In a decision to one of the talked-about blunders in latest historical past, F2Pool, a distinguished Bitcoin mining pool, has opted to return the inadvertently overpaid community payment of 19.82108632 BTC to Paxos, the stablecoin issuer and crypto brokerage agency. The disclosure got here a couple of in the past from a tweet by Mempool, a Bitcoin explorer, stating, “F2Pool have despatched the 19.82108632 BTC payment overpayment again to Paxos.”

The Largest Bitcoin Payment Ever Paid

On September 10, 2023, Paxos, an organization well-known for issuing stablecoins like PayPal USD and Pax Greenback (USDP), performed a Bitcoin transaction that grew to become notorious in a single day for its disproportionately giant community payment. The transaction concerned a mere 0.07 BTC, roughly valued below $2,000 on the time, but had an astonishing payment of almost 20 BTC—translating to over $515,000.

Blockchain analytics first indicated that the sender had paid charges that had been exponentially greater than what is mostly required. Jameson Lopp, co-founder of Casa pockets, famous that the account in query “appears to be like like an trade or cost processor with buggy software program,” contemplating it had processed over 60,000 transactions from the identical deal with.

Initially, speculative eyes turned in the direction of PayPal, largely due to the recognized habits of the pockets concerned. Blockchain fanatics noticed that the sending account, designated as “bc1qr35….”, displayed transactional traits matching these of a beforehand inactive pockets labeled as belonging to PayPal. The hypothesis was additional fueled by the truth that an intermediate account had transferred 18.5 BTC from the previous PayPal-labeled account to the brand new sending deal with.

Nevertheless, Paxos cleared the air on September 13 with a press release: “Paxos overpaid the BTC community payment on Sept. 10, 2023. This solely impacted Paxos company operations. Paxos shoppers and finish customers haven’t been affected and all buyer funds are protected. This was on account of a bug on a single switch and it has been mounted. Paxos is involved with the miner to recoup the funds.”

F2Pool’s Resolution And Neighborhood Backlash

The Bitcoin block containing the transaction was mined and confirmed by F2Pool. The pool’s administration had initially provided to return the mistakenly excessive payment if claimed inside three days. The choice to truly return the funds has, nevertheless, sparked a barrage of criticisms throughout the Bitcoin neighborhood.

Outstanding voices like Richard “Dick” Whitman remarked, “Guess in case you are on F2Pool it’s time to change LOL”, whereas others expressed considerations saying, “Dangerous precedent” and “wow, if I used to be a miner in that pool I’d be pissed.” Pledditor, a widely known determine within the Bitcoin realm, humorously commented, “Think about contributing hash to a pool that actively offers your rewards away LOLOLOLOLOL.”

Whereas the payment error from Paxos stands out for its sheer dimension, it’s not an remoted incident within the crypto area. Earlier occurrences embrace an Ethereum consumer dropping over $300,000 in 2019 on account of an identical mistake, although 50% of the misplaced funds had been returned by the mining pool concerned. In 2020, one other Ethereum consumer paid a staggering $9,500 for a $120 commerce.

F2Pool’s resolution to return the exorbitant payment opens a dialog concerning the ethics and governance frameworks that mining swimming pools ought to maybe adhere to. It additionally serves as a stark reminder for all actors within the crypto area concerning the necessity for meticulous consideration to element, particularly in a realm the place one unsuitable click on can lead to monumental monetary loss.

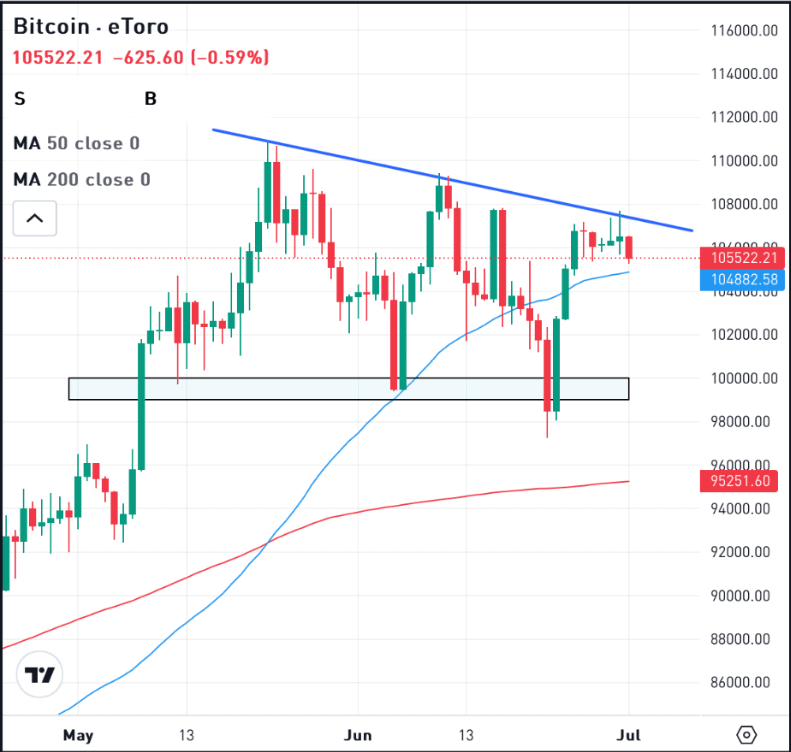

At press time, BTC traded at $26,638.

Featured picture from iStock, chart from TradingView,com