A preferred crypto analyst says that a number of indicators are suggesting that digital asset markets are gearing up for a speedy growth to the upside.

The pseudonymous analyst generally known as TechDev tells his 408,000 Twitter followers that earlier than every certainly one of Bitcoin’s (BTC) run to all-time highs (ATHs), the Chinese language 10-year observe bottomed out and the transferring common convergence divergence (MACD) indicator crossed bullish.

The MACD is a technical indicator designed to sign a attainable reversal in development.

Says TechDev,

“This occurred earlier than each ATH-setting Bitcoin transfer.”

TechDev additionally says that the altcoin market is organising for a giant run based mostly on historic patterns.

The analyst seems to be on the complete crypto market cap excluding Bitcoin and identifies intervals of downward worth motion (correction), sideways motion (accumulation) and worth rallies (markup).

In response to the analyst, altcoins are actually within the “markup” part, poised for greater costs.

“Replace:

Correction –> Accumulation –> Markup”

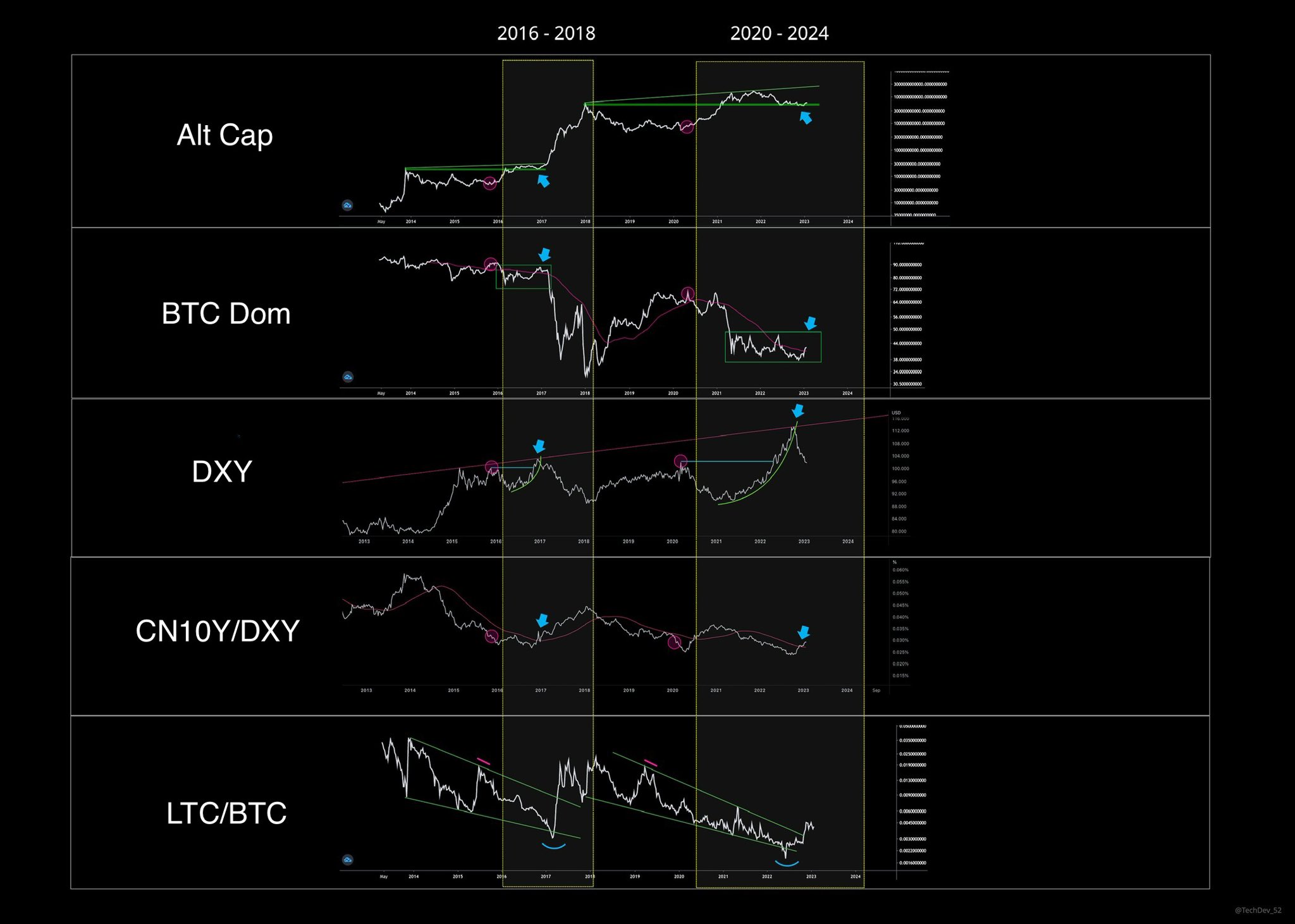

TechDev additionally compares the altcoin market cap in opposition to 4 different charts. He contains the Bitcoin dominance chart (BTC.D), which compares the market cap of Bitcoin to that of the remainder of the crypto markets and the greenback index (DXY), which pits the greenback in opposition to a basket of different main currencies. Additionally included are the charts of the Chinese language 10-year observe in opposition to the DXY (CN10Y/DXY) and the Litecoin versus Bitcoin (LTC/BTC) pair.

In response to TechDev, all charts look like following their market buildings between 2016 and 2018, suggesting that a number of metrics are aligning to sign an explosion within the altcoin markets.

“Generally persistence is all you want.”

Trying on the Bitcoin dominance chart, TechDev seems to foretell an enormous breakdown for BTC.D, much like what occurred between 2016 and 2018. A bearish BTC.D chart signifies that altcoins are rising quicker in worth than BTC.

For the DXY, the analyst means that the greenback index seems to have topped out, indicating that traders are beginning to make their capital work in danger belongings reminiscent of crypto.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/SimpleB