That is an opinion editorial by Shane Neagle, the editor-in-chief of “The Tokenist.”

Macroeconomic headwinds are repeatedly including to a bearish narrative throughout all markets, together with bitcoin.

As of October 2022, bitcoin is down greater than 60% for the reason that begin of the 12 months, but bitcoin’s buying and selling quantity stays pretty constant since July 2022. Does that imply nearly all of holders are giving up on the prospect of bitcoin and opting to promote?

This can be a advanced subject to dive into, however there’s one indicator that may assist us paint an image of what’s happening behind the noise: coin days destroyed (CDD).

What Are Coin Days Destroyed?

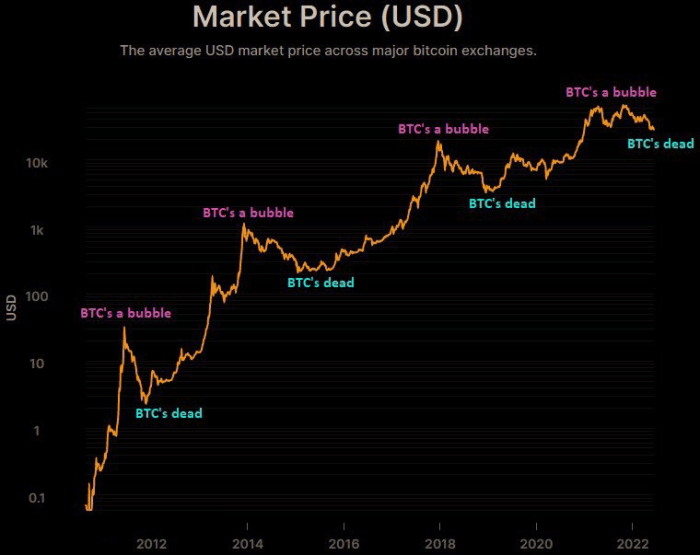

All through the course of an asset’s buying and selling historical past, there’s a important distinction if the shopping for value was on the decrease or increased finish of the value spectrum. Within the case of bitcoin, that spectrum is comparatively brief — simply 13 years — however fairly variable by way of value (starting from $0-$69,000). The unique cryptocurrency has undergone 4 main bull and bear cycles, however when zooming out, has repeatedly trended upwards.

Picture credit score: Visualize Bitcoin

The implication of this long-term, upward trajectory is obvious. Buyers who have been the earliest to purchase bitcoin have essentially the most to realize by promoting, even in bear markets. Likewise, buyers who took the chance to buy bitcoin early and at a decrease value, had the chance to purchase far more bitcoin for a similar quantity of fiat foreign money in comparison with costs later in bitcoin’s historical past.

In flip, bitcoin that have been mined and bought earlier have completely different worth significance than newer bitcoin launched into the circulating provide. If these “aged” bitcoin are held in the identical pockets for an prolonged time frame, such on-chain exercise would recommend a powerful conviction held by the proprietor by way of bitcoin’s long-term worth proposition. Such exercise sends a powerful sign to the Bitcoin community.

As well as, a long-term holder of dormant bitcoin has an elevated probability of experiencing a number of bear and bull market cycles, which additional amplifies the importance of outdated bitcoin shifting.

The metric of coin days destroyed measures this significance. In response to Glassnode, “Coin days destroyed is a measure of financial exercise which supplies extra weight to cash which have not been spent for a very long time.” CDD is calculated by multiplying the variety of cash in a given transaction by the variety of days since they final moved from a pockets.

Bitcoin is usually critiqued for its excessive ranges of volatility. But there’s clear demand for bitcoin in long-term investments, even in conventional IRAs. CDD is a well-liked on-chain indicator used to measure the sentiment maintained by long-term holders — people who see worth within the long-term prospects of bitcoin.

So, what does the present CDD degree recommend?

Bitcoin’s CDD Has Been Fairly Low

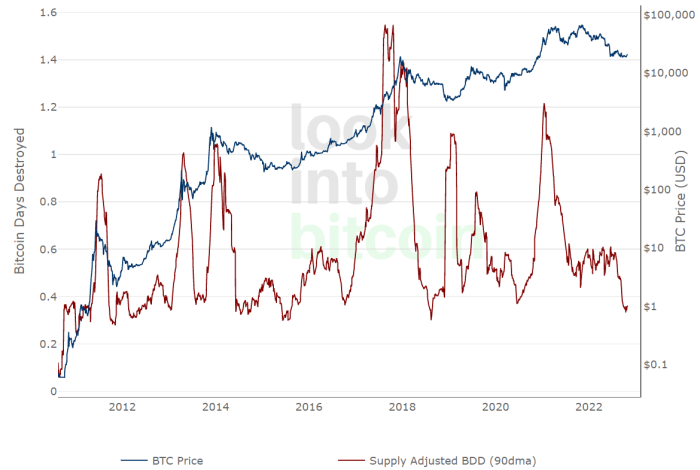

At 0.36, the 90-day shifting common of bitcoin’s CDD in October 2022 hit one of many lowest values all through its historical past. This explicit vary was solely visited beforehand in 2018, 2015 and late 2011. Because the supply-adjusted bitcoin days destroyed (BDD) chart beneath reveals, the very best BDD upticks occurred throughout bull run peaks, which is to be anticipated as long-term holders lock of their earnings.

In different phrases, long-term Bitcoiners — within the context of the asset’s historic promoting exercise — are persevering with to carry bitcoin in giant numbers. This may very well be one of many the explanation why bitcoin’s value exercise has been comparatively steady. Such holders may very well be performing as safeguards towards promoting strain.

