That is an opinion editorial by Dustin Lamblin, a portfolio supervisor and AI quantitative researcher.

When folks work, they commerce their private time on Earth in trade for cash. Because the outdated adage goes, “Time is cash.” When folks lose management over their cash, they provide up their most treasured useful resource they’ve of their restricted time on Earth: the management of their time and thus, their freedom. Sadly, this nightmare is a actuality for billions of individuals around the globe. Individuals get robbed of various types of their hard-earned financial savings on a regular basis. It could occur throughout wars or beneath authoritarian regimes, however typically it could actually even be as delicate because the passing of time with the insidious type of wealth erosion that we generally name inflation.

The invasion of Ukraine has reminded us how fragile life is and the way every little thing could be taken from us within the blink of a watch. In life, nothing could be taken without any consideration: freedom, sovereignty, cash. Between the warfare in Ukraine, rampant inflation everywhere in the world, rising measures from authoritarian regimes, it’s price shedding a lightweight on the humanitarian advantages of Bitcoin and the way Bitcoin is changing into a lifeline for a lot of. On this world the place so many issues are exterior of our management, we nonetheless have the liberty to decide on how to answer it. Bitcoin can supply financial freedom. For skeptics, I hope to problem your present beliefs and present you one other facet of the story, distant from the Ponzi scheme and hypothesis that mainstream media loves to speak about.

Bitcoin Is Censorship Resistant

At first sight, In case you are dwelling within the Western world, it may be exhausting so that you can think about why bitcoin might be helpful. You and I each most likely dwell in a democracy. Now we have entry to capital and banking companies. As we lay down at night time, we don’t have to surprise what’s occurring to our euros and {dollars} sitting in our checking account, questioning if they’re secure. It might by no means cross our minds that somebody would confiscate our life financial savings, nor that our cash might be nugatory in a single day. As a matter of truth, the overwhelming majority of individuals don’t really perceive how our financial system works or how cash itself is constructed. Most of us simply use it. We belief the system. This tells lots in regards to the blind confidence we are likely to have in our establishments.

When you acknowledge your self in what I simply described, congratulations, you already received on the lottery of life. Understandably, when folks inform you about bitcoin, you surprise how this new foreign money might be helpful. Luckily for you, you aren’t a part of the overwhelming majority of the world inhabitants, for which this type of drawback retains them awake at night time.

“A housewife who has had no expertise of the horrors of foreign money depreciation has no thought what a blessing secure cash is, and the way wonderful it’s to have the ability to purchase with the notice in a single’s purse the article one had meant to purchase on the value one had meant to pay.” — Adam Ferguson, “When Cash Dies,” Germany, 1920.

In the mean time, 2.6 billion folks dwell in nations with out the freedoms which most of us take without any consideration. In these nations, your complete life financial savings might be taken from you at any time. Any property you personal might be frozen in a single day, no query requested. You don’t have to be any sort of terrorist or evil individual to be focused. Merely talking your thoughts and opinions can get you thrown in jail or worse. This might imply you might be pressured to go away your relations behind with no earnings for assist. One of the crucial vital options of bitcoin solves this drawback: censorship resistance. Bitcoin is a protection mechanism to protect your wealth from exterior threats. As fashionable stoics would say, “You’ll be able to’t management what occurs to you, however you possibly can defend your self from monetary threats with bitcoin.”

What makes bitcoin censorship resistant? All of it comes right down to decentralization. Centralized programs being the norm could be defined by the Byzantine Generals’ Downside, a game-theory drawback that describes the difficulties of reaching consensus in a decentralized system with out counting on a trusted central occasion. How can members of a decentralized system collectively agree on a reality, with out figuring out and trusting every particular person member? Central figures, e.g., governments, banks, and many others., are generally established to settle what’s true or to provide instructions. The trade-off for this effectivity is sort of usually corruption and abuse of energy.

