On Dec. 19, the Twitter account Zachxbt revealed he found 5 chilly wallets from the now-defunct Quadrigacx crypto trade transfer 104 bitcoin. The next day, ‘massive 4’ accountancy agency EY, Quadrigacx’s chapter court docket trustee, defined it didn’t authorize the spending of the funds and that prior stories detailed that the chilly wallets had been inaccessible to EY.

Chilly Wallets Related With Now-Defunct Quadrigacx Get up After Years of Sitting Idle

In the course of the first week of Feb. 2019, the crypto trade Quadrigacx informed clients it was shutting down operations till it solved liquidity points. Then the Supreme Court docket of Nova Scotia ordered the enterprise to enter into the Firms’ Creditor Association Act (CCAA), and the court docket appointed the accountancy agency EY to handle the agency’s remaining belongings.

Making issues worse, it was found that $150 million in buyer funds had been misplaced after the demise of Quadrigacx’s founder Gerald Cotten. Reportedly, the non-public keys Cotten held couldn’t be accessed, and it spurred quite a few conspiracy theories that stated Cotten might have faked his personal demise.

5 wallets attributed to QuadrigaCX unexpectedly moved ~104 BTC on Dec 17 for the primary time in years.

1ECUQLuioJbFZAQchcZq9pggd4EwcpuANe

1J9Fqc3TicNoy1Y7tgmhQznWrP5AVLXj9R

1MhgmGaHwLAvvKVyFvy6zy9pRQFXaxwE9M

1HyYMMCdCcHnfjwMW2jE4cv9qVkVDFUzVa

1JPtxSGoekZfLQeYAWkbhBhkr2VEDADHZB— ZachXBT (@zachxbt) December 19, 2022

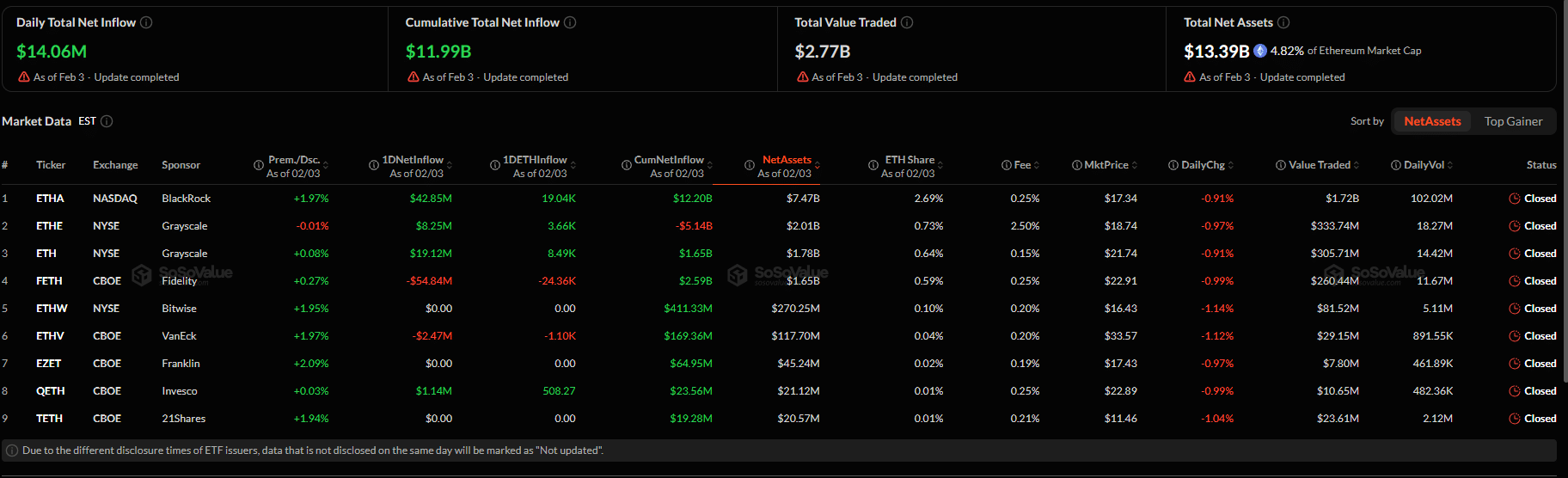

Near 4 years later, the Quadrigacx thriller remains to be unsolved, and on Monday, Dec. 19, 2022, the Twitter person Zachxbt explained he found 104 bitcoin (BTC) transfer from 5 completely different Quadrigacx-flagged chilly wallets. The 104 BTC is price $1.75 million utilizing at present’s trade charges and Zachxbt believes round 69 BTC was despatched to Wasabi, a bitcoin mixing pockets service.

