This week, Celsius Community printed a big doc containing all of the account balances of its clients.

The transfer is a part of the corporate’s ongoing restructuring course of following its Chapter 11 chapter submitting from earlier this 12 months. The doc displays person balances as of July 13, 2022, when the corporate’s restructuring started, and buyer transactions that occurred within the 90 days previous the Chapter 11 submitting, per the corporate’s FAQ.

Unsurprisingly, the discharge of such detailed buyer information, which incorporates balances, transactions and names, induced an uproar on Twitter. That info can’t solely make clear every person’s monetary info but in addition allow observers to research the blockchain and de-anonymize on-chain addresses, for the reason that transaction quantities and date are detailed within the doc.

Placing all of it collectively, it turns into clear that customers’ privateness acquired invaded and their safety compromised. However don’t fret (but); this text opinions why this occurred and what might be performed to mitigate some threats for those who’re among the many doxxed customers.

Why Did Celsius Make This Doc Public?

As talked about beforehand, this doc is a part of Celsius’ restructuring course of. Celsius was obliged to reveal buyer info as a part of its restructuring course of, given the mandatory transparency demanded by U.S. legislation. Whereas that normally applies solely to the corporate’s belongings, since Celsius held buyer belongings in custody they have been affected as effectively.

In response to a courtroom doc, Celsius submitted a request to chop again on the shopper personally identifiable info (PII) being launched although a redacting course of earlier than making it public. The lender submitted three arguments.

First, Celsius argued that such a big database of client info was too priceless for the corporate to be made public. Doing so would “considerably lower the worth of the shopper listing as an asset in any future potential asset sale,” the corporate claimed.

Second, Celsius put ahead the argument that, have been clients’ PII revealed, they may change into targets of “id theft, blackmail, harassment, stalking and doxing,” per the courtroom doc.

Lastly, the cryptocurrency lender argued that since lots of its clients reside in several jurisdictions everywhere in the world, disclosing their PII may “expose [Celsius] to potential civil legal responsibility and important monetary penalties.” The doc notes particularly the UK Normal Knowledge Safety Regulation (U.Okay. GDPR) and the European Union’s GDPR.

The U.S. trustee, then again, argued that Celsius “don’t and can’t depend on any exceptions to the final rule that chapter proceedings needs to be open, public and clear” and have provided “nothing greater than obscure statements supporting their request” to redact the confidential info.

Additionally they argued that the PII that Celsius sought to redact “is neither confidential nor industrial info.”

“The U.S. Trustee argues that [Celsius’] personal privateness insurance policies help the argument that clients’ info just isn’t confidential as a result of it permits clients names and phone info to be shared with third occasion ‘enterprise companions’ and, subsequently, just isn’t confidential,” per the courtroom doc.

Moreover, the “U.S. Trustee contends that the data just isn’t actually industrial in nature as a result of the Debtors aren’t searching for to redact all collectors’ names and figuring out info and are as an alternative requesting that figuring out info be redacted for under sure collectors, ‘however info with respect to a different group will likely be absolutely disclosed due to the place such collectors stay.’”

On the worldwide legal guidelines side, the U.S. trustee additionally reasoned that, below United States chapter legislation, chapter proceedings needs to be public, and people ought to prevail over the U.Okay. GDPR and EU GDPR.

Lastly, and most shockingly, “the U.S. Trustee contends that [Celsius’] arguments that collectors is likely to be topic to violence if their identities have been revealed quantities to anecdotal proof, which doesn’t rise to the extent of proof needed to beat the presumption for open and public chapter.”

In response, Celsius printed one other movement, searching for to implement an entire anonymization course of to not reveal detailed person info. That went past the preliminary movement submitted, which requested the power to redact dwelling and e mail handle of U.S. clients and title, dwelling handle and e mail handle of U.Okay. and EU clients.

