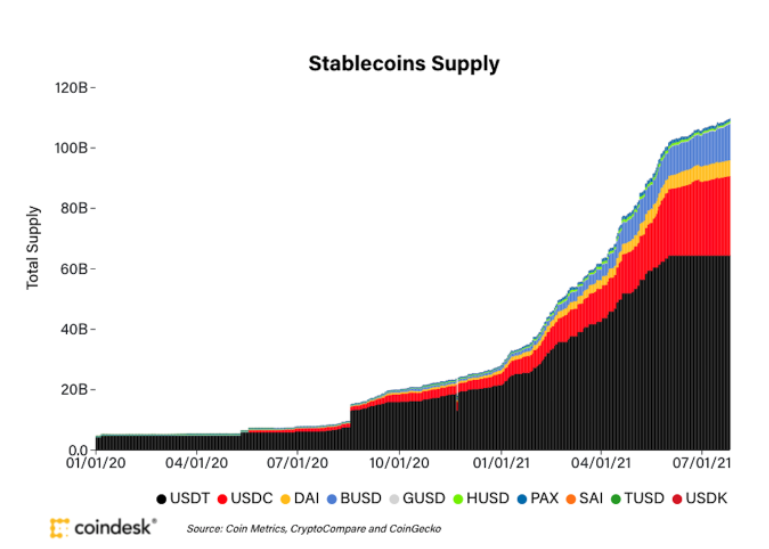

The turmoil within the crypto market was sarcastically triggered by volatility in stablecoins.

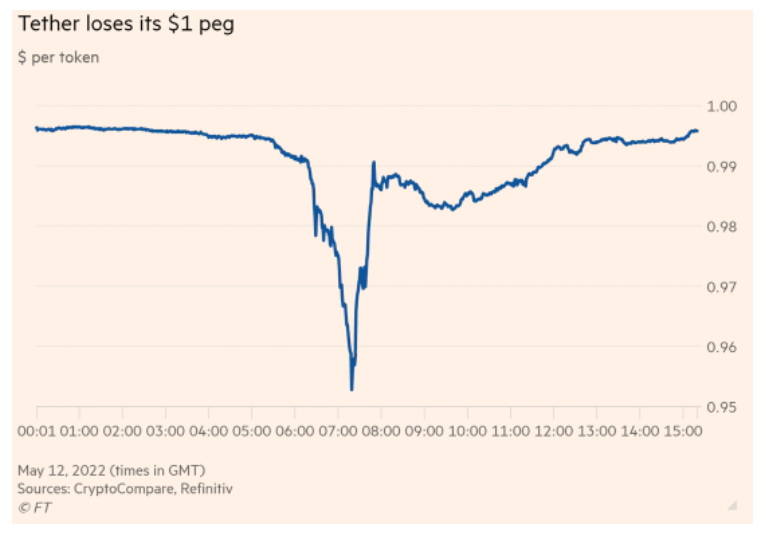

A stablecoin is a cryptocurrency that’s linked to actual cash such because the euro and the greenback. The perfect-known instance is Tether, a stablecoin that was enormously well-liked and till not too long ago was all the time price the identical because the greenback or the euro. This fastened change fee is much like nations which have locked of their currencies to the greenback, for instance (Bahrain, Belize, Cuba, Djibouti, Eritrea, Hong Kong, Jordan, Lebanon, Oman, Panama, Qatar, Saudi Arabia, and the United Arab Emirates). To ensure this, ‘peg,’ {dollars} or euros should, after all be held, and that is exactly the place the issue lies. {Dollars} in an account give much less return than, as an illustration, Treasuries, and in addition to, there are extra investments (industrial paper) you may consider that give higher returns. The issue is that any funding apart from a greenback or a euro might jeopardize the fastened change fee. When the peg comes beneath stress, positions could need to be offered, after which even regular liquid paper could come beneath stress. Lehman normally used Basic Electrical bonds as collateral as a result of this gave a better yield than, for instance, US authorities paper or French authorities bonds, however when Lehman collapsed, plenty of GE paper abruptly appeared available on the market, leading to appreciable worth stress.