Along with Zachxbt’s discovery, EY addressed the bitcoin actions the next day on Dec. 20, 2022, in a “discover to affected customers” that highlights the “unauthorized switch of Quadriga bitcoin.” EY insists that the transfers weren’t licensed by the accountancy agency and it famous that the corporate and consultant counsel “have turn into conscious of an unauthorized motion of bitcoin.”

Whereas Zachxbt’s tweet mentions 5 addresses, the EY replace features a whole of six bitcoin wallets (1, 2, 3, 4, 5, 6). EY says that on a number of events it has been documented by the CCAA proceedings that these particular funds had been inaccessible. “Quadriga inadvertently transferred sure cryptocurrency into chilly wallets that the candidates had been unable to entry,” EY’s replace particulars.

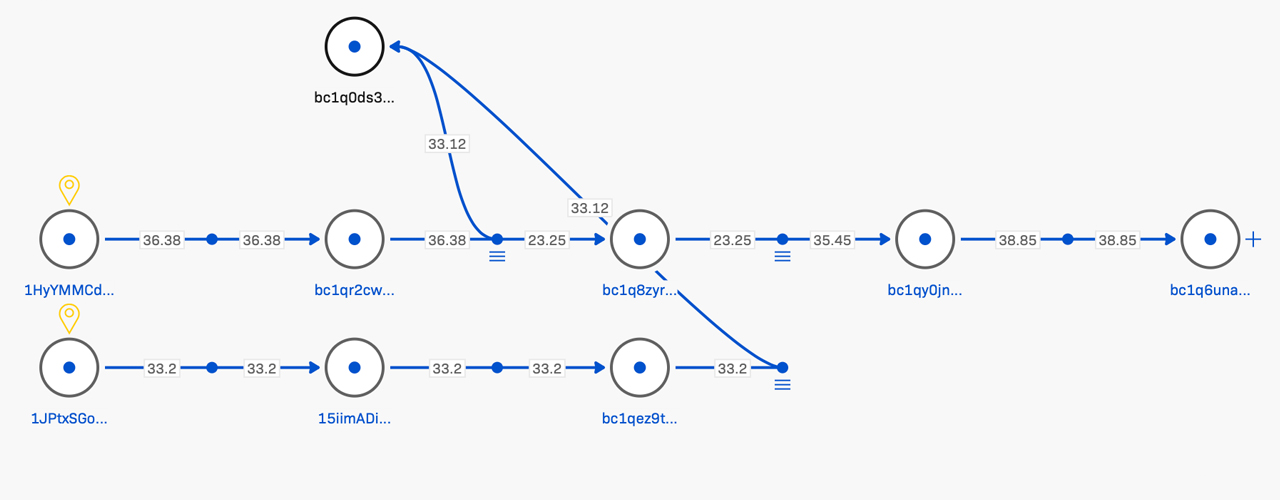

Onchain information exhibits the bitcoin addresses “1J9Fq” and “1Mhgm” linked following the primary transactions earlier than transferring to the bitcoin pockets “1GVsp.” Moreover, whereas Zachxbt detailed that it appeared “1HyYM & 1JPtxS had been despatched to Wasabi” 5 days in the past, onchain information exhibits the 2 addresses linked, and 33.12 BTC was despatched to “bc1q0.”

The 33.12 BTC or simply over $500K price of bitcoin utilizing at present’s trade charge has remained idle within the handle since Dec. 17. Apparently, the one transaction of 33.12 BTC despatched to bc1q0 got here from 164 completely different senders. A number of matched bitcoin addresses had been recognized within the onchain actions between 1HyYM, 1JPtxS, and bc1q0.

What do you concentrate on the Quadrigacx bitcoins that moved this week? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.