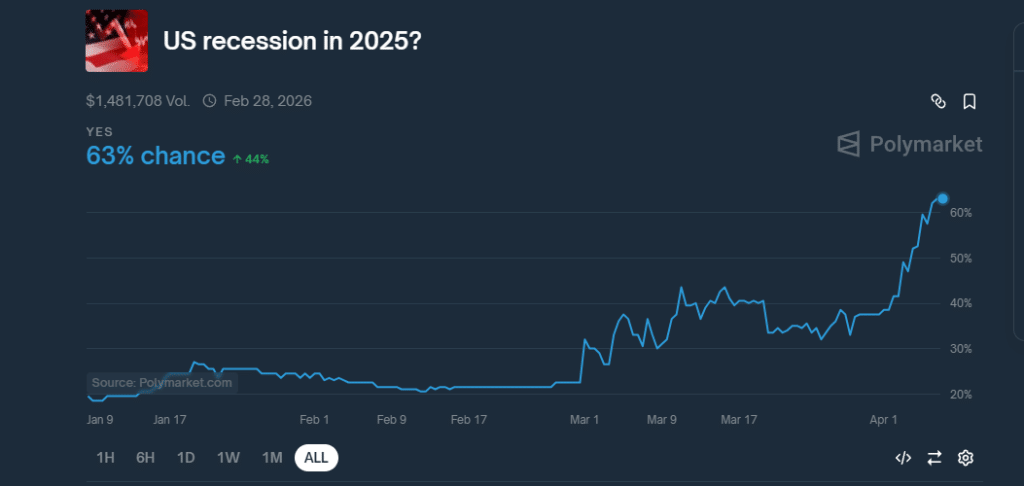

Bitcoin is facing critical selling pressure amid ongoing macroeconomic uncertainty, with bulls unable to reclaim the $90,000 level and bears repeatedly failing to break below the $81,000 support. The market remains caught in a tight range, reflecting broader investor caution as global financial conditions remain unstable. Tariffs, geopolitical tensions, and risk-off sentiment continue to weigh on high-volatility assets like Bitcoin, dampening bullish momentum.

However, some analysts argue that the worst may already be behind. According to crypto analyst Daan, when adjusting for the S&P 500’s decline, Bitcoin is now down less than 10% from its all-time highs — a significantly more resilient performance than headline numbers suggest.

This perspective highlights the importance of viewing Bitcoin in context with traditional markets, especially on higher timeframes where the correlation often becomes more apparent. While BTC remains under pressure in the short term, the relative strength against equities could be a sign of underlying resilience. If macro conditions begin to stabilize, Bitcoin may be well-positioned for a recovery as capital rotates back into risk assets.

Bitcoin Holds Strong As Equities Slide: Recovery On The Horizon?

Bitcoin is facing a crucial test as it continues to hold above critical demand levels despite intense volatility in global financial markets. While panic selling gripped investors last week, the cryptocurrency managed to show relative strength. The S&P 500 lost 10% of its value in just two days during the Thursday and Friday trading sessions—its sharpest two-day decline in years—triggering widespread fear across risk assets. Yet, Bitcoin did not break below its key support zone near $81,000 and remains within striking distance of reclaiming the $90,000 level.

This relative stability is giving bulls renewed hope for a recovery rally. According to Daan, most of Bitcoin’s decline this year has been tied to weakness in equities. When adjusted for the S&P 500’s performance, Bitcoin is now down less than 10% from its all-time highs—a notable show of strength in a market defined by uncertainty.

Daan emphasizes the importance of analyzing Bitcoin relative to traditional financial indices like the SPX. On higher timeframes, BTC and equities often show meaningful correlation, and when stocks suffer, crypto tends to follow. However, BTC’s current resilience suggests it may be ready to decouple—or at least outperform—in the next leg of the cycle. As macroeconomic tensions persist, this comparison could become increasingly valuable for gauging Bitcoin’s true strength amid broader volatility.

Price Action: BTC Consolidates Above $81K level

Bitcoin is currently trading at $83,000 after several days of tight consolidation between the $81,000 support and the $88,000 resistance level. The market remains indecisive, with bulls attempting to hold critical ground while facing continued macroeconomic headwinds. Despite brief attempts to push higher, BTC has failed to break out, and price action continues to reflect caution and fading momentum.

For bulls to regain control and validate a recovery rally, Bitcoin must decisively reclaim the $90,000 level. Doing so would not only restore bullish sentiment but also confirm the continuation of the broader long-term uptrend that began in late 2023. Without a breakout, however, uncertainty will continue to dominate.

The $81,000 level remains the most important support for now. A clean breakdown below this zone in the coming week could trigger a sharp sell-off and confirm a deeper correction phase. With global markets still rattled by economic tensions and volatility in equities, Bitcoin’s next move is likely to set the tone for the crypto market. Traders and investors are watching closely as BTC hovers at a pivotal price range that could determine its direction for the rest of the quarter.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.