For the longest time, bitcoin miners have held on to the spoils of their actions. That’s when the profitability of mining the cryptocurrency was nonetheless excessive. On account of a excessive money move, these miners may afford to carry on to portion of their rewards whereas having the ability to nonetheless perform their operations. Nonetheless, current market traits have tanked the profitability of bitcoin mining, main miners to begin dipping into their BTC stash and promoting to maintain operations alive.

Bitcoin Miners Are Promoting

A great variety of bitcoin miners had held on to the appreciable baggage principally by way of the bear market. With the flip of the market and bitcoin now buying and selling under $29,000, it has grow to be tougher for miners to carry on to those cash with out compromising their means to fund their operations. The results of this has been quite a lot of distinguished bitcoin mining corporations popping out to say that they’ve bought or can be promoting among the BTC they maintain.

Associated Studying | Bitcoin Change Outflows Counsel That Buyers Are Beginning To Accumulate

Marathon Digital is little question one of many first names that pop up when the subject of bitcoin mining comes up. The corporate has been in a position to cement its place as a prime contender within the mining world and has attracted numerous traders however even large corporations haven’t been in a position to escape the market onslaught.

Final month, the agency had introduced throughout an earnings name that it could must promote a few of its bitcoin holdings. Marathon Digital holds greater than 9,600 BTC, most of which it has held for nearly two years. Nonetheless, it appears the day of reckoning is quick approaching and even massive corporations must eliminate a few of their BTC.

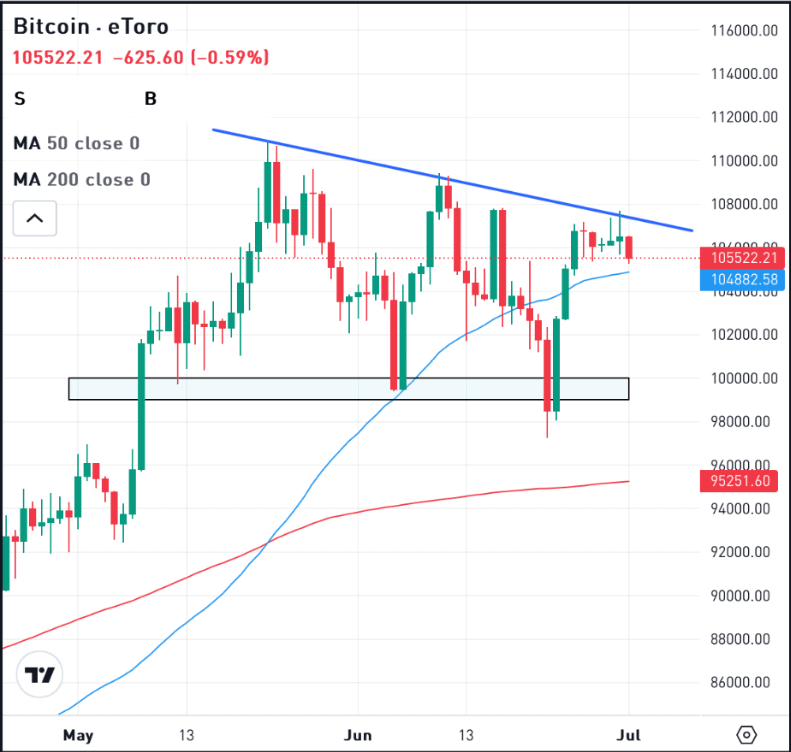

BTC continues to battle as sell-offs intensify | Supply: BTCUSD on TradingView.com

Firms which have already bought a few of their BTC embrace Riot and Cathedra Bitcoin. Riot had reportedly bought about $10 million price of Bitcoin again in April which got here out to a complete of 250 BTC. Most just lately, Cathedra Bitcoin had introduced that it bought 235 BTC at a mean value of $29,152. It got here out to a bit of over $8.7 million. The corporate defined in its report that this was to assist it insulate “itself from extra declines within the value of bitcoin and maintains its liquidity place.”

Mining No Longer Worthwhile?

Bitcoin mining stays worthwhile however with the value greater than 50% down from its all-time excessive, the profitability has declined by a major margin. A report from Bitcoinist highlighted the profitability of BTC mining machines. The miners are actually returning 50% much less money move than they did when BTC was buying and selling at $69,000.

Associated Studying | Bitcoin Rests Tentatively Above $31,000, Bull Rally Or Lure?

Moreover, day by day miner revenues are nonetheless on the low aspect. It had grown by 4.50% final week to land at its $26,706,581 worth however these stay low. It’s a results of the typical transaction worth and day by day transactions being down over the previous week.

Religion in bitcoin mining shares can be on the decline. So now, miners are compelled to promote a few of their BTC holdings to have the ability to preserve their operations going.

Featured picture from Outlook India, chart from TradingView.com

Observe Best Owie on Twitter for market insights, updates, and the occasional humorous tweet…