Nonetheless, in relation to Bitcoin, no person is accountable for the protocol. There isn’t a button that somebody can push or somebody who could be pressured so as to change the code to grab your cash. No one controls the system. You could have the custody of your personal cash. You don’t want a financial institution anymore since you are your personal financial institution. You’ll be able to retailer your complete wealth on a tool that’s the measurement of a USB key (a “signing gadget,” extra generally known as a {hardware} pockets). No supranational entity can resolve what you do along with your bitcoin; it’s yours and it’s unseizable with out the password, which is represented by 12 or 24 phrases. Residing within the Western world, this will likely sound foolish to you, however in lots of nations on the planet, holding bitcoin is the one option to shield the financial savings of your loved ones. Worldwide, 31% of adults are unbanked, however 83% of the world inhabitants owns a smartphone. You don’t want a financial institution to personal bitcoin, a smartphone is ample.

And for those who assume seizure of funds by banks or governments solely occurs beneath authoritarian regimes, I counsel you to take a look at what occurred in Cyprus in 2013. Whereas the nation was getting ready to chapter, they determined to tax 6.75% on all savers of the nation and as much as 10% for these with greater than 100,000 euros of their checking account. Identical to that, in a single night time, 10% of your cash was gone.

The truth is, when financial or political conditions begin to shortly deteriorate, governments have typically restricted entry to overseas capital and exhausting foreign money. In Lebanon in 2021, folks had been restricted to withdraw a specific amount in native foreign money so as to keep away from a financial institution run. Then in early 2022 the federal government introduced that whereas there was over $104 billion of exhausting foreign money within the Lebanese banking system, they solely deliberate to permit savers to redeem $25 billion of their very own cash. That could be a heartbreaking 75% haircut on the hard-earned financial savings of residents.

One other instance of monetary censorship occurred lately throughout the Freedom Convoy protest in Canada. Individuals supported this protest by sending bitcoin to truck drivers. When the federal government found out what was occurring, they pressured exchanges with know-your-customer legal guidelines (KYC) to disclose identities behind addresses and used an emergency regulation to freeze private banking accounts and bank cards. These folks had been banned from the monetary system for displaying monetary assist to a peaceable protest. No matter your political view on the topic, what occurred there may be simply morally mistaken. And it occurred in Canada, one of many main democratic nations on the planet. That is horrifying. Individuals don’t worth privateness till somebody comes knocking on their door.

Bitcoin Protects Your Wealth Throughout Wartime

Bitcoin can play a significant function for financial savings preservation when warfare breaks out. When violent battle emerges, cash might be the final concern as folks scramble to save lots of their lives. Being pressured to go away your life behind and maybe changing into an immigrant abroad is already a tricky spot to be in, however it could actually attain a brand new layer of hell for those who shouldn’t have entry to any cash.

If or when it occurs, it occurs quick, and often entry to banking is shut down or restricted. Most individuals’s conventional property are illiquid: You probably have a enterprise, a home or a automobile, there may be often no option to shortly convert these to fiat on such brief discover. With bitcoin, you possibly can depart along with your complete wealth saved on a tool the scale of a USB drive. You’ll be able to cross oceans, lands and borders along with your life financial savings in your pocket. Attempt to do the identical with gold or another sort of asset. Bitcoin enhances all of the properties that make for a superb retailer of worth: It’s acknowledged by tons of of thousands and thousands of individuals around the globe, it’s transportable and could be exchanged for native foreign money at usually low charges.

Most individuals to migrate with money and face unbelievable risks throughout their journey with the danger of dropping their cash, getting mugged or assaulted. If a {hardware} pockets is just too intimidating, folks can retailer their bitcoin on a smartphone utility, depart the nation and have entry to their liquidity the entire time.

As a real-life instance, Francesco Madonna explains how his webmaster escaped Ukraine proper earlier than they enforced martial regulation. At that second, the webmaster couldn’t get any entry to his cash as a result of ATM withdrawals had been restricted and his financial institution blocked all worldwide transfers. How are you presupposed to feed your loved ones and discover shelter abroad for those who shouldn’t have entry to cash? As a result of this man had a bitcoin pockets, he was capable of finding a bitcoin ATM overseas and withdraw money to pay for his survival.

