The worth of the crypto market has began to slip once more after a bullish run-up over the past seven weeks. The whole worth locked (TVL) in decentralized finance (defi) has slipped under the $50 billion mark to $49.8 billion. The TVL in defi has fallen by 2.24% over the past 24 hours. Throughout that very same timeframe, the highest good contract token economic system misplaced 3.7% in opposition to the U.S. greenback.

Good Contract Token Economic system and Worth Locked in Defi Dip

Cryptocurrency costs are down this weekend, affecting the values of good contract tokens and the full worth locked in defi. On the time of writing, the good contract token economic system is valued at $326.11 billion, however has dropped 3.7% over the past day. Over the past week, ethereum (ETH) has misplaced 5.6% in opposition to the dollar, and polygon (MATIC) has dropped 17.6% in worth.

Presently, the TVL in defi in the present day is $49.8 billion, with 18.03% of that worth residing within the Lido liquid staking protocol. The worth locked in Lido in the present day is round $8.75 billion, up 8.43% over the past month. Makerdao, Curve, Aave, Convex Finance, Uniswap, Justlend, Pancakeswap, Instadapp, and Compound Finance comply with Lido so as. Apart from Lido’s 8.43% rise, Uniswap had the second-largest 30-day enhance with 6.43%.

As of Feb. 25, 2023, Ethereum has the biggest TVL out of all of the blockchains, dominating by 58.45%. Tron follows with 10.64%, Binance Good Chain (BSC) with 10.01%, Arbitrum with 3.89%, and Polygon with 2.36%. All 5 of those blockchains seize 85.35% of the mixture worth locked in decentralized finance on Saturday. Out of the highest ten blockchains when it comes to TVL dimension, solely Arbitrum noticed will increase, with the TVL rising 9.39% final week and 60.87% over the past month.

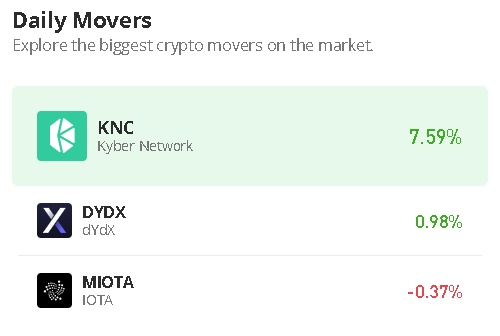

Among the many high ten good contract cash, Polygon had the biggest drop this week, at 17.6%. By way of your complete good contract token economic system, the largest gainer this week was stacks (STX), which rose 102.5%. The second-biggest good contract coin gainer was kylin community (KYL), which rose 69.1% in opposition to the dollar. The 2 greatest losers over the past seven days when it comes to good contract tokens had been astar (ASTR), which misplaced 26.2%, and shiden community, which shed 23.9% this week.

What do you suppose brought about the latest slide in cryptocurrency costs, and the way do you suppose it can have an effect on the way forward for decentralized finance markets? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial photograph and widget credit score: TradingView / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.