The supply of the present market volatility and liquidity points with firms reminiscent of Celsius and Three Arrows Capital might be immediately linked to staked Ethereum (ETH) on Lido, based on a June 29 report by evaluation agency Nansen on the impression of the stETH/ETH depeg on the crypto business.

Infinite cash glitch

When Ethereum is staked into ETH 2.0 by way of Lido buyers, obtain an ERC-20 token named stETH. This token is tradeable, and one stETH is redeemable for 1 ETH after Ethereum strikes to proof of stake and is merged with the beacon chain.

Nevertheless, buyers also can publish stETH as collateral on websites reminiscent of Aave to borrow ETH. This borrowed ETH may also be staked on Lido to obtain extra stETH. This yield loop multiplies the ETH staking rewards however places the investor in danger ought to 1 stETH not equal 1 ETH. Lido promoted this technique by way of a Twitter publish in March.

2) Leveraged ETH staking

stETH on Aave means that you can leverage your ETH staking to maximise staking returns.

1. Provide your stETH as collateral.

2. Borrow ETH in opposition to the stETH.

3. Restake borrowed ETH for extra stETH.Repeat this course of as a lot as your danger profile permits.

— Lido (@LidoFinance) March 1, 2022

How Ethereum introduced down Celsius and 3AC

Nansen highlighted that throughout the UST depeg disaster, bETH depositors (a wrapped bridged model of stETH on Terra) moved their tokens again to the Ethereum mainnet amid fears of the community’s stability. The report acknowledged that 615,980 bETH was bridged again to Ethereum throughout this time and was unwrapped again to stETH.

It’s this stETH that Nansen claimed was then offered again to Ethereum that began the promoting stress on the stETH/ETh peg, based on knowledge out there on its platform. A rise of 567k stETH was added to the stETH/ETH pool of Curve, creating an imbalance and forcing Lido to take measures to aim to revive the peg.

A big web outflow ensued as buyers turned apprehensive by the scenario and Nansen mentioned that Three Arrows Capital was one of many largest recipients of stETH from Curve. The Three Arrows outflow reportedly totaled 9724 stETH and 486 WETH.

As the value of Ethereum and the broader crypto market, generally, started to fall, Nansen acknowledged

“addresses we flagged as Celsius and Three Arrows Capital have been the most important withdrawers, eradicating virtually $800m value of liquidity mixed (236k stETH and 145k ETH, respectively) on 12 Could.”

