The U.S. economic system grew at an annualized tempo of 1.1% in Q1 2023, which got here in slower than expectations and was forecasted to come back in at 1.9%. Stagflation is now a priority for the U.S.; this GDP print was considerably smaller than the earlier two quarters, 2.6% and three.2%, respectively.

Subsequent week’s FOMC assembly, which takes place on Might 3, is anticipated to lift charges by an additional 25bps taking the federal funds charge to five.00%.

The U.S.

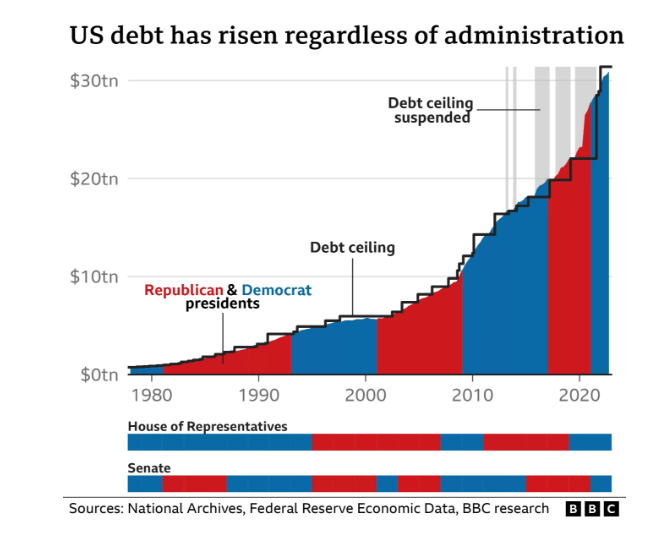

Debt ceiling drama

What’s the debt restrict? In line with the U.S. Division of Treasury, it’s “The debt restrict is the overall amount of cash that the US authorities is allowed to borrow to fulfill its current authorized obligations, together with Social Safety and Medicare advantages, army salaries, curiosity on the nationwide debt, tax refunds, and different funds”.

In line with information from 1960 and corroborated by Lyn Alden, Congress has raised the debt ceiling 78 instances, which has been raised by Democrats and Republicans 29 and 49 instances, respectively.

You will have heard the information that the U.S. is approaching the debt ceiling, and this has prompted uncertainty available in the market. The bottom case and what we count on is for the U.S. debt ceiling to be raised and to kick the can down the street; this recreation of rooster will most definitely go on into the eleventh hour. We’ve got beforehand highlighted that the Treasury Common account has been depleted, heading to 0, which has dislocated the market.

Nonetheless, each Democrats and Republicans are miles other than agreeing. Democrats insist on elevating the debt ceiling with none situations. Republicans are calling for spending cuts.

