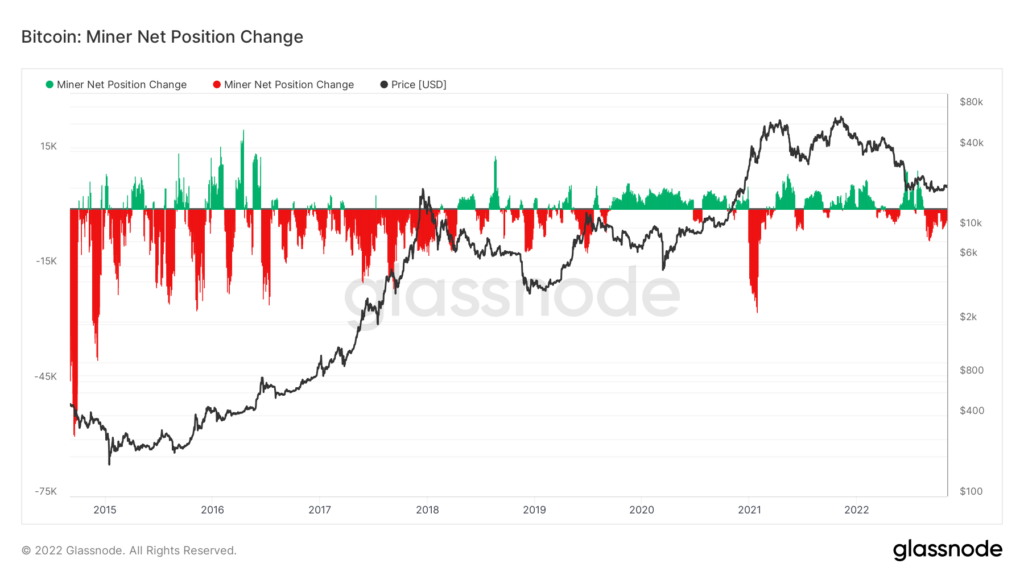

Bitcoin miners have been promoting BTC holdings at a fee not seen since early 2021. Additional, the persistence of the unfavourable web place change has not occurred since 2017. Miners constantly offered Bitcoin for the previous three months at an aggressive fee more likely to cowl liabilities akin to power payments and loans.

Since 2020, miners’ web Bitcoin positions have turned unfavourable on 5 events. Bitcoin noticed a significant worth enhance in 4 of these 5 occurrences throughout the next months. There was additionally sustained promoting from Bitcoin miners all through everything of the 2017 bull run.

Whereas miners promoting Bitcoin will be seen as a symptom of an underperforming market, it has additionally traditionally been a precursor to upside motion in Bitcoin’s worth.

The one intervals in Bitcoin’s existence when miner accumulation occurred alongside bullish sentiment have been after the COVID crash of Might 2020 and as Bitcoin hit its all-time excessive in Nov. 2021.

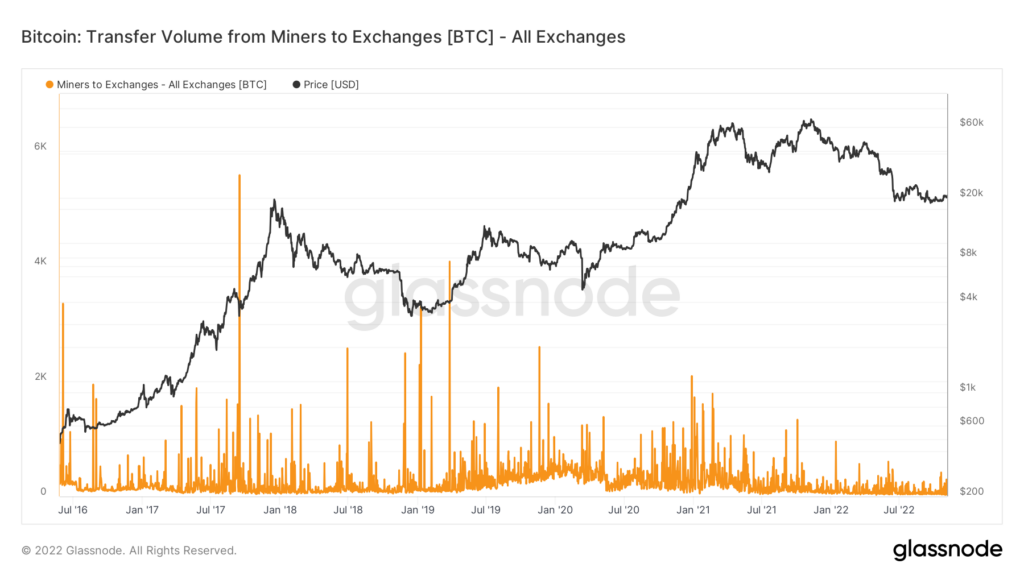

Miners, nonetheless, are transferring more and more much less Bitcoin onto exchanges. Whether or not the reason is expounded to the failure of a number of exchanges throughout the bear market or the elevated availability of P2P OTC trades is unknown.

The chat under highlights the quantity of Bitcoin despatched to exchanges from miners since 2016. There have been no spikes in quantity throughout 2022, however there was constant transferring of Bitcoin to exchanges. Bitcoin miners are promoting cash at an accelerated tempo which could possibly be indicative of future upside potential.