In areas the place the web is gradual or unstable, utilizing Bitcoin’s Lightning Community could be a problem. What are the most effective instruments out there?

That is an opinion editorial by Anita Posch, the founding father of Bitcoin For Equity who has traveled all over the world to learn the way the globally unbanked can profit from sovereign cash.

In my work as a Bitcoin educator, I assist individuals to take their first steps into the area and acquire an understanding of why Bitcoin is essential for them personally and for the world at giant. I additionally assist Bitcoin neighborhood builders to grow to be educators and share their information with their friends. My focus lies on monetary sovereignty, which might solely be achieved by holding bitcoin in self custody and utilizing extra instruments to achieve an honest degree of privateness.

To seek out out if it’s time to onboard individuals onto a non-custodial Lightning pockets, even in troublesome settings, I got down to do a Lightning pockets take a look at in rural Zimbabwe with low and erratic web connectivity on cell knowledge. I’m not speaking about Bitcoin on-chain wallets: There’s actually no want in any respect to make use of a custodial Bitcoin pockets. I’m speaking about Lightning wallets right here, non-custodial ones.

The Resistance To Change A Behavior

Again and again, I hear and browse statements saying that newbies want handy, easy-to-use instruments, in any other case they might be overwhelmed and gained’t use Bitcoin. I feel that is unsuitable. People who find themselves being onboarded onto custodial companies are tougher to persuade to step up their sport towards monetary sovereignty and begin utilizing non-custodial instruments. There’s a large resistance to vary habits. If an individual begins utilizing a custodial pockets, they very, fairly often consider that they’re utilizing Bitcoin already. They’ll let you know that they by no means confronted any issues and that they, subsequently, don’t see a necessity to vary their setup.

As a Bitcoin educator, it’s my first obligation to show individuals about self custody, why it is necessary and to make them conscious of the dangers they’re taking. They should perceive the distinction between custodial and non-custodial companies. Solely then do I current totally different instruments and make them accustomed to the professionals and cons of every one. Afterwards, they should resolve for themselves which route they wish to take. That’s the solely manner that folks gained’t take into account me chargeable for any losses they may incur and it’s the one manner that they are going to perceive that Bitcoin is all about possession. In case you’re utilizing a custodial service, you’re not financially sovereign. You’re a pre-coiner, with one foot nonetheless within the previous world and you’ll be rug pulled at any time. I feel most individuals have already forgotten about Mt. Gox and even FTX. Quick cash, quick entry to (a false perception that you simply’re actually utilizing) bitcoin, quick loss.

After we got down to present our associates the right way to use Bitcoin within the first place, why will we rush the onboarding by utilizing handy instruments? Why not take a bit of extra time and do some groundwork beforehand. It’s nearly the identical effort for an educator to introduce a custodial pockets compared to a non-custodial pockets. I feel exhibiting a custodial pockets first shouldn’t be even performed for the comfort of the beginner, it’s slightly performed for the comfort of the educator. Extra comfort, much less clarification wanted. That’s quick sighted.

I’m satisfied that everybody who’s utilizing Bitcoin right this moment might want to change wallets and companies sooner or later. Improvement is quick; I estimate that I’ve been utilizing round 15 totally different wallets in my Bitcoin journey to date. Extra to return. Individuals have to know this, too. It’s not lifelike to anticipate that you simply’ll be utilizing the identical pockets now and for the subsequent 20 years, such as you would possibly do together with your checking account (you probably have one).

I really feel a giant discomfort when persons are rushed into utilizing custodial wallets, receiving a couple of satoshis after which they’re despatched off, all for the sake of quick adoption. I did it as soon as, too. I helped somebody set up Pockets of Satoshi and I regretted it later. Up till now, I really useful utilizing Blue Pockets on the BFF Bitcoin flyer, primarily due to its ease of use and the chance to have a Bitcoin and Lightning pockets in a single app. I used to be conscious of the draw back, the custodial Lightning pockets, however I believed that non-custodial Lightning node wallets like Breez or Phoenix wouldn’t work reliably in areas with gradual or unhealthy web connectivity.