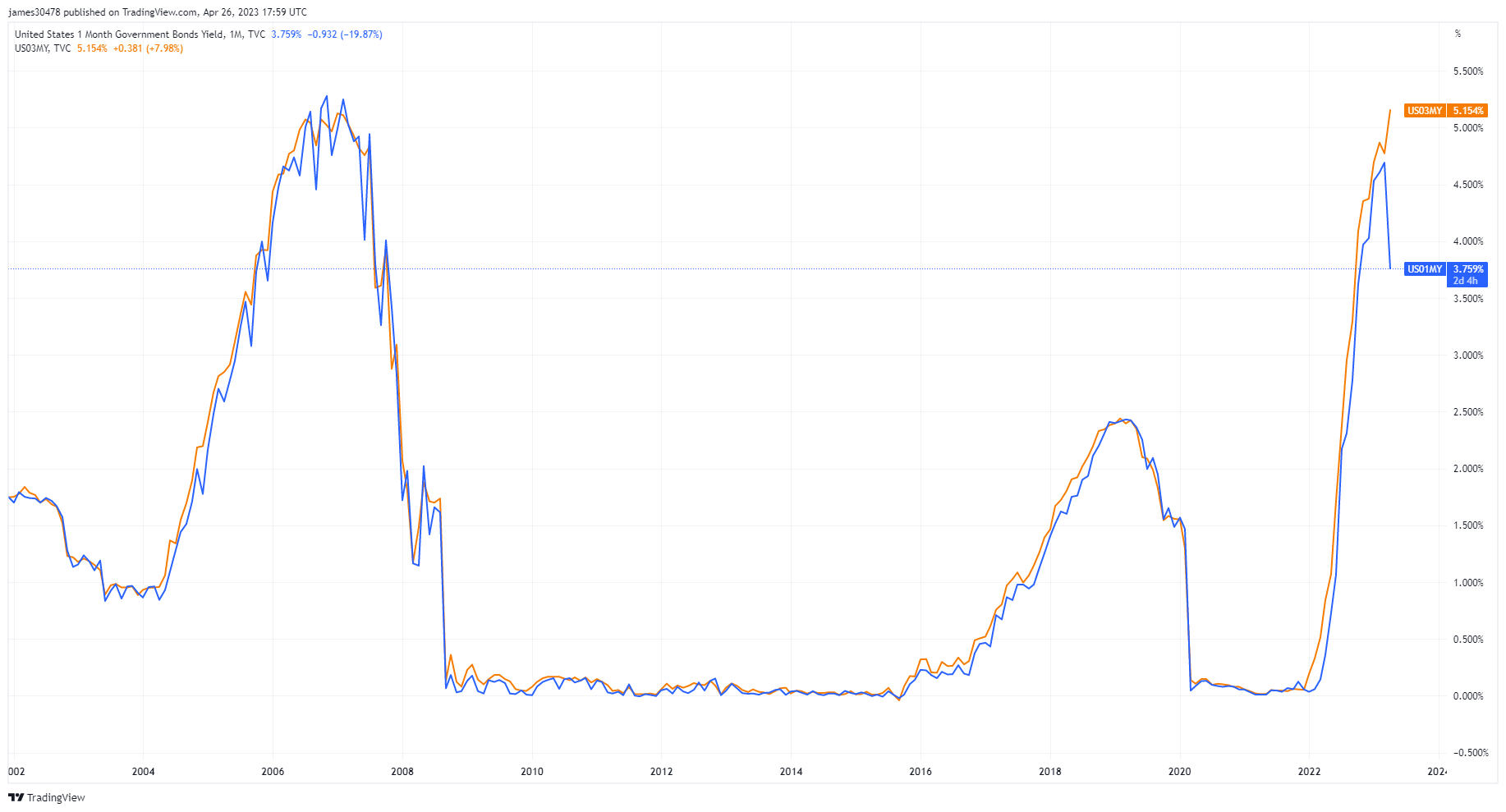

The longer this continues, places additional stress on monetary markets, which could be finest seen by the unfold between the one and three-month U.S. treasury payments. The unfold between the 2 yields needs to be zero. As you possibly can see, the demand for the US 1-month T-bill, which matures earlier than the U.S. treasury runs out of money, is at 3.759%. On the similar time, the 3-month T-bill faces the potential for default until Congress raises the debt ceiling, which is yielding 5.154%. Buyers are involved concerning the potential of a default, the earliest the Treasury would now not be capable of pay its payments would come as early as June, however we consider the ceiling might be prolonged.