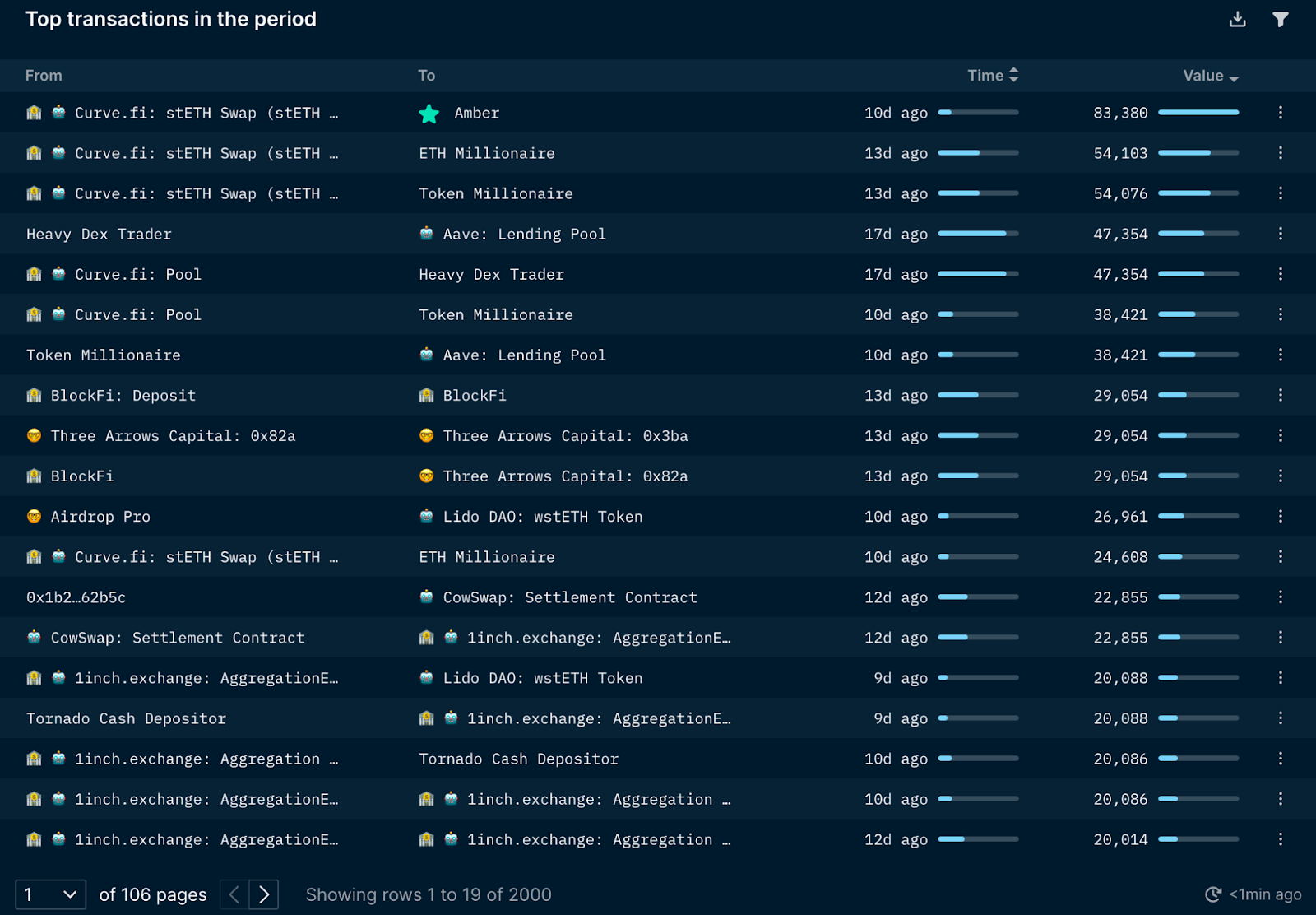

It continued to remark that “these transactions have been most impactful to the preliminary deviation from the ETH value.” The under transactions are the highest wallets that switch stETH between June 1 and 12.

From the above wallets, Nansen analyzed the person transactions to disclose that Amber Group, Celsius, Three Arrows Capital, and a number of other whale wallets all moved critical quantities of stETH throughout this time. Amber Group and Celsius moved stETH to FTX in a potential OTC commerce as stETH liquidity on FTX have been too shallow to promote the tokens with out incurring colossal slippage. Nansen additionally revealed that Celsius took out giant stablecoin loans from Compound to “presumably meet redemptions.”

After Celsius paused withdrawals, 108.9 ETH and 9,000 WBTC have been despatched to FTX, originating from one among its main wallets. This pockets is “nonetheless the highest 1 lender/borrower for ETH (incl. WETH and stETH) and WBTC collateral throughout each Aave and Compound with a mixed collateral worth of virtually $1 billion,” based on Nansen.

Three Arrows Capital “withdrew a large quantity of 29,054 stETH from BlockFi” on June 7 and deposited it between Lido and Aave. One other 3AC pockets borrowed 7,000 ETH from Aave utilizing a part of the funds faraway from BlockFi as collateral and despatched to FTX. Over the next week, a number of extra transactions have been made by 3AC with funds deposited between FTX and Deribit. Deribit is among the largest choices and derivatives buying and selling platforms in crypto; depositing funds to this alternate is more likely to both pay down margin or open up new by-product contracts.

Nansen revealed that on June 13, 3AC started to unload its belongings by “unwrapping its wstETH for stETH and offered it for wETH by way of Cow Swap” for a complete of 49,021 stETH. 3AC offered tens of hundreds of stETH for ETH and stablecoins over the next days, thus, exiting its stETH positions.

Conclusion

The report concluded that Celsius had a liquidity challenge, and its have to promote and switch stETH led to a domino impact. 3AC was a “sufferer of the contagion” and never the preliminary reason behind the stETH/ETH depeg. Nansen acknowledged that 3AC is “most probably decreasing its dangers and accepting its losses.” In distinction, Celsius diminished its danger, and “their well being ratio remains to be respectable within the context of issues, so long as there isn’t a sudden downward swing of >30% in costs of their collateral.”