As the Bitcoin market steps into 2025, investors are keenly analyzing seasonal trends and historical data to predict what February might hold. With Bitcoin’s cyclical nature often tied to its halving events, historical insights provide a valuable roadmap for navigating future performance. By examining historical data—including Bitcoin’s average monthly returns and its post-halving February performance—we aim to provide a clear picture of what February 2025 might look like.

Understanding Bitcoin’s Seasonality

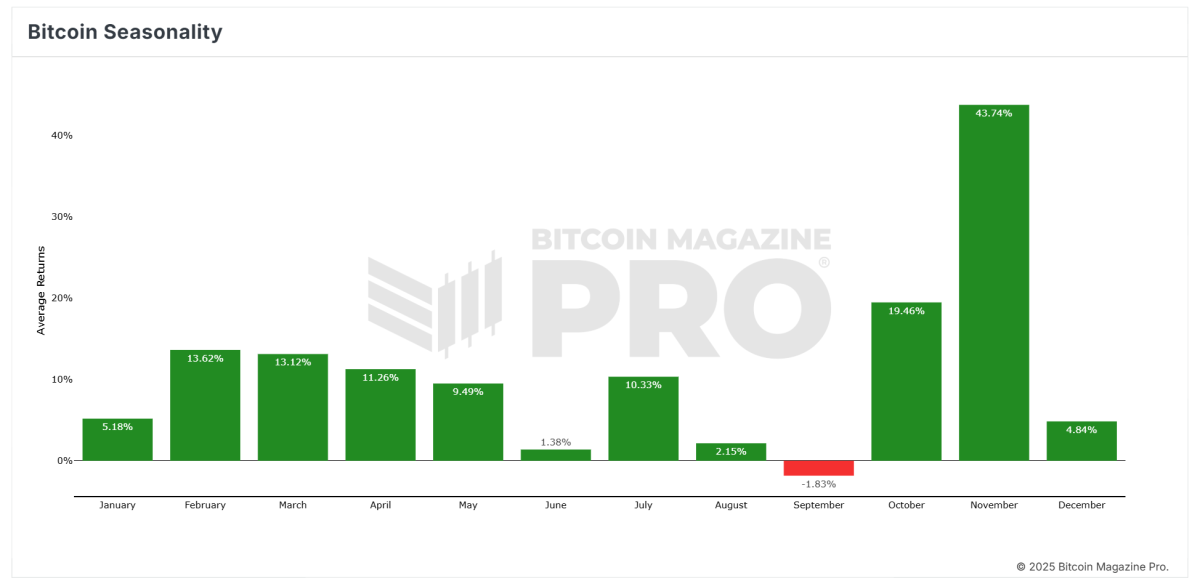

The first chart, “Bitcoin Seasonality,” highlights average monthly returns from 2010 to the latest monthly close. The data underscores Bitcoin’s best-performing months and its cyclical tendencies. February has historically shown an average return of 13.62%, ranking it as one of the stronger months for Bitcoin performance.

Notably, November stands out with the highest average return at 43.74%, followed by October at 19.46%. Conversely, September has historically been the weakest month with an average return of -1.83%. February’s solid average places it in the upper tier of Bitcoin’s seasonality, offering investors hope for positive returns in early 2025.

Historical Performance of February in Post-Halving Years

A deeper dive into Bitcoin’s historical February returns reveals fascinating insights for years that follow a halving event. Bitcoin’s halving mechanism—which occurs roughly every four years—reduces block rewards by half, creating a supply shock that has historically driven price increases. February’s performance in these post-halving years has consistently been positive:

