The Amesbury, Massachusetts-based Bankprov, a subsidiary of Provident Bancorp, has introduced that it’ll now not present loans secured by cryptocurrency mining rigs. In a submitting with the U.S. Securities and Change Fee (EX-99.1), Bankprov said that income from its digital asset mortgage portfolio will proceed to lower as the corporate has discontinued new mortgage originations backed by mining tools.

Bankprov’s Portfolio of Cryptocurrency Collateralized Loans Decreased by 65%

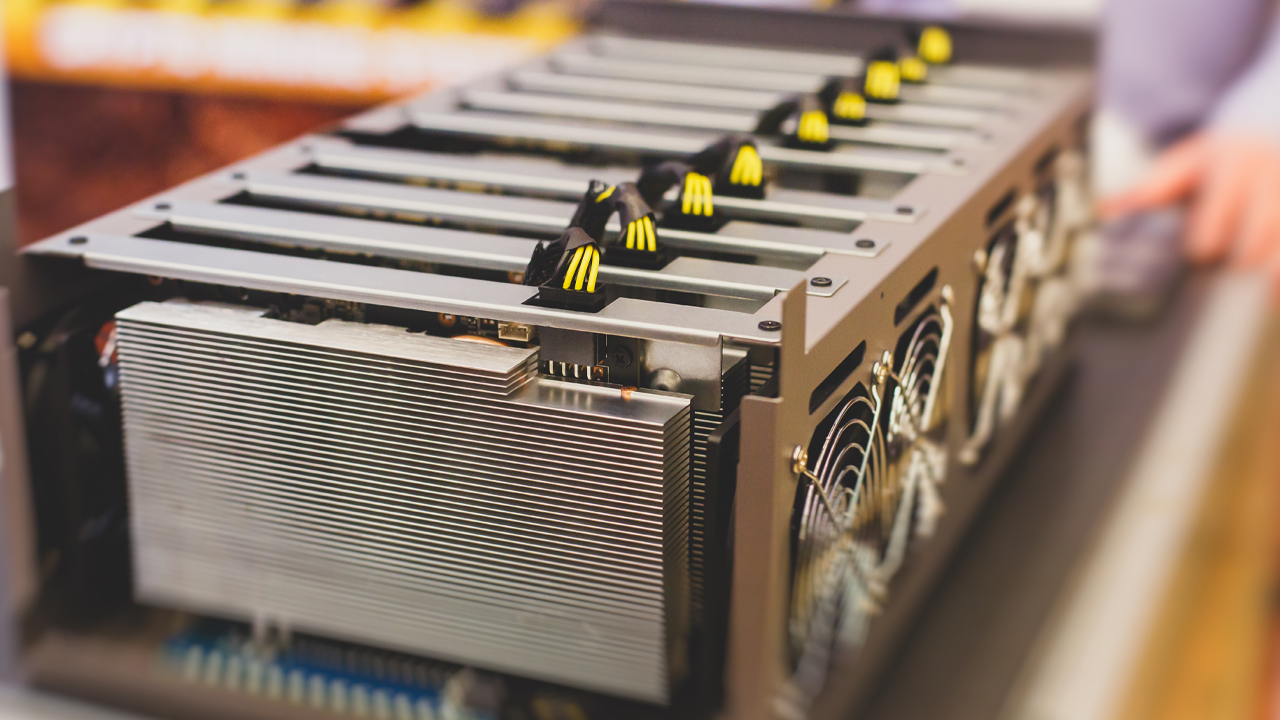

Bankprov disclosed that it holds roughly $41.2 million in cryptocurrency-collateralized loans, with about $26.7 million of the debt backed by crypto-mining tools. Collateralized loans secured by application-specific built-in circuit (ASIC) mining rigs grew to become a well-liked funding automobile in 2021, however the crypto winter resulted in important stress on the business. By the top of June 2022, Luxor government Ethan Vera estimated that about $4 billion in loans backed by mining machines have been underneath monetary pressure.

Since then, a number of crypto-mining corporations have both sought chapter safety or reorganized tens of hundreds of thousands in debt. For instance, on the finish of September 2022, the bitcoin mining agency Compute North filed for chapter. Two months later, Core Scientific additionally filed for chapter. Different mining operations try to restructure debt. Greenidge Era introduced Tuesday that it has reorganized $11 million in debt with B. Riley.

Bankprov said that it repossessed ASIC mining tools from undisclosed crypto-mining operations in September. “Our digital asset mortgage portfolio declined by $79.3 million, or 65.8%, largely as a consequence of paydowns on excellent traces of credit score, the partial charge-off, and repossession of cryptocurrency mining rigs in change for forgiving a $27.4 million mortgage relationship,” in line with Bankprov’s submitting.

The monetary establishment’s EX-99.1 earnings submitting added:

The portfolio of loans secured by cryptocurrency mining rigs will proceed to say no because the Financial institution is now not originating one of these mortgage.

One other crypto-friendly monetary establishment, Metropolitan Business Financial institution, introduced throughout the second week of January 2023 that it plans to “exit its crypto-asset-related enterprise.” Metropolitan said that it holds no publicity to crypto belongings, however has enterprise relationships with 4 prospects targeted on cryptocurrencies. The financial institution didn’t specify an actual date, however mentioned that these relationships and the crypto enterprise can be phased out this yr.

What do you suppose the long run holds for banks and the cryptocurrency business? Share your ideas within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.