That is an opinion editorial by Frank Nuessle, a publishing entrepreneur, former college professor and social system architect.

On this essay, I argue that Bitcoin and the Lightning Community are, by themselves, not sufficient to efficiently implement an American sound cash system, and that following evolutionary economics, new social applied sciences and new social system designs have to be a part of the equation.

The first function of cash is to facilitate the trade of worth. Cash can be our most important, most vital, baseline social system. Bitcoin shouldn’t be but cash. Bitcoin fulfills one of many three features of cash in that it’s a reliable know-how for the digital retailer of worth. As soon as Bitcoin is built-in with newly-developed social system applied sciences, it little doubt will fulfill that major function of cash — to facilitate the trade of worth.

The Issues With The American Fiat System

Earlier than launching into my argument, let me clarify why my focus is on the implementation of an American Bitcoin financial system.

First, being an American, I do know extra about America than anyplace else.

Secondly and extra importantly, America has probably the most to lose when the U.S. greenback is now not acknowledged because the world’s solely reserve foreign money, or the greenback turns into nugatory by exponential printing. Below both consequence, there will probably be hell to pay — cataclysmic disruption in the US with out there being a parallel sound cash system working efficiently alongside the present Federal Reserve system.

Even right this moment, the proof is all over the place that the American financial system shouldn’t be working for everybody. Disruption and anger are spilling out throughout. Mass killings taking place each few days are waking folks as much as the very fact that there’s a psychological illness of hate and nihilism that appears to be spreading.

America’s nationwide political events should not assembly the second. The monstrous scale of American monetary inequality makes real democracy not possible. Just a few years in the past, ABC Information reported that 40% of Individuals couldn’t elevate $400 to cowl an emergency. How can anybody suppose their votes give them the identical political energy as, say, Jeff Bezos who makes such an obscene amount of cash?

And now the crypto business has to take care of the perfidy of Sam Bankman-Fried, who The New York Instances as soon as nicknamed the “Crypto Emperor” as a result of he embodied the pretension of the renegade, “folks’s” billionaire. He lived the approach to life embodied by Elon Musk, Bezos and different tech billionaires, however turned out to be too younger to acknowledge that you would be able to’t get there by cooking the books.

Perhaps, Bankman-Fried’s downfall will probably be a wake-up name for the crypto business to grasp that Bitcoin and blockchain should not about people changing into the subsequent billionaires, however are about using Bitcoin know-how to create actual services and products that resolve actual human and planetary wants, and by so doing, transferring America into an increasing state of societal effectively being.

In his e book, “The Value of Tomorrow,” Jeff Sales space writes, “The development of extra wealth inequality, extra polarization, and extra discord is a significant risk to our collective future. And it’s all being brought on by the identical factor: adherence to an financial system designed for a unique time.”

The present financial system favors massive firms and is the enemy of native commerce. This method extracts worth from the native market and delivers it to distant shareholders and to company administration.

Bankman-Fried, like others within the get-rich-quick crypto group, lives out of the unexamined mindset that life is a dog-eat-dog wrestle and that getting filthy wealthy is the way you win the sport. It’s rumored that Bankman-Fried performed video video games throughout investor conferences. This mindset guidelines company capitalism, and let’s be trustworthy, all of us are troubled, to some extent, with this psychological state.

A very powerful product of many firms right this moment is now not no matter they supply to prospects, however the shares they promote to buyers. In his e book “Workforce Human,” Douglas Rushkoff writes, “Companies destroy the markets on which they rely or dump their best divisions with the intention to improve the underside line on their quarterly reviews.”

In America right this moment, producing cash is extra vital than producing a sustainable services or products. The company takes cash out of the native financial system — out of the land and labor — and delivers it to its shareholders.

The Significance Of Cash As A Social System

Cash is a very powerful and highly effective social system ever invented by man. Civilization started with the trade of worth. The first function of cash is to facilitate the trade of worth inside a group. A group is a bunch of people that depend on one another.

The true nature of the human being is to be in relationship with the planet and inside a group. Solely a cash system that’s constructed upon that understanding can hope to satisfy the desires we every have invested in the way forward for Bitcoin and in our personal communities.

The Bitcoin sound cash financial system should be designed for the distribution of wealth, not simply the exporting of capital to the already rich.