Bitcoin Solves Points With Remittances

As soon as folks immigrate, whatever the cause, they will present for any household or buddies again house with bitcoin and the Lightning Community, the place folks can ship and obtain funds internationally at nearly no price. Remittances like these are a lifeline for a lot of, offering them cash that will probably be used for his or her primary human wants — similar to meals, housing and schooling — in addition to cash that can be utilized to elevate folks out of poverty and stimulate native financial exercise. Remittance charges, nonetheless, lower the disposable earnings of migrants and likewise cut back their incentive to ship more cash overseas to assist their family members. In sub-Saharan African nations, remittance charges are notably costly at 8%, however in different elements of the world it may be within the double digits. With out mentioning the hours of strolling or potential to get robbed when going to the closest Western Union, it’s straightforward to underestimate the affect that bitcoin and the Lightning Community can must develop financial exercise in these areas. Bitcoin is cheaper, quicker and safer. Individuals can obtain bitcoin straight into their pockets immediately whereas secure at house. They’re able to defend themselves from exterior threats.

We are able to envision a world via the Lightning Community of microcredit exercise between folks lending and borrowing cash with out monetary intermediaries: a world the place retailers might arrange store wherever and get the complete advantage of their gross sales with out being ripped off by bank card processing charges; a community that promotes inclusion no matter social background and subsequently offers equal financial alternative.

Bitcoin Is A Hedge In opposition to Inflation

“Sound cash is the primary bastion of a society’s protection.” — Adam Ferguson, “When Cash Dies”

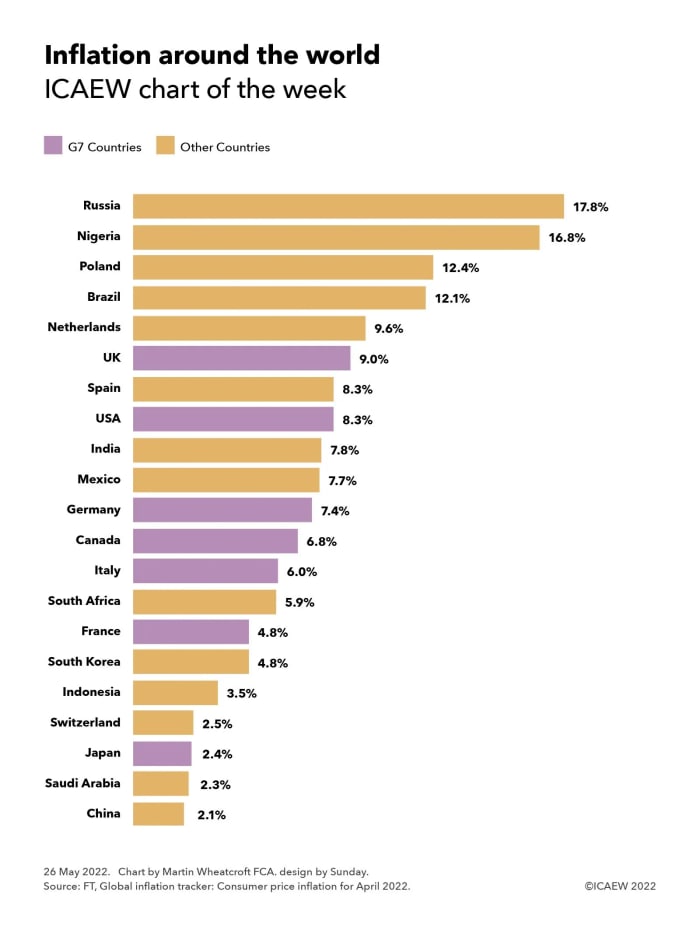

Defending your wealth doesn’t solely imply ensuring your property are secure. Financial savings are the one hedge you’ve for no matter shock life goes to throw at you. All over the world, folks have seen their financial savings deteriorating and being eroded by inflation and foreign money depreciation. Based on latest information, more than 2 billion people dwell beneath double-digit inflation. Even for those who shouldn’t have to fret about your cash being seized, it might be on a fast-eroding path as a result of a number of elements: financial coverage by the central financial institution, mismanagement of assets by the federal government, world provide chain points and plenty of extra.

