Since January 2022, the complete crypto economic system has shed $1.36 trillion in worth, because the market capitalization dropped from $2.34 trillion to immediately’s $979 billion. Whereas the crypto economic system is down in worth, commerce volumes are decrease, and the worth locked in decentralized finance (defi) has shed billions, treasuries held by decentralized autonomous organizations (DAOs) have elevated by 7.69% in worth since January, as roughly $700 million was added to the tasks’ caches in eight months.

DAO Treasuries Soar 7.6% Larger in USD Worth, Since 2016 the Worth Held by Decentralized Autonomous Organizations Grew by 6,025%

On June 10, 2022, the entire quantity of funds held by decentralized autonomous group (DAO) treasuries reached the $10 billion vary for the primary time in historical past. Whereas the crypto trade is coping with decrease costs and bearish sentiment, the worth held by DAO treasuries has managed to climate the storm.

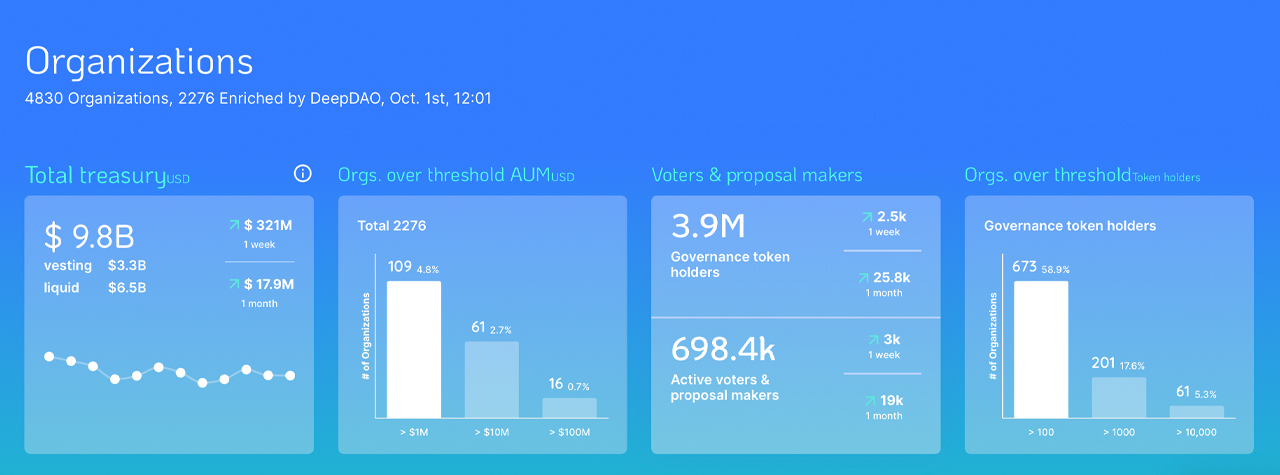

Presently, throughout 4,830 organizations, DAOs maintain $9.8 billion, which is simply $200 million lower than the combination worth held by DAOs 112 days in the past. Whereas it’s $200 million lower than it was three months in the past, DAO treasury values have elevated by $700 million since January, in line with stats aggregated by deepdao.io.

On January 22, deepdao.io metrics recorded by archive.org point out there have been 4,227 organizations at the moment, and collectively, $9.1 billion was held in DAO treasuries. With $9.8 billion immediately, that’s a 7.69% enhance in USD worth held by DAO treasuries during the last 251 days.

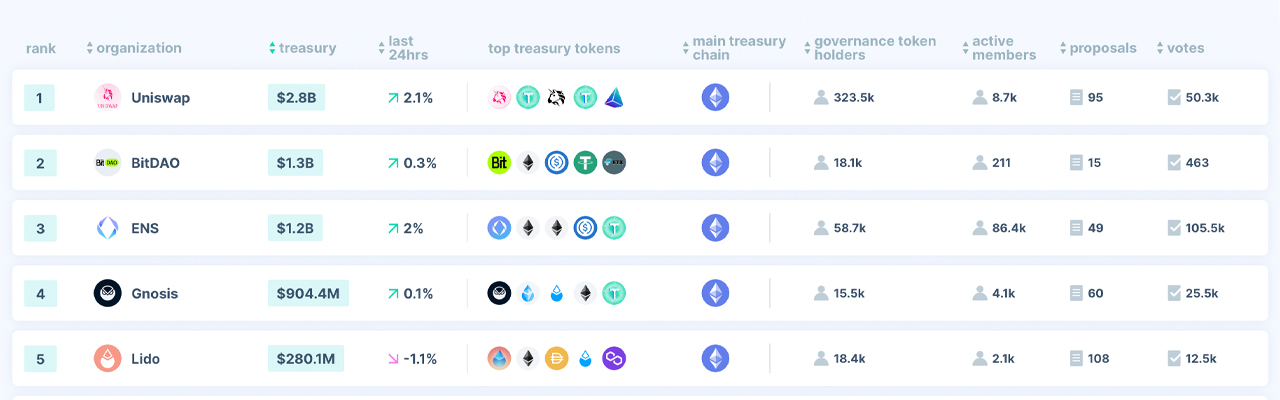

On the time, Bitdao held $2.4 billion in its treasury and it was the biggest DAO treasury in January. Uniswap was the second largest on the time, with $2.1 billion. Each Bitdao and Uniswap are nonetheless the highest two DAOs when it comes to treasury dimension, however Uniswap is now the biggest.

On October 1, Uniswap has $2.8 billion, whereas Bitdao’s cache has shrunk to $1.3 billion from the $2.4 billion held originally of the 12 months. Bitdao’s $1.3 billion makes it the second largest DAO treasury and it’s adopted by ENS which holds roughly $1.2 billion.

251 days in the past, ENS was the 14th largest and on the time, the third largest was Lido Finance. The liquid staking protocol’s DAO is now the fifth largest, with $283 million held within the Lido DAO immediately. The highest ten DAO treasuries embrace Uniswap, Bitdao, ENS, Gnosis, Lido, Olympus DAO, Mango DAO, Benefit Circle, Compound, and Aragon Community.

Out of the complete $9.8 billion, there are 3.9 million governance token holders, and 698,400 energetic voters and proposal makers. 109 DAOs maintain $1 million or extra, whereas solely three DAOs have greater than a billion in funds.

Whereas Uniswap has $2.7 billion, 98.7% of the venture’s treasury funds are held in uniswap (UNI) tokens, and Bitdao has a treasury comprised of a bunch of various crypto belongings which embrace tokens like BIT, ETH, USDC, and USDT.

Because the crypto economic system continues to take care of tumultuous occasions, decentralized autonomous group treasuries have seen steadfast progress because the begin of the 12 months. For the reason that first DAO was created in 2016, DAO treasuries have elevated 6,025% in USD worth over the past six years.

What do you concentrate on the hundreds of DAOs immediately and the $9.8 billion held by DAO treasuries? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.