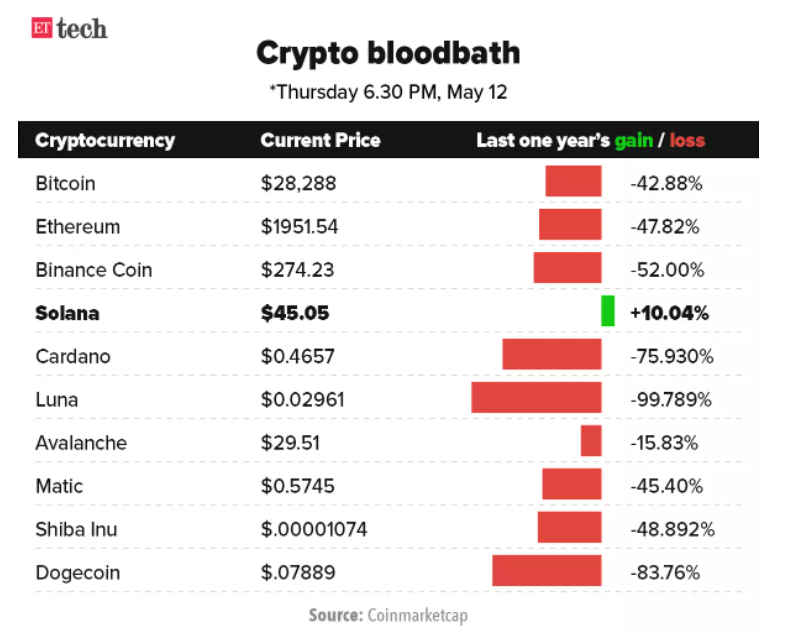

Final Thursday, Tether was unable to keep up its peg towards the greenback. The token dropped to 95.11 cents towards the greenback. Earlier, its smaller rival Terra USD had run into hassle, instantly pushing Bitcoin to its lowest degree since 2020. Tether and Terra USD are unregulated, and stablecoins play a central position within the crypto market, a protected place to park money with out having to carry out all types of expensive operations to transform them to actual {dollars} or euros. There are 80 billion Tether tokens in circulation. Because of this there should be 80 billion Tether tokens in circulation. Nonetheless, there are inadequate particulars about how the 80 billion are managed, and there’s no supervision by an accountant. Paolo Ardoino, the CTO of Tether, promised to defend the peg with the greenback however, in an interview with the Monetary Occasions, he didn’t wish to give particulars concerning the 40 billion in US authorities bonds in his portfolio as a result of he didn’t wish to give away the ‘secret recipe.’ That sort of response doesn’t assist confidence, after all. Final yr, Tether was fined 41 million {dollars} by the US CFTC for deceptive statements about its reserves. Giant accounting corporations don’t dare have a relationship with Tether due to status dangers.

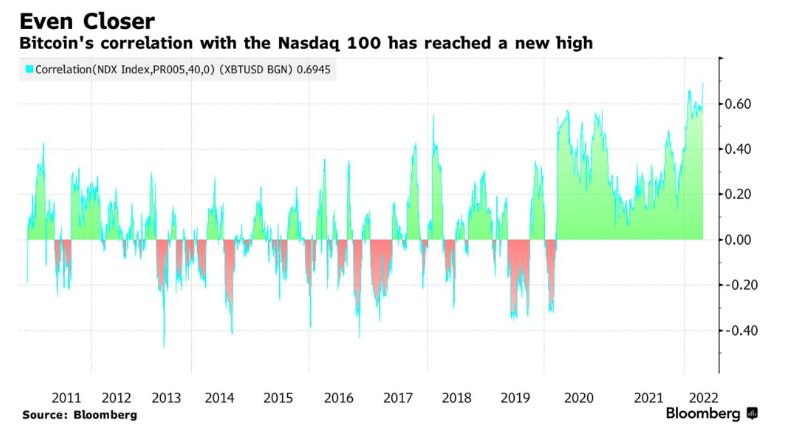

An essential distinction between cryptocurrencies and gold and different treasured metals is that cryptocurrencies want fixed upkeep to keep up their properties (learn worth). The second there is no such thing as a extra curiosity in a selected cryptocurrency, it rapidly loses its worth. When one thing can go to zero, even when the prospect is small, the money worth of such a coin rapidly turns into zero, that’s merely the consequence of calculating with zero. Moreover, cryptocurrencies have as soon as once more proven, as within the correction within the early 2020s, that they fall extra sharply than the Nasdaq when the inventory market is beneath stress. Bitcoin is down 31 per cent this yr on the time of writing. That isn’t a beneficial attribute for including crypto to a portfolio. Nonetheless, the volatility in bitcoin was once more unprecedented, which implies that the events who could make use of it will possibly earn rather a lot within the quick time period, after all, so long as the crypto market as an entire can preserve adequate worth. The worth of the overall crypto market was virtually $3 trillion at its peak in November final yr. Lower than half of that now stays.

In the meantime, Reddit and Twitter are stuffed with tales about younger and inexperienced crypto buyers who have been worn out in a matter of days. The benefit is that these individuals can now get again to work. Excellent news, given the shortages within the labour market. It might additionally cut back demand within the housing market in sure elements of the world. It might even assist to cut back inflation slightly. However it might additionally get in the best way of the value restoration within the Nasdaq. This improvement will undoubtedly result in elevated requires supervision and authorities intervention, particularly if market members have used leverage to put money into crypto-currencies. The soundness of the normal monetary system will then be in danger.

Disclaimer: Investing carries threat. This isn’t monetary recommendation. The above content material shouldn’t be considered a suggestion, advice, or solicitation on buying or disposing of any monetary merchandise, any related discussions, feedback, or posts by the writer or different customers shouldn’t be thought of as such both. It’s solely for normal data functions solely, which doesn’t contemplate your personal funding goals, monetary conditions or wants. Traders ought to do their very own analysis and should search skilled recommendation earlier than investing.