-

SSV Community is a fast-growing supplier of liquid staking infrastructure.

-

The builders launched a $50 million ecosystem progress fund.

-

It has fashioned a rising broadening wedge and a bearish engulfing sample.

Liquid staking is doing nicely as buyers watch for the upcoming Ethereum’s Shanghai improve. Lido DAO, the most important liquid staking supplier, has grown to develop into the most important DeFi supplier on this planet. And SSV, a number one liquid staking infrastructure supplier, has seen its token develop by greater than 91% this 12 months.

SSV launches ecosystem fund

SSV Community introduced that it was launching a brand new $50 million ecosystem fund in a bid to develop its ecosystem. For starters, SSV doesn’t provide liquid staking itself. As an alternative, it companions with staking suppliers like Lido to supply a distributed validator know-how (DLT) resolution. By so doing, most builders can deal with what they do greatest.

SSV Community mentioned that the fund will go to builders engaged on the DVT know-how. It comes a 12 months after the builders launched a $3 million fund. It has distributed a few of these funds to firms like Ankr, Stader, and Moonstake. SSV additionally allotted $10 million in 2022 as we wrote right here. In a press release, the co-lead of SSV community mentioned:

”Distributing Ethereum’s safety layer has by no means been extra vital. The protocol is at present secured by a small group of firms that, when put collectively, management all the Blockchain. DVT’s goal is to distribute Ethereum’s safety by providing fast and quick access to an open-source public good.”

The foremost catalyst for the SSV token worth would be the upcoming Shanghai improve that may let Ethereum holders have the ability to withdraw their staked cash. One other catalyst for the token shall be SSV’s mainnet launch which can occur within the subsequent few months. Its testnet is already up and operating. It has 763 operators and 5,307 validators with 168,824 ETH staked. On the present worth, the quantity is price over $260 million.

SSV crypto worth forecast

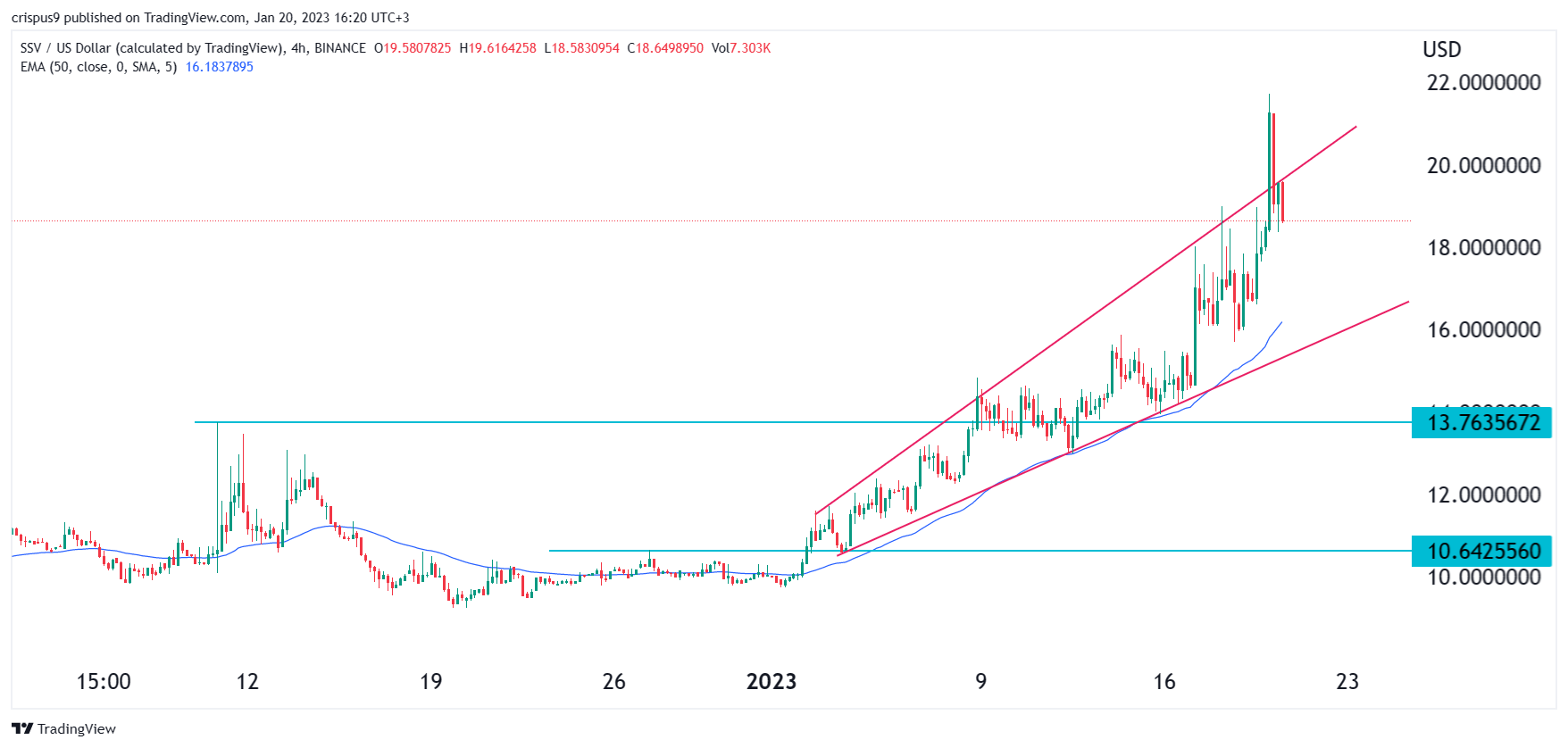

SSV chart by TradingView

The 4H chart reveals that the SSV Community worth has been in a gentle bullish pattern prior to now few months. Nonetheless, a better look reveals that a number of bearish patterns have began forming. The token has fashioned a bearish engulfing sample, which is normally a warning signal. Additional, the token has fashioned an ascending broadening wedge sample. In worth motion evaluation, this sample can be a bearish signal.

Subsequently, the outlook for SSV crypto worth is bearish, with the subsequent stage to look at would be the decrease facet of the ascending wedge at $16. The pattern invalidation level for this commerce shall be at this week’s excessive of $21.67.