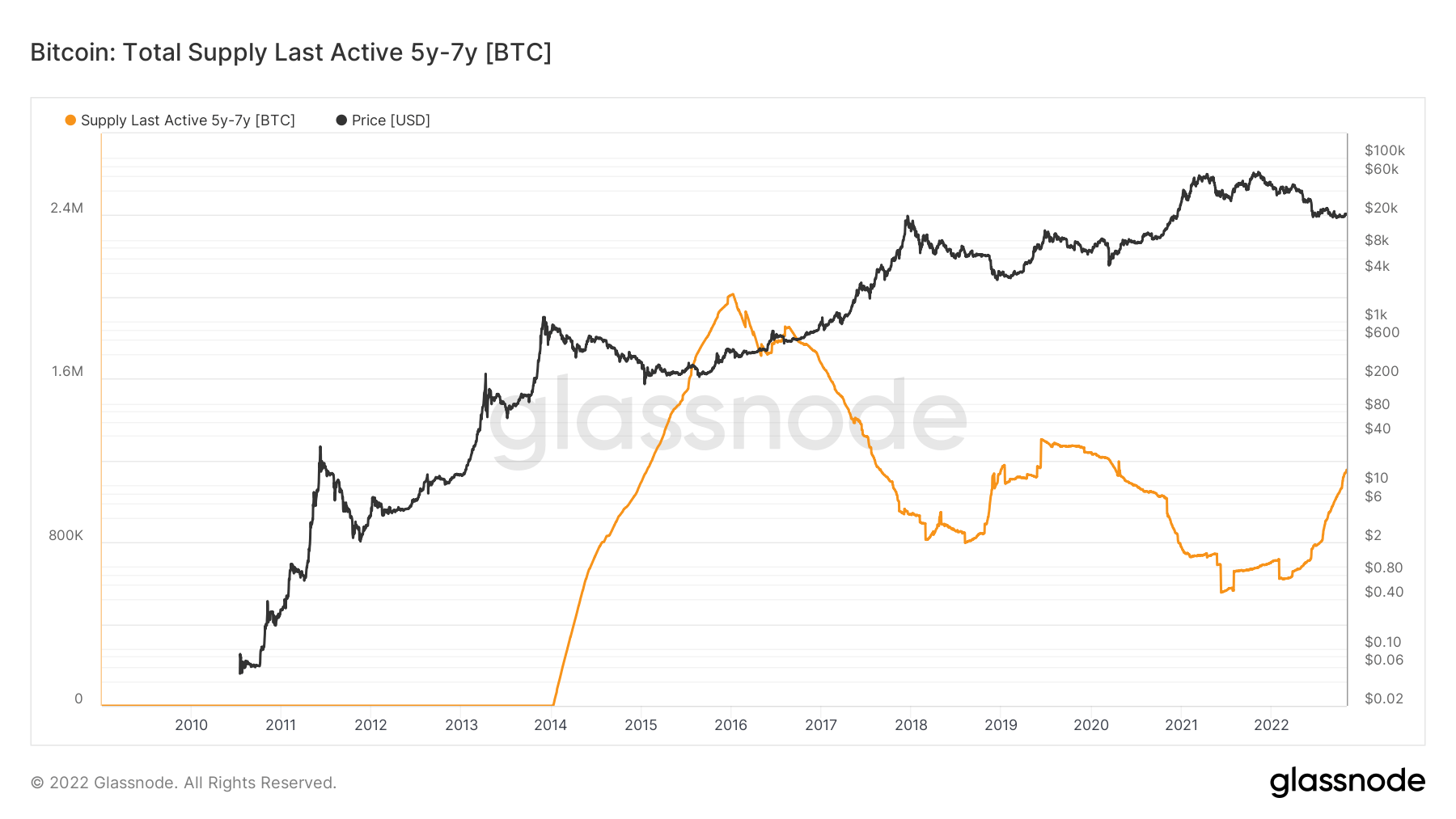

Historical Cash

Every bear market cycle types new diamond fingers or historical cash, known as five-year holders. The metric provide final lively 5+ years in the past exhibits the p.c of circulating provide that has not moved in a minimum of 5 years which is at the moment going vertical at 25%. That is because of the run-up in This fall 2017, when BTC was approaching $20k. Whereas the quantity of cash the 5-7 12 months cohort maintain is simply over 1 million cash

The quantity of circulating provide final moved between 5 years and 7 years in the past. 25% and over 1 million cash, anticipate this quantity to proceed to develop within the quick time period.