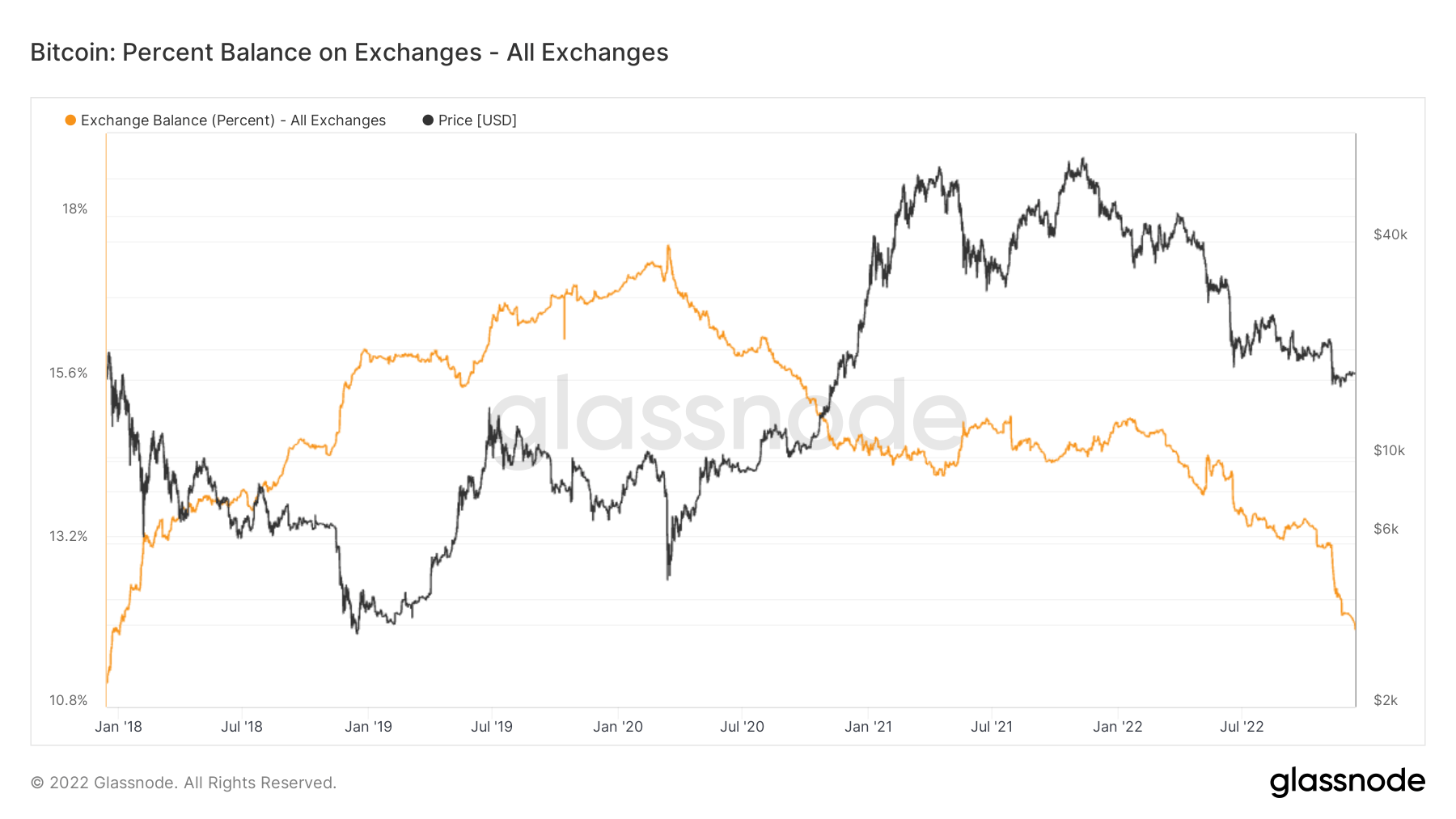

Lower than 12% of the present Bitcoin (BTC) provide is held on exchanges, marking a brand new low since January 2018, in keeping with Glassnode knowledge analyzed by CryptoSlate.

The chart under demonstrates the BTC steadiness held on exchanges with the orange line and begins in Jan. 2018, when the steadiness was simply above 10.8%.

Exchanges’ BTC reserves grew exponentially between Jan. 2018 and Jan. 2020, when the COVID-19 pandemic began. On Jan. 2020, almost 18% of all BTC provide was held on exchanges. After that peak, the quantity of BTC held on exchanges began to shrink steadily and fell as little as at present’s 12%.

