[ad_1]

Every day Conquest 8.16.22 #062

Every thing it’s essential to know of right this moment’s fast-moving crypto markets

Subscribe to this day by day e-newsletter TO NEVER MISS AN ISSUE.

The crypto market is a wild, wondrous and intimidating place; don’t trek alone! Subscribe to The Crypto Conquistador, and allow us to be your information.

Overview

- Arthur Hayes’ Ethereum prediction.

- Market pause. The place can we go from right here?

- Vitalik desires to punish some validators.

- Can Acala re-establish aUSD peg?

Good morning Fam,

The previous BitMEX CEO is at it once more by releasing one other very informative article the place he explains his buying and selling methods and predictions main into the key occasion.

Most of us don’t have time to take a seat down and skim the 30-minute weblog publish, however I did you the stable of recapping the advanced materials to its most simple ideas. Only for you!

Hayes is presently studying Alchemy of Finance by George Soros, which impressed him to write down the publish. The central concept of Soros is the “concept of reflexivity” — a suggestions loop between market contributors and costs.

Fundamentals of Idea of Reflexivity

- Market contributors’ notion of a given market state of affairs influences how the state of affairs performs out.

- These expectations affect the details (“fundamentals”).

- Shapes expectations.

- A suggestions loop that turns into a self-fulfilling prophecy.

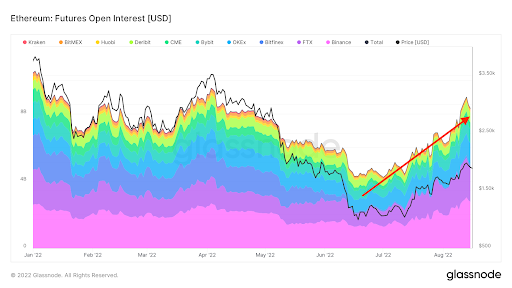

After Hayes spends the vast majority of the weblog publish outlining the inputs and outputs per the speculation of reflexivity, he then weighs the data towards the market’s present outlook for Ethereum. General, the futures market seems to carry a brief ETH place, which incorporates merchants hedging their spot Ether or contributors who plan to obtain the free chain-split tokens.

“ Provided that your entire curve out to June 2023 is buying and selling in backwardation — that means that the futures market is predicting ETH’s worth by the maturity date will likely be lower than the present spot worth — there may be extra promote strain than purchase strain on the margin.” *Chart beneath.

In line with Hayes, if the merge is profitable, the ETH shorters will possible shut their positions, and only a few will shut lengthy spot positions. Consequently, the next setup units the stage for a powerful worth rally.

Hayes then mentions some methods to commerce the merge:

- Shopping for spot ETH.

- Shopping for Lido Finance (LDO).

- Longing ETH futures (Advanced and dangerous).

- Shopping for ETH name choices (Advanced and dangerous).

- Futures hedge (Advanced and dangerous).

Expectations

Hayes expects the structural discount in inflation (deflation) to occur post-merge and play out like bitcoin halvings (massive rallies).

However earlier than the merge, Hayes will proceed to purchase the dips in ETH, however plans to not shut any ETH spot positions.

Author’s Conclusion and translation

- If the Ethereum Merge fails, merchants will possible not need to personal ETH, and a few will quick it.

All the next data is related IF The Merge is profitable:

- Arthur Hayes is exceptionally bullish on The Ethereum Merge and presents some ways to commerce it. Nevertheless, any derivatives trades maintain sophisticated dangers. Until you’re skilled, DO NOT TRADE THEM.

- Hayes predicts the same worth motion to Bitcoin halvings after the structural adjustments to Ethereum tokenomics.

- Don’t over-trade The Merge. The worth will likely be unstable main as much as the occasion.

- If we’re fortunate, we get a number of dips earlier than The Merge.

SPX/USD

The inventory market motion quelled after two bullish days. The S&P 500 reached a three-month excessive of $4,325 earlier than closing at $4,305. The index seems prepared for a pullback, however a scarcity of draw back catalyst may see shares proceed their month-long rally.

