Background

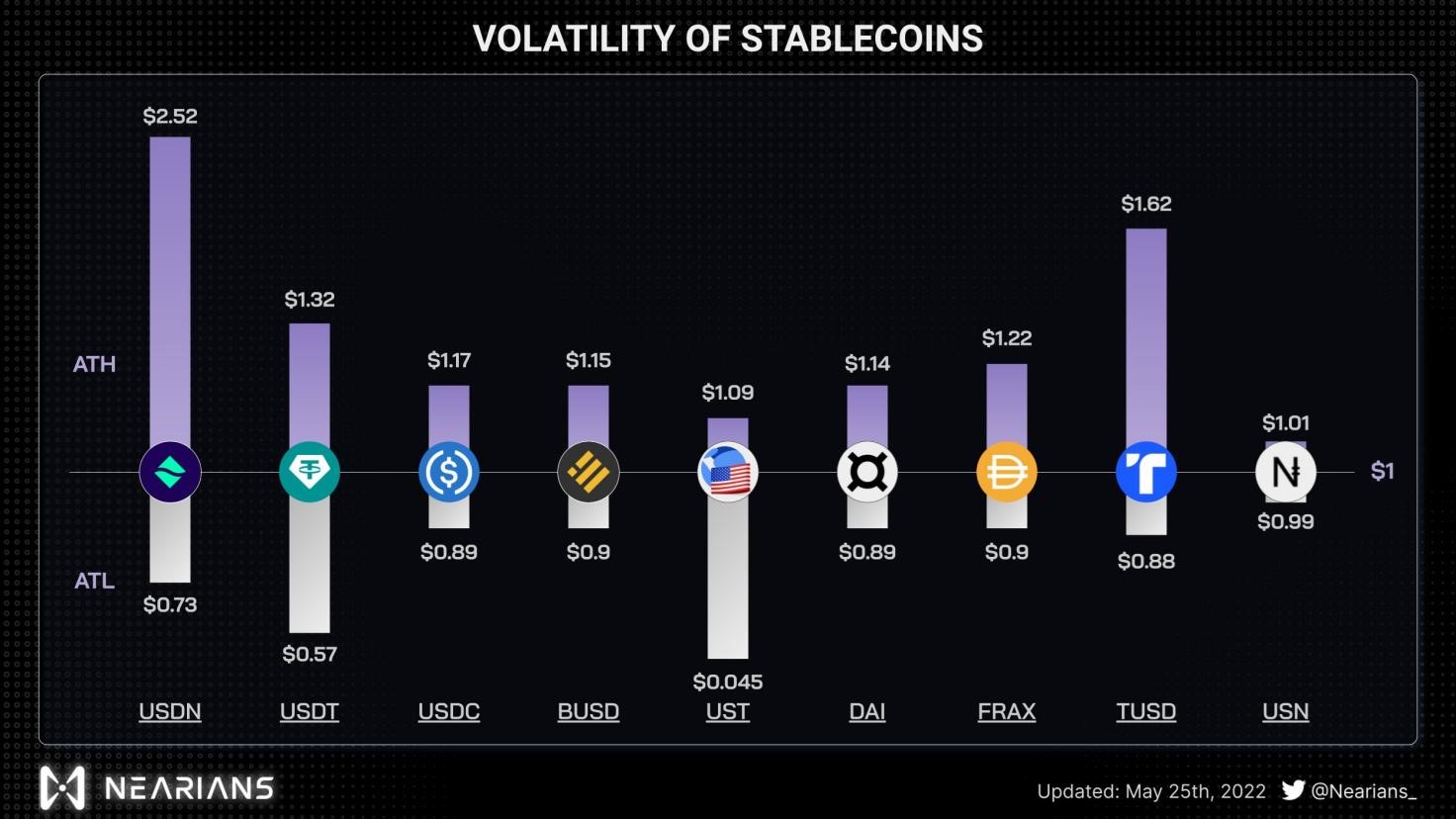

In Might 2022, UST and LUNA, which as soon as recorded a complete market cap of over $40 billion, collapsed in a single day, and loads of customers suffered enormous losses because of this. Following the crash, algorithmic stablecoins have as soon as once more develop into a preferred crypto subject. USN, a stablecoin native to an rising public chain named NEAR, was launched nearly concurrently UST collapsed. The autumn of UST confirmed this nascent stablecoin how the loss of life spiral of an algorithmic stablecoin can engulf and destroy all the pieces like a terrifying black gap, and customers additionally wonder if USN may keep away from an analogous ending sooner or later.

