Kane McGukin has 13 years of wealth administration expertise spanning brokerage and institutional fairness gross sales. He’s an impartial registered funding advisor.

Because the calendar neared September 2021, the cash printer had slowed and people had been starting to tire from the toils of buying and selling a basket of work-from-home shares. At this level, COVID-19 was over, the crash was previous information and lockdowns had been nearing two years previous. Most had been seeking to shift their focus to one thing new. One thing like getting again to what was once their actual day jobs.

You Can Solely Hold An Animal Caged For So Lengthy

That’s the powerful actuality of the nook the Federal Reserve has boxed itself into.

For many years, the Maestro had carried out a seemingly stunning orchestra, however you may solely preserve individuals and monetary devices locked up for thus lengthy. Finally, there’s a breaking level — a degree the place you may now not therapeutic massage the info or print sufficient cash to fulfill human greed. Greed, that inner emotion that leads one to imagine if they only get more cash, they’ll discover happiness.

In some unspecified time in the future, animal spirits start to stir. In instances of financial stress, these spirits have a voice of their very own. One that can’t be tamed or managed by a board of 12 members, headed by a chair.

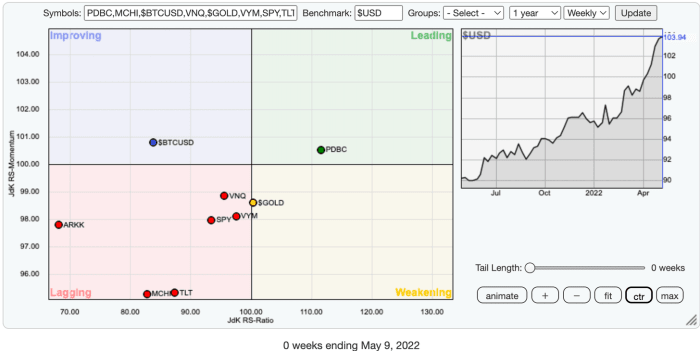

For a few years, and extra particularly in 2021 and 2022, I’ve watched the rotations of the key monetary asset lessons. Just lately, to my shock, solely three asset lessons have had optimistic returns over the past seven months. These are commodities, gold and the greenback (although when accounting for [tru]inflation, 11.8% now with a peak of 12.74%, the greenback’s return is definitely damaging as of time of this writing).

Notice: precise actual property has been up and fairly bubbly in lots of locations within the U.S., although the general public market ETF exhibits damaging returns. Probably as a result of public markets are all down and it’s a publicly traded instrument.

Most property have been punished since late 2021, as markets started to chill and charges began to reverse their 40-year downtrend.

When Cash Is Free, Leverage Builds In The System

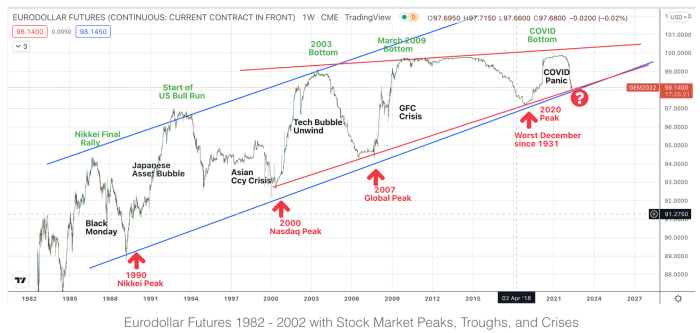

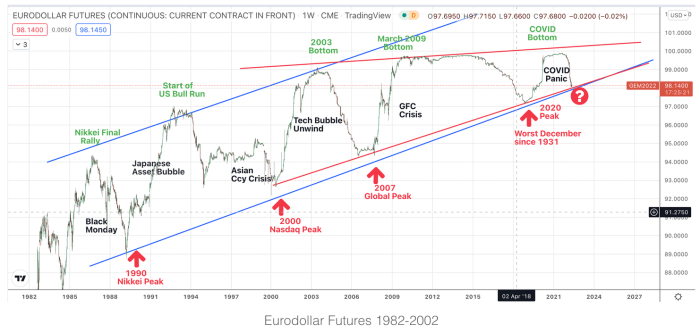

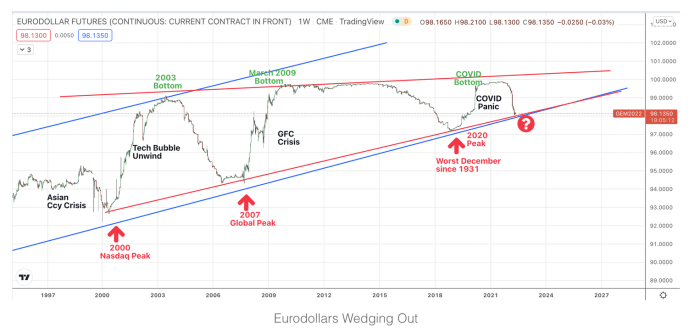

The eurodollar market is a bit obscure in that its dimension is comparatively unknown (about $14T in 2016), and it was answerable for roughly 90% of worldwide loans in 1997. So, one can assume that eurodollars are the middle of most world monetary exercise with regards to lending. That is abundantly clear when viewing the eurodollar futures chart beneath.

Background: The eurodollar market began in 1957 when non-U.S. banks started holding {dollars} on behalf of entities or nations probably being blocked from holding precise {dollars} instantly with U.S. banks. For doing so, these middleman banks obtained greater curiosity on the {dollars} they lent out and in addition paid the next stage of curiosity to the rightful, however not precise, proprietor/holder of the {dollars}. Given the extra linkages, which result in extra layers of danger, it is sensible that greater rates of interest are anticipated by buyers.

These {dollars}, roughly, grew to become a second spinoff of the U.S. greenback.

If you break it down, is it probably not simply a world financial institution holding {dollars} and re-lending them outdoors of the purview of the authorized jurisdiction of the Fed?

Successfully, these non-U.S. banks create cash with out having the identical powers because the U.S. Fed. Bear in mind, the worldwide notion is that the Fed is the one one who can lend {dollars}. Nonetheless, as a result of world unfold of fractional reserve banking and monetary engineering, we will see that by eurodollars many different banking establishments have been taking part in “Fed” with their very own re-lending of {dollars} all through the worldwide monetary system.

During the last 37 years, a transparent channel was established for the eurodollar. As worth approached the higher facet of the channel (nearing par), bottoms shaped in monetary markets; and as worth approached the underside facet of the channel, tops shaped in numerous world markets.

Notice, the underside facet foreshadowed a few of the worst monetary crises in historical past as world leverage unwound and eurodollar costs started spiking greater throughout these runs towards $100.

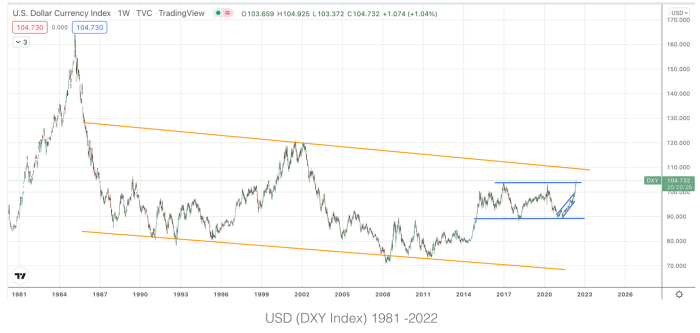

Because the chart exhibits, within the Nineteen Eighties, the growth in credit score was actually starting as globalization started heating up. At this level, with U.S. {dollars} firmly cemented as the worldwide reserve foreign money, it was the eurodollar that was the precise progress driver. They had been used to finance world progress, create leverage or in some circumstances circumvent sanctions by the U.S. Exterior of disaster instances, eurodollars typically rose whereas precise {dollars} fell. Through the powerful durations, lending and leverage would abate, whereas credit score was unwound and disasters struck world monetary markets (eurodollars falling, {dollars} rising).

Definitionally, “Eurodollar futures are interest-rate-based monetary futures contracts particular to the Eurodollar, which is just a U.S. greenback on deposit in business banks outdoors of the USA.”

The TL;DR

In newer a long time, as most property have been financialized, only a few really maintain the underlying asset, and most transactions or loans depend on reserves, credit score or a ramification of some variety, slightly than the switch of a bodily underlying asset.

For instance, with eurodollar futures as an expectation of future charges, in the event that they fall from 99 to 98 the expectation is for charges to fall (relationship: the underlying — {dollars} — go up).

That is what the Bretton Woods system promoted: borrow low cost cash (at low charges) to lever up and purchase property.

As charges start rising, it will definitely slows the inducement to purchase property which might be rising over time. This encourages early spinoff levers to unwind again to {dollars}, Treasuries, and/or gold (security) as market danger will increase. That’s the flight to security: again to a “danger free” asset. In flip, this promoting of property and shifting again to security, places strain on costs and crashes, with late patrons or weak fingers shedding cash. After being flushed out, the method begins once more with eurodollars at a lower cost and room to reflate to the upside once more. After I take a look at these charts, that is what turns into abundantly clear.

From the ‘80s to now, the greenback fell from $160s to a low of round $70, whereas eurodollars rose from round $85 to simply underneath $100. One acted because the reserve, and the opposite because the software of leverage and credit score to drive world consumption.

In line with Wikipedia,

“A number of elements led eurodollars to overhaul certificates of deposit (CDs) issued by U.S. banks as the first non-public short-term cash market devices by the Nineteen Eighties, together with:

- The successive stability of funds deficits of the USA, inflicting a internet outflow of {dollars};

- Regulation Q, the U.S. Federal Reserve’s ceiling on curiosity payable on home deposits throughout the excessive inflation of the Nineteen Seventies

- Eurodollar deposits had been a less expensive supply of funds as a result of they had been freed from reserve necessities and deposit insurance coverage assessments”

Taking A Nearer Look

Zooming in, what’s most fascinating is the wedge that has begun to kind in recent times. For the reason that Nice Monetary Disaster, worth has not reached the higher sure indicating a waning momentum.

Pondering this by, it is sensible on a few fronts.

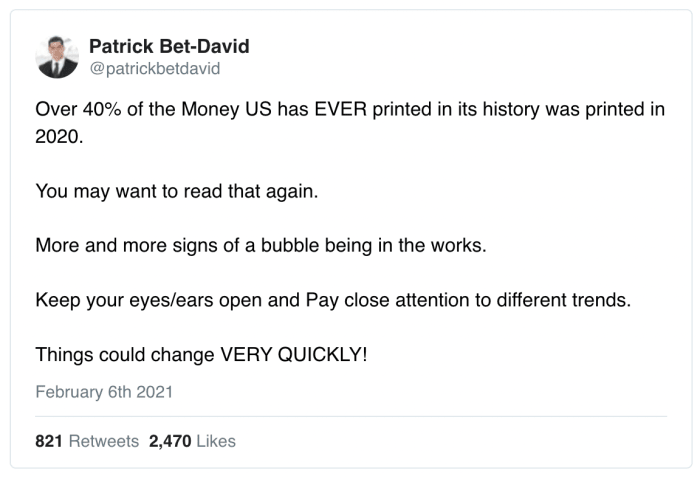

First, globally, we’re at peak credit score and cash sloshing round within the system. U.S. authorities stimulus in 2020 amounted to 40% of all {dollars} ever created. Suppose on that one for a minute.

(Source)

So, if the common individual wants credit score or leverage, it’s typically accessible a technique or one other.

Second, if you concentrate on eurodollars as a spinoff of the greenback, then it might make sense that you wouldn’t wish to pay over par (100) to lever-up greater than wanted. Particularly if the interior price of return was not considerably greater than your borrowing price. It simply doesn’t make mathematical sense.

Final, eurodollar futures are additionally a gauge for rates of interest in that they reply to 3-month Libor rates of interest. Since 1981, rates of interest have fallen from 16% to close 0% in 2021. As an inverse, the eurodollar rose. Have been Treasuries appearing as a financial savings mechanism whereas the spinoff eurodollar was the credit score mechanism? Throughout this era, appearing as the worldwide reserve foreign money, the U.S. has largely been the benefactor right here.

That’s why present macro and geopolitical skirmishes are so heated nowadays.

Wanting again on the chart, this dynamic makes the wedge setup very fascinating.

Wedges at peaks and troughs have a tendency to point worth corrections and pattern modifications in the other way. On this case, eurodollars would possible fall to the mid- to low-90s. If that had been to be, I can think about it might imply loads of gamers in world markets can be de-levering for one motive or one other.

Moreover, it might point out that rates of interest would have much more room to upside. Inflation anybody?

Once more, as a second or third spinoff, why would you wish to pay over 100 to bid it up much more? Room to the upside is required until your entire world goes on a zero interest-rate coverage.

That might imply rates of interest must go damaging and keep damaging, which doesn’t precisely work. A couple of European international locations tried this, solely to cease someday after as they’d no thought as to what else may break within the system. Nor did they perceive the unintended penalties as a result of it’s by no means been finished earlier than (besides in Japan).

The setup appears to recommend we might even see a reflation of shares, however possible not for too lengthy as there are solely two factors to the upside earlier than reaching eurodollar par (100). Is the following eurodollar rollover the all-asset bubble? Is it a high quality indicator? Or, does the U.S. pull out the Japanese playbook and take charges damaging to stave off the inevitable?

Granted, we’ve mocked and criticized Japan for the higher a part of 30 years, so there can be an about-face if the U.S. had been to reverse course in financial insurance policies. By the identical token, it is laborious to say what the present administration is succesful or incapable of doing nowadays. Sorry, the proof’s within the information.

My thought after this overview is that the eurodollar has been an instrument that allowed for large world credit score and leverage for over three a long time. However, there’s now not any room to run as a result of we’re primarily at 100. To ensure that the Fed and different central banks to kick the can down the highway as soon as extra, they’ll want one other software.

(Source)

The Function of Stablecoins? Eurodollars 2.0?

(Source)

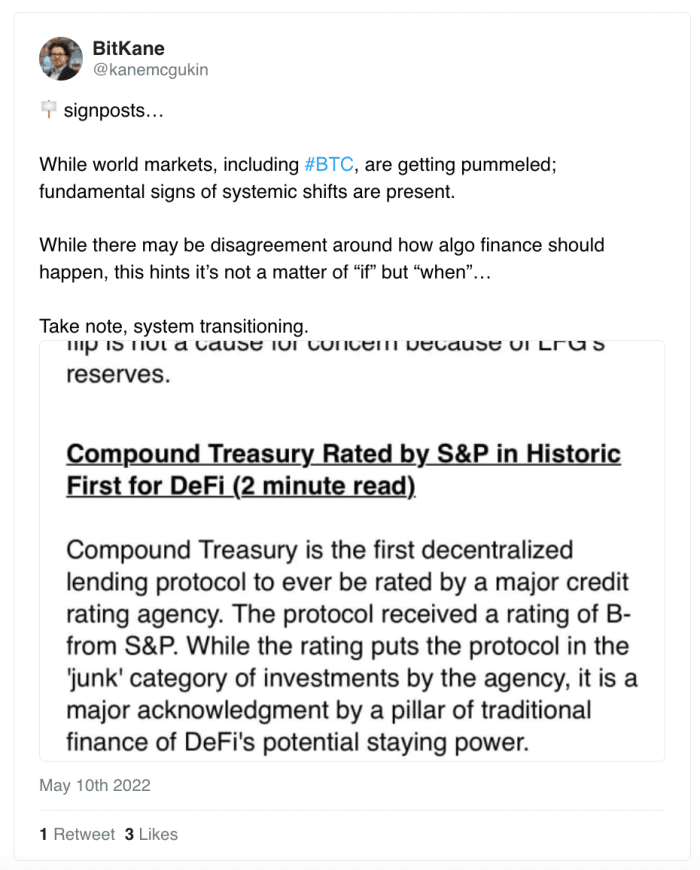

First issues first. If cryptocurrency was pointless, then the S&P has no enterprise taking a look at Compound, a Decentralized Finance (DeFi) rate of interest protocol. A lot much less, giving it a score! That’s a basic signal, in my view, that cryptocurrency is right here to remain, and the monetary rails are positively in transition.

With the Fed and different world central banks out of ammunition, and people and establishments tired of dwelling with out credit score (being largely productive). There are solely two choices:

- Take an enormous haircut: Let the eurodollar fall and de-lever whereas the worldwide monetary system unwinds in a nasty approach.

- Introduce one other software in a parallel monetary system that permits for leverage and lending to hold on, however extra importantly, permits governments to kick the can down the highway as soon as once more. That’s the trail chosen for the final 20 years. That’s a job stablecoins and central financial institution digital currencies (CBDCs) may fill, the latter of which might be full Trendy Financial Principle, in my view. Additionally including a a lot deeper Large-Brother perception into how and the place individuals spend their cash. (Bear in mind how effectively this labored out with Fb…) Plus, offering the aptitude so as to add or pull funds at any level that companies need, and for any motive.

Assuming a brand new unit is added to the foray of leverage ({dollars}, Treasuries, eurodollars, stablecoins/CBDCs), this probably permits — at minimal — disbursement of the leverage that has occurred on a singular sound asset, gold. For a fast primer on this previous historical past, learn Nik Bhatia’s “Layered Cash.” It’s straightforward and a must-read.

As well as, we’re at present watching a brand new parallel monetary system being constructed. That’s the Bitcoin community and it offers an extra and much-needed sound cash asset.

Bitcoin together with different digital asset integrations offers on- and off-ramps between stablecoins, digital property and conventional greenback property/monetary markets. Within the coming a long time, cash will be capable of circulate from our previous world greenback monetary community to a brand new monetary community constructed on Bitcoin, as a result of in spite of everything, information is the brand new oil. And cash is the best type of communication that we’ve.

These supporting casts will probably be essential because the system continues its transition, very like it did within the Thirties from a gold-based system to the Bretton Woods system of pegged currencies. Finally, a gathering will probably be held and the brand new Bretton Woods settlement will probably be introduced, paving the way in which for the Bitcoin financial system to supply ample assist to the failing, previous and rusty monetary rails of the previous.

The subsequent few a long time of finance are going to be enjoyable, however not with out a few bumps and bruises as we’ve seen lately with the demise of the algorithmic stablecoin Terra Luna.

Opinions expressed on this article are to not be thought-about funding recommendation. Previous efficiency is just not indicative of future efficiency as all investments carry danger together with potential lack of precept.

This can be a visitor submit by Kane McGukin. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.