“The spouse of a physician whom I do know lately exchanged her lovely piano for a sack of wheat flour. I, too, have exchanged my husband’s gold look ahead to 4 sacks of potatoes, which is able to in any respect occasions carry us via the winter.” — Adam Ferguson, “When Cash Dies,” Austria, December 1918

Inflation is insidious; it begins by slowly eroding folks’s buying energy, however can in a short time develop into exponential and spiral uncontrolled. As soon as it goes down this path, it is extremely exhausting to fight and it could actually carry out the worst in folks. When primary wants are usually not met anymore, folks could act towards one another to do no matter it takes to guard their future. Society and norms develop into secondary. Hyperinflation fosters polarized concepts, populist claims, excessive regimes and folks in search of a scapegoat accountable their scenario on.

“The pie was rising smaller and increasingly more folks wished to have items of the pie and so, there was nothing left from the ‘good neighbor’ environment of former days. Everyone noticed an enemy in everyone else.” — Frau von Pustau, Germany, 1922

The saddest factor about inflation is that it impacts a inhabitants in drastically alternative ways. In case you are rich and from the Western world, you possible have entry to capital, subsequently you’ve many alternative methods to guard your self from inflation via that capital: actual property, commodities, gold, bitcoin. Alternatively, center class and decrease class income-earners are those that endure probably the most. They’ve much less instruments accessible to defend themselves from inflation. For these dwelling in creating nations, your possibilities of struggling drastic inflation are excessive and your instruments to battle it are restricted.

“When folks don’t perceive what is going on, or why it’s occurring, and do not know about what to do about it, and are usually not informed, panic should observe.” — Adam Ferguson

“Nothing is sturdy, whether or not for a person or for a society.” — Seneca

Governments, not less than these within the developed world, are sometimes seen right now as infallible entities, the place we should always put all our belief. That is why folks see authorities bonds as risk-free property, pondering that it’s the most secure place to take a position. That will very nicely be true, however just for a sure time frame. Historical past has proven us that in the long run, empires at all times fall. The Ottomans, Romans, even the British Empire — regardless of how massive and highly effective — have all ended up failing. What makes you assume that it will likely be any completely different for the fashionable U.S. empire? How far do you assume we’re from the tipping level? Do you assume the chance of the U.S. failing within the coming many years is null? Then why do you personal 100% of your wealth in USD?

In the end, we don’t know what the longer term will probably be. That’s the reason we have to be ready for a black swan state of affairs. In finance we have now phrases for it: We name it insurance coverage, or a hedge. Bitcoin is the insurance coverage coverage on the present financial system. A small allocation might present the uneven payoff that may present financial freedom to your future generations.

“Sure, however mine are authorities securities: Absolutely they will’t be something safer than that?”

“My expensive girl, the place is the State which assured these securities to you? It’s useless.” — Anna Eisenmenger diary, December 15, 1918 in Austria, the day she misplaced 75% of her wealth.

Certainly, bitcoin is risky and nonetheless speculative. At this level folks shouldn’t put more cash than they will afford or are prepared to lose. Because the adoption charge retains rising and extra folks begin to acknowledge bitcoin as each a retailer of worth and a method of trade, I imagine the volatility will progressively stabilize over time. I feel that individuals investing now will get rewarded for using the steepest a part of the adoption curve. Over the previous few years, we have now seen a persistent adoption of the know-how: El Salvador made bitcoin authorized tender in 2021; many S&P 500 firms now maintain bitcoin on their steadiness sheets, e.g., Tesla and MicroStrategy; an rising variety of firms have began to just accept bitcoin as cost methodology, e.g., Microsoft and PayPal; even pension funds begin to supply bitcoin of their 401(okay) plans, e.g., Constancy.

