Terra is crumbling.

The blockchain challenge residence to the favored algorithmic stablecoin TerraUSD (UST), which had lately change into the fourth-largest stablecoin by market worth however now sits at fifth, is close to collapse as UST repeatedly fails to maintain its $1 peg and LUNA, the blockchain’s native token, nears zero.

Terraform Labs, the tech start-up behind the event of Terra, halted the manufacturing of recent blocks on the community on Thursday “to forestall goverance assaults following extreme $LUNA inflation and a considerably diminished price of assault,” it mentioned on Twitter.

A governance assault grew to become inexpensive due to the nearly-free worth of LUNA – an attacker might cheaply purchase sufficient LUNA tokens to socially assault the community by forcing a majority vote. (Since Terra depends on a derivation of proof-of-stake (PoS) for consensus as an alternative of {hardware} and electrical energy as in Bitcoin’s proof-of-work (PoW), coin possession equals energy. In Bitcoin, the quantity of BTC you personal doesn’t grant you extra energy on the community.)

The community went live a few hours later because the software program patch was launched.

That is one other necessary distinction between a community like Terra and Bitcoin: whereas within the former a minority of entities that may vote on issues like halting the community, Bitcoin’s true decentralization makes it proof against the whims of any particular group.

How Does UST Work?

Stablecoins are digital representations of worth within the type of tokens that attemptively preserve a one-to-one parity with a fiat foreign money just like the U.S. greenback. Tether (USDT) and USD Coin (USDC) lead the market capitalization rank and are the preferred and widely-used stablecoins. Nonetheless, they’re issued (minted) and destroyed (burned) by centralized entities that additionally preserve the required dollar-equivalent reserves to again the coin.

Terra’s UST, however, sought to change into a stablecoin whose minting and burning course of was carried out programmatically by a pc program – an algorithmic course of.

Beneath the hood, Terra “guarantees” that folks can change 1 UST for $1 price of LUNA (whose worth fluctuates freely in response to provide and demand) at any given time. If UST breaks its peg to the upside, arbitrageurs can change $1 price of LUNA for 1 UST, capitalizing on the premium with an on the spot revenue. If it breaks the peg to the draw back, merchants can change 1 UST for $1 price of LUNA additionally for an on the spot revenue.

What Does Bitcoin Have To Do With This?

Terra grew in consciousness among the many Bitcoin group after Terraform Labs founder Do Kwon mentioned earlier this 12 months that the challenge would purchase as much as $10 billion of bitcoin for the reserves of UST.

The purchases could be made and coordinated by the Luna Basis Guard (LFG), a nonprofit group primarily based in Singapore that works to domesticate demand for Terra’s stablecoins and “buttress the steadiness of the UST peg and foster the expansion of the Terra ecosystem.”

Whereas company treasury allocations to bitcoin grew in reputation over the previous couple of years on the heels of MicroStrategy’s steady BTC buys, LFG’s transfer represented the primary main BTC allocation as a reserve asset by a cryptocurrency challenge. The information was met with a mixture of enthusiasm and skepticism among the many group.

Bitcoin Journal reported on the time that the algorithmic maneuver employed by the UST stablecoin to take care of its peg was of uncertain sustainability, and the bitcoin purchases didn’t make UST a stablecoin “backed by bitcoin.” Even Terraform Labs acknowledged that “questions persist concerning the sustainability of algorithmic stablecoin pegs.”

Terraform Labs additionally mentioned how there must be sufficient demand for Terra stablecoins within the broader cryptocurrency ecosystem to “soak up the short-term volatility of speculative market cycles” and assure a greater probability of reaching long-term success. That is what the challenge sought with BTC – create demand for UST by conferring extra confidence in peg sustainability.

How Did Terra Implode?

Given the numerous open questions concerning the sustainability of such an algorithmically-sustained peg, Terra’s design failed to carry in a interval of stress.

As UST started dropping its peg to the draw back, additional strain was consequently placed on LUNA as a result of huge quantity of UST more and more attempting to exit and change

As UST started dropping its peg to the draw back, merchants sought to exit by redeeming every of their UST for $1 price of LUNA. Nonetheless, given the quick tempo of devaluation, an enormous quantity of UST tried exiting – greater than what Terra was in a position to change for LUNA. That stretched out the on-chain swap spread to 40% and put additional strain on LUNA, sending its worth south sharply.

The token then went down a “death spiral.”

UST has struggled to take care of its peg to the U.S. greenback since Monday. Picture supply: TradingView.

