That is an opinion editorial by Morgan Rockwell, founding father of Bitcoin Kinetics.

I am not involved with Sam Bankman-Fried allegedly getting a mortgage from Alameda, which was really FTX buyer funds wired by Alameda to be credited on FTX. I am not involved with the ethical compass of the superstar buyers who gave billions to a child they did not actually know or perceive, but endorsed with wealth and credibility. I am not very involved with the monetary and market results upon the various firms, exchanges and merchants who for some motive relied on FTX in any type.

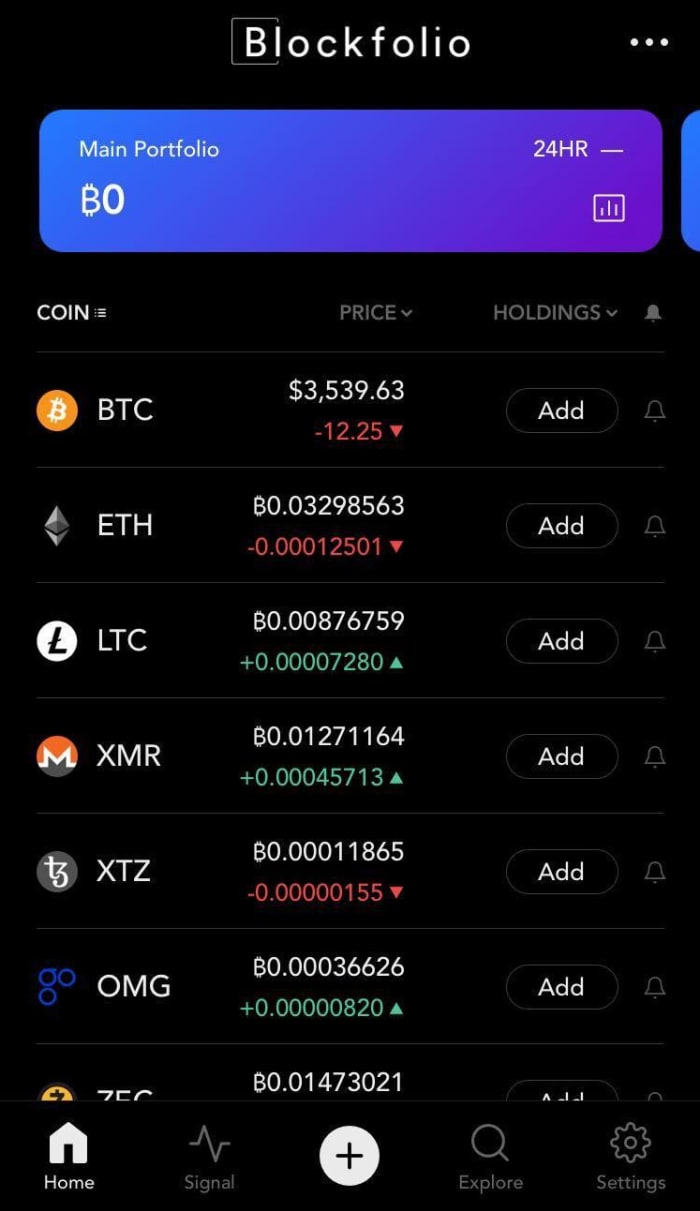

I am most involved with Sam Bankman-Fried getting the private identification data of thousands and thousands of shoppers, and utilizing that knowledge to do chain evaluation on the Blockfolio app he bought which was utilized by many Bitcoiners and cryptocurrency holders as a monitoring instrument of Bitcoin, Ethereum and different watch-only cryptocurrency wallets.