Clearly, the Lightning Community permits for the speed of transactions that may make the Bitcoin sound cash financial system doable in the US. But the Lightning Community shouldn’t be sufficient.

I agree with Rushkoff, who believes that we can not resolve America’s issues solely with extra know-how. He writes that Bitcoin and blockchain “could disintermediate exploitive monetary establishments, nevertheless it doesn’t assist rehumanize the financial system, or reestablish the belief, cohesion and ethos of mutual help that’s undermined by digital capitalism.”

As a result of Bitcoin, as a technologically-sound cash system, represents a possible transformative evolution of our social actuality, its profitable implementation requires that we should delicately design its implementation to embed our greatest and most highly-refined human traits resembling honesty, integrity, generosity and forgiveness.

To take action, we should keep in mind the work of the evolutionary economist, Eric Beinhocker, and his proposal that financial evolution shouldn’t be a single course of, however reasonably the results of three interlocked processes — bodily know-how, social system know-how and system design health.

To achieve success, Bitcoin by the Lightning Community should ignite the evolutionary search engine that’s localized, free market capitalism.

Bitcoin and the Lightning Community are clearly the wanted bodily applied sciences, however what are the social applied sciences and the social system design that can permit the Bitcoin sound cash system to unfold like a virus?

Integrating With The Present Fiat Cash System

To reply the above query, Bitcoiners should absolutely perceive what we’re up in opposition to after we take into consideration social applied sciences to alter the American choice for the present cash system.

First, there’s the very sturdy human resistance to alter as a result of nation-controlled cash methods have been predominant for a whole bunch of years.

Secondly, cash carries a lot self-worth-related emotional baggage that there’s a sturdy reluctance to speak brazenly about cash and even much less curiosity within the methods for cash creation. Cash, like intercourse, is simply not talked about.

When contemplating the sturdy human resistance to alter, it’s useful to grasp a little bit little bit of historical past. First, there’s the historic axiom that whoever is in energy in a society creates its cash.

From the tenth to the thirteenth centuries, a historic interval in Europe often called the Center Ages, currencies had been issued by native lords, after which periodically recalled and reissued with a tax collected within the course of. This was a type of demurrage that made cash much less fascinating as a retailer of worth. The end result was the blossoming of tradition and widespread wellbeing all through Europe. This prosperity corresponded precisely to the time interval when these native currencies had been issued.

We’re speaking about 600 years of enculturation which give a powerful psychological headwind in opposition to the profitable implementation of another, American, bitcoin-based cash system. We have now all confronted this headwind when making an attempt to persuade buddies or relations in regards to the significance of the Bitcoin innovation.

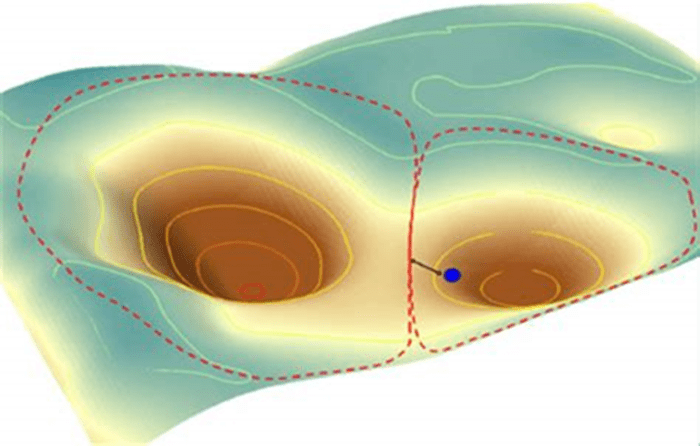

There’s an attention-grabbing new idea from advanced methods principle referred to as “basins of attraction” that may assist to visualise this headwind.

A basin of attraction is any advanced system, resembling a organic ecosystem, a human social system or concepts a few cash system, that has a number of, native equilibrium states reasonably than a single equilibrium level. That is simpler to grasp with a visible representing two basins of attraction positioned close to one another.

Image a ball, representing the concepts a few cash system or cash normally, mendacity on the backside of one in all these basins and take into consideration the way it should transfer to a different basin of attraction for lasting change to happen.

You possibly can think about how the present cash system will resist incremental change and that it’ll have the capability to soak up many shocks to retain its historic attraction. There are over 600 years of pull into the state-controlled cash system basin of attraction.

