Knowledge of an on-chain indicator suggests the vast majority of the altcoins have now dropped into the historic “hazard zone,” an indication that could possibly be bearish.

Altcoins Could Be Overbought Presently As Dealer Income Have Shot Up

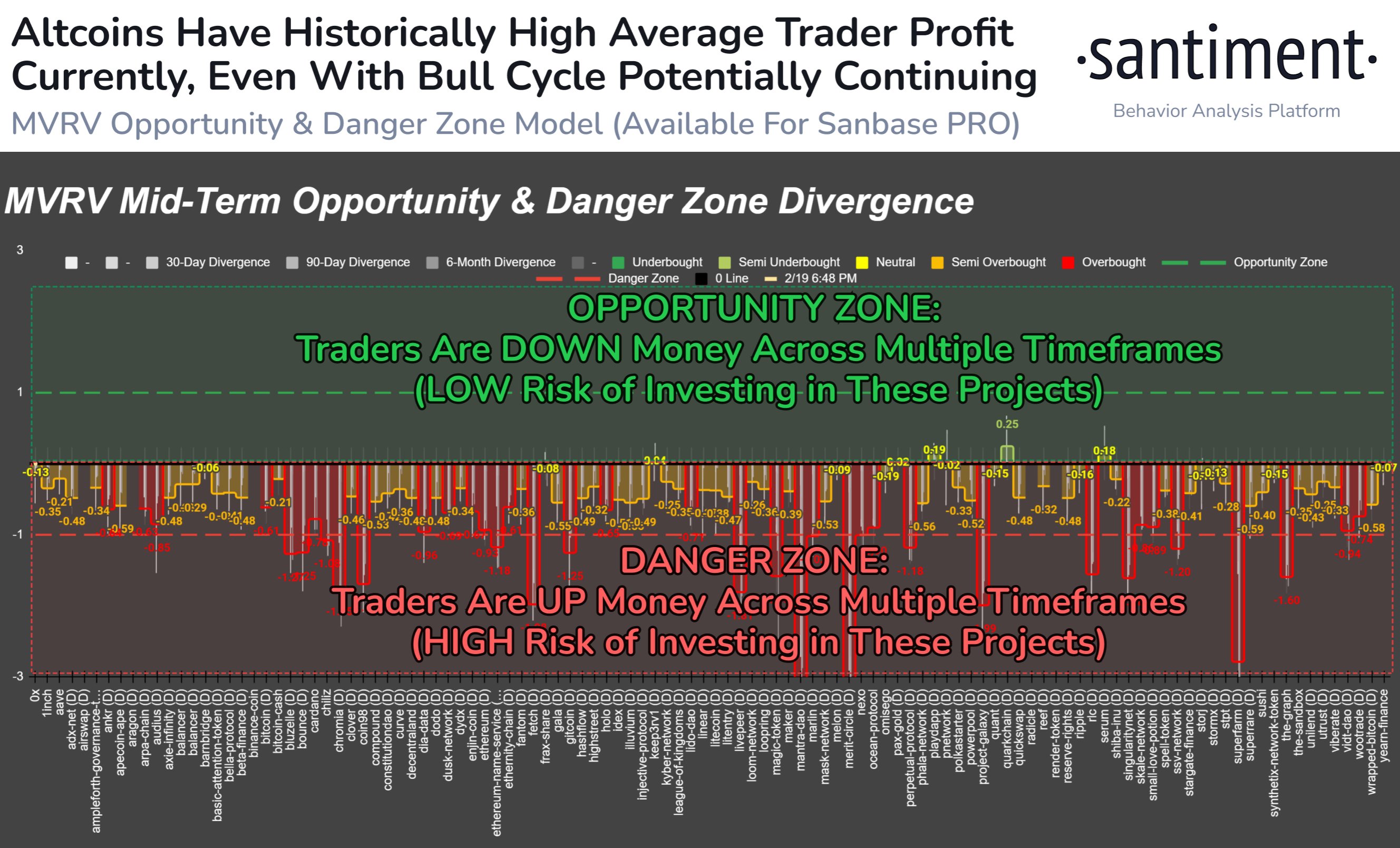

In a brand new post on X, the on-chain analytics agency Santiment has mentioned how the altcoins as a complete have been observing excessive income not too long ago primarily based on the MVRV ratio.

The “Market Worth to Realized Worth (MVRV) ratio” is an indicator that retains monitor of the ratio between the market cap and realized cap for any given cryptocurrency.

The “realized cap” right here refers to a capitalization mannequin that assumes the actual worth of any token in circulation shouldn’t be the present spot worth of the asset, however quite the worth at which it was final moved on the blockchain.

Because the earlier transaction for any token was probably the purpose at which it final modified arms, this earlier worth would function its present value foundation. As such, the realized worth primarily accounts for the associated fee foundation of each investor out there.

For the reason that MVRV ratio compares the market cap of an asset (that’s, the whole worth the traders are holding proper now) with its realized cap (the worth that the holders as a complete put into the coin), it may well inform us concerning the profitability ratio for the typical investor of the cryptocurrency.

Traditionally, the traders holding giant quantities of income (that’s, a excessive MVRV ratio) have been a sign that the asset is overheated, whereas the traders being in losses have instructed an underbought standing. Primarily based on this historic sample, Santiment has outlined “alternative” and “hazard” zones for the market.

The chart under exhibits a measure of the divergence of the MVRV ratio for various timeframes and for numerous altcoins:

The worth of the metric appears to have been damaging for all of those altcoins | Supply: Santiment on X

In keeping with Santiment’s mannequin, the MVRV ratio diverging to the -1 mark (from its regular 0% worth) suggests the asset in query is contained in the hazard zone the place merchants carry excessive income. From the graph, it’s seen that a lot of the altcoins are inside this area proper now.

“Exterior of some lagging altcoins, the overwhelming majority of crypto tasks have generated income for the typical pockets on a mid to long run timescale,” explains Santiment. “Because of this our mannequin is indicating a good bit of ‘overbought’ indicators.”

Much like the hazard zone however reverse to it’s the alternative zone, the place the indicator’s divergence reaches the 1 stage. On this zone, few traders are carrying excessive income, so cash inside this zone might current a ripe alternative for accumulation. Presently, although, no asset is current on this area.

“This actually doesn’t imply that cryptocurrency is on the verge of a large correction,” says the analytics agency. “However primarily based on historical past, the extremely respected MVRV metric is revealing there’s a larger danger than common in shopping for or opening new positions whereas markets are within the midst of a 4+ month surge.”

ETH Value

Ethereum has seen a decoupling from Bitcoin not too long ago because the coin has registered a contemporary surge above the $2,900 mark, whereas the unique cryptocurrency has slumped sideways.

Appears to be like like the value of the asset has surged not too long ago | Supply: ETHUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.internet