By Paul Hoffman from BestBrokers

Looming Fed fee hikes had been the most popular matter at first of 2022. Shortly after that world markets dove even deeper into the pink with the beginning of the conflict between Russia and Ukraine. Not lengthy after the LUNA crash adopted and crypto markets plunged deeply.

Unfavorable occasions for the worldwide economic system continued and triggered additional harm to all crypto property. Regardless of all of the negativity surrounding crypto and a number of printed analyses, concluding with the announcement of “crypto winter”, the NFT sector saved creating at a superb tempo and our crew at BestBrokers determined to tug some uncooked knowledge out of the Blockchain with Dune Analytics and provides a visible illustration.

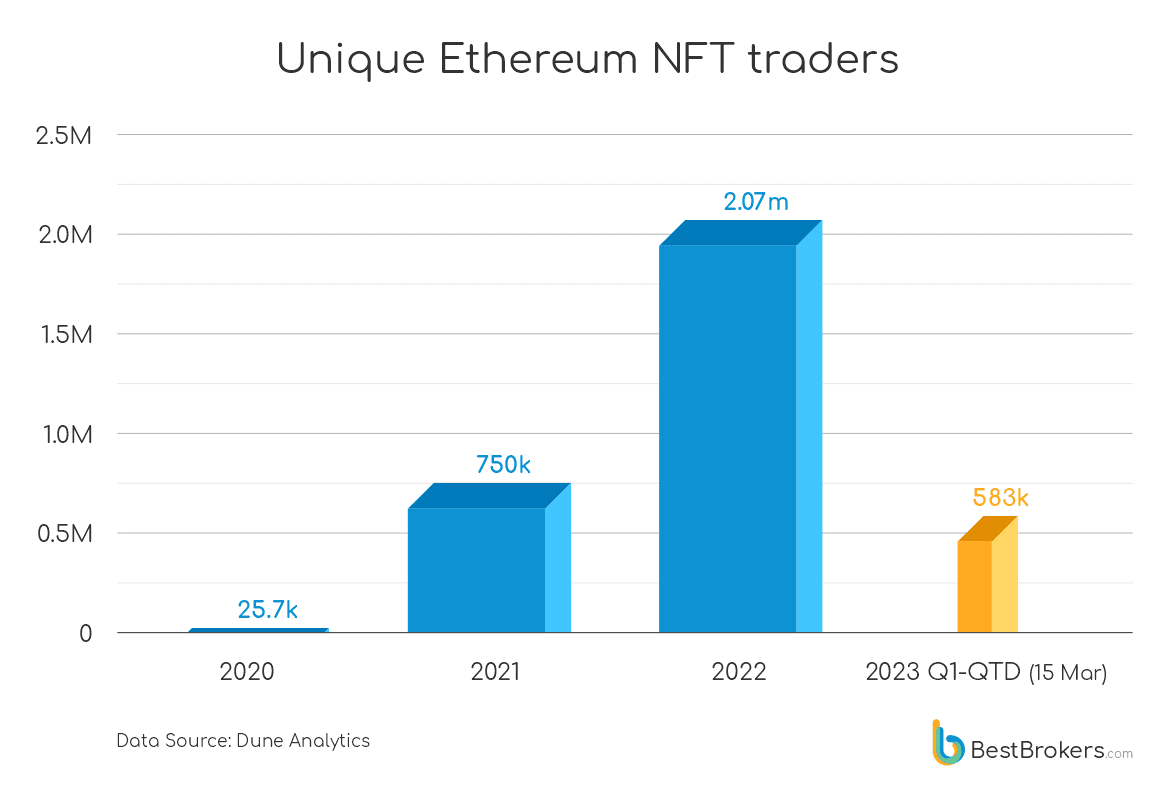

For the report Dune Analytics was used to run uncooked queries and analyse uncooked knowledge from the blockchain. It additionally options breakdowns by 12 months and quarter of the distinctive Ethereum NFT merchants and the variety of Ethereum NFT merchants in addition to professional opinion on the general NFT buying and selling exercise.

The variety of the distinctive energetic NFT merchants on the Ethereum blockchain rose to over 2.07 million in 2022. Regardless of the adverse circumstances in 2022, the variety of energetic NFT merchants on the Ethereum community surged 276% in comparison with 2021.