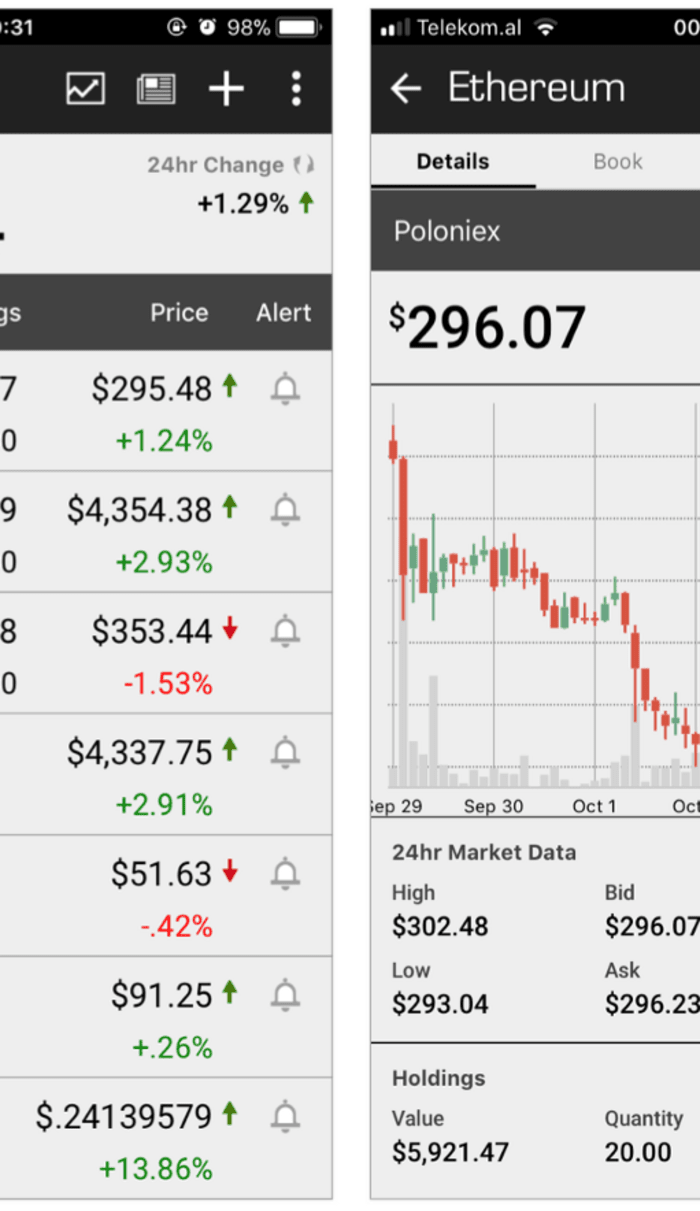

Supply: Google Pictures

For those who aren’t conscious, Blockfolio was an app that was utilized by many Bitcoin holders and different cryptocurrency holders to maintain observe of the change fee or the costs of their cash held in chilly storage or on wallets that they solely wished to be watching and never have actively on a scorching pockets on their cellular system. Storing the pockets addresses really weren’t even wanted on the app. You possibly can simply put in a quantity of a sure cryptocurrency that you simply wished to observe and say that you simply had — however there was additionally a function to hook up with exchanges to maintain observe of your entire cash throughout the entire exchanges you had them on in a single app. This was the fantastic thing about Blockfolio because it did not essentially ask for an excessive amount of private identification data apart from an e-mail to assist hold observe of your account so you’ll be able to log in from a number of units.

Most of us like myself turned conscious of Sam Bankman-Fried due to the acquisition of Blockfolio by a newly fashioned entity known as FTX. Over a number of weeks the Blockfolio app was rebranded because the FTX app which now had its personal change. It additionally had a brand new set of Know Your Buyer guidelines, Anti-Cash Laundering insurance policies, a brand new Phrases of Service, in addition to its personal custodial pockets held by FTX, we assumed.

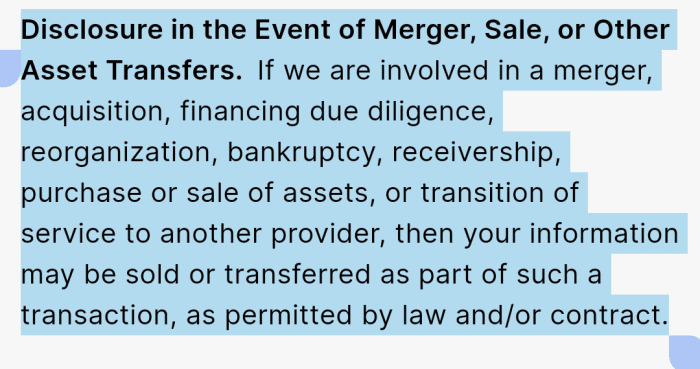

Right here you’ll be able to see the Phrases of Service at Blockfolio from June 30, 2017:

Supply: Blockfolio Privateness Coverage 2017

Blockfolio avidly argued that they weren’t and wouldn’t ever promote person knowledge. Blockfolio even tried to de-identify customers with a hashing mechanism for IDs to not even let themselves determine and join person portfolios to e-mail addresses; this apparently by no means occurred after the acquisition and transformation into FTX.