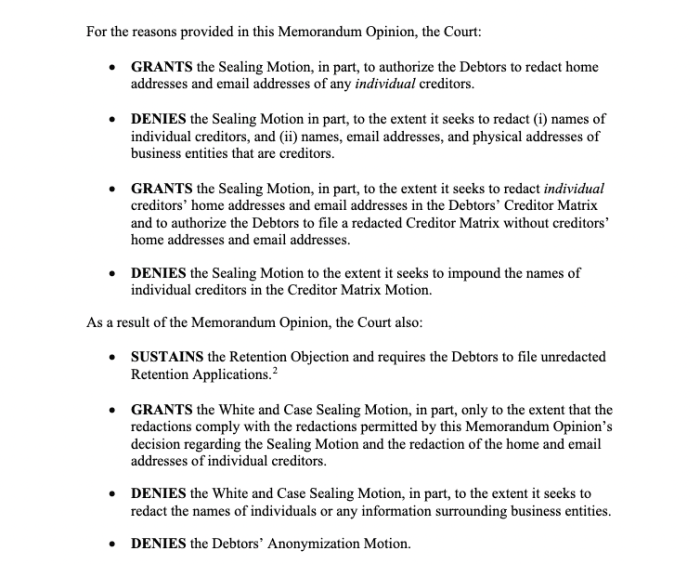

The courtroom dominated in opposition to the vast majority of Celsius’ requests. It dismissed the differentiation between U.S. and U.Okay./EU clients based mostly on the arguments above and allowed the corporate to solely redact dwelling and e mail addresses. It denied the anonymization movement fully.

Right here’s What Doxxed Customers Can Do

There are a lot of choices one can take in the event that they discover themselves uncovered within the Celsius paperwork, however none of them will have the ability to erase the previous. The nearer one can get to that, within the occasion that the discharge of these information factors has the potential to tangibly hurt the individual, they’ll legally change names as an (excessive) choice of final resort. One may additionally transfer to a special handle, however for the reason that courtroom approved Celsius to redact dwelling addresses, that may not be such an enormous concern to try to mitigate. It’s value noting, nevertheless, that unredacted variations of the filings are accessible to “the U.S. Trustee, and counsel to the Committee, and that any occasion in curiosity” that requests and is granted entry; the case for shifting houses can nonetheless be made.

Customers also can take measures to mitigate a number of the threats on the digital world. In relation to the on-chain addresses that observers can de-anonymize by wanting on the blockchain and the data disclosed within the doc, good privacy-focused instruments can come to the rescue.

The easier different is to CoinJoin funds. Though that gained’t erase the person’s transaction historical past, if performed appropriately it can allow the person to get pleasure from good forward-looking privateness. Which means that spending from that time on gained’t be clearly noticed as a transaction coming from the doxxed person. (Much like how the financial institution is aware of while you withdraw money at an ATM however can’t get detailed info on what you spend it on afterwards.) The person can embark on different privateness instruments, like PayJoins, that additionally break heuristics that unhealthy actors use to deduce info from on-chain information.

However maybe crucial factor that customers can do is take the low-time-preference strategy and keep away from utilizing centralized companies that harvest person information. Monetary companies firms worldwide, in cryptocurrency and past, have to adjust to know-your-customer (KYC) and anti-money laundering (AML) guidelines. Although such legal guidelines are possible well-intentioned, their effectiveness is disputed and the downsides are clear –– as on this Celsius case.

Within the info age, information is essentially the most priceless commodity and, as such, firms that gather huge quantities of knowledge change into honeypots, successfully changing into targets of cyber assaults as hackers and others search to monetize that info.

Whereas world governments don’t notice this gigantic concern within the twenty first century, customers are incentivized to do what they’ll to take possession of their information and declare again their privateness. As the established order pushes individuals to share as a lot about their lives as doable, the appropriate to privateness shouldn’t be seen as one thing law-abiding residents don’t want however moderately because the very proper that permits all the opposite ones.