If we flip to bitcoin’s buying and selling quantity, will we see the same sample?

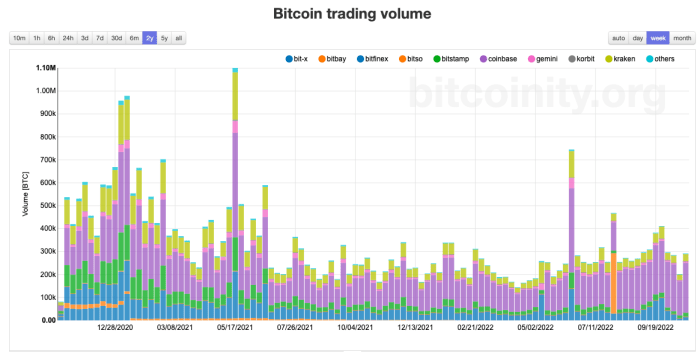

The above chart reveals bitcoin’s buying and selling quantity from October 2020 to October 2022. What’s famous right here is pretty regular and constant buying and selling quantity from roughly July 2021 to October 2022. We don’t see a drop, which resembles the exercise from CDD.

The mixture of knowledge from these two indicators — a low CDD with regular and constant buying and selling quantity — additional means that a lot of the bitcoin traded was by short-term holders. The truth is, bitcoin from 2010/2011, bought at properly beneath the $100 vary, have moved the least.

General, in accordance with Glassnode knowledge, simply over 60% of circulating BTC haven’t moved in over a 12 months. This holding pattern additionally contributed to bitcoin’s exceptionally low volatility. Comparatively, in 2018, the same value volatility was adopted by a 50% drop in a single month, from $6,408 in November to $3,193 in December.

Is it doubtless we are going to see a brand new backside even with long-term Bitcoiners holding the road?

Extra Bitcoin Promote-Off Pressures

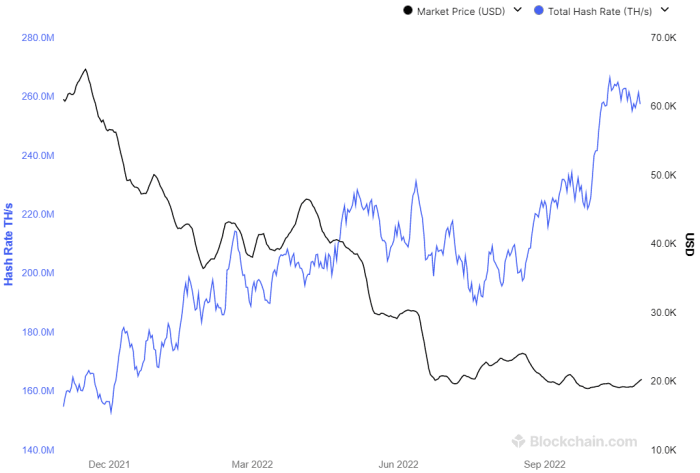

Presently, bitcoin’s value is inversely associated to its record-high hash fee. This isn’t excellent news contemplating miners must service their money owed by promoting mined bitcoin, even at their backside value level on this bear cycle.

Already, one of many largest bitcoin mining firms, Core Scientific (CORZ) — with a share of hash fee round 5% of the community’s complete — is exploring chapter. Within the meantime, CORZ inventory collapsed by 98.32% year-to-date.

Argo Blockchain (ARBK) shares the identical destiny, having fallen by 91.56% and is unable to promote sufficient property to cowl the prices. In response to an operational replace from Argo in October 2022:

“Ought to Argo be unsuccessful in finishing any additional financing, Argo would turn into money movement destructive within the close to time period and would want to curtail or stop operations.”

Though these mining firms will doubtless find yourself reducing the Bitcoin hash problem, in a recreation of survival of the fittest this has the potential to trigger one other contagion spiral. This time round, vulnerability and market sell-offs might come from remaining centralized platforms which can be lending {dollars} to bitcoin mining firms. Going again to the continuing macroeconomic headwinds, how the market interprets the Federal Reserve’s subsequent strikes could find yourself elevating the value of bitcoin simply sufficient for miners to remain above water.

As a result of the Fed will increase the price of capital and borrowing, making the greenback stronger within the course of, this sometimes makes buyers depart risk-on property, reminiscent of bitcoin. When buyers forecast a recession, the greenback reigns even stronger, as buyers dive into money as a secure harbor.

By the identical token, the Fed’s signaling towards accelerated tightening — a pivot from its anticipated increase schedule — might present market reduction.

With that mentioned, the so-called “Fed pivot” shouldn’t be understood as a return to decrease rates of interest, however as a deceleration to probably mountaineering solely 50 foundation factors in December (if incoming inflation knowledge favors it). Nonetheless, within the present fearful market atmosphere, which may be ample for a short-term rally, or not less than, the avoidance of a brand new bitcoin backside.

Regardless of the numerous elements pushing buyers away from risk-on property — the Fed battling 40-year-high inflation, a looming power disaster in Europe, ongoing world provide chain points and even Bitcoin’s mining problem — knowledge from CDD and bitcoin buying and selling quantity offers us with an fascinating statement. Lengthy-term holders appear extra assured than ever within the long-term worth proposition that bitcoin offers. Such holders are presently promoting bitcoin at one of many lowest charges we’ve seen within the historical past of the Bitcoin community.

This can be a visitor submit by Shane Neagle. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.