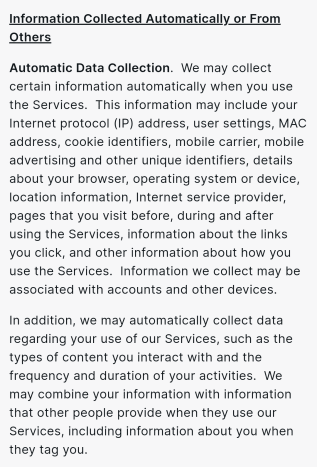

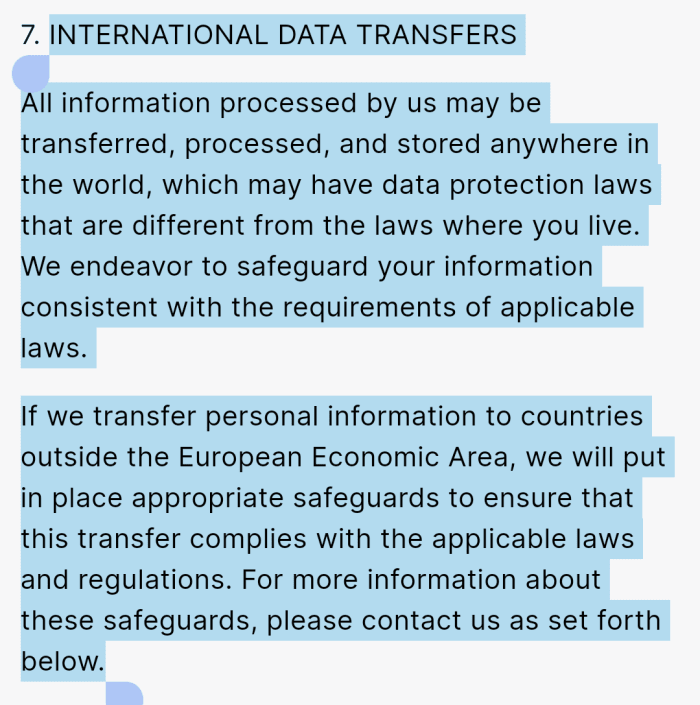

Right here you’ll be able to see the stark distinction within the new FTX Privateness Coverage:

Supply: FTX Privateness Coverage 2022

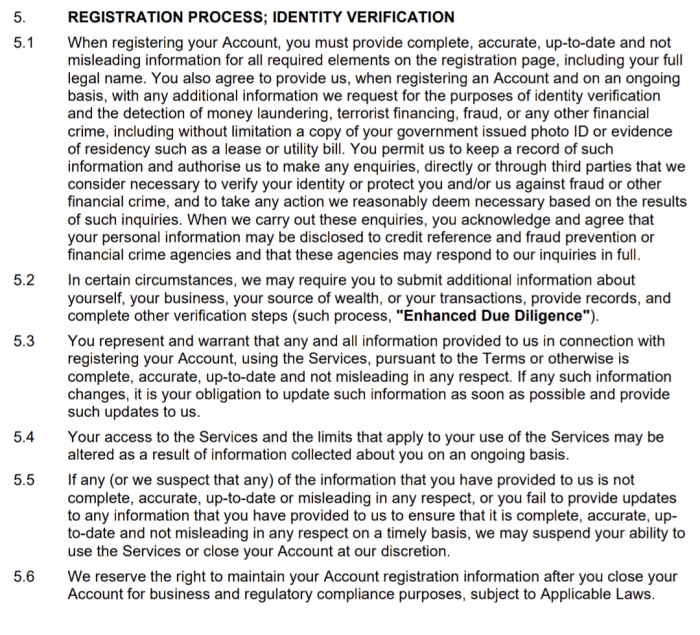

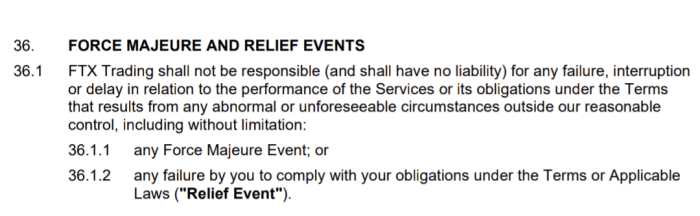

Here’s what little is talked about about private identifiable data inside the FTX Phrases of Service, which is a distinct doc than the Privateness Coverage.