I really feel fortunate to be a part of a technology that now has an alternative choice to the present financial system. You don’t have to make use of bitcoin, however not less than it’s an accessible choice. No matter the place you come from, you should have entry to a basic proper: a cross-border, censorship-free type of cash. Bitcoin is freedom cash and no person will have the ability to take that choice from you anymore.

“Focus camps supply ample proof that every little thing could be taken from a person, however one factor: the final of the human freedoms — to decide on one’s angle in any given set of circumstances, to decide on one’s personal approach.” — Viktor Frankl

Bitcoin Is Totally different

Probably the most lovely factor about Bitcoin is that no person owns the protocol. Like I discussed, there isn’t a single one who could make overarching choices for the system. We don’t have to fret about who’s going to be the subsequent individual in cost and what politics they’ll run on subsequent. In fashionable society, centralization is the norm: governments are centralized, cash is centralized, the schooling system is centralized. That is how we grew up, we didn’t have any alternate options and subsequently we by no means needed to query it. Now, we have now another. The 18th century was pushed by the Enlightenment motion that pushed the separation of the church from the state. I imagine the twenty first century would be the century of the separation of the cash from the state.

The open-source protocol of Bitcoin is totally decentralized and left to the customers. There isn’t a central entity, similar to the federal government, concerned within the coverage. The financial coverage could be very clear, clear and hard-coded. There will probably be 21 million bitcoin issued, no extra. A disciplined financial coverage fully impartial of political lobbying is a crucial characteristic for a sound financial system as a result of decentralized programs are immune to corruption. That is opposite to the present financial coverage which is dictated by just a few central financial institution officers who make politically influenced choices behind closed doorways. Central bankers don’t bear the implications of their actions however nonetheless have an effect on the lives of tons of of thousands and thousands of individuals around the globe. Sadly, people are corruptible and grasping, and energy makes this worse. That is why Satoshi Nakamoto got here up with this decentralized system. With Bitcoin, we don’t must belief one another so as to cooperate. As defined, Bitcoin is the reply to the Byzantine Normal’s Downside.

Some Closing Ideas

Bitcoin has been painted by Western media as an evil bubble of hypothesis. From our very privileged perspective, it’s exhausting to know that a lot of the world nonetheless doesn’t have entry to primary human rights, and even much less entry to financial freedom. It’s straightforward to dismiss when we have now entry to secure foreign money, equal financial alternative, banking and capital in a free nation. We must always have the decency to confess that the system is damaged for most individuals and respect their resolution to decide on one other path deemed extra sustainable. Individuals have the best to resolve what’s finest for them.

Bitcoin is the quickest adopted know-how in human historical past for a cause. It provides financial freedom for billions of unbanked folks around the globe. It is usually probably the most democratic weapon ever invented. Bitcoin builds bridges between cultures and religions everywhere in the world. When utilizing bitcoin, it doesn’t matter which religion you imagine in or the place you got here from. Bitcoin has no faith, no political agenda, no flag and no border to guard. Bitcoin doesn’t discriminate between members. Wealthy or poor, folks have the identical worth within the Bitcoin community. No matter how a lot cash you’ve, you can not corrupt the Bitcoin community.

Bitcoin is an thought, a brand new philosophy and there may be nothing extra highly effective than concepts. No one can kill an thought. They unfold like hearth and as soon as they’re on the market, there is no such thing as a option to put the genie again within the bottle.

Individuals will argue that bitcoin just isn’t backed by something. Sure, bitcoin just isn’t backed by any tangible property, however guess what? That is actually how our complete system is constructed. A financial institution can mortgage 10 occasions greater than they’ve on their steadiness sheet. Central banks can print trillions of {dollars} out of skinny air. All the pieces is in our head; it’s known as the “cognitive revolution.” This skill to ascertain issues that didn’t bodily exist is what made us — homo sapiens — probably the most lethal species on Earth. Belief is the only factor backing most issues in life, and by way of cash, Bitcoin is the final word type of belief.

This can be a visitor put up by Dustin Lamblin. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.