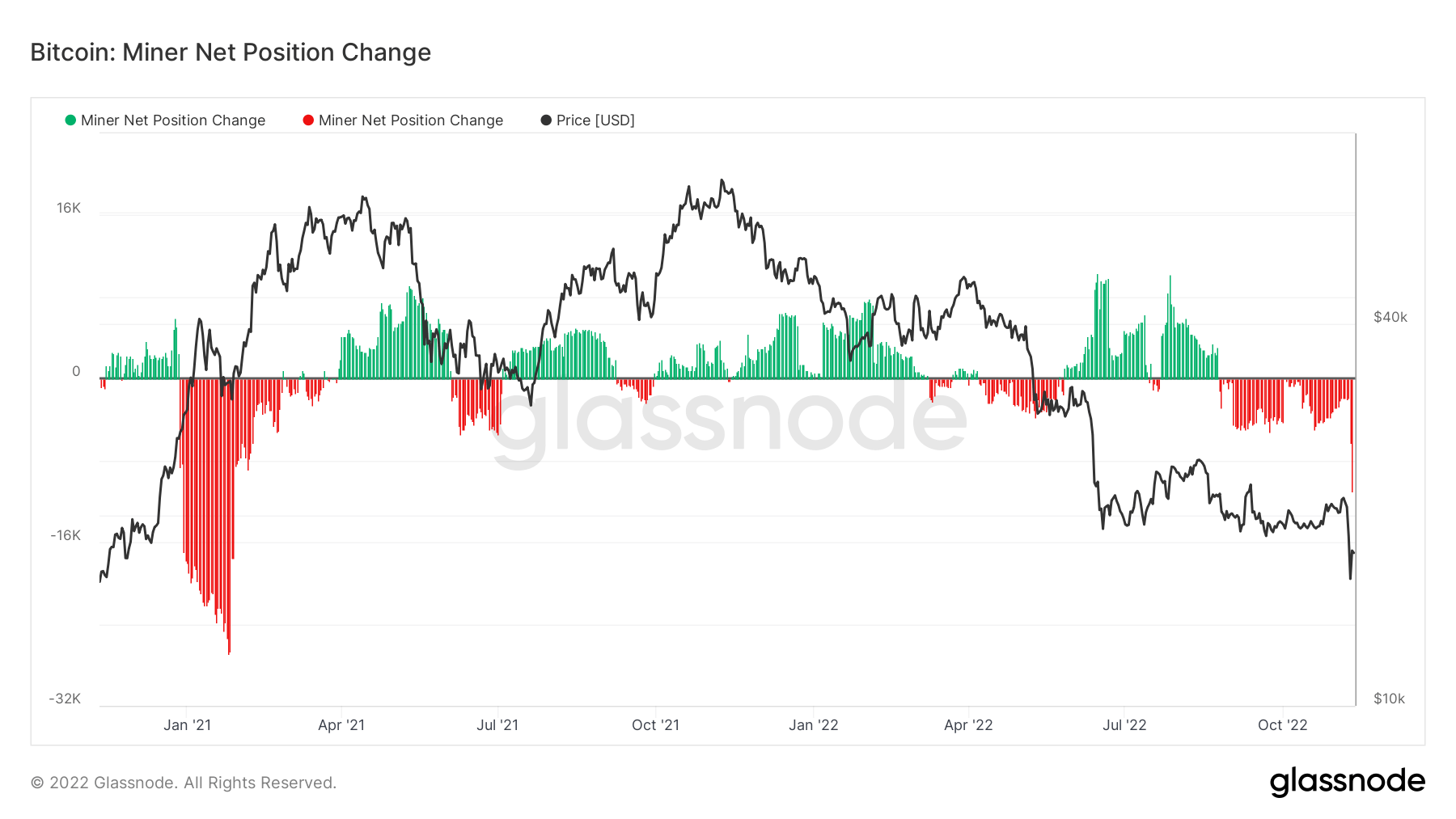

The continuing market hunch brought on by the FTX fallout hasn’t left Bitcoin miners unscathed. The market has seen the largest one-day miner promoting stress since January 2021, and information analyzed by CryptoSlate reveals that the promoting stress reveals no indicators of stopping.

