Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

New inflation data fosters a “higher-for-longer” sentiment,

Hotter than expected US inflation numbers shaped market dynamics. The Consumer Price Index (CPI) rose to 2.7% from 2.6%, while the Producer Price Index (PPI) climbed to 3.0% from 2.6%, marking the biggest increase since February 2023. These figures prompted bond investors to push the yield on the US 10-year Treasury bond from 4.15% to 4.40%, reflecting a “higher-for-longer” rate outlook.

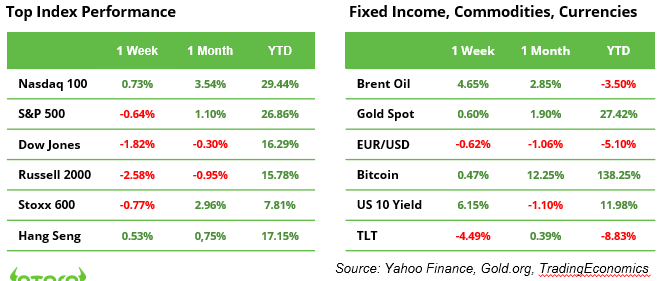

Equity markets responded to the inflation data with mixed movements, partially reversing recent trends. The small-cap Russell 2000 Index dropped 2.6%, and the value-heavy Dow Jones Index declined by 1.8%. However, the Nasdaq 100 gained ground, driven by strong performances from Google, that made headlines with a breakthrough in quantum computing, and Broadcom, that projected $90 billion in revenue from custom AI chip by 2027, reigniting a rally in AI stocks.

In the commodities market, oil prices surged 4.7%, while cocoa spiked 17%, as unfavorable climate conditions threatened the upcoming harvest and pressured existing contracts.

Fed, BoJ and BoE to announce their interest rate decisions

Following last week’s rate cuts by the ECB and SNB, (SNB surprising markets with a 0.50% “jumbo” cut), attention now shifts to the Fed on Wednesday and the BoJ and BoE on Thursday. The US Federal Reserve is expected to cut rates by 25 basis points to a range of 4.25% to 4.50%, a decision priced in by the market with a 96% probability. However, a Bloomberg survey indicates that the Fed’s rate-cutting path will likely slow down in 2025. The updated dot plot and Jerome Powell’s press conference are expected to provide valuable insights.