What’s wanted is a brand new basin of attraction, a brand new configuration of concepts, with its personal gravitational pull.

Bitcoin as sound cash is that new basin of attraction.

Any aware try to maneuver that ball into a brand new bitcoin basin of attraction should embody publicity and acceptance by a tipping level of public acceptance inside a market. To efficiently transfer the tradition to the bitcoin basin of attraction would require a change to the American story about cash. Extra about that later on this essay.

Cash As A Measure Of Self Value And Survival

When contemplating the sturdy human resistance to fascinated with cash methods, it’s useful to dive into the deeper emotional points folks have about cash.

Cash is among the major taboos of American society, together with intercourse and dying. Cash is de facto the final taboo. Give it some thought: it’s much less taboo right this moment to speak about who you slept with final night time than about how a lot cash you could have. It’s an actual cultural blind spot.

To know what these taboos have in frequent, we have to delve into collective psychology finest described by archetypes. Archetypes are patterns of feelings and habits that may be noticed throughout civilizations and time intervals.

One vital archetype is the good mom, which represents the mom determine in mythology, faith and Jungian psychology. Repression of the good mom archetype is evident within the American collective consciousness. If you repress an archetype, it manifests itself by its particular shadows — with cash, that seems to be greed and worry of shortage.

The earliest currencies all straight associated to the good mom.

As an illustration, hundreds of years earlier than the frequent period, the unique Sumerian shekel was carefully linked to Inanna, the goddess of life, dying and sexuality. Grain backed the cash of the time. Farmers got shekels for his or her grain which they may trade for intercourse with the virgins of the temple. This was how they assured grain storage for the lean years they’d typically skilled of their historical past.

For the Sumerians, it was the clergymen who managed the cash. They gave receipts for wheat delivered to the temples as tax. The receipts may very well be used as foreign money to pay for intercourse with the temple priestesses or for different items within the market. These receipts had been one thing like a modern-day, tax-funded welfare system — the wheat was a buffer inventory, the intercourse, a fertility ritual and a appeal in opposition to harvest failure (consider it as a kind of early insurance coverage).

It’s additionally attention-grabbing to notice that the English phrase “cash” itself derives from the Roman temple of Juno Moneta in Rome from whose basement the mint of the empire operated. Juno was the Italic goddess of the menstrual cycle, sexuality, being pregnant, start… and, in fact, cash.

How To Persuade Others Of The Worth Of Bitcoin

So, how does one burst by the very sturdy human resistance to alter and the unconscious psychological taboos that encompass fears about cash?

Many Bitcoiners have come to comprehend that you’re by no means going to beat their brother-in-law’s beliefs by the pressure of logic and proof. Folks organize the proof to align with their present beliefs and their outlooks on life.

These particular person private beliefs are woven right into a cultural story that turns into a consensus actuality about cash or, within the language of cultural methods principle, America’s present basin of attraction for cash.

The present American cultural story about cash is a narrative about shortage and about there by no means being sufficient. This can be a design characteristic of the present debt-based cash system the place the cash provide should develop to pay again the curiosity as a result of there’s actually “by no means sufficient” so folks should combat over what there’s. This design characteristic is the fiat cash system development crucial which should, in some unspecified time in the future, go exponential or undergo a means of debt forgiveness.

As Charles Eisenstein writes, “So long as most individuals acquiesce to the current system, these closely invested in its perpetuation (i.e. the already wealthy) will discover methods to maintain pretending that it’s sustainable.”

To alter present opinions and beliefs about cash requires giving folks an expertise that doesn’t match the present story or an expertise that resonates with a brand new story.

Buckminster Fuller used to say that you just by no means change something by combating the present actuality. To alter a social system, construct a brand new mannequin that makes the present mannequin out of date.

Eisenstein believes that probably the most direct option to disrupt the American story of shortage is to present folks an expertise not primarily based on shortage. That may very well be “an act of generosity, forgiveness, consideration, fact or unconditional acceptance.” This new story should be an invite to a brand new manner of being on the earth, unafraid and related. It should be a proposal. One can not compel one other individual to alter beliefs.

Remembering Beinhocker’s three interlocked processes of financial evolution, we’re again to the seminal query: “What are the social applied sciences and the social system design parameters that can combine with Bitcoin know-how to permit the Bitcoin sound cash system to unfold like a virus?”

This can be a visitor publish by Frank Nuessle. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.