For reference, if in case you have by no means learn a Phrases Of Service or Privateness Coverage of an organization earlier than, I strongly advocate you seize a powerful beer and luxuriate in this phrase soup!

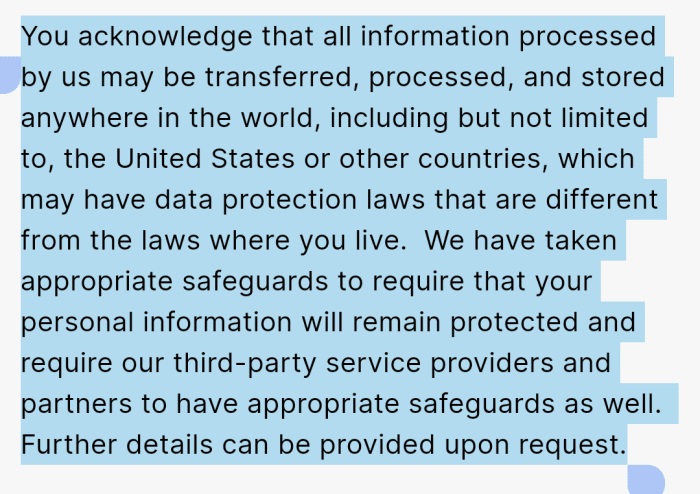

This all has introduced up questions round this merger and the acquisition that occurred within the cryptocurrency trade just a few years in the past. I’m involved as a result of after the fallout of this change, FTX going bankrupt and all of its property probably being put up for public sale, I want to know the state of the private identification data that FTX had been compelled to assemble due to KYC and AML legal guidelines. My concern is the huge quantity of data gathered together with passports, cellphone numbers, IP addresses, house addresses, cryptocurrency pockets addresses, e-mail addresses, passwords and authorities IDs. All of those might be bought at public sale as buyer knowledge or buyer profiles to whoever finds them helpful.

Supply: FTX Privateness Coverage (disclosure within the occasion of merger, sale, or different asset transfers)

Now the property held by FTX whether or not they have been really actual cryptocurrency corresponding to bitcoin or made up tokens constructed on one other layer one community corresponding to ethereum aren’t too vital on this dialog for my part. What’s vital is the info, the privateness knowledge, the info mining operation that might have or will likely be carried out on all of this knowledge FTX had gathered on prospects both it was carried out by them or it will likely be carried out by whomever buys this knowledge at public sale. Much more so, the jurisdiction of that knowledge is open to wherever on earth.

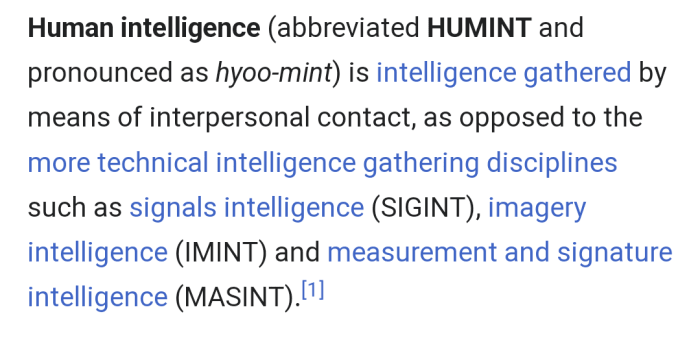

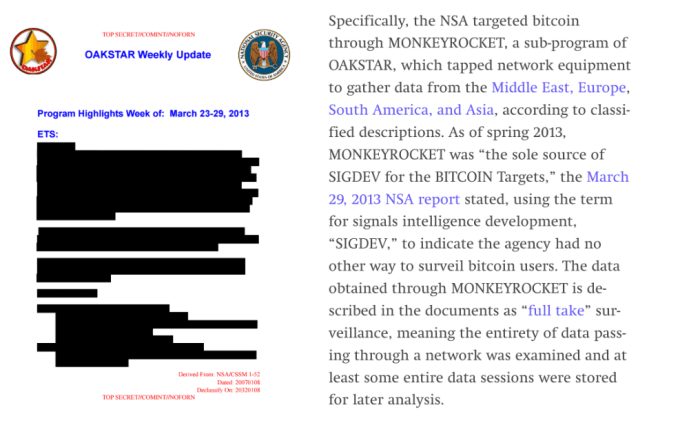

As somebody who has personally labored on coin evaluation ideas and expertise for the US Army, in addition to consulted on this for the Division of Protection as a so known as “material professional,” I can personally attest that it is vitally simple to correlate an individual to their Bitcoin pockets tackle utilizing nothing greater than the quantities of bitcoin held on particular addresses, in addition to the system knowledge that’s holding observe of these particular quantities on particular addresses — that is easy SIGINT, MASINT or HUMINT, all of that are completely different types of intelligence gathering.

