[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin managed to show fairly an impressive efficiency this month, however the weekly low of $22.3k raised some scepticism in direction of Bitcoin’s worth motion for months to come back. On this article, we’ll handle whether or not bitcoin will meet a rebound, bearing in mind the quite a few components at play.

Market Progress Trigger Elevated Mining Income For Bitcoin

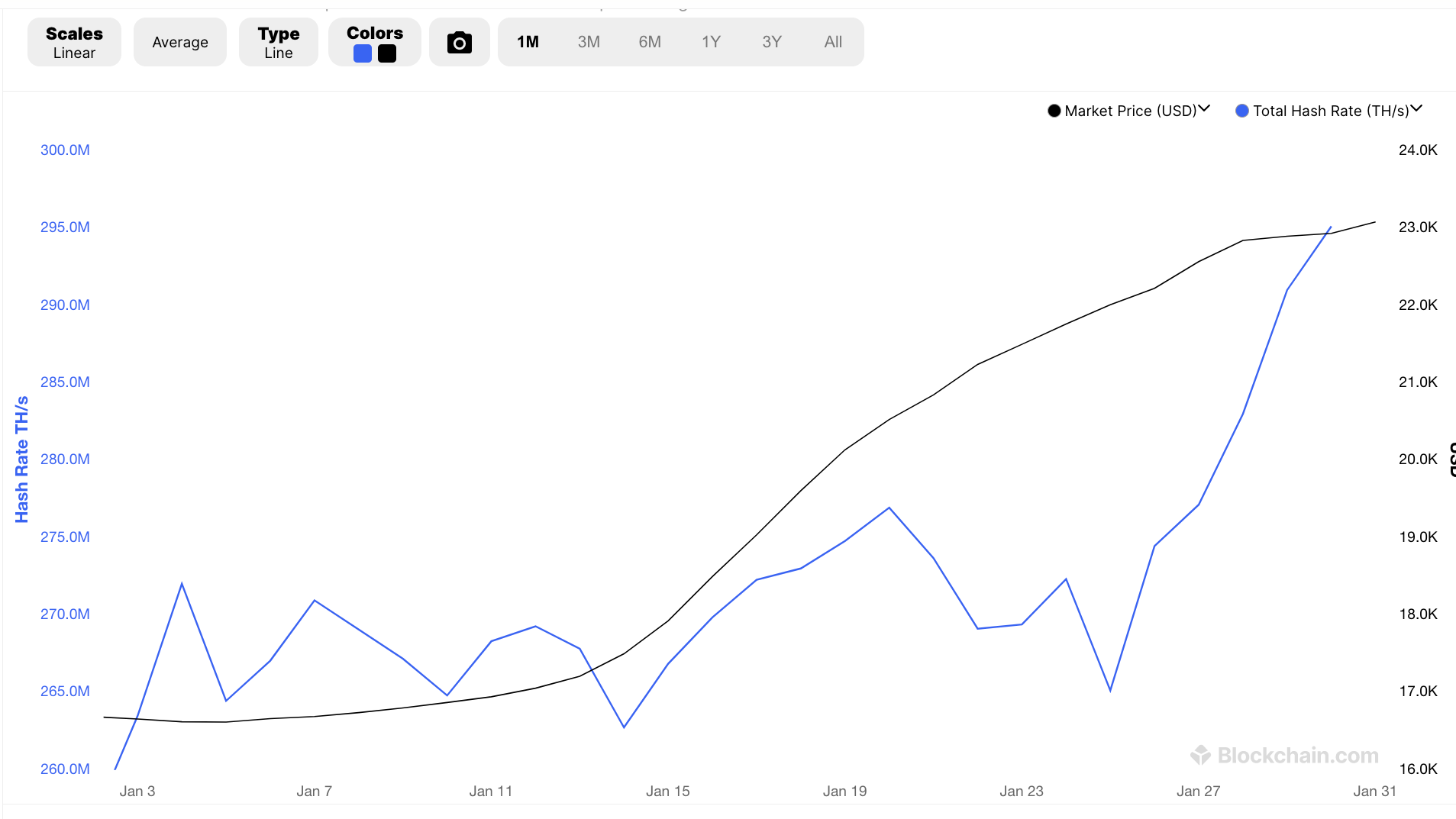

The mining of Bitcoin is displaying indicators of development, with revenues from payouts and transaction charges experiencing a 50% improve within the first month of 2023. Regardless of the falling earnings beneath $14 million in late December 2022, this latest improve in revenue measured in U.S. {dollars} is an indicator that Bitcoin remains to be on observe for a sustainable restoration. Over the course of 30 days, earnings in Bitcoin mining rose from $15.3 million on January 1st to roughly $23 million.

The hash price of Bitcoin continues to succeed in new heights as extra miners are becoming a member of to offer vitality and make sure the safety of the community. With roughly 300 exahashes per second, Bitcoin operates independently from any central authority. Nonetheless, the proof-of-work consensus technique utilized in Bitcoin is going through criticism for its excessive vitality consumption, however efforts are being made to make use of renewable vitality for Bitcoin mining operations to handle this concern.

