Bitcoin and the crypto market are again within the purple. The primary crypto by market cap data a 2% loss within the final 24-hours and will push different digital property into vital help zones.

Associated Studying | Bitcoin Indicator Hits Historic Low Not Seen Since 2015

On the time of writing, Bitcoin is without doubt one of the best-performing property on this rating solely surpassed by Binance Coin (BNB) and Ethereum (ETH), in response to knowledge from Coingecko. BTC’s value trades at $37,600 with a 7% loss over the previous week.

After a significant outage to its community, Solana (SOL) data a 16% loss and stands because the worst-performing cryptocurrency by market cap. Terra’s native cryptocurrency LUNA carefully follows with a 15.5%.

These losses appear small when in comparison with different cryptocurrencies within the high 100 by market cap. Tokens that have been increased within the rating, like Shiba Inu (SHIB) and Avalanche (AVAX), now document as a lot as 20% losses in a single week alone.

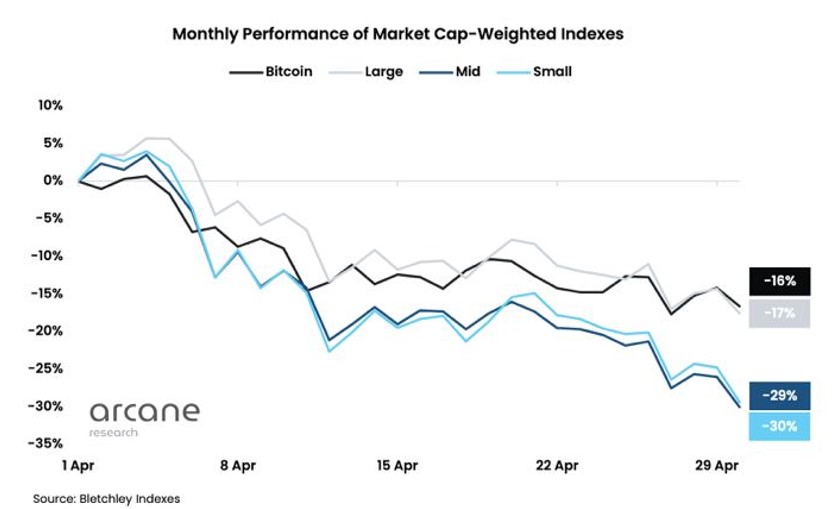

In response to a current report from Arcane Analysis, smaller cryptocurrencies have been underperforming within the present market situations. Traders appear to be fleeting to “security” because the urge for food for threat decreases pending a possible 50 foundation level enhance from the U.S. Federal Reserve (FED).

Whereas Bitcoin and bigger cryptocurrencies have been exhibiting a correlation with a 16% loss for April, Arcane Analysis’s small-cap index and mid-cap index are trending decrease. The previous document a 30% loss whereas the latter data a 29% loss over the identical interval.

Conversely, Bitcoin’s dominance has been shifting reverse to small cash. This metric stands at 42% with a excessive likelihood of extending as macro-conditions proceed to show unfavorable. Arcane Analysis famous:

Stablecoins additionally see rising dominance. UST has entered the highest 10, changing into the primary algorithmic stablecoin to attain this. We now have three stablecoins among the many high 10, and 4 among the many high 11, illustrating the present flight to security tendencies available in the market.

What To Count on From Bitcoin In The Quick Time period?

A separate report from FTX Entry claims the market is pricing 50 bps hikes for the upcoming 4 FED conferences. This could place rates of interest at round 2 or 2.5 bps for the top of 2022.

Associated Studying | Bitcoin Taker Purchase-Promote Ratio Rebounds Again Into “Maintain” Zone

In that sense, FTX Entry claims that until there’s a shock from the monetary establishment, the market might see some reduction:

Powell’s tone shall be fascinating however with out elevating +75bps or rising the tempo of QT it’s a excessive bar for a hawkish shock. A few of that is trigger for optimism, however sadly sentiment is all-time low.