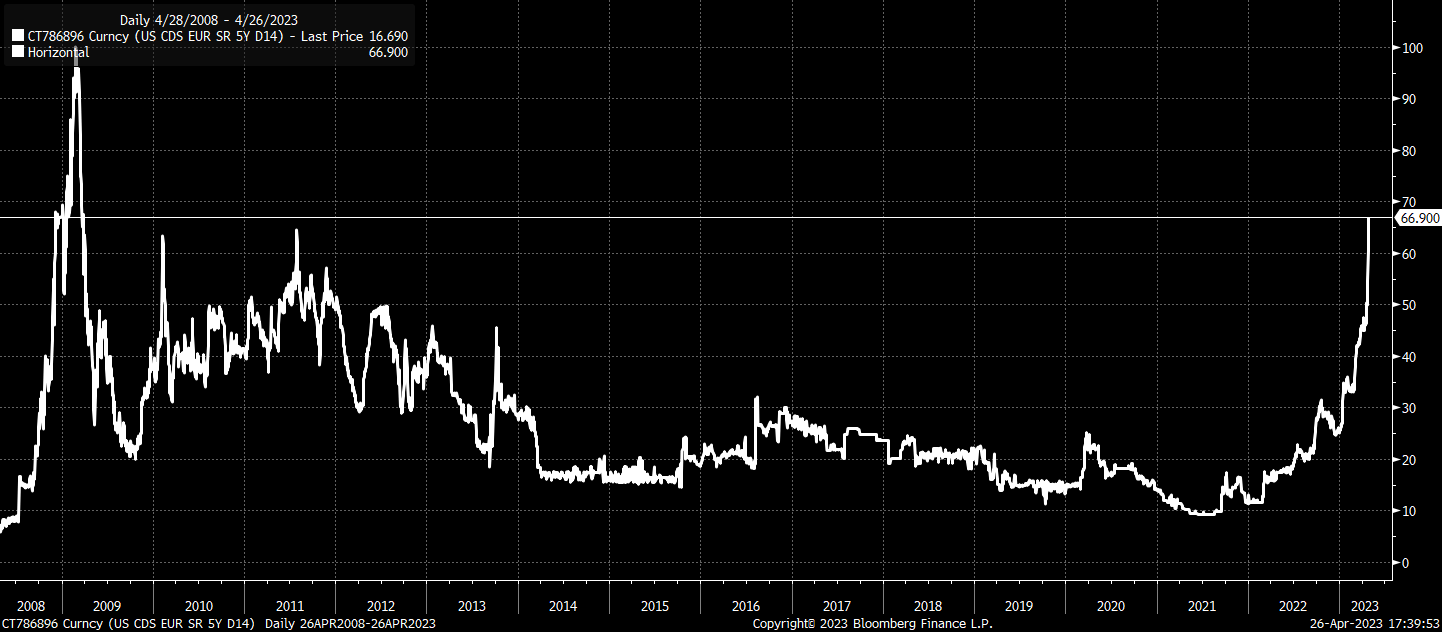

U.S. Treasuries are the inspiration of your complete monetary system, so a everlasting default would disrupt your complete system. Nonetheless, a small short-term default would have an effect on U.S. credit score, which could be seen with the 5 yr US CDS unfold at its highest ranges since 2009.

First Republic Financial institution

Why would the regional financial institution disaster be over when charges are nonetheless rising and elevated? Shares in First Republic Financial institution are nearly down 95% previously six months. Because the federal funds charge is approaching 5%, deposit flights are an actual difficulty for banks. First Republic Financial institution reported an enormous deposit flight.

The disaster might deepen if the FDIC or a non-public group finds no decision. In line with Macro Funding, if FRB held to maturity belongings are bought, the realized losses on these belongings would wipe out the worth of its fairness. It’s extra possible that the Fed and Treasury might want to set up a bailout just like Credit score Suisse.

The U.Ok.

BOE doesn’t take the blame for inflation

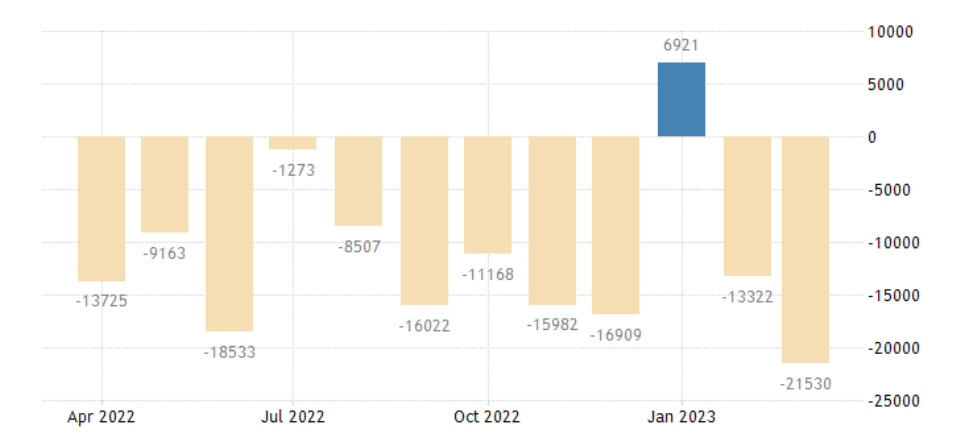

UK public sector borrowing elevated yearly, totaling £21.5 billion, equal to five.5% of the GDP, a deficit of £21.53 billion. As well as, curiosity prices soared over 47% larger than final yr to over £106.6 billion.

It was every week to overlook for the policymakers in cost, who have to, fairly frankly want to return to high school and perceive the basics of economics. Deputy Governor Ben Broadbent outright refused that cash printing throughout covid resulted from this out-of-control inflation. He blamed the price of importing vitality.

