The Talmud gives funding teachings which have handed the check of time, however the place would possibly bitcoin match into one among its most iconic classes?

That is an opinion editorial by Konstantin Rabin, a finance and expertise author.

As an enormous supporter of all issues crypto, and particularly Bitcoin, my ideas usually drift to a time earlier than this revolutionary expertise appeared on the scene, and I stand in awe of what it’s certain to perform. I’m wondering: How would our forefathers have checked out it, and the way can we use their teachings, making use of the considered the outdated thinkers to our fashionable existence?

Whereas the cash administration methods that may be present in books from 1000’s of years in the past may appear crude or irrelevant to us immediately, I’ve at all times tried to look previous the phrases on the web page and into the which means behind them to determine what classes they could train us immediately. Sooner or later, whereas chatting with a good friend about this, we thought of why Bitcoin would possibly even be backed by Talmudic teachings.

The Begin Of An Thought

I am not a non secular particular person by nature, however it’s onerous to keep away from conversations that stray off into that realm when sitting with a few of your Jewish buddies who’re eager college students of the Talmud and all issues referring to Judaism. So, one evening as I sat with one among these buddies of mine, he introduced up the Gemara, a part of the Talmud that includes funding recommendation and is commonly praised for its simplicity and effectiveness. The 63 books of the Gemara function a commentary on the Mishnah, which in flip serves as the primary main writings of the Jewish oral traditions, spanning a whole lot of years. The part that my good friend was referring to, although, was a studying that goes as follows:

“R. Isaac additionally stated: One ought to at all times divide his wealth into three elements: (investing) a 3rd in land, a 3rd in merchandise, and (protecting) a 3rd prepared at hand.”

–The Gemara, Tractate Baba Mezi’a 42a

The concept is that, in an effort to make investments your cash in a correct approach, it is best to divide your belongings into three equal elements unfold equally amongst land, money available and dangerous belongings.

Therefore, that is what the standard Jewish diversified portfolio would appear like:

A Third In Land

Land — or if we generalize, actual property — is without doubt one of the most secure investments on the market. Shopping for and holding onto land or every other sort of residential or industrial actual property has been a observe for 1000’s of years and is simply as legitimate immediately, with expectations of the actual property market rising at a compound annual progress price of 10.7% from 2022 to 2031. Therefore, protecting a portion of your funds in actual property appears to be nice for wealth preservation and combating inflation.

A Third Prepared To Hand

We’ve all heard the phrase “money is king,” and that is what the Gemara teaches us too. Maintaining a good portion of your wealth in money is kind of helpful for a number of causes. Firstly, the significance of remaining liquid can’t be understated — borrowing cash prices cash, and having the likelihood to settle any type of surprising debt and stay solvent shouldn’t be undermined. Apart from that, markets are at all times getting in cycles, and at occasions when liquidity is low and the demand for money is nice, different belongings are likely to drop in worth. Therefore, having a considerable portion of money in hand permits you to seize varied belongings when they’re undervalued.

A Third In Merchandise

Whereas the title could be a bit deceptive, my understanding is that “merchandise” refers to any type of dangerous belongings and undertakings — my very own enterprise, shares, commodities, just about these issues that you just put some cash into hoping that sooner or later, they could yield a big return.

Such belongings often do properly when the market goes upward, they admire in worth and will be bought for a large revenue.

The place Does Bitcoin Belong?

Whereas the reasoning behind the allocations outlined within the Gemara makes good sense to me, I questioned how this may be translated into the trendy world and the place bitcoin would possibly match into the grand scheme of issues. So, the very first thing that my good friend and I sat there doing as our dialog progressed was to outline this funding concept in a extra fashionable approach, to have the ability to make higher sense of it with respect to the world we presently stay in.

Does Bitcoin Fall Into The ‘Dangerous Belongings’ Class?

Throughout our dialogue, we got here to the conclusion that bitcoin may pretty simply match into the “merchandise” class, as it may be thought of a dangerous asset as a consequence of its volatility, however an asset nonetheless. When comparisons of shares and crypto investments it’s apparent that each of a majority of these belongings maintain threat and that both one may fall underneath the “merchandise” heading.

Does Bitcoin Fall Into The ‘Money’ Class?

One other place the place bitcoin would possibly slot in is within the “prepared at hand” column. Due to how straightforward it has grow to be lately to maneuver your cash from fiat to bitcoin and again once more, it has reached some extent the place the adoption of bitcoin and the liquidity it supplies has made it akin to money, however maybe with larger foreign-exchange threat. That is very true since BTC is buying and selling freely towards different main currencies like USD and EUR. As well as, BTC is commonly a sort of “common money” for buying varied different crypto belongings and a rising listing of products and companies.

Does Bitcoin Fall Into The ‘Actual Property’ Class?

Although there are nations just like the United Arab Emirates the place the Dubai Land Division first adopted blockchain expertise again in 2017 to handle its actual property market, I might not say that bitcoin will be thought of actual property within the Talmudic sense.