About USN

As the primary NEAR-native algorithmic stablecoin, USN is soft-pegged to the US Greenback and backed by a Reserve Fund that accommodates collaterals akin to NEAR and USDT. USN is positioned to be an efficient solution to bootstrap liquidity within the NEAR ecosystem whereas including a brand new layer to NEAR’s utility as a token. USN’s core stability mechanisms include on-chain arbitrage and the Reserve Fund based mostly on the Forex Board precept. Decentral Financial institution (https://decentral-bank.finance/), the DAO growing and supporting USN, manages the sensible contracts of $USN and its Reserve Fund. The DAO can vote to stake the NEAR from the Reserve Fund and distribute the staking rewards to the customers of protocols that combine USN.

USN’s issuance mechanism

The preliminary provide of USN is double-collateralized by NEAR and USDT by way of the Reserve Fund. Decentral Financial institution points the preliminary provide of USN by over-collateralization of the preliminary collateral (NEAR) at a ratio of two:1. Subsequently, the brand new USN will likely be instantly minted with NEAR or different stablecoins at a 1:1 ratio. In different phrases, after preliminary issuance, customers can mint new USD with NEAR or different stablecoins at a 1:1 ratio, they usually may also instantly convert NEAR into new USN within the Sender pockets. Nonetheless, not like Terra’s UST minting mechanism, NEAR used for such conversions isn’t instantly burned however will likely be channeled into Decentral Financial institution’s Reserve Fund. In the meantime, when USN is burned, an quantity of NEAR that’s definitely worth the equal worth will likely be added, which resembles UST’s burning mechanism.

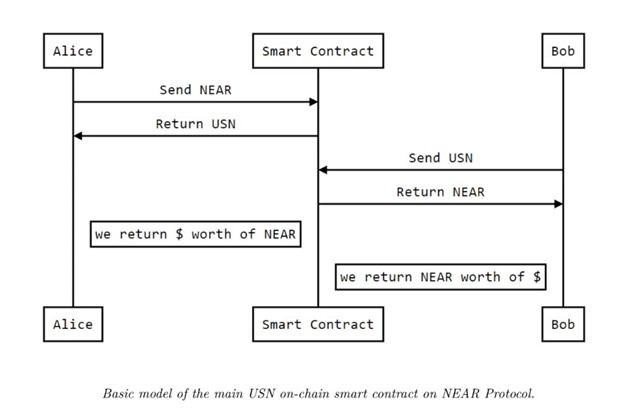

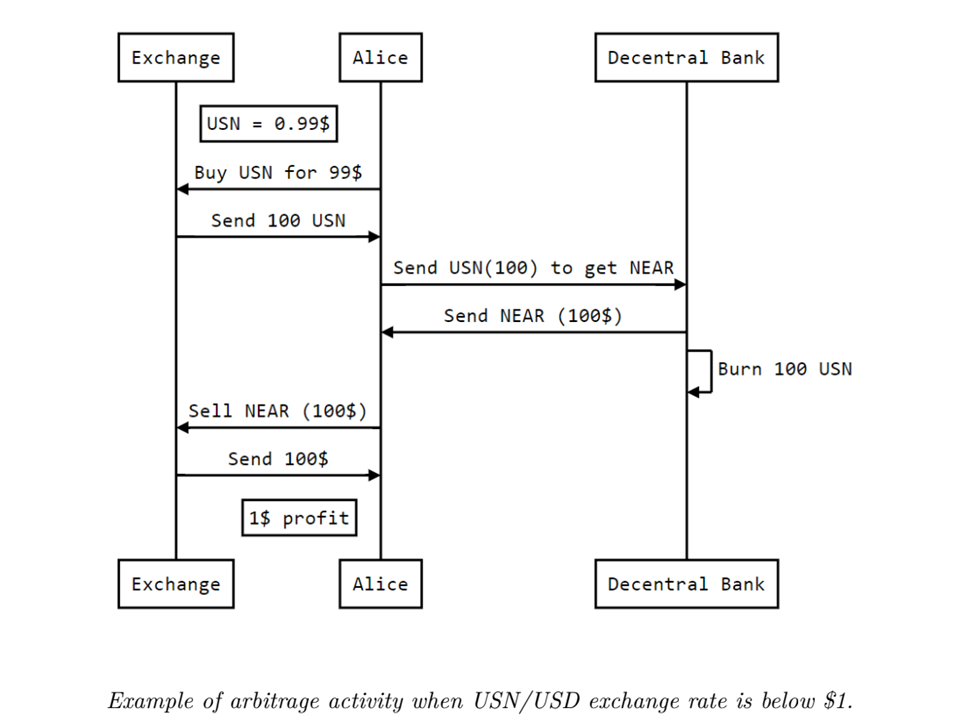

Pegging mechanism

USN’s 1:1 peg to the US Greenback is secured by on-chain arbitrage and the Reserve Fund. USN maintains its peg by a wise contract which permits for the alternate of NEAR for USN with 0 slippage and minimal commissions. As quickly as USN loses its peg, arbitrageurs will exploit the worth distinction between NEARUSN and NEARUSD till USN returns to its peg. At its launch, part of the USN provide will likely be deposited into Ref Finance’s StableSwap to enhance the stablecoin’s liquidity by liquidity mining incentives.