If you’re holding observe of any bitcoin on any pockets over any Bitcoin explorer that’s appeared by a browser or app on any system, cellphone, laptop computer or pill, there’s now a file that will likely be linked to the IP tackle, the MAC quantity, the SIM cellphone quantity, the VOIP quantity, bank card quantity, house tackle and another private figuring out data that’s hooked up in any option to this system. I do know this as a result of Edward Snowden leaked paperwork exhibiting that the NSA had a program known as XKEYSCORE and purposes have been used like OAKSTAR and its subprogram MONKEYROCKET to particularly hold observe of Bitcoin customers on the NSA.

Supply: https://theintercept.com/2018/03/20/the-nsa-worked-to-track-down-bitcoin-users-snowden-documents-reveal/

Now what I am getting at is that this knowledge that FTX was compelled underneath AML and KYC regulation to be gathered. That is probably one of many largest gatherings of such a knowledge within the cryptocurrency trade ever carried out in historical past. This knowledge, mixed with coin evaluation data associated to bitcoin, ethereum and different cryptocurrency quantities being tracked by the beforehand titled Blockfolio app has created a state of affairs the place KYC knowledge private figuring out data will be now superimposed over Blockfolio e-mail addresses, UTXOs and watch addresses that loads of folks used on Blockfolio with none private data being divulged to the app.

So which means that folks that used Blockfolio to maintain observe of the quantity of cryptocurrency that they had, wished to purchase or have been holding observe of for no matter motive will now be capable to be correlated to very detailed private identification data. The priority I’ve shouldn’t be whether or not FTX and its a whole bunch of subsidiaries have been holding observe of this data from Blockfolio or utilizing it in any method, however that their huge new pool of buyer data and knowledge will likely be binded sooner or later to the Blockfolio knowledge. I do not assume FTX was clever sufficient to do that for any function corresponding to promoting, or knowledge sharing with a hedge fund like Robinhood was caught doing, however I do assume that they might have thought of promoting this knowledge to regulation enforcement businesses, to advertisers or to actors within the intelligence neighborhood as SBF stated there was an open door to regulators and regulation enforcement businesses at FTX.

What we want to consider now’s when the property of FTX go up for public sale, which they may, that not solely the digital currencies and tokens in addition to the licenses will likely be bought to some new occasion, however it will likely be the purchasers themselves, private figuring out data and the huge knowledge mining that might have been or will likely be carried out with that knowledge.

I used to be by no means an FTX person, I by no means created an account with FTX or FTX.us and I by no means wired any cash to Alameda. Sadly, due to my longevity within the Bitcoin house, I used Blockfolio like many Bitcoin customers earlier than me to maintain observe of the quantities of Bitcoin I had in a number of areas and their whole worth. Now that knowledge that I believed was non-public will likely be linked to KYC knowledge of anybody I do know, interacted with over a wire and any system they used, particularly if by a number of connections it leads again to FTX in any method.

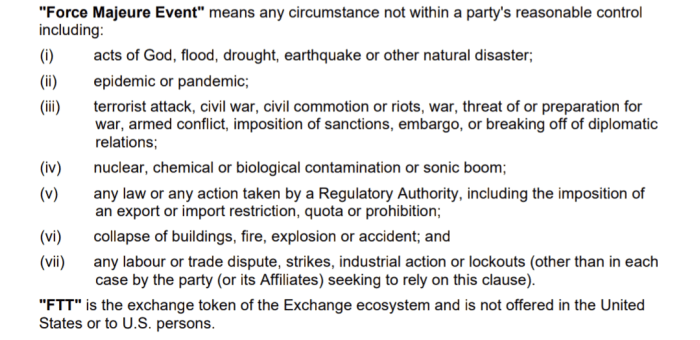

What we have to do now’s ask the intense questions and never give attention to the monetary obligations or mishandlings of SBF and FTX. However we should ask who has this knowledge? What has been carried out with this knowledge and who will likely be proudly owning this knowledge sooner or later? The fact is FTT dissolving into nothing is not a “Drive Majeure Occasion,” so a lot of the customers are screwed.