Nevertheless, one may actually argue that BTC is essentially the most secure of cryptocurrencies and would possibly seek advice from BTC because the “actual property of crypto.”

Bitcoin Is Nonetheless A Dangerous Asset

Whereas it’s clear that bitcoin has options that make it just like money and actual property, we got here to the conclusion that it presently falls into the “dangerous asset” class greater than anything. Nevertheless, it could be much less dangerous than different belongings that needs to be saved on this class. Let’s examine bitcoin to a couple different “dangerous” belongings beneath:

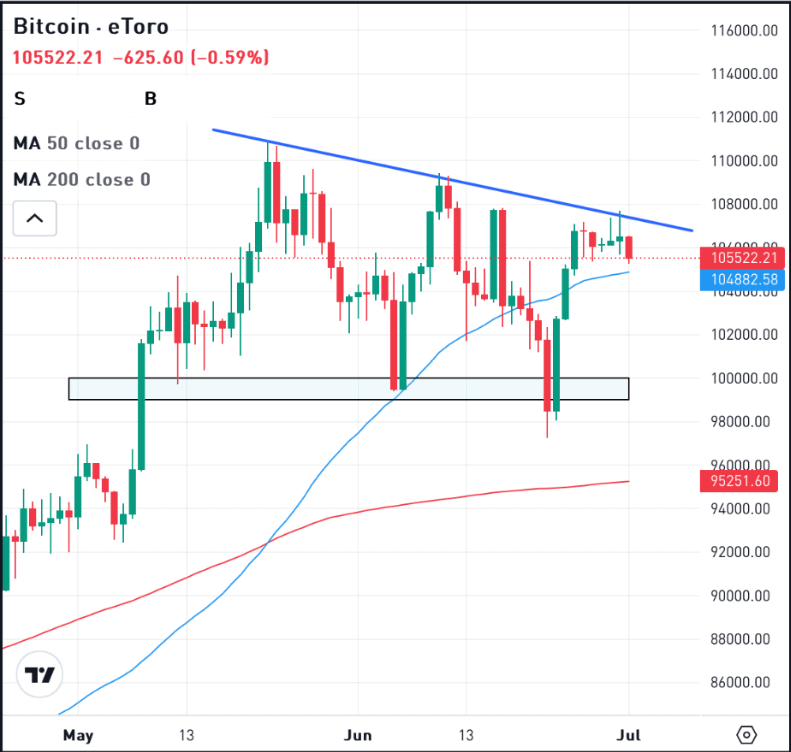

As demonstrated within the desk above, calculating the five-year return on funding (ROI) for these “dangerous” belongings based mostly on their closing costs on February 6, 2018 in comparison with their closing costs on February 6, 2023; their most potential drawdown based mostly on their lowest costs throughout the identical interval; and their most potential ROI based mostly on their highest closing costs throughout the identical interval, bitcoin gives comparatively excessive returns in addition to comparatively excessive threat.

Buying some bitcoin 5 years in the past (in February 2018) and promoting them in February 2023 would have supplied the best return among the many listed belongings. If one was fortunate sufficient to promote on the all-time excessive value, then bitcoin would yield a return of over 500%. Clearly, excessive returns inherently include elevated dangers, and bitcoin additionally exhibits the best potential drawdown listed above.

Is Bitcoin Funding Religiously Moral?

“Any device can be utilized for good or dangerous. It is actually the ethics of the artist utilizing it.”

–John Knoll

Considering the query of ethics has pushed many a sensible man insane, however as we sat there considering of the position that Bitcoin is ready to play on this planet, I considered the above saying by visible results legend John Knoll. Whereas we may provide you with many moral concepts round Bitcoin, in the long run, my good friend and I made a decision to deal with the obvious issues which can be solved by it to see if these would profit good or dangerous actors.

Decentralization: This one is commonly touted by Bitcoin fans as being all the function of blockchain expertise, and it actually has its deserves. To function with out a government aligns properly with Jewish rules of autonomy and freedom.

Transparency: Because the Bitcoin community is open supply and clear, it helps to advertise accountability and honesty by these utilizing it, each of that are ethically sound and align properly with these truths which can be held expensive by all of mankind.

Utilization: In its darkish (net) days, Bitcoin was usually used for illegitimate or unlawful transactions — shopping for pretend IDs, medication, firearms and so forth. This will surely make Bitcoin unethical for a lot of. But, within the present occasions, cryptocurrencies like Monero and USDT are sometimes used to conduct authorized transactions, and have maybe inherited many of the unethical implications from Bitcoin.

A Lesson That Has Handed The Take a look at Of Time

The significance of diversification can’t be overstated, and above I’ve shared one easy mannequin that has handed the check of time. Clearly, Judaism’s funding teachings are 1000’s of years outdated and don’t particularly take into account bitcoin however, at any price, they supply an attention-grabbing thought experiment for us immediately.

This can be a visitor publish by Konstantin Rabin. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.