That is an opinion editorial by Andrew Hetherington, a contributor to Bitcoin Journal.

For the reason that Nixon Shock of 1971, wealth inequality has soared to ranges not seen in over a century. The greenback was now not redeemable for gold however was as a substitute backed solely by religion. With out the restrictions of a backed foreign money, these in energy got the chance to create as a lot fiat foreign money as they desired, with little to no consequence. Destined to lose religion on account of abuse, fiat foreign money was doomed from inception.

Bitcoin seeks to treatment the inequalities of fiat foreign money. Bitcoin is decentralized, fungible, permissionless and finite; it doesn’t enable for central authorities to profit from the theft of its holders’ asset worth by inflation. Moreover, it doesn’t limit entry from those that want it most, offering monetary providers to these incapable of accessing conventional banking

A Story Of Two Cities

Inequality in America has risen to unexpected heights in latest many years, with solely the earnings and internet value of these in greater earnings brackets rising.

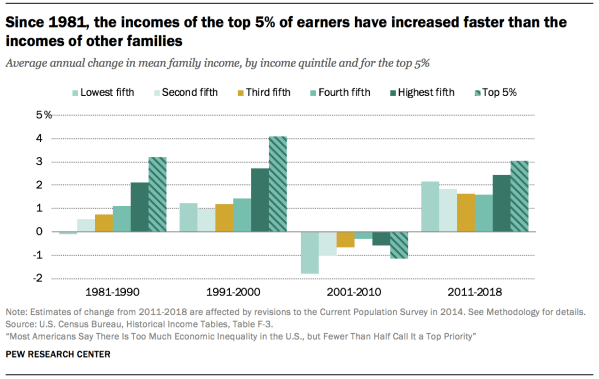

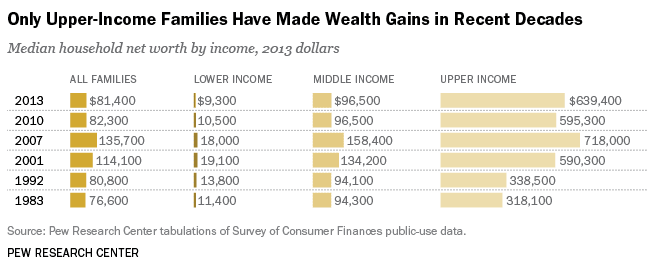

In response to knowledge from the Pew Analysis Middle, the online value and earnings of the higher earnings earners have soared above that of the extraordinary employee. From 1981 to 2018, the highest 5% of earners outpaced each different earnings bracket. Moreover, from 1983 to 2013, the median family internet value solely elevated within the higher earnings bracket.

Because the elites proceed to see their earnings and internet value soar, the common employee is struggling to feed his or her household on account of an more and more manipulated economic system. Fueled by abusive financial coverage, wages haven’t elevated in shopping for energy since 1971.

First found by Richard Cantillon in the course of the 18th century, the uneven growth of foreign money disproportionately advantages these closest to the supply. This creates theft of shopping for energy from these in decrease earnings brackets, straight into the palms of the elite. Solely by utilizing their foreign money are they in a position to do that. With the superior financial qualities of bitcoin, it should finally substitute fiat as the usual medium of alternate. As Bitcoin adoption will increase, and slowly renders fiat foreign money much less essential, the printing of latest fiat foreign money by nation-states will hamper their potential to govern the shopping for energy of the working class.

Because of the decentralization of Bitcoin, for the primary time in human historical past, foreign money growth will now not disproportionately profit any authorities or central authority. Forex growth will now grow to be a enterprise, benefiting taking part companies and people who’re able to securing the community in a worthwhile method. Most significantly, in contrast to fiat foreign money’s extra printing, bitcoin foreign money growth from block rewards will profit not solely these closest to the creation of the digital foreign money, comparable to miners and exchanges, but in addition the holders of bitcoin itself by rising shortage and community safety. This lack of manipulation by a government permits Bitcoin to scale back inequality.

Not Your Typical Financial institution Run

In response to the Middle for Monetary Inclusion, roughly 1.7 billion persons are unbanked. More and more, analysis is presenting proof of cell cash providers bettering monetary circumstances in creating nations. In response to this research by Tavneet Suri and William Jack, estimates counsel roughly 194,000 Kenyan households have been lifted out of poverty with the growth of a cell cash service often called M-Pesa. The research cites elevated monetary resilience, financial savings and occupational selection — significantly for girls — as the most important enhancements supplied by cell cash providers.

Bitcoin gives the entire alternatives of cell cash providers like M-Pesa with far decrease charges and higher accessibility. These utilizing it as a method of storing wealth can accomplish that with no account charges and minimal transaction charges. In February 2022, Kenyans dwelling overseas despatched dwelling over 300 million U.S. {dollars}. In response to the World Financial institution, the common price to ship remittances to Kenya is 9.54% as of 2020. If Kenyans overseas had been to make use of Bitcoin versus conventional remittance providers, hundreds of thousands of U.S. {dollars} could be saved per 30 days.

Alongside monetary advantages, Bitcoin is well accessible because it requires as little as a smartphone to get began. As reported by the World Financial institution, roughly 1.1 billion individuals globally haven’t any authorized identification. With out government-recognized identification, these persons are incapable of accessing the normal finance system. Even with out identification, these persons are nonetheless able to accessing the Bitcoin community. Bitcoin gives trendy monetary providers to those that want it most, with out restrictions.

With the entire aforementioned advantages of Bitcoin over conventional finance, adoption has been hovering in Africa with cryptocurrency use rising over 1,200% final 12 months in line with Chainalysis. Kenyan founding father of Well being Land Spa, Tony Mwongela, has been accepting bitcoin as fee since 2018. As firms are frequent victims of fee fraud, Mwongela cites the security and safety of Bitcoin as his main causes for deciding to simply accept it as fee.

Persevering with to financial institution the unbanked, Bitcoin adoption is offering alternative to these left behind by the normal banking business. With higher safety, accessibility and reliability, Bitcoin is main us to a extra equitable world.

This can be a visitor publish by Andrew Hetherington. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.