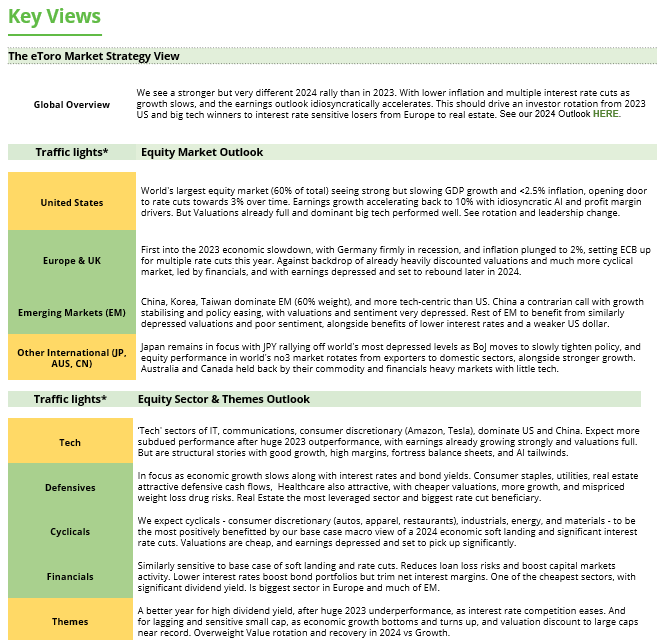

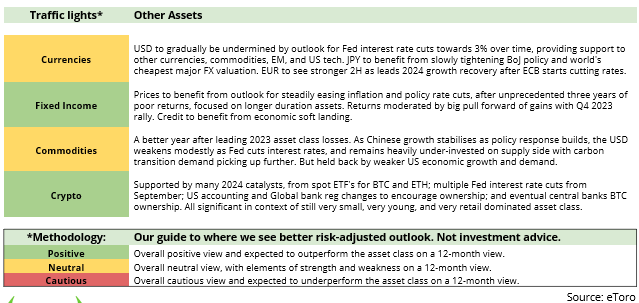

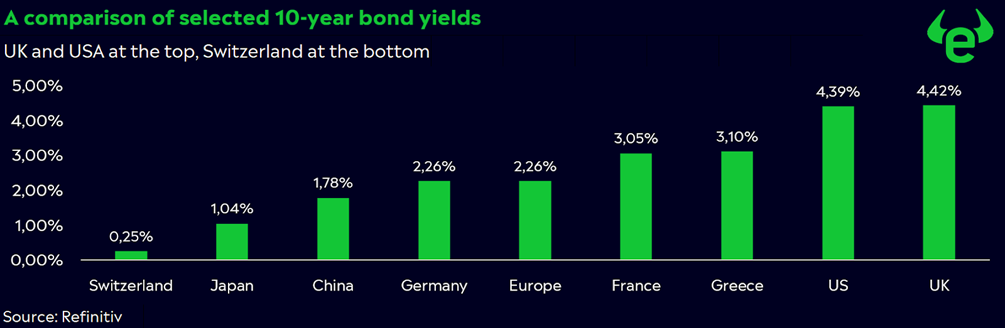

There is a strong correlation between interest rates and bond yields. Looking at 10-year bond yields globally (see chart), UK and US lead the pack. In the US, Trump’s debt policies remain a focal point. In Europe, political crises in France and Germany dominate attention. Meanwhile, China’s 10-year bond yield hit a record low, with only Japan and Switzerland offering lower yields.

Bonds remain a valuable addition to portfolios for stability. However, their long-term return potential is significantly lower than that of equities. Higher returns in the fixed income markets are currently only achievable with high-risk bonds.

Can the US Manufacturing PMI Break Through 50?

US economic data dominates this week, with Monday’s PMI figures in focus. The Services PMI is expected to dip slightly from 56.1 to 55.7, while Manufacturing PMI is forecast to rise modestly from 49.7 to 49.8. A breach of the 50 mark could signal the end of the sector’s recession. Later in the week, retail sales data and PCE inflation figures will provide further clues on the economy’s direction.

Musk’s successful investment in Trump

Elon Musk, the world’s wealthiest man, invested at least $274 million in Donald Trump’s election campaign. Beyond financial contributions, Musk played an active role in influencing public opinion, with his election-related posts on X garnering an estimated 17 billion views.

Was it a good investment? In the short term, it appears so. Tesla’s stock, where Musk owns a 13% stake, surged over 70%, adding $80 billion to his net worth. The impact extended beyond Tesla. SpaceX, where Musk holds a 42% stake, saw its valuation jump to $350 billion last week, up from $210 billion in June. Additionally, Musk’s other ventures, including Neuralink, X, and xAI, are reported to have experienced significant valuation increases since 5 November.

The next key question for investors is how Trump’s policies will impact Musk’s diverse portfolio of businesses. As the new administration takes shape, market watchers will closely monitor potential regulatory and economic shifts that could affect Musk’s wide-ranging ventures.

Which stock markets outperformed the US in 2024?

The Nasdaq 100 Index delivered a 29% return, and the broader S&P 500 Index gained 27% so far in 2024 (see table). While few markets have outperformed these impressive figures, a handful stand out. Argentina and Pakistan’s stock markets have surged by approximately 70% this year. The Global X MSCI Argentina ETF, listed in USD, benefited from successful reforms under the Milei government, which focused on cost-cutting measures and curbing inflation. Similarly, the Xtrackers MSCI Pakistan Swap ETF, listed in EUR, posted strong gains, driven by internal reforms and the highest levels of foreign investment inflows since 2014.

Earnings and events

Macro: PMI (16/12) Retail Sales (17/12), Fed (18/12), BoE, BoJ (19/12). PCE inflation (20/12)

Earnings: Micron, Lennar (18/12), Nike, Fedex (19/12)