If this in any respect considerations you or entails you, I’d recommend all of us discover the correct channels to guard ourselves from the worst case situation from this fallout of knowledge. That is the largest downside with KYC and AML legal guidelines,as a result of in any case of this monetary chaos, there’s now a criminal-run change that’s in possession of thousands and thousands of individuals’s private details about their units, their houses, their financials and extra, all accessible to the best bidder.

Notes:

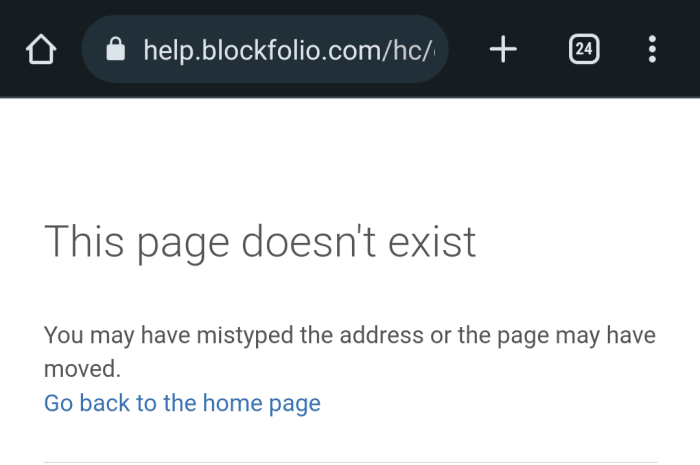

The Blockfolio TOS & Privateness Coverage go to useless hyperlinks on the FTX.com web site, however I discovered a 2017 model.

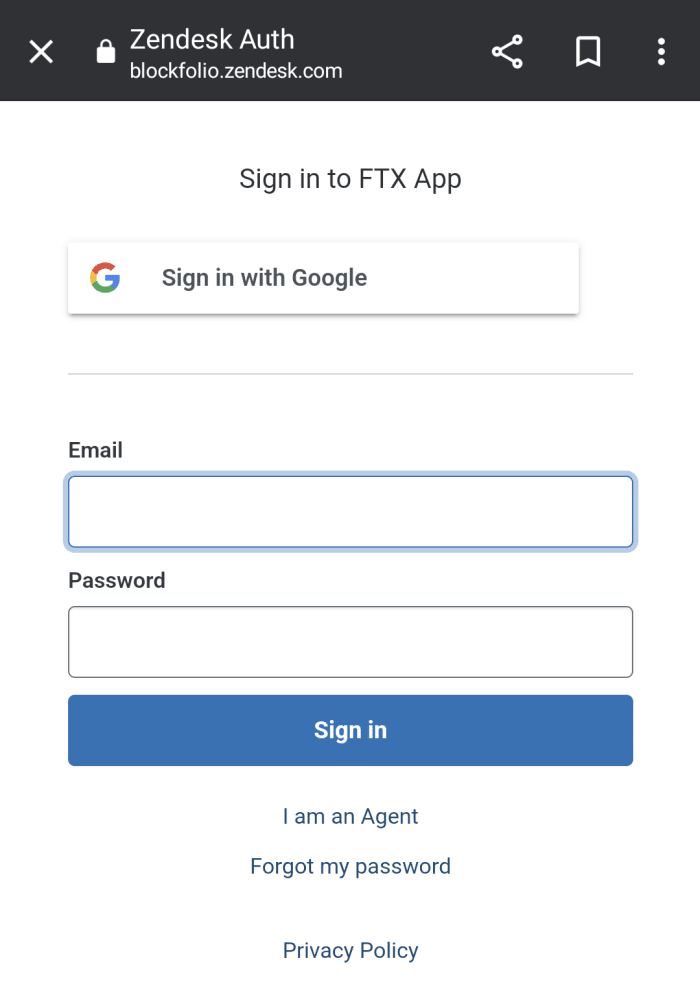

You will need to check in by Zendesk to view the lacking Blockfolio TOS/PP in addition to the brand new FTX TOS/PP which implies I needed to give an e-mail and PPI to even see the paperwork.

This can be a visitor submit by Morgan Rockwell. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.