Traders consider it’s extremely doubtless that the goal charge will stay unchanged on the June 14 Federal Open Market Committee (FOMC) assembly, following the U.S. Federal Reserve’s resolution to extend the federal funds charge by 25 foundation factors on Could 3. Because the battle in opposition to inflation within the U.S. rages on, the Biden administration appointed Philip Jefferson as the brand new vice chair to interchange Lael Brainard. The American president said that his nominees will play a “essential function” in sustaining value stability and overseeing the nation’s monetary establishments.

Fedwatch Instrument Factors to Low Probability of Charge Hike

Simply over per week in the past, on Could 3, 2023, the U.S. central financial institution raised the federal funds charge to five.25% after a quarter-point charge hike. Fed chair Jerome Powell was fast to emphasise that inflation was nonetheless a significant concern and that the FOMC was dedicated to bringing the inflation charge again right down to the two% goal. Nonetheless, the newest Shopper Value Index (CPI) report, launched on Could 10, revealed that over the previous 12 months, “the all gadgets index elevated 4.9%.”

Final Friday was a tough day for the inventory market, with the S&P 500, Dow Jones Industrial Common, Nasdaq Composite, and Russell 2000 Index all closing within the crimson. The crypto financial system has additionally been experiencing a downward pattern, whereas treasured metals like gold and silver have been buying and selling sideways.

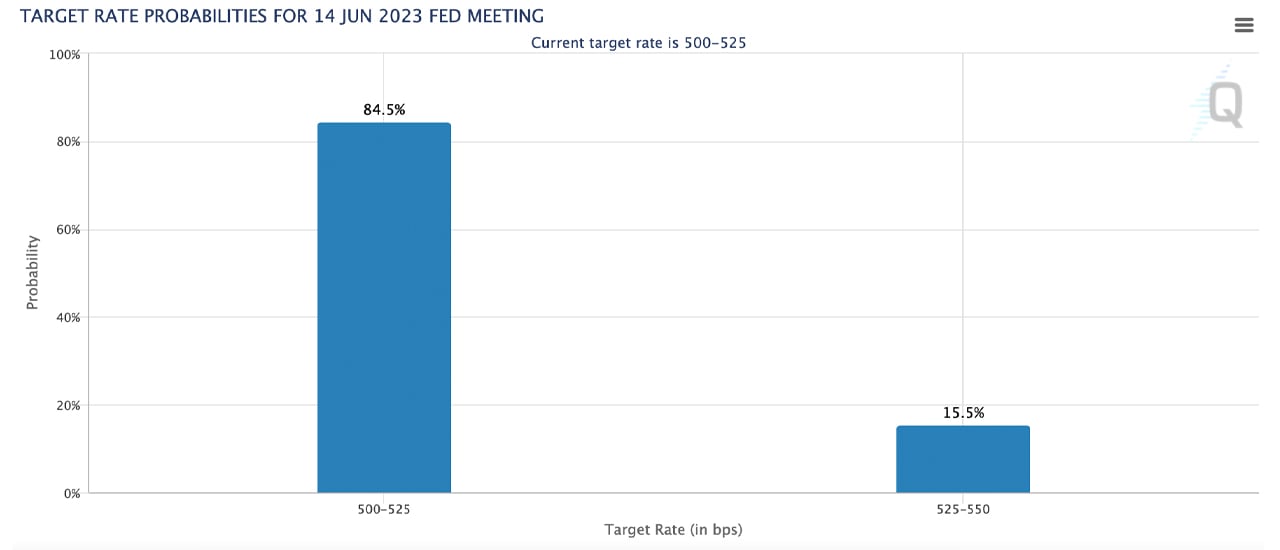

The subsequent FOMC assembly is shaping as much as be a nail-biter, with the newest information from the CME Fedwatch device indicating that there’s an 84.5% probability the rate of interest will stay unchanged. Nonetheless, there’s additionally a slim probability of a quarter-point charge hike to five.50%, with the Fedwatch device displaying a likelihood of roughly 15.5%.

Biden’s New Fed Vice Chair Faces Excessive Expectations

Forbes journalist Simon Moore studies that almost all policymakers favor preserving rates of interest at their present degree, in line with the newest information from March. Nonetheless, Moore says just a few consider charges needs to be nearer to six%, and one participant predicts charges won’t stay at their present degree by the tip of the yr.

Based on the reporter, the query on each market investor’s thoughts is whether or not or not the central financial institution will pivot this yr. Along with the expectations in regards to the subsequent FOMC assembly, president Joe Biden has additionally made some main adjustments to the Fed’s management.

With recent blood on the helm, many are questioning how this can affect the central financial institution’s insurance policies and priorities shifting ahead. Powell will now have a brand new second-in-command as president Biden appointed Philip Jefferson as the brand new vice chair. Biden said that Jefferson was confirmed by the Senate with a powerful bipartisan vote of 91-7 and harassed that he seems ahead to his “swift affirmation” as vice chair.

Reviews counsel that Jefferson is aligned with Powell’s efforts to curb inflation and is unlikely to push again in opposition to the Fed’s present insurance policies.

What do you assume the appointment of Philip Jefferson as the brand new Fed vice chair means for the way forward for the central financial institution’s insurance policies? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.