Nonetheless recording some inexperienced on small timeframes, the worth of Bitcoin has remained above $30,400. Regardless of the latest promoting stress throughout the sector, the help round this stage held, offering bulls an opportunity to battle again.

As of this writing, Bitcoin trades at $30,458 with sideways motion within the final 24 hours. The earlier week, the primary crypto by market cap recorded comparable value motion whereas different cryptocurrencies skilled losses.

Bitcoin About To Explode?

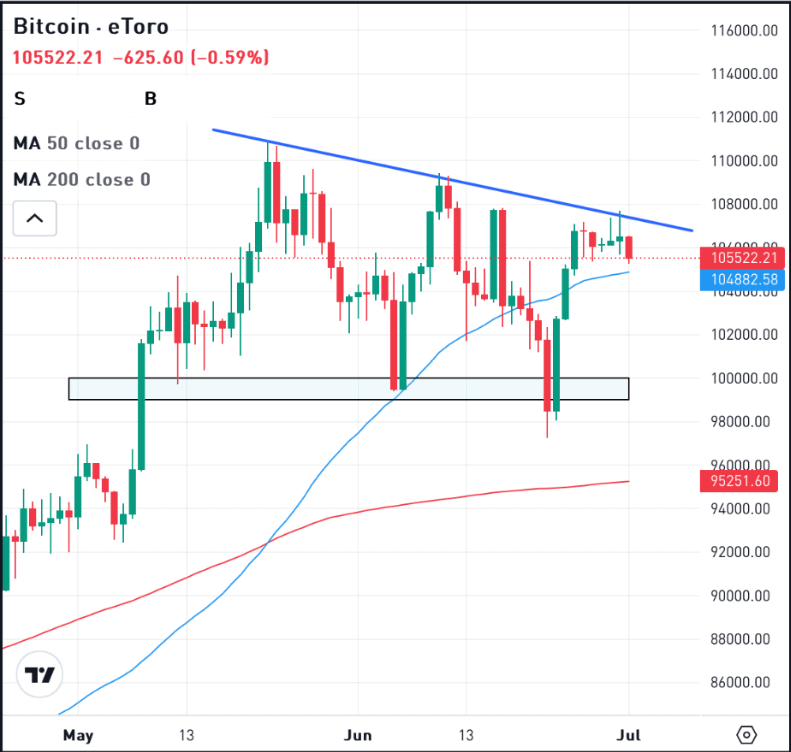

Information from crypto choices platform Deribit, shared by analyst Tom Dunleavy, exhibits that over $7 billion in these contracts will expire immediately, Friday 29th. In different phrases, immediately, choice holders can train their proper or obligation to purchase/promote BTC and different property at a selected value, relying on their contract.

Over $5 billion of the choices contracts are primarily based on Bitcoin, whereas the remaining are primarily based on Ethereum, as seen within the chart beneath. Nonetheless, choice holders may select to “roll over” their contracts to a later date.

Consequently, in response to Dunleavy, spot costs may see a spike in shopping for stress as main choice gamers hedge their positions. This elevated shopping for stress may see BTC hovering above the $31,000 mark.

Through Twitter, the analyst stated:

Huge choices expiration date for each ETH and BTC tomorrow ETH: ~$2B notional BTC: ~$5B notional If these are rolled into extra calls we should always see spot shopping for from sellers to hedge their books; places reverse story. Both method anticipate some vol (volatility).

As Dunleavy claims, the crypto market is poised for volatility, whichever path. The chart above exhibits the Max Ache value for BTC choices, which is $26,500.

Max Ache is the worth Bitcoin should commerce to disclaim most choices merchants from reserving earnings. In that sense, the BTC value will possible flip to the draw back with a spike in volatility.

Past $31,000, What’s Subsequent For BTC?

Evaluation and crypto schooling agency Blofin lately posted a report on BTC’s short- and long-term dangers and situations. The agency claims the latest rally was pushed by a “starvation for optimistic information” and a “rebalancing” of inner liquidity.

In different phrases, crypto buyers obtained bullish and took cash from altcoins into BTC. Nonetheless, there’s nonetheless a liquidity challenge throughout the sector that would restrict any rally, however there’s a silver lining on this state of affairs.

Blofin acknowledged:

The decline within the value of BTC shall be extra restricted, with a comparatively small chance of falling beneath $28k, whereas the upward area is comparatively giant, and there’s even hope for a rebound to $35k and above.

Cowl picture from Unsplash, chart from Tradingview