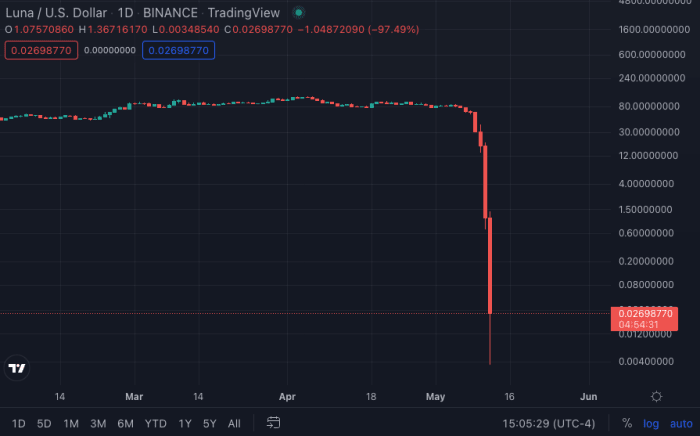

In a ripple impact, LUNA has plunged, dropping close to zero on Thursday. Picture supply: TradingView.

What Does This Train Us?

Briefly, it may be argued that the lesson realized from that is: different cryptocurrency initiatives (altcoins) are however an experiment, whereas Bitcoin is the one tried and examined peer-to-peer digital cash.

Bitcoin was born out of the beliefs of the cypherpunks, a gaggle of early cryptographers with a shared imaginative and prescient that acquired collectively to discover what privateness might imply within the then-upcoming digital world – particularly because it pertains to cash.

The cypherpunk motion was spun out, for essentially the most half, of the work of Dr. David Chaum, a cryptography pioneer that introduced the mathematical expertise out of the fingers of presidency bureaucrats and into the realm of public data. His explorations kick-started a complete line of labor, devoted to discovering how society might port peer-to-peer cash – money – to a digitized economic system.

With a transparent objective in thoughts, these mathematicians started crafting what an answer might appear like by way of analysis and experimentation. Many years later, Satoshi Nakamoto would put all of it collectively and add their very own spin to reach at Bitcoin, the primary and solely decentralized and trustless type of digital cash.

As Bitcoin grew in reputation, different types of what got here to be referred to as a cryptocurrency – a foreign money that exists within the digital realm by way of the utilization of cryptography – began to be created. Whereas these cash initially have been born to compete with Bitcoin, a complete new slew of initiatives later started to emerge with completely different worth propositions whereas placing their very own spin to the blockchain, consensus and cryptography that made Bitcoin work.

Nakamoto designed the Bitcoin protocol to leverage PoW, a consensus mechanism that depends on computing energy and free competitors to mint new BTC on Bitcoin’s blockchain. The bitcoin mining race, as it’s identified, contains 1000’s of miners scattered all over the world with a single goal – discover the subsequent legitimate block and obtain bitcoin as reward.

The altcoins, nonetheless, have principally drifted away from PoW to favor different novel consensus mechanisms. The preferred different, PoS, permits individuals to lock their holdings of the given challenge’s native token to change into block creators as an alternative of letting them compete with mining {hardware} and electrical energy to mine new cash.

Whereas PoW brings real-world prices to miners, prices in PoS are merely digital and signify the sum of money spent to purchase these cash being staked. The idea with PoS is that staking these cash ensures miners have pores and skin within the recreation and are therefore inspired to behave truthfully, however there isn’t any proof that such dedication is sufficient of an incentive. Furthermore, in circumstances the place a robust devaluation occurs as with LUNA, the community dangers being hit with a governance assault and will discover itself having to take totalitarian actions like halting block manufacturing of what was presupposed to be a permissionless and unstoppable decentralized community.

The PoW-PoS dynamic is necessary additionally as a result of it highlights the experimental nature of altcoins.

As a substitute of copycatting Bitcoin’s mannequin – a technique that has been proved unsuccessful repeatedly – new altcoin initiatives try and “innovate” by copying some components of Bitcoin’s design and altering up others.

Because of this, initiatives being launched in the present day drift away from many of the beliefs underpinning the cypherpunk motion that began many years in the past. Such initiatives name themselves decentralized however for essentially the most half have a founding staff that hardly drops its controlling place and may steer each resolution that occurs on the community.

With such a robust want to innovate, “crypto” initiatives for essentially the most half find yourself creating synthetic issues that don’t exist to allow them to invent a novel resolution.

Dr. Chaum and the cypherpunks noticed a transparent drawback in society: How will we’ve cash within the digital age that can’t be spent twice and not using a centralized authority retaining monitor of balances? It took many years of analysis for a lot of specialised scientists and mathematicians of various backgrounds to in the end culminate in a sublime resolution to this drawback.

As we speak, nonetheless, cryptocurrency groups take however a few years from thought technology to a minimal viable product, not having fun with an natural development in favor of giant quantities of capital that disproportionately favors insiders on the expense of the common consumer.