From one incompetent policymaker to the following, Chief Economist Huw Capsule adopted up this week by saying that folks within the UK “want to just accept that they’re worse off and cease attempting to take care of their actual spending energy”. He blames individuals for pushing for larger wages contributing to larger inflation. He additionally expects inflation to come back right down to 2% within the subsequent two years. He can now be added to the “inflation is transitory” group with Jerome Powell.

Japan

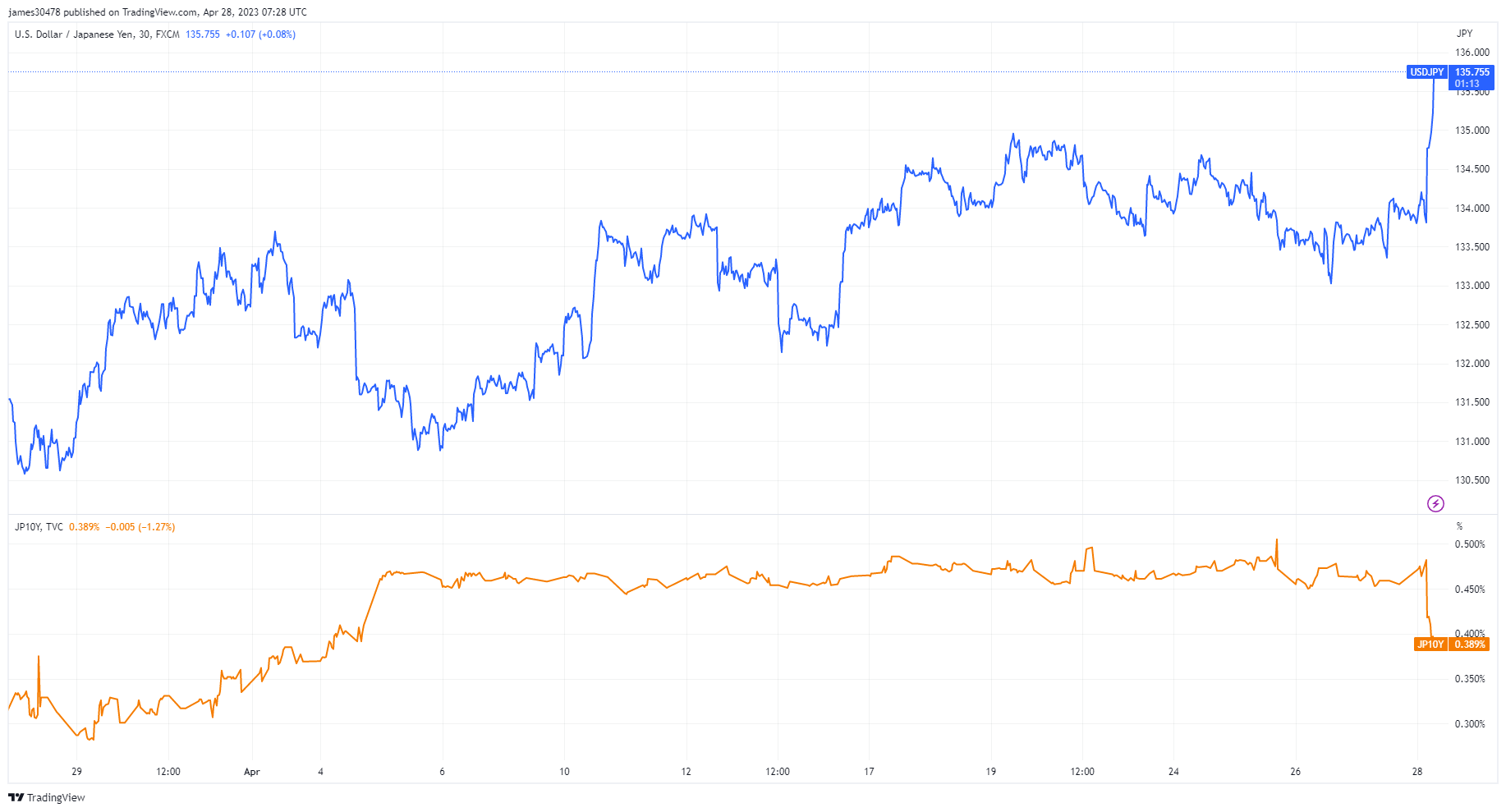

The Financial institution of Japan met once more on Friday and unsurprisingly dedicated to a stimulus-first strategy to take care of yield curve management on the 10-year bond. Because of this, this despatched the Yen and yields sharply decrease.