Based on Bloomberg, a current analysis report from Sanford C. Bernstein has make clear the potential affect of Change Traded Funds (ETFs) on the Bitcoin market dynamics.

Potential Surge In Bitcoin Market Worth

Sanford C. Bernstein’s analysis signifies that ought to the US green-light a fund investing immediately in spot Bitcoin, ETFs may represent roughly 10% of Bitcoin’s market worth throughout the subsequent three years.

Such a shift may amplify Bitcoin’s presence in conventional monetary portfolios and doubtlessly foster extra important institutional adoption.

Based on Bloomberg, Gautam Chhugani, an analyst at Bernstein, highlighted the rising chance of a spot Bitcoin ETF within the report.

In a separate report, this identical analyst had lately disclosed that the SEC believes {that a} Bitcoin Spot ETF could also be “unreliable” since crypto exchanges (equivalent to Coinbase) aren’t underneath their oversight, resulting in issues about potential value manipulation and unreliability.

Whereas the hypothesis on the SEC approval of a Spot Bitcoin ETF continues, with the Grayscale Bitcoin Belief presently holding about 4% of all Bitcoin, in line with Bloomberg, a direct funding, ETF may greater than double this determine, doubtlessly aiding the expansion of the crypto funding panorama.

The “Progress Flywheel” Impact

As soon as regulatory approval is in place, Bernstein anticipates a “progress flywheel” impact propelled by retail and different institutional inflows. Such a cascade impact can be harking back to different monetary markets the place introducing new monetary merchandise spurred contemporary investments and liquidity waves.

Notably, to perceive the importance of this, one solely wants to think about the broader ETF market’s progress trajectory. Since their inception, ETFs have grown exponentially, with property underneath administration surging throughout numerous sectors and asset lessons.

Introducing a Spot Bitcoin ETF would imply integrating a extremely liquid, decentralized, and more and more accepted asset into this combine, additional validating Bitcoin’s place within the monetary ecosystem.

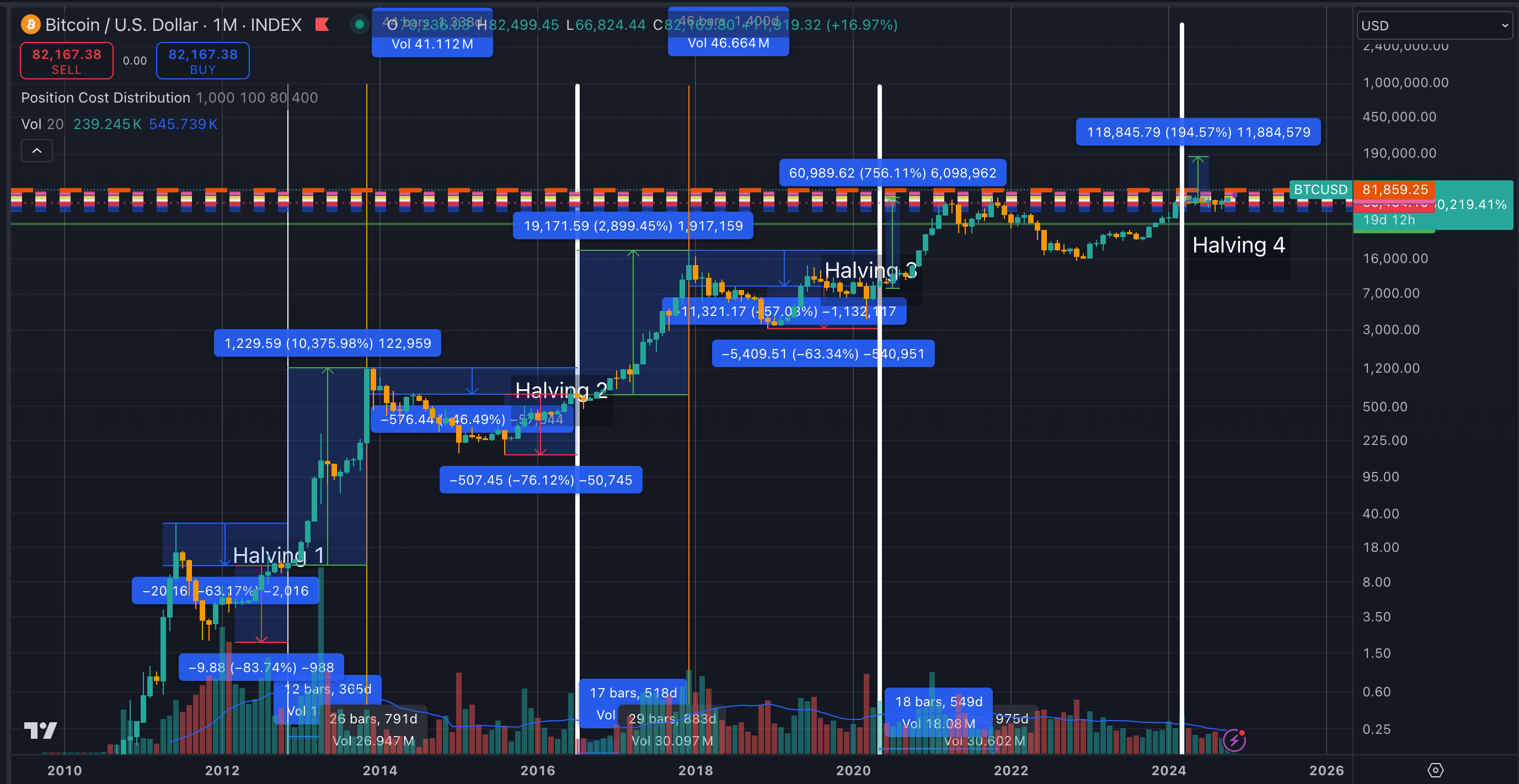

In the meantime, Bitcoin’s value is struggling to interrupt above the $30,000 mark after slipping beneath that value vary final week. As of this writing, the asset trades at $29,623, recording a slight improve of 0.5% over the previous 24 hours.

Alongside its struggling value, BTC’s market capitalization has elevated by greater than $10 billion in simply the previous week. The asset market cap has surged from a excessive of $560 billion earlier final week to a present cap of $573 billion.

The highest crypto’s buying and selling quantity has additionally adopted carefully with its surging market cap and has seen a big spike from final week’s every day buying and selling quantity. Bitcoin’s 24-hour buying and selling quantity presently stands at $11.3 billion in comparison with a lesser quantity of $8.7 billion final Monday.

Featured picture from iStock, Chart from TradingView