Coinbase and Binance

Coinbase and Binance, the 2 main exchanges, collectively account for five.5% of the 12% held in exchanges.

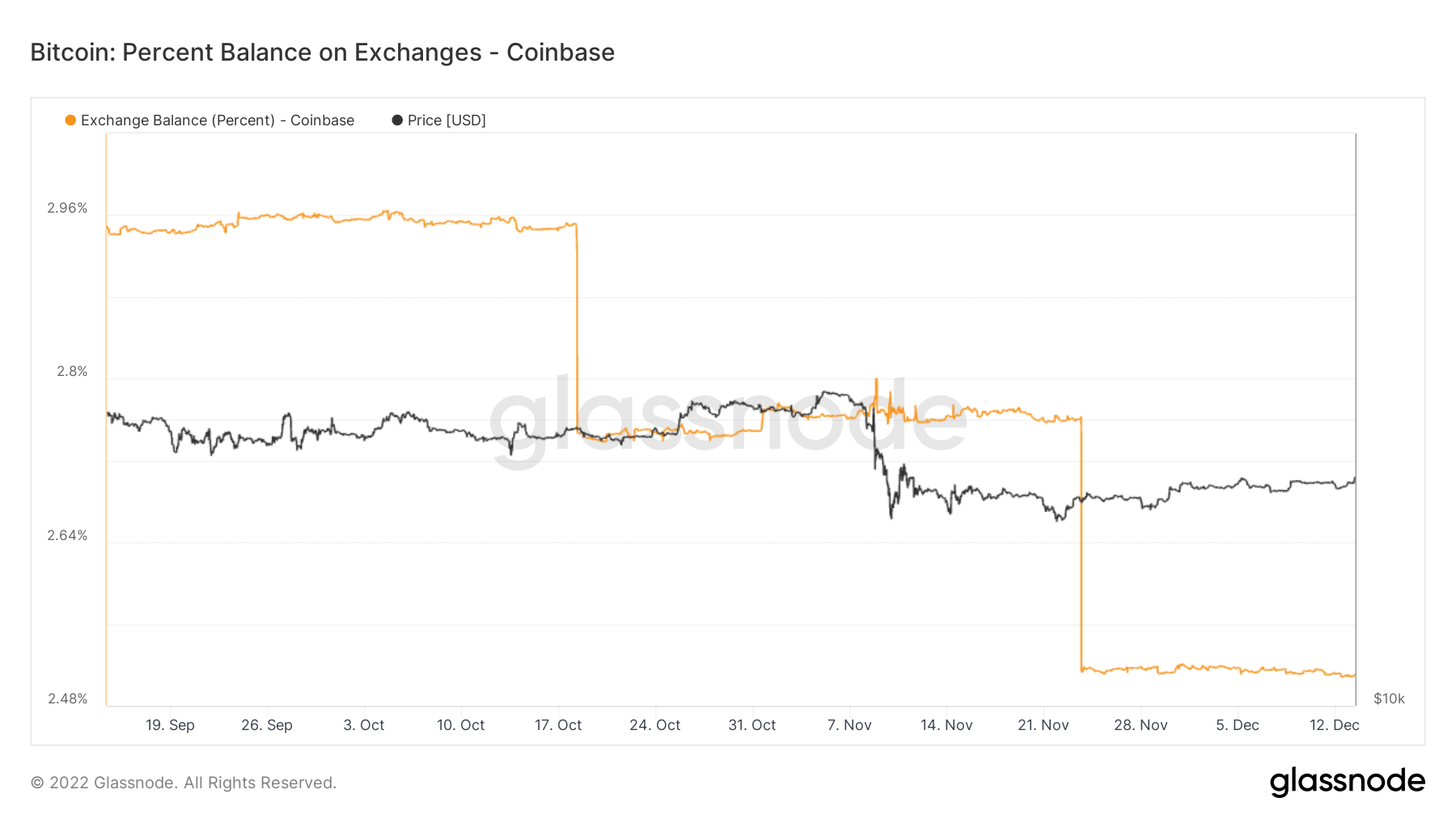

Coinbase

Coinbase’s title has been on the headlines in the course of the previous two months for shrinking its BTC reserves. The chart under demonstrates Coinbase’s BTC reserves since mid-September and exhibits two sharp downfalls.

On Oct. 18, round 50,000 BTC had been withdrawn from the change. This incident was the primary hefty withdrawal since June 2022. On the time, Coinbase held round 525,000 BTC in its reserves, which was 22% decrease than in the beginning of the yr.