US president Biden signed the Inflation Discount Act into legislation, which units a 15% minimal company tax for corporations with revenues over $1 billion. Moreover, the invoice features a $369 billion funding into local weather and vitality insurance policies and $64 billion to increase the Inexpensive Care Act. The invoice’s signing into legislation had little impact on futures, however tomorrow’s opening may inform in any other case.

Excessive-resolution chart

BTC/USD

The crypto market was comparatively quiet, with a number of altcoins, similar to Dogecoin (DOGE) (up 14.9%), taking the chance to climb. BTC appears poised to interrupt the uptrend assist on the day by day charts, however till a candle closes beneath the extent, the uptrend stays legitimate. BTC accomplished the day by day candle down -1.00% to $22,854.

Excessive-resolution chart

When you’re having fun with this report and suppose it’s price 20 sats (.01 cent), please press the clap button beneath to assist assist my writing. (As much as 50 instances!) THANKS!

Vitalik received’t have it! Ethereum co-founder, Vitalik Buterin, wants to burn the staked Ether of validators that complied with OFAC sanctions of Twister Money. The feedback got here after analysts started questioning the centralization of the community when validators complied with regulator requests. In line with @TheEylon, 66% of validators complied with the censorship requests.

$1 trillion vaporized. The New York Instances has launched “How two wall road washouts with a can’t-lose crypto hedge fund vaporized a trillion {dollars},” which covers Three Arrows Capital’s collapse behind founders Zhu Su and Davies’ aggressive buying and selling methods.

Solana seeks to enhance decentralization. Soar Capital and the Solana Basis have teamed as much as create a secondary validator consumer for the Solana blockchain. The transfer would enhance the blockchain’s efficiency and decentralization.

Information Tidbits:

- Crypto Lender Hodlnaut applies for creditor protections in Singapore.

- Coinbase releases plans for the Merge.

- Alex Mashinsky was accused of taking management of buying and selling methods at Celsius early within the 12 months.

- FTX hints at introducing choices buying and selling.

- Coinbase premium re-emerges.

- BitBoy sues YouTube persona Atozy over defamation.

On the protocol degree ⛓

DeFi giants be part of Optimism L2: Yearn Finance and Iron Financial institution have joined the Optimism L2 community. The corporations joined the community to enhance cross-chain interoperability, safety, and capital effectivity for customers.

Acala stablecoin is recovering. The Acala native stablecoin aUSD is nearing the $1.00 market after sixteen wallets exploited the community and printed $1.3b price of aUSD. Acala handed the referendum to burn the surplus tokens to re-peg the stablecoin’s greenback worth.

Protocol degree.

- Thread: Justin Bons accuses Polygon of being extremely insecure and centralized.

- Case study of Positive factors Community token GNS.

- Nearing the launch of the Canto Layer 1 community.

NFT & metaverse replace ?

- Homeowners of CyptoPunks and Meebits non-fungible tokens (NFTs) at the moment are allowed to make use of them for industrial acquire after Yuga Labs launched the mental property rights for the collections.

- NFT Analytics agency Zash partners with Binance to develop NFT information and intelligence merchandise.

My 5 cents….

“Finest crypto market author on the planet.”

That’s what Raoul Pal mentioned about Arthur Hayes, and I agree. His articles aren’t solely informative, however very entertaining. Who else can efficiently evaluate the lifeless our bodies floating in a river to the crypto collapse as Hayes did in Floaters? Fascinating work.

Nonetheless, these two mega-minds are rooting for ETH earlier than The Merge. After all, nothing in life is concrete, and each funding is a threat, however the Ethereum Merge presents a chance we seldom see in crypto. There’s a slight likelihood it won’t go as deliberate, but when it does, be careful, ETH provide dynamics will dictate market circumstances for a lot of months to return.

Thanks for studying, comply with me on Twitter for day by day updates!

NOT FINANCIAL ADVICE!

[ad_2]

Source link