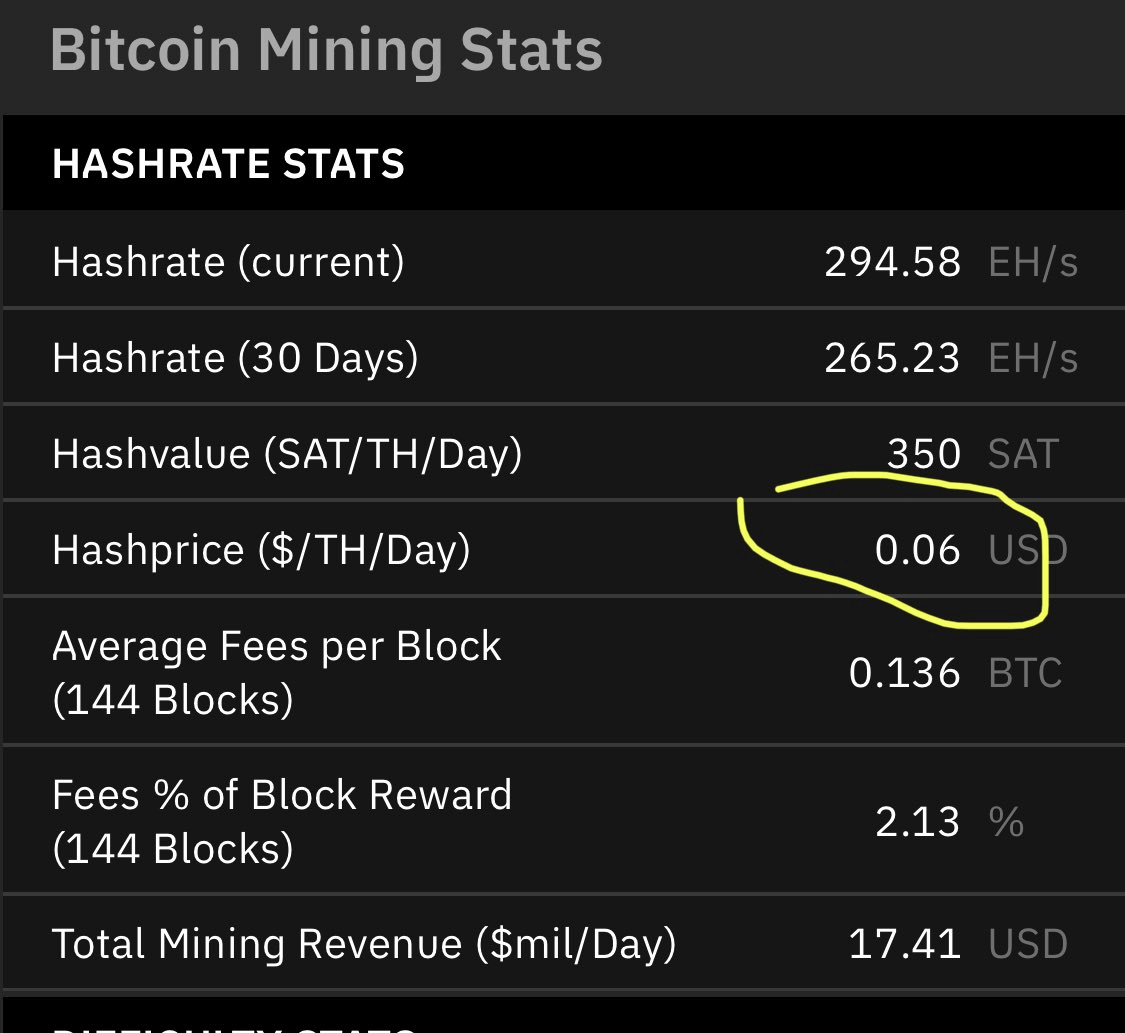

We might see prolonged promoting stress from miners till the common hash worth begins lowering. In November 2022, the common hash worth reached $0.05. Bitcoin’s present $17,500 ranges make mining borderline unprofitable not only for small miners, however for big operations as nicely.

The addition of tens of hundreds of recent ASIC miners to the market up to now 12 months put even the biggest mining operations deep within the crimson, with few anticipating such a pointy improve in hash worth.

At round $9,000 per machine, the most recent Bitmain S19Pro ASIC miner has a payback interval of 1,500 days at a mean hash worth of $0.06.