Coinbase recorded one other hefty withdrawal equating to over $3.5 billion between Nov. 23 and Nov. 27, which lowered the change’s reserves to new lows. Regardless of these, Coinbase nonetheless holds round 2.52% of the whole BTC provide.

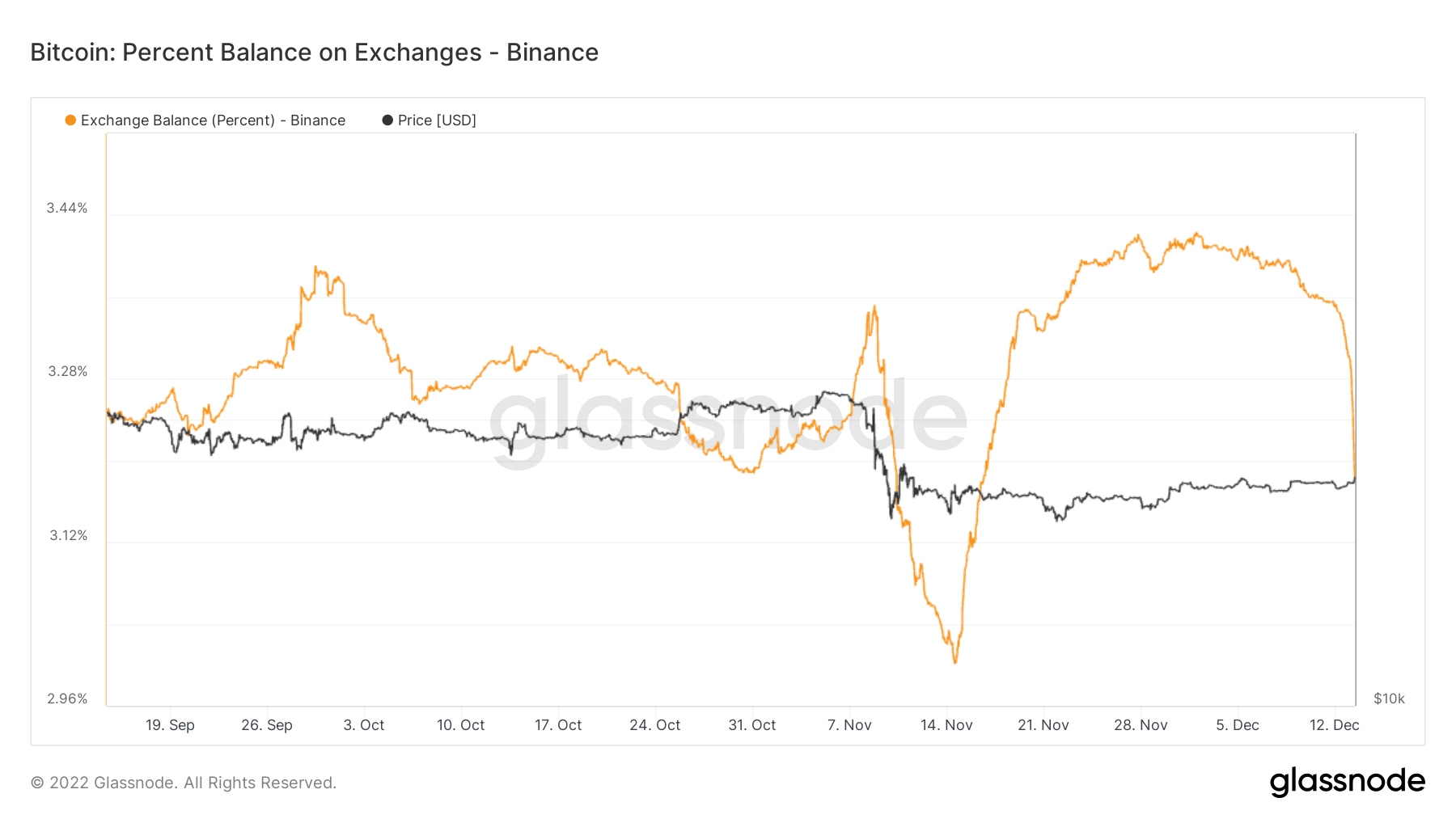

Binance

Binance’s BTC reserves, however, didn’t shrink steadily like Coinbase. Whereas Coinbase recorded its massive withdrawals on Oct. 18, and Nov. 23-27, Binance has been accumulating BTC.

Solely a pointy decline in Binance’s BTC reserves was recorded between Nov.7 and Nov. 14. Nonetheless, the change rapidly recovered its earlier BTC depend and even exceeded above to account for almost 3.40% of the whole provide.

