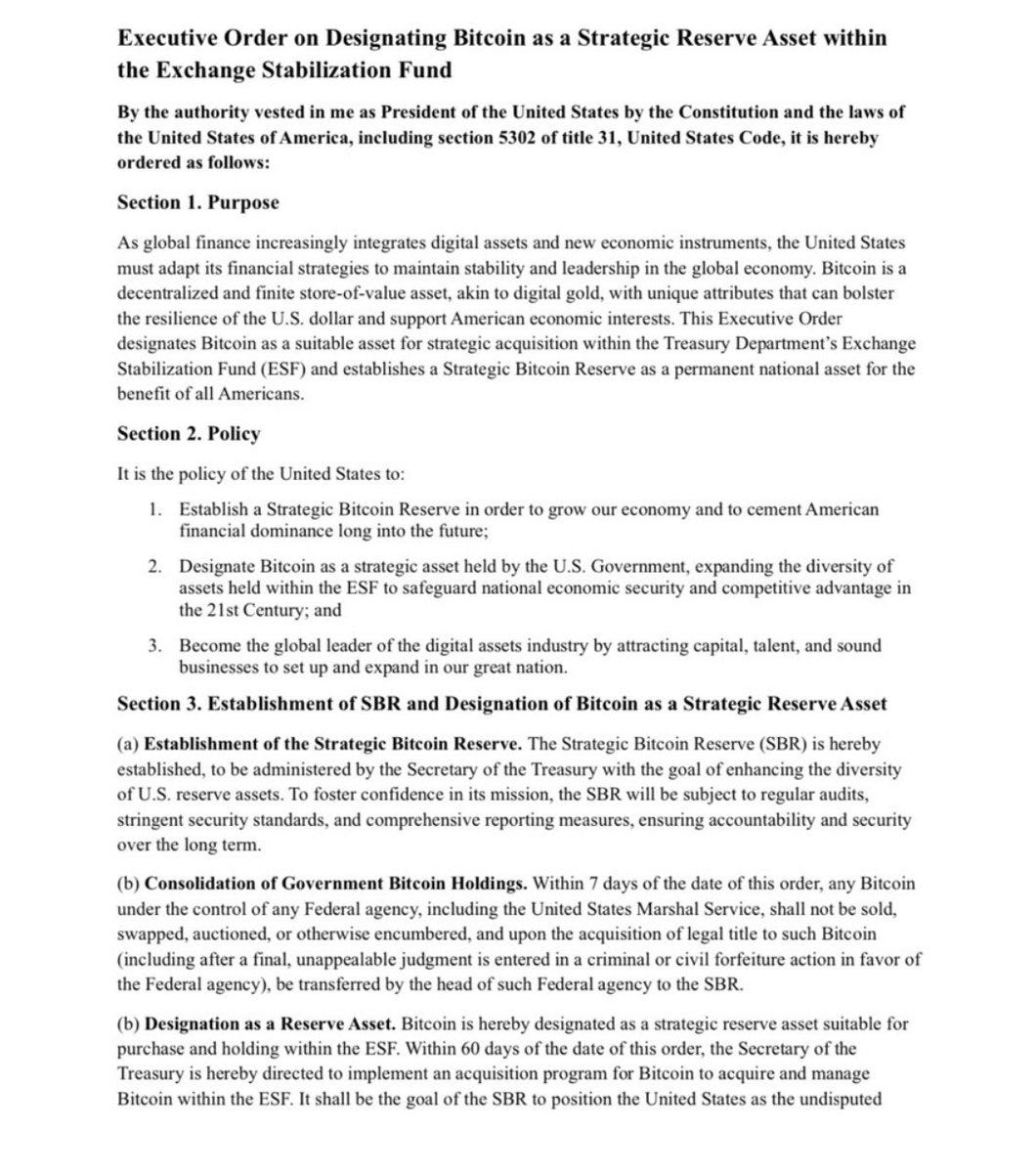

In an unprecedented move, the President of the United States has issued an Executive Order designating Bitcoin as a Strategic Reserve Asset within the Treasury’s Exchange Stabilization Fund (ESF). This landmark policy solidifies Bitcoin’s place not only in global finance but also within the foundation of American economic strategy.

Bitcoin, often dubbed “digital gold,” is a decentralized, finite digital asset. The Executive Order recognizes Bitcoin’s potential to bolster financial stability, diversify reserves, and maintain U.S. leadership in the rapidly evolving digital economy.

The directive highlights three key policies:

1. Strategic Bitcoin Reserve (SBR): A reserve will be established to promote economic growth and ensure long-term American financial dominance.

2. Bitcoin as a Strategic Asset: The U.S. Government will incorporate Bitcoin into its reserve portfolio, safeguarding national economic security.

3. Digital Asset Leadership: The U.S. aims to become the global hub for digital assets, attracting talent, businesses, and innovation.

The SBR, overseen by the Treasury Department, will operate under strict security standards and audits. This move represents a diversification of national reserves traditionally dominated by gold, foreign currencies, and government bonds.

Additionally, government-held Bitcoin from federal agencies will be consolidated under the SBR. This will bring a clearer, unified management of digital assets within U.S. reserves.

1. Bitcoin as a Global Reserve Asset

By positioning Bitcoin alongside traditional reserves, the U.S. government legitimizes Bitcoin’s status as a safe, store-of-value asset. Just as gold became a hedge against inflation in the 20th century, Bitcoin could emerge as the digital equivalent for the 21st century.

2. Increasing Institutional Adoption

This policy signals confidence in Bitcoin’s long-term value, likely encouraging more institutional investors to adopt Bitcoin as part of their portfolios. Countries and corporations may follow suit, leading to increased demand and stability.

3. U.S. Leadership in Digital Finance

The Executive Order aims to make the U.S. the global leader in digital assets, fostering innovation in blockchain technology, crypto regulations, and decentralized finance (DeFi). It’s a move that could attract major investments in tech startups, talent, and businesses.

4. Potential for Bitcoin Price Surge

With the U.S. government actively acquiring Bitcoin for reserves, market confidence is expected to rise. The increased demand, combined with Bitcoin’s fixed supply of 21 million coins, could push prices higher.

While this policy opens new horizons, it is not without challenges. Concerns regarding Bitcoin’s volatility, regulatory hurdles, and global competition will require thoughtful implementation. Additionally, the infrastructure for securely managing Bitcoin at a national level will need significant investment.

The Executive Order to establish Bitcoin as a Strategic Reserve Asset is a pivotal step toward the integration of digital assets into traditional financial systems. By taking this bold initiative, the U.S. government is not only embracing the future of finance but also redefining its role in a decentralized global economy.

Bitcoin’s rise from a niche digital currency to a strategic national asset marks the dawn of a new financial era — one driven by innovation, decentralization, and trust in technology.

“The Executive Order positions Bitcoin as the digital gold of our time — an asset that could shape the next generation of global finance.”

https://x.com/BitcoinMagazine/status/1869102704783716684