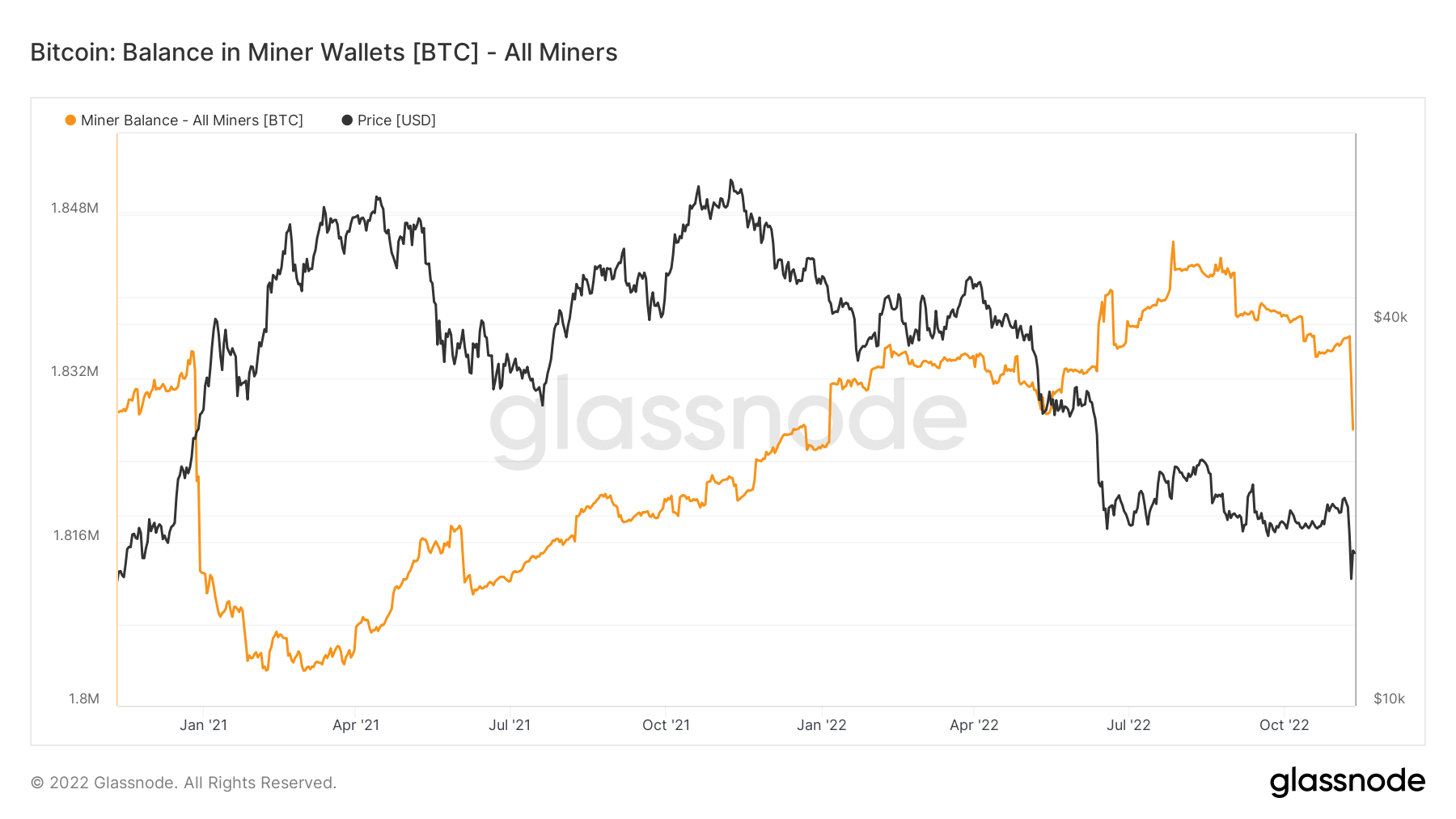

This improve in mining prices and drop in profitability pushed miners to promote their Bitcoin holdings. There was a vertical drop within the steadiness in miner wallets for the reason that starting of November, reaching a low recorded in January 2021.

The online place change in miner holdings completely correlates with the vertical drop in Bitcoin’s worth. With power costs anticipated to extend all through the winter and no finish in sight to the continuing bear market, we might see a wave of unprofitable miners shutting down their operations.