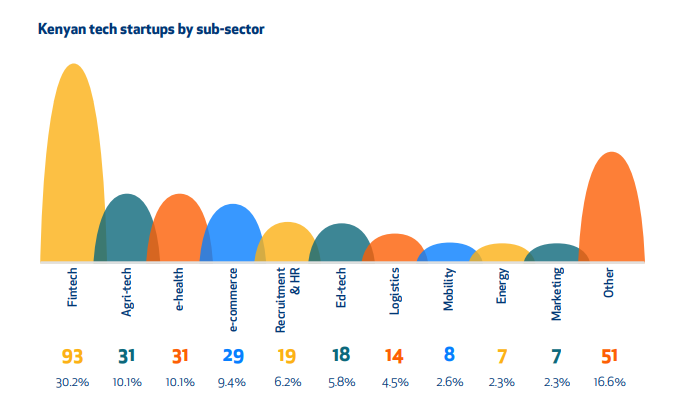

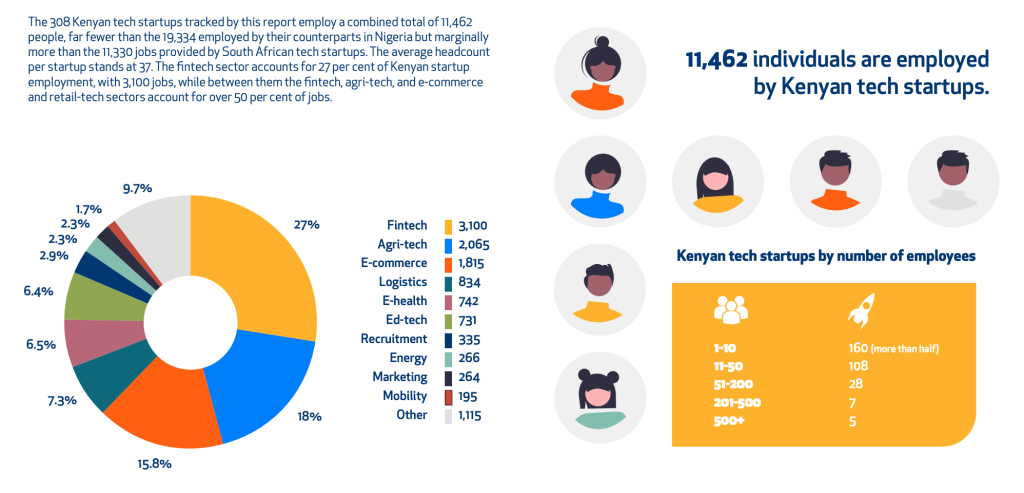

As of November 2022, Kenyan fintechs accounted for 30.2% or 93 out of the 308 tracked tech startups, a Disrupt Africa examine lately discovered. As well as, the examine findings present that the fintech sub-sector alone accounted for 3,100 or 27% of the 11,462 those who had been employed by tech startups throughout the identical interval.

Fintechs Fixing Basic Issues

In line with the findings of a examine on Kenya’s startup house, fintech ventures alone accounted for simply over 30% or 93 out of the 308 tracked startups. This determine is nearly 3 times greater than that of the closest challengers, specifically agri-tech and e-health, which each accounted for 10.1% of Kenya’s tech startups that had been tracked between January and November 2022.

Nevertheless, as defined in Disrupt Africa’s examine report on the Kenyan startup ecosystem, the dominance of fintechs is just not uncommon.

“Fintech takes the highest spot in most African nations because it solves elementary issues for the populace, is an space by which novel tech options are usually effectively obtained and shortly adopted, in addition to providing enticing returns for buyers,” the report mentioned.

Remittances and Lending Extra Fashionable Classes

Apart from accounting for the most important share of tech startups, fintechs additionally employed extra employees (3,100) than different sub-sectors. Agritech and e-commerce are the one different tech sub-sectors that employed greater than a thousand employees.

In the meantime, as proven by the examine’s breakdown of the fintechs’ areas of focus, remittances (24%), in addition to the lending and financing (21%) house, seem like the extra widespread classes. In line with the report, a part of the rationale for that is that “these areas cowl most of the most elementary monetary companies which are nonetheless missing for a lot of the inhabitants.” The report added that such classes have been “the jumping-off level for fintech ecosystems continent-wide.”

Regarding the tech startups’ use of blockchain, the examine discovered that 12 of the 30 blockchain-based ventures are fintechs. E-health (6) and agri-tech (5) are ranked second and third, respectively.

Register your electronic mail right here to get a weekly replace on African information despatched to your inbox:

What are your ideas on this story? Tell us what you assume within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.