The optimistic momentum of Bitcoin was confronted with uncertainty on January thirtieth because the market atmosphere was tense, however the first three weeks of 2023 noticed a big rise within the worth of bitcoin. The bull run drove the value from its low of $16,499 on January 1st to $23,200, as reported by CoinMarketCap, representing a rise of 47%. Regardless of the robust comeback seen within the fourth week, the BTC confirmed indicators of volatility within the face of quite a few international occasions.

Total, the mining business of Bitcoin is displaying indicators of development, with a 50% improve in revenue measured in U.S. {dollars}. Regardless of the challenges confronted prior to now, the hash price continues to succeed in new information, and efforts are being made to energy the mining operations with renewable vitality. Regardless of the uncertainty out there, the value of bitcoin noticed a big improve within the first three weeks of 2023, however indicators of volatility stay within the face of main world occasions.

Institutional Funding To Pull Bitcoin Up From Backside

In January, Bitcoin noticed a 40.5% improve in worth, reaching above $22,500 on January 20. The rise in Bitcoin’s worth displays the general enchancment within the inventory market, which has been boosted by China lifting its COVID-19 restrictions.

Main leisure and e-commerce firms recorded large beneficial properties throughout this time. It’s anticipated that Apple will announce an enormous $96 billion in earnings for 2022 on February 2, surpassing Microsoft’s $67.4 billion revenue.

In line with a examine by Matrixport, 85% of latest Bitcoin purchases have been made by American institutional traders, indicating that main gamers stay all in favour of cryptocurrency. Regardless of the 49% rise in worth from the November 21 low of $15,500, Bitcoin has nonetheless dropped 39% prior to now yr.

Then again, the USD Coin premium, which measures the distinction between China-based peer-to-peer trades and the US greenback, is at 3.7%. It declined from a reduction of 1% two weeks in the past, indicating elevated demand for stablecoin shopping for in Asia. The futures premium for Bitcoin, a favorite amongst skilled merchants, has remained impartial since January 21, with an annualized premium of over 4%.

Nonetheless, the market is cautious of the Federal Reserve’s rate of interest hike marketing campaign. The pivot from this marketing campaign in 2023 might affect inventory market efficiency and cut back Bitcoin’s attraction as an choice for inflation safety. Though present financial indicators recommend a reasonable correction, merchants are monitoring the Fed’s actions carefully.

Main indicators present that the correction is enough to ease inflation, however the market is cautious of any potential shifts from the Federal Reserve’s rate of interest hike marketing campaign. This pivot, if it happens in 2023, might restrict inventory market efficiency and cut back the attraction of Bitcoin as a method of safety towards inflation. Merchants are holding an in depth eye on the Fed’s strikes to raised perceive the market’s future.

Bitcoin Market Dominance Signifies A Rebound

The dominance of Bitcoin over different digital property reached a brand new excessive in January 2023. The Bitcoin dominance index, which tracks the proportion of Bitcoin’s market capitalization in comparison with the remainder of the crypto market, stood at 44.82% on January thirtieth, its highest degree since June 2022.

Traders typically flock to Bitcoin throughout bear markets because of its better liquidity and stability in comparison with various cryptocurrencies, which has contributed to its rising market share. At the moment, Bitcoin has risen 38% thus far this yr, outpacing the 30% achieve by the second-largest cryptocurrency, Ethereum.

Technical evaluation means that the Bitcoin dominance index might proceed to extend within the coming weeks because it reclaims its 50-week exponential shifting common. One market analyst predicts the index might attain 46%, in step with the higher trendline of a big descending channel sample.

The present development within the crypto market means that the Bitcoin dominance index might improve additional within the quick time period, nonetheless, the long-term outlook is unsure. There’s a bearish argument that the index might decline after testing its resistance degree, as has occurred beforehand.

Then again, if the token continues to carry its help space, it could see a rebound rally and improve its share out there, probably as much as 20%. As for Bitcoin’s efficiency on Jan thirty first, the token reached a low of $22.7k, whereas it recovered by the day buying and selling at $23,160 on the time of writing. Suggesting that the weekly low encountered by bitcoin was just for a short time and the token might very properly be on an upward trajectory from right here.

Conclusion

Elevated mining income from Bitcoin, together with rising dominance out there and optimistic help from institutional traders signifies that Bitcoin is on its method to a rebound, tracing again to the month-to-month excessive it achieved in January. With that being stated, a bunch of different components equivalent to modifications within the prospects of rates of interest might decelerate this much-anticipated rally.

Learn Extra:

Struggle Out (FGHT) – Latest Transfer to Earn Undertaking

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Stay Now

- Earn Free Crypto & Meet Health Objectives

- LBank Labs Undertaking

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link