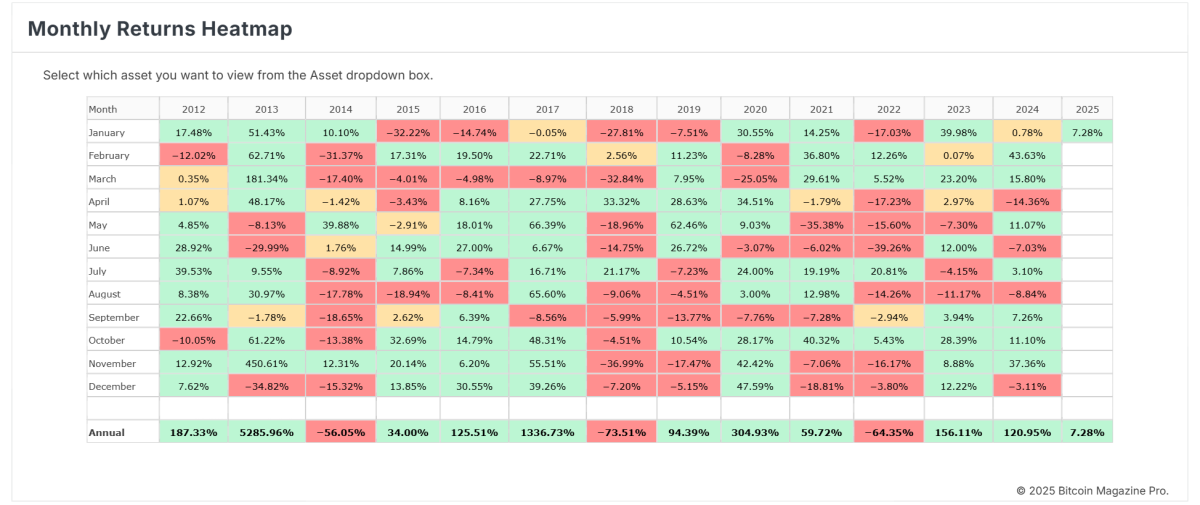

- 2013 (Post-2012 Halving): 62.71%

- 2017 (Post-2016 Halving): 22.71%

- 2021 (Post-2020 Halving): 36.80%

The average return across these three years is an impressive 40.74%. Each of these Februarys reflects the bullish momentum that often follows halving events, driven by reduced Bitcoin supply issuance and increased market demand.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

January 2025’s Performance Sets the Stage

While February 2025 is yet to unfold, the year began with a modest 7.28% return to date in January, as shown in the “Monthly Returns Heatmap.” January’s positive performance hints at a continuation of bullish sentiment in the early months of 2025, aligning with historical post-halving patterns. If February 2025 follows the trajectory of past post-halving years, it could see returns in the range of 22% to 63%, with an average expectation around 40%.

What Drives February’s Strong Post-Halving Performance?

Several factors contribute to February’s historical strength in post-halving years:

- Supply Shock: The halving reduces new Bitcoin supply entering circulation, increasing scarcity and driving price appreciation.

- Market Momentum: Investors often respond to the halving event with increased enthusiasm, pushing prices higher in the months following the event.

- Institutional Interest: In recent cycles, institutional adoption has accelerated post-halving, adding significant capital inflows to the market.

Key Takeaways for February 2025

Investors should approach February 2025 with cautious optimism. Historical and seasonal data suggest the month has strong potential for positive returns, particularly in the context of Bitcoin’s post-halving cycles. With an average return of 40.74% in past post-halving Februarys, investors might expect similar performance this year, barring any significant macroeconomic or regulatory headwinds.

Conclusion

Bitcoin’s history provides a valuable lens through which to view its future performance. February 2025 is shaping up to be another positive month, driven by the same post-halving dynamics that have historically fueled impressive gains. Combining historical data performance with a positive regulatory environment, the incoming pro-Bitcoin administration, and the news that The Financial Accounting Standards Board (FASB) has issued a new guideline (ASU 2023-08) fundamentally changing how Bitcoin is accounted for (Why Hundreds of Companies Will Buy Bitcoin in 2025), 2025 is shaping up to be a transformative year for Bitcoin. As always, investors should combine these insights with broader market analysis and remain prepared for Bitcoin’s inherent volatility.

Related: Why Hundreds of Companies Will Buy Bitcoin in 2025

By leveraging the lessons of history and the patterns of seasonality, Bitcoin investors can make informed decisions as the market navigates this pivotal year.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.