Two notable Bitcoin mining corporations, Hut 8 and US Bitcoin, have introduced a merger as detailed in a press launch revealed on Feb. 7.

Mixed firm may have six websites

The merger will mix two of Hut 8’s websites in Canada with all 4 of US Bitcoin’s websites within the US. The mixed agency will make the most of 825 megawatts of gross vitality throughout all six websites. The brand new firm will be capable of leverage an estimated 5.6 exahashes per second (EH/s) of self-mining energy throughout 5 websites.

The variation within the variety of websites included in these estimates is because of ongoing conflicts. Hut 8 has a 3rd web site in Ontario, Canada, that has seemingly been halted to an influence dispute. Moreover, one US Bitcoin web site in Niagara Falls, NY, is locked in a dispute with the town however stays operational.

Although in the present day’s settlement is described as a merger of equals throughout the press launch, the brand new firm will function as “New Hut” or “Hut 8 Corp.” The merger will seemingly drop all branding associated to US Bitcoin.

Whereas an settlement has been reached amongst executives and stockholders, a particular assembly should nonetheless shut the deal within the second quarter of this 12 months.

Hut 8 will even present US Bitcoin with secured bridge financing as much as $6.5 million, however not till definitive mortgage documentation has been accomplished.

Mining business faces challenges

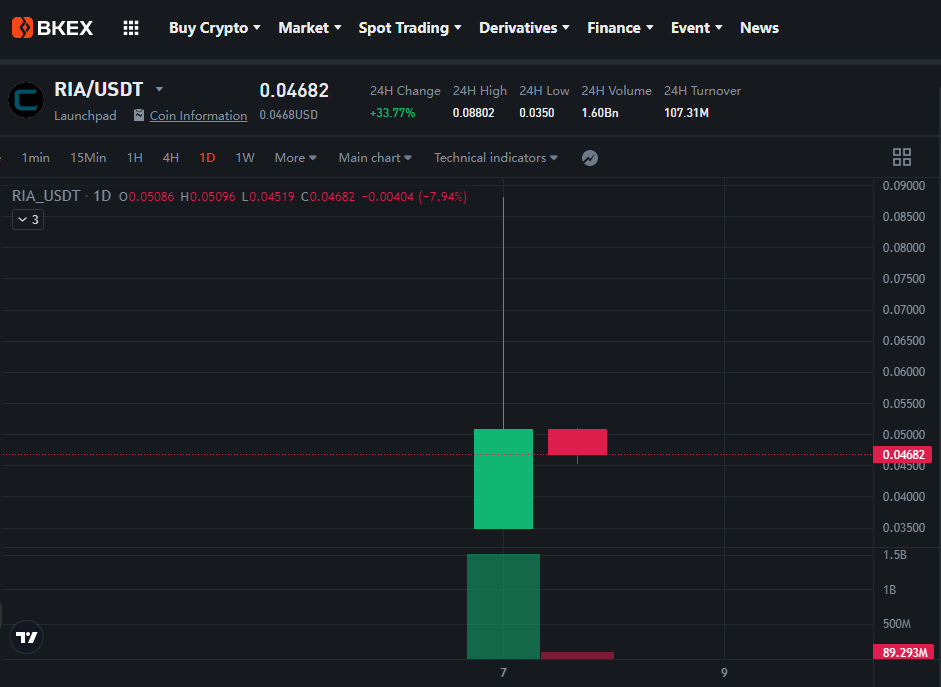

Hut 8 inventory’s worth is down 8.78% in the present day. It’s unclear whether or not this is because of a destructive response to the merger or to broader market challenges.

The mining business is presently going through harsh circumstances as a result of excessive value of energy and Bitcoin’s comparatively low market worth. Hut 8 is thought to be one of many corporations affected by these challenges: earlier this 12 months, the agency reported a drop in Bitcoin output in December because it offered again energy to its vitality provider.

Hut 8 nonetheless held about 20% of the Bitcoin reserved by publicly traded miners on the finish of 2022. It additionally managed to outlive whereas its competitor Core Scientific failed, suggesting that it’s in a comparatively robust place.

The merger is anticipated to enhance the worth of the corporate. The deal is projected to roughly double Hut 8’s present market cap to $990 million, and its inventory shall be listed on each the Toronto Inventory Change and Nasdaq.

Shares of Hut 8 shall be consolidated at a ratio of five-to-one, which means that the shares shall be lowered in quantity however will even obtain a rise in worth.