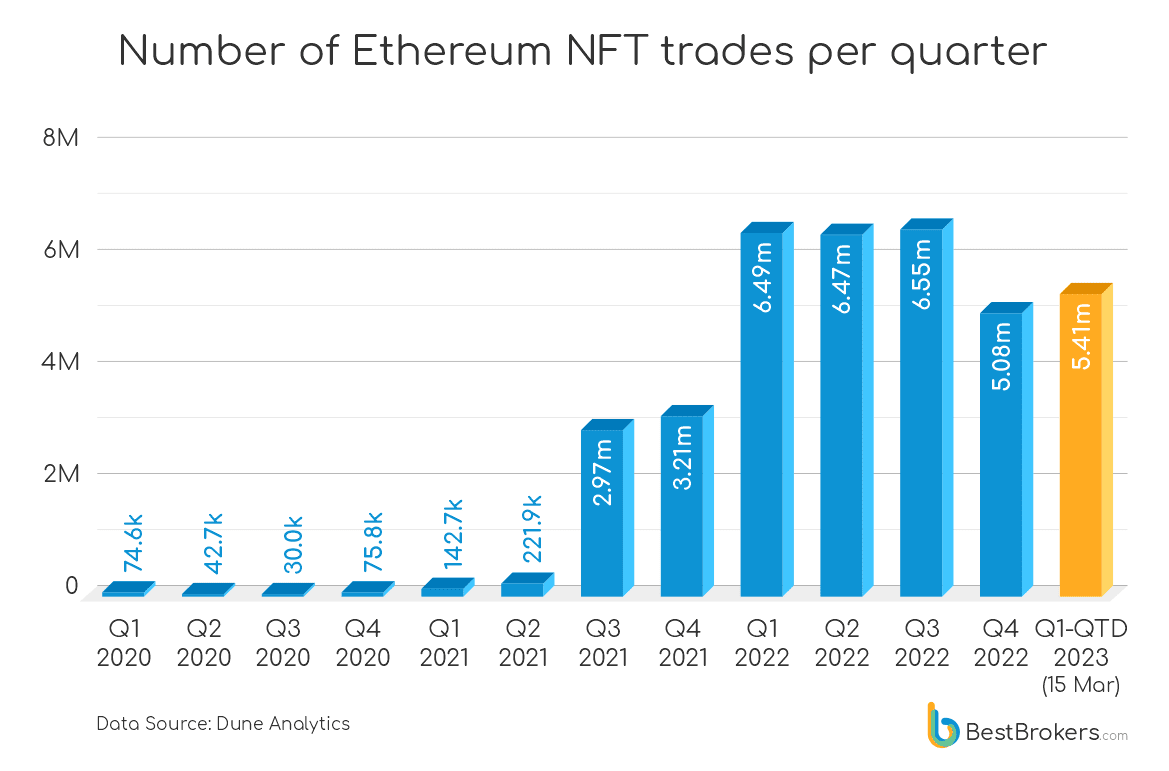

Initially the variety of trades plummeted 22.48% within the fourth quarter of 2022 however bounced again properly within the first quarter of 2023, which already makes this 12 months look promising.

Regardless of the falling costs and the a lot decrease buying and selling quantity for many of the cryptocurrencies, the variety of the distinctive energetic NFT merchants on the Ethereum blockchain rose to over 2.07 million in 2022 or 276% in comparison with 2021.

|

“The truth that NFTs saved merchants’ consideration throughout such robust occasions for the entire investing world implies that there’s something particular about this asset. With the crypto costs anticipated to solely rise from this level on, NFT will turn into much more mainstream and ultimately will convey a number of youthful buyers to the markets”

Steady general buying and selling exercise

Ethereum NFT buying and selling exercise initially skyrocketed to nearly 3 million trades for the third quarter of 2021 with BTC and Ethereum reaching all time excessive. Nonetheless, this pattern remained steady regardless of the turbulent 2022, solely dropping within the fourth quarter of 2022 when the Fed fee reached (and exceeded) the 4% mark for the primary time in 15 years.

Even after the variety of trades plummeted 22.48% within the fourth quarter of 2022, it nonetheless bounced again within the first quarter of 2023 with the variety of trades on this present first quarter already 6.65% greater as of 15 March 2023.

|

“Such steady exercise, regardless of crypto and world markets having probably the most turbulent years of their historical past, solely strengthens the expectations that NFTs will probably be probably the most common buying and selling devices sooner or later. We’ve seen the facility of retail buyers within the so-called ‘meme shares’ rallies previously 12 months, now we see it within the NFT buying and selling.”

– feedback Alang Goldberg, analyst at BestBrokers.