Binance’s BTC holdings have been lingering round at 3.40% when current occasions lowered it to under 3.20%.

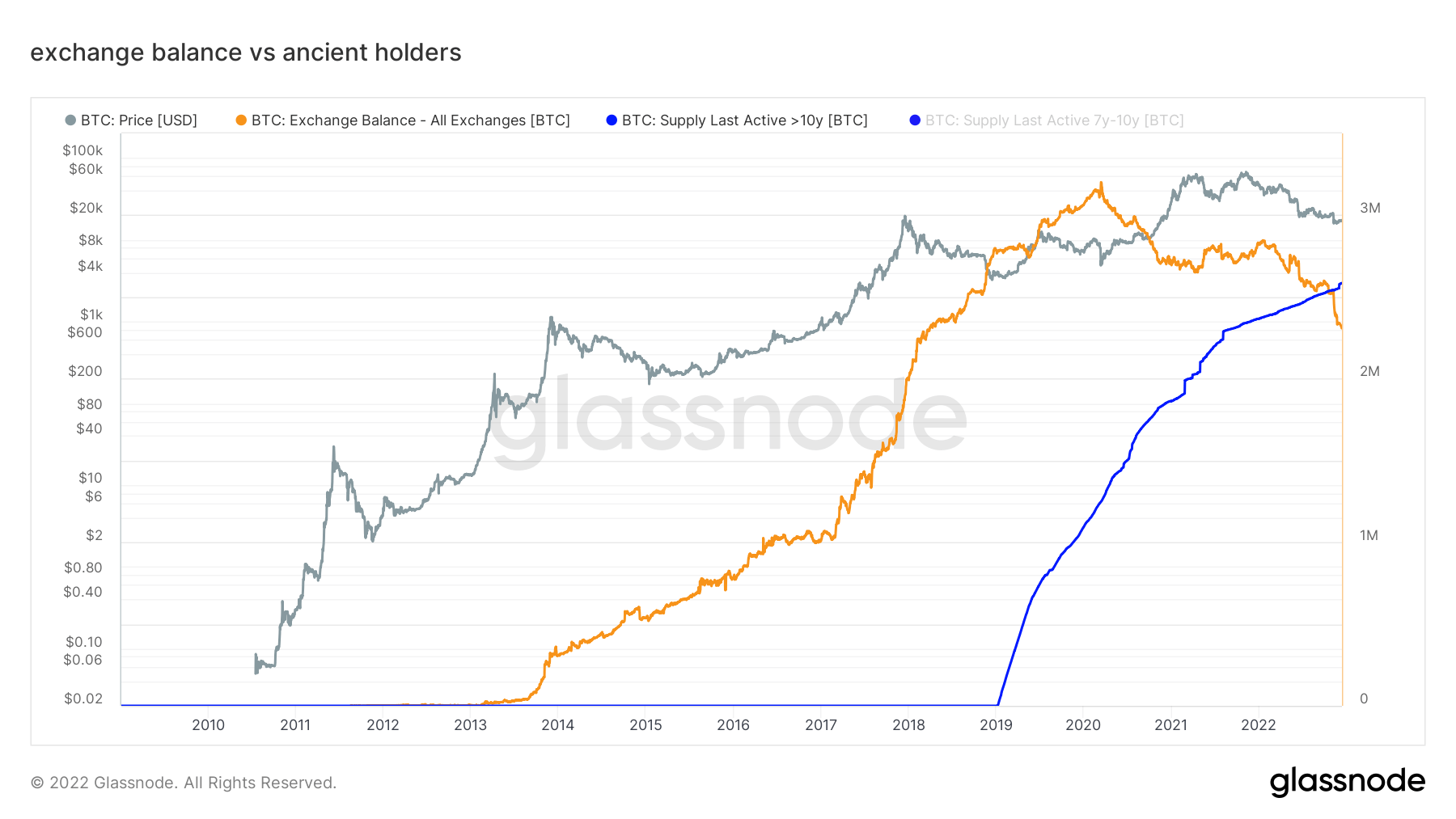

Historic holders and exchanges

The info additionally exhibits that “historical” wallets maintain round 2,6 million BTC, whereas all exchanges maintain round 2,3 million.

The time period “historical” refers to addresses which were holding BTC and was final energetic over ten years in the past. The chart under demonstrates their complete BTC steadiness with the blue line, whereas it represents the steadiness on exchanges with the orange one.

The chart begins from even earlier than 2010. Since then, the whole reserves of the traditional holders have been under the whole reserves of exchanges. Historic holders surpassed the exchanges for the primary time in November 2022, in the course of the FTX collapse.