Objective: Figuring out A Non-Custodial Lightning Pockets That Works In Areas With Low Web Velocity

I’ve been asking myself during the last couple of months if it wouldn’t be higher to advocate a non-custodial Lightning pockets. I used to be not sure, although, if Phoenix or Breez would work in a setting with unhealthy web connectivity. That’s why I got down to do a take a look at within the space of Nice Zimbabwe, about 300 kilometers south of the Zimbabwean capital of Harare. I wrote a separate article concerning the spectacular historic significance of Nice Zimbabwe.

Take a look at Setting

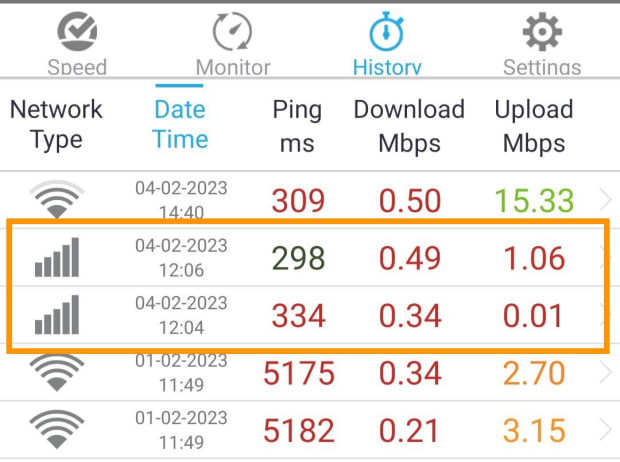

The cell web velocity on the time of testing in February 2023:

I hadn’t examined it, however I had the impression that Android was dealing with the low web velocity higher than iOS. On the location the place I examined, I had 3G on an iPhone and H+ on an Android system. Now that I’m writing this text, I researched the distinction and realized that H+ delivers a lot larger speeds than regular 3G.

I did two assessments, one at Lake Mutirikwi and one in Nice Zimbabwe. I introduced on Twitter that I used to be going to ship bitcoin to the primary three individuals who despatched me an bill.

I did the primary couple of assessments on the dam of Lake Mutirikwi. I examined Breez, Zeus and Blue Pockets on an iPhone and Phoenix and Zap on an Android system. The next day, I did some extra assessments.

Reviewing Lightning Wallets

Machankura 8333

Machankura 8333 is a service that enables customers to ship and obtain bitcoin through Lightning with out an web connection. Tens of millions of individuals on the African continent are utilizing function telephones. Machankura is utilizing a expertise known as USSD code, identical to the cell cash suppliers M-Pesa or EcoCash do. USSD stands for unstructured supplementary service knowledge. You dial a code on the cellphone and a menu opens, which you navigate by means of by typing numbers. I’ve used Machankura to ship and obtain Lightning bitcoin in Zambia.

It’s essential to notice that Machankura 8333 is a custodial answer and really new. Due to its dependency on permission from centralized cell community suppliers, its adoption is unsure. Machankura shouldn’t be out there in Zimbabwe and, subsequently, not part of this take a look at.

Pockets Of Satoshi

One of many quickest and best to make use of Lightning wallets is Pockets of Satoshi. I’ve seen many individuals utilizing it on their telephones, for example in South Africa, Ghana or Zambia. It’s all the time launched as probably the most handy and best answer for learners. And it’s true: it really works nice, even in distant areas with restricted bandwidth and it’s the solely pockets so far as I do know that provides you a Lightning Community tackle (alternatively, you should use Alby and Blue Pockets). Pockets of Satoshi has large downsides although.

