Regardless of what has been a tough downturn for the cryptocurrency market, blockchain gaming is proving its longevity for the long run by way of tasks exhibiting clear resilience and rising as new leaders within the house.

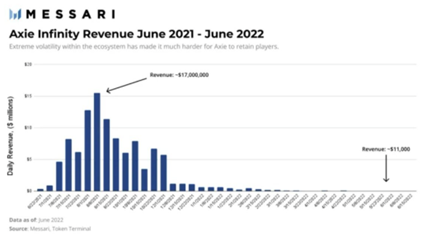

Axie Infinity (AXS), whose pet-themed buying and selling blockchain recreation catapulted to notoriety in the course of the financial shutdowns of 2020, has continued its painful descent over the weekend, with energetic customers contracting to beneath 60k. As famous in an exhaustive Twitter (TWTR) thread covering Axie’s market shift, these numbers are in stark comparability to the three million participant excessive at Axie’s spectacular peak.

Axie’s income has additionally decreased from $17 million/week to $11,000/week, and solely 10 new Axie holders are becoming a member of the neighborhood per day. The mint to burn ratio has additionally hit a important level, with the Axie “breeding” market struggling consequently.

Splinterlands (SPS), the worldwide main gaming Dapp, nonetheless, continues to onboard a whole bunch of customers a day, bringing in regular income and rising its participant base, even whereas many different Internet 3.0 tasks, like Axie, wrestle. Energetic gameplay stays constant, seeing anyplace from 250k-450k day by day energetic customers. Splinterlands continues to replace key facets of the platform, launch new updates and work together with their neighborhood on a weekly foundation, locking of their agency place within the primary spot of the blockchain gaming vertical and setting their sights on rivaling the mainstream gaming business. Amongst the a whole bunch of 1000’s of day by day energetic customers, Splinterlands sees 3M-5M transactions per day and has 10-12M battles which are performed day by day. With their latest node sale, they noticed an 11-minute sellout of their first tranche (2000 node licenses) and have burned or despatched over 35 Million Splintershards (SPS) to their DAO.

In a time when all of Internet 3.0 is being examined, Splinterlands is rising as a transparent winner within the gaming house.

Splinterlands CEO Jesse “Aggroed” Reich stated that alongside their dedication to an engrossing recreation and thriving neighborhood, deflationary mechanisms and an natural financial system based mostly on the wants, desires, and enter of its gamers has all the time been on the core of the platform.

These deliberate, built-in strengths have seen Splinterlands efficiently navigate the storms of the cryptocurrency house–now, a number of occasions.

“We consider in decentralized gaming. It’s the long run,” he stated. “Splinterlands is taking part in a important position in bringing this future about, exhibiting in real-time how the challenges of the sector may be overcome and the way an unimaginable recreation may be enhanced and continually improved by the chances of Internet 3.0.”

“From the beginning,” he continued, “We have now had in thoughts numerous these financial parts that at the moment are taking part in out: card pack deflation, differentiation between battle ranks, strategic staking, and node purchases obtainable to anybody who desires to construct the way forward for gaming with us. And we’re seeing that these methods, alongside our constant participant onboarding, are working, even by way of a devastating bear market.”

The financial questions surrounding decentralized gaming require considerate consideration because the challenges are labored out in a unstable business–not so completely different from the Internet 2.0 revolution of prior years–and Splinterlands appears to be providing this wanted growth each for its personal recreation and on behalf of the entire new frontier of the GameFi business.

A number of parts to what Splinterlands is doing proper stand out.

First, for gamers, there’s a fixed draw. The sport is constructed with a powerful and interesting technique, in addition to a charming storyline, graphics, and soundtrack; there isn’t any GameFi with out the recreation.

However from the financial facet, there’s additionally a substantive draw. Gamers will discover they’ve continuous, worthwhile alternatives to earn as they develop strategic prowess.

Like Axie, however with no comparable financial downturn, the Splinterlands prolonged neighborhood has developed ample “guild” and scholarship techniques by way of their buzzing Discord channel, obtainable for gamers of all ranges and financial contributions. These guilds are comprised of teams of gamers from the neighborhood, often run by an account or a number of accounts with giant aggregates of in-game belongings. The belongings are then delegated out to be used by the members (often known as “students”), who’ve the chance to play and earn on the larger ranges. These teams profit all immediately concerned, in addition to the whole recreation’s financial ecosystem.

Lots of the guilds are at present recruiting students, and new customers can interact in these teams straight away and discover shared methods of progressing by way of Splinterlands.

Guilds usually are not absolute safety towards a vicious bear market. Axie’s ample guilds, which contributed considerably to their explosive success in 2020, haven’t been capable of maintain the platform by way of the cryptocurrency market’s latest decline. Nonetheless, paired with the prolonged community of mechanisms ordered towards a recreation’s longevity, guilds show a strong and constant technique of inspiring enthusiasm in new customers and ongoing dedication to the sport in its gamers of all ranges.

Splinterlands has additionally been vigilant about its card releases, avoiding flooding the in-game market and constructing in efficient deflationary mechanisms. Thus, no playing cards from earlier sold-out collections have misplaced worth when evaluating their worth at this time to their worth at launch.

Splinterlands additionally regularly provides match awards and weekly prizes, and not too long ago introduced the cut up between its “Fashionable” and “Wild” battle codecs, permitting for a extra even match between gamers of various ranges of ability and card possession, in addition to the resultant doubled obtainable earnings for all gamers because the reward swimming pools had been doubled in dimension.

GameFi capitalists are additionally flocking to Splinterlands at a gradual charge, bringing in much more continuous worth to the platform. With the sport’s elaborate staking system and detailed roadmap, investor confidence is regular and rising.

There are a variety of artistic methods for organizations to get entangled within the Splinterlands ecosystem, together with the acquisition of card packs and, particularly now, nodes. Each can be found at an opportune time for these buying with the in-game forex of Darkish Vitality Crystals (DEC), with card packs typically hovering beneath simply $4 per pack.

As weaker tasks proceed to really feel the stress of the bear market, and Splinterlands continues to thrive, buyers are seeing the sport as a transparent Internet 3.0 progress alternative. Earlier this yr, Balthazar, who was backed by Aspect Door Ventures, was seen streaming a $1 Million USD pack opening value of Splinterlands belongings.

The wrestle of the cryptocurrency house continues, and the basics of blockchain tasks are proving important to survival maybe greater than ever earlier than.

However despite the “Wild West” that’s blockchain technological growth, Splinterlands is proving itself because the de facto chief of GameFi, succeeding within the midst of a sea of downturn and setting the stage for Internet 3.0’s place within the gaming business for years to come back.

Picture by Pexels from Pixabay