Following the abstract judgment delivered in favor of Ripple within the ongoing XRP vs. SEC lawsuit, the Chair of the US Securities and Trade Fee (SEC), Gary Gensler, stays taciturn on the fee’s subsequent line of motion.

Throughout a segment on Bloomberg TV, Gensler was evasive on questions bothering on whether or not the SEC intends to enchantment the judgment. He, nonetheless, maintained that the SEC was but to take a call, having beforehand expressed disappointment over the ruling stating that the company intends to guage the ruling within the Ripple Labs lawsuit.

Uncertainty Trails Gensler’s Evasiness

In a ruling delivered by Decide Analisa Torres on July 13, 2023, the XRP token was categorised as a safety primarily when promoting them to institutional traders, whereas gross sales to retail traders have been thought-about to not be a violation of federal securities legislation.

The affect of the ruling was huge as main crypto exchanges like Coinbase relisted the XRP tokens on their platforms. The market reacted positively, with XRP experiencing spectacular worth rallies, reaching $0.80 in gentle of the favorable choice.

Following the ruling, there was a demand for readability on what the SEC intends to do subsequent. However SEC Chair Gary Gensler has largely shunned providing any significant assertion, solely stating that the SEC is at the moment analyzing the choice.

Nevertheless, he maintained his place that the crypto trade nonetheless continues to fall in need of assembly the calls for of securities legal guidelines, no matter the current XRP judgment.

Deliberate Technique Or Concern Of XRP’s Strengths?

The cryptocurrency house has been awash with speculations over the probably implications of Gensler’s silence. Consultants postulate on the choices accessible to the SEC, with most believing an enchantment is just not removed from the desk.

John E. Deaton, an legal professional for XRP holders, famous that an enchantment doesn’t essentially imply a setback for Ripple. Additionally, Ripple’s Chief Authorized Officer, Stuart Alderoty, said that ought to XRP be thought-about not a safety, then the SEC will robotically lose its jurisdiction over the buying and selling of XRPs.

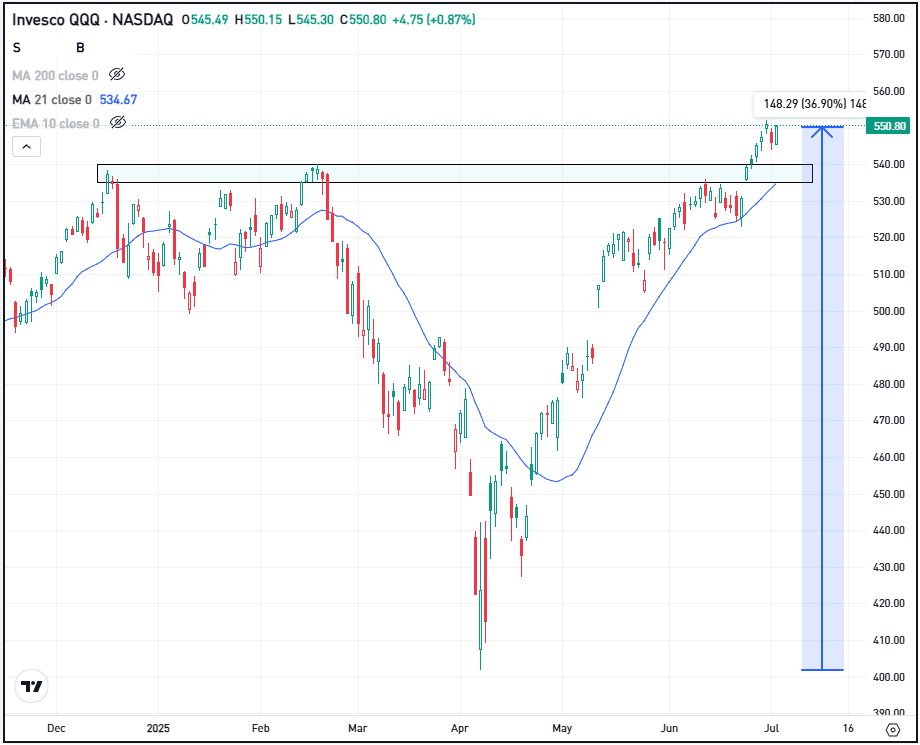

XRP worth jumps above $0.7 | Supply: XRPUSD on Tradingview.com

Nevertheless, former SEC official John Reed Stark has re-echoed Gensler’s place, stating that the choice in XRP vs. SEC lies on “shaky floor” and can invariably be appealed. Stark argued that the ruling did not differentiate clearly between personal gross sales of XRP to institutional traders and gross sales to exchanges. He postulated that this may probably beginning a brand new class of “quasi-securities,” whose standing can be topic to the traders’ sophistication.

There have been speculations that Gensler could probably resign in gentle of the ruling. Rumors of the resignation have been largely amplified by members of the XRP neighborhood.

The SEC was compelled to challenge a statement confirming that its Chair was not resigning and was solely targeted on pursuing the targets of the fee.

In the meantime, with the prospect of an enchantment looming giant on the horizon, the way forward for XRP and the cryptocurrency trade stay removed from sure.

Featured picture from Instances Tabloid, chart from Tradingview.com