First: It’s a custodial answer. Your funds are being held by the corporate behind it. It is advisable belief it. Second: It’s not open supply. No one besides the pockets builders can learn and revise the code, which is totally antithetical to Bitcoin, whose distinctive place stems from being decentralized and open supply. For me, I keep away from Pockets of Satoshi. That’s why I didn’t embody it within the take a look at.

Blue Pockets

I actually like Blue Pockets, primarily for its ease of use and the chance to make use of Bitcoin on-chain and thru Lightning in the identical app. But it surely has a draw back: Whereas on-chain funds are held in a non-custodial manner, so that you simply and solely you’ve the seed phrases and are the proprietor of your bitcoin, the Lightning pockets is custodial. In case you run your personal Lightning node, you may join it as a distant to your node. Then Blue Pockets is a good answer, but when you need to use the pockets’s default Lightning settings, watch out and solely retailer small quantities of bitcoin there. Every little thing else you must transfer over to your self-custodied, on-chain pockets.

One other upside of Blue Pockets is that you may combine a Lightning tackle with a custodial pockets from Alby. You arrange an account at Alby, select a Lightning tackle and import it into Blue Pockets. There you may see incoming funds and in addition ship them.

Muun

The Muun pockets is a really user-friendly, non-custodial Bitcoin pockets, which is commonly promoted as a Lightning pockets despite the fact that all of your cash are saved on chain. In contrast to Blue Pockets, the place Lightning and on-chain Bitcoin are represented as two wallets with two balances, Muun pockets exhibits one steadiness. Customers don’t have to resolve if they need to do a Lightning or an on-chain fee. The pockets selects the suitable methodology routinely.

Why is Muun not my favourite? Due to its backup methodology. The usual for self custody is a seed phrase. That is what has been taught over the previous couple of years and what I consider would be the commonplace within the foreseeable future. Once I clarify self custody to members of my meetups or workshops, securing the seed phrase is all the time crucial half. All of a sudden, this works in another way for Muun. So long as there are true self-custodial Lightning pockets options which can be working with the seed phrase or a better backup mechanism, I’ll emphasize these. As an illustration, Breez or Phoenix.

Breez

The Breez app brings a Lightning node to your smartphone. It shops your cash in full self custody. You will have a Google Drive, Apple iCloud or to make use of a distant server to backup, although. Since many individuals in African nations don’t fulfill these necessities, it’s not attainable for them to make use of Breez. That’s a pity as a result of, moreover being a Lightning pockets, it serves as a Value4Value podcast participant and a point-of-sale utility for companies.

Phoenix

Like Breez, Phoenix is a self-contained Lightning node that provides you full entry to your funds. It’s non-custodial and affords a 12-word seed as backup. You may ship your Lightning funds to an on-chain Bitcoin tackle (that is known as “swap out”). The one draw back is that you need to obtain not less than 10,000 satoshis ($2.15 on the time of writing) to initialize a brand new pockets. That is the minimal quantity for a brand new fee channel to be created. This requirement could be a drawback for individuals with decrease incomes. There’s a little little bit of belief concerned whereas doing swaps and channel openings however usually it’s a actual, self-contained Lightning node that runs in your cellphone. You might be in full management of your funds.

Working Your Personal Node? Zeus And Zap

Zeus and Zap are wallets that you should use as a distant to your personal node. You can too join Blue Pockets together with your node, after which it’s a nice Lightning pockets.

I’m working a Lightning node on Voltage. It’s not absolutely self hosted, I have to belief Voltage, however as a nomad, I can’t run my very own node in the meanwhile. I’ve Zeus linked with my node on my iPhone and Zap on my Android. That’s the configuration I did in my first Lightning take a look at in rural Zimbabwe in September 2022.

Take a look at Outcomes

As said above, I used to be below the impression that Android dealt with the low velocity higher than my iOS would. I examined Muun, Blue Pockets, Zeus and Breez on iOS, and Phoenix and Zap on Android.

Muun

I despatched one fee from Muun and had no points.

Blue Pockets

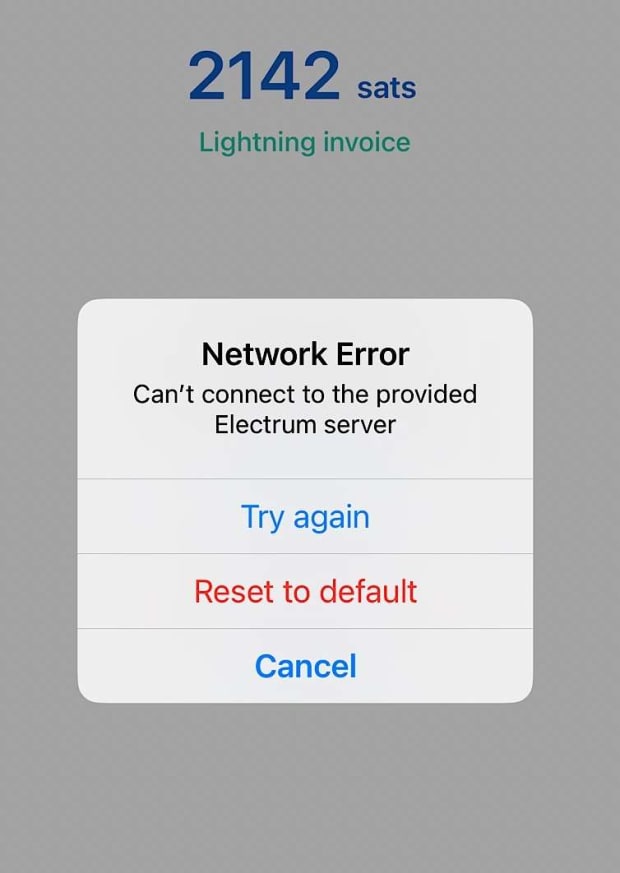

I had some connectivity points, as you may see within the photograph, however I used to be in a position to ship and obtain funds.

Zeus

I despatched 4 funds. Typically, the pockets timed out as a result of it misplaced connection to the node, however after re-opening the app, it labored.

Zap

My Zap pockets by no means linked with my node.

Breez

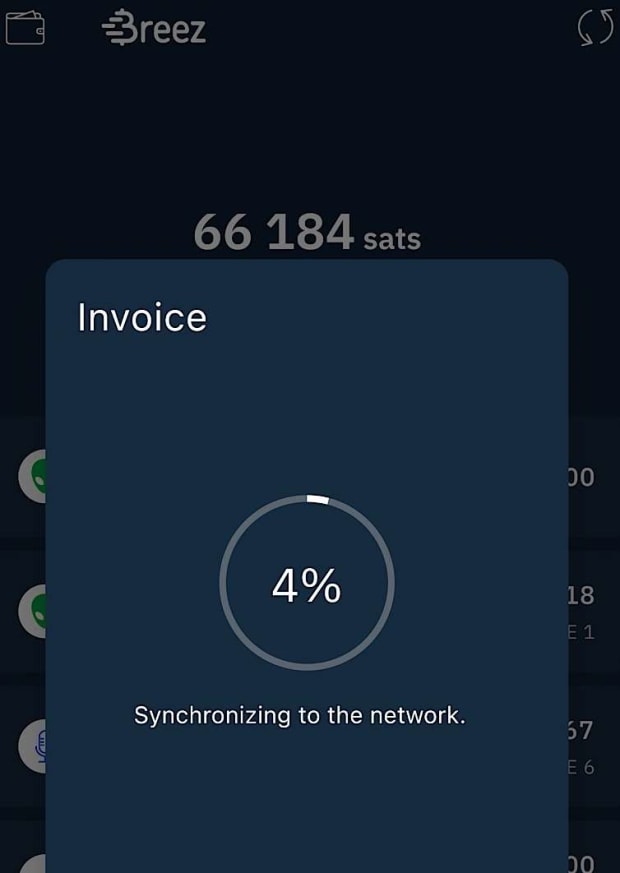

This was sadly not working. The method of loading the app began, however after some time I finished as a result of it by no means completed loading. It’s a improbable app and the channel creation requires solely a minimal quantity of two,000 sats (in comparison with 10,000 with Phoenix), so in areas with good web connection I absolutely advocate it.

Phoenix

I despatched and acquired a number of funds efficiently with none issues.

Pockets Overview

Charges

It’s actually troublesome to make a charge comparability, as a result of the functionalities below the hood of the wallets are totally different. The uncertainty of the underlying charges on the Bitcoin blockchain think about as properly, as a result of when a channel is being opened or a swap-out to a Bitcoin tackle occurs, they should be paid for too.

That’s why I didn’t even attempt to make a charge comparability. The chance to personal censorship-resistant cash, that one can ship globally, that’s settled immediately and works permissionlessly with none transaction limits, is priceless. It’s already cheaper than every other type of worldwide fee.

Only recently, somebody despatched me $2,500 from his checking account in a foreign country to mine. I now have $2,466 in my account. The charge on his facet was $20 on prime of the $2,500. Moreover, there was a $4.14 charge on my facet. Which means in between, somebody (and we’ve no clue who) took $30. He paid $2,520, I’ve $2,466 in my account — we paid $54 in charges. And but the cash shouldn’t be even exchanged to euros.

Conclusion

In solely 10 minutes (messaging on Twitter included), I had despatched and acquired bitcoin in Zimbabwe from a number of nations, like Benin, Nigeria, Bangladesh, Germany, the U.Ok. and Italy, all that with out the necessity of exhibiting an ID or getting permission from anybody and with none transaction limits and really low charges. That is what monetary sovereignty and inclusion is all about.

What’s the most effective answer for you? The very best answer is the one that matches your private wants greatest. As you may see within the above desk, each pockets has totally different options, in addition to up- and drawbacks. It’s on you to determine your wants and prospects after which to search out the optimum answer for these.

For brand new customers, Phoenix and Breez are nice options. Given the truth that I wished to search out the most effective pockets working in areas with weak web connectivity, I like to recommend Phoenix. It’s a non-custodial pockets, simple to make use of and swap-outs to the Bitcoin blockchain are free (aside from the mining charges) and it really works with a seed backup. The one draw back is that you need to obtain not less than 10,000 satoshis ($2.15 on the time of writing) as a primary fee to initialize a brand new pockets. This requirement could be a drawback for individuals with very low incomes.

I hear over and over that Pockets of Satoshi is a good pockets to start out with, as a result of its use is easy and handy. A lot of the invoices I acquired throughout my take a look at had been really despatched from Pockets of Satoshi. This freaks me out. The standard suggestion to make use of solely a small quantity of funds, due to the custodianship, can’t be utilized to lower-income customers. A lack of $2 will be big for them. I don’t see any cause anymore to advocate a closed-source, custodial pockets like Pockets of Satoshi over a permissionless, self-custodial pockets like Phoenix or Breez.

The requirement of Phoenix to obtain a primary time fee of 10,000 satoshi is a barrier to be acknowledged, however an individual who doesn’t have the funds to obtain 10,000 satoshi will undergo from the lack of the identical quantity in a custodial pockets much more. As I stated above, it’s each particular person’s personal resolution which path to take, however I discover it essential that folks perceive the dangers of utilizing custodial wallets at this early stage.

Non-custodial Lightning wallets is likely to be rather less handy to make use of and include an preliminary value when establishing the channels, however you might be in full management over your personal funds. You might be financially sovereign.

Moreover, I’m optimistic that Bitcoin builders and entrepreneurs will discover options to make self custody much more handy and decrease the barrier of entry within the coming years.

This can be a visitor publish by Anita Posch. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.