Automation of Treasury Administration

Automation of Treasury Administration is a design distinctive to USN. Each USN issued is backed by the corresponding collateral that’s saved within the Reserve Fund. Decentral Financial institution, the supervisor of the Reserve Fund, manages such collaterals by NEAR-based sensible contracts. These on-chain contracts routinely execute Treasury Administration methods in order that they might carry out dynamically configurable, real-time small-volume transactions to keep away from any extreme imbalances within the Reserve Fund. Based on USN’s whitepaper, the first Treasury Administration methods are as follows: When the NEAR worth rises to the purpose the place the upward pattern slows down, Decentral Financial institution would promote NEAR to stability the property of the Fund. Conversely, it will purchase NEAR when the worth drops to a degree the place the downward pattern slows down. With this design, Decentral Financial institution plans to promote NEAR to go off the bubbles when the worth turns into overheated and maintain the market secure when the customers begin to panic as a result of worth drops.

Comparability between USN and different algorithmic stablecoins

USN comes with its personal distinctive options and incorporates the options of another algorithmic stablecoins. The preliminary provide of USN is issued by the Reserve Fund by way of the double over-collateralization of NEAR and USDT. That is barely completely different from the issuance mechanism of DAI, which is minted by collateralizing an quantity of ETH that’s value twice the worth of the DAI to be minted.

A controversial side of UST is that the UST minted could be extra beneficial if the LUNA worth soars. In the meantime, the LUNA provide would go down, which might drive up its worth, thereby creating an upward spiral. Nonetheless, as soon as LUNA goes downhill, redeeming LUNA with UST would result in a LUNA crash, giving rise to a loss of life spiral. Not like the non-collateralized UST, the NERA spent on minting USN isn’t instantly burned or erased from circulation however enters the USN Reserve Fund as a substitute. The Reserve Fund then stabilizes the market upfront by Automation of Treasury Administration to keep away from any extreme worth impacts that the USN provide could have on NEAR. Aside from NEAR, USN can also be partially backed by USDT. UST, however, is backed by Luna Basis Guard, which holds reserve property akin to Bitcoin and AVAX which might be extremely correlated with LUNA. As such, when the market declined, Luna Basis Guard failed to assist UST preserve its peg. From the attitude of collateral, USN is, to a sure extent, extra like FRAX, a fractionally-collateralized stablecoin.

May USN keep away from the loss of life spiral?

As of Might 31, the USN provide is value $108 million, whereas NEAR includes a $4.3 billion circulating market cap, a $6.1 billion FDV, and a $607 million 24H buying and selling quantity. In contrast with NEAR’s market cap and buying and selling quantity, the danger dealing with USN remains to be manageable. As well as, when USN is issued, the Reserve Fund, based mostly on the Forex Board precept, will obtain a corresponding quantity of NEAR or different stablecoins. It routinely balances to take care of a backing of $USN at a fee better than 100% always. Due to this fact, beneath regular circumstances, a critical USN de-peg is unlikely to occur.

Nonetheless, because the USN provide expands, customers can solely mint USN with NERA, which signifies that the Reserve Fund could not essentially have the equal quantity of stablecoins. If the Reserve Fund did not swiftly reply to an enormous worth drop of NEAR beneath excessive circumstances, then USN may lose its peg, and loads of holders may discover it exhausting to redeem their USN: changing USN into the equal worth of collaterals.

As such, to get ready for the affect of utmost circumstances, USN should improve the earnings of the Reserve Fund by way of such strategies as minting charges, Automation of Treasury Administration, and NEAR staking income. In the meantime, the availability of USN ought to be capped to keep away from the technology of extreme bubbles when the market overheats, bubbles that may be an insufferable burden if the market turns bearish.

Conclusion

No algorithmic stablecoin is ideal, and USN additionally has its professionals and cons. Thankfully, NEAR’s USN witnessed the historic Terra/UST meltdown throughout its infancy, which gave a robust warning to the builders and customers of USN. By way of such components as the present provide and collateral reserve, USN is unlikely to run right into a loss of life spiral. Nonetheless, as stablecoin turns into extra extensively adopted, the availability will broaden, and the danger of a loss of